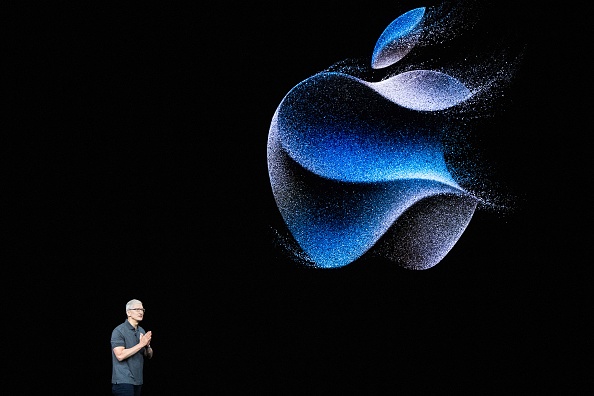

Inside Apple’s Spectacular Failure to Build a Key Part for Its New iPhones

The company set out to design a silicon chip that would allow it to cut ties with Qualcomm, a longtime supplier and bitter foe

The new iPhone models unveiled last week are missing a proprietary silicon chip that Apple had spent several years and billions of dollars trying to develop in time for the rollout.

The 2018 marching orders from Apple Chief Executive Tim Cook to design and build a modem chip—a part that connects iPhones to wireless carriers—led to the hiring of thousands of engineers. The goal was to sever Apple’s grudging dependence on Qualcomm, a longtime chip supplier that dominates the modem market.

The obstacles to finishing the chip were largely of Apple’s own making, according to former company engineers and executives familiar with the project.

Apple had planned to have its modem chip ready to use in the new iPhone models. But tests late last year found the chip was too slow and prone to overheating. Its circuit board was so big it would take up half an iPhone, making it unusable.

Investors had counted on Apple saving money with an in-house chip to help compensate for weak demand in the larger smartphone market. Apple—which hasn’t publicly acknowledged its modem project, much less its shortcomings—is estimated to have paid more than $7.2 billion to Qualcomm last year for the chips.

Engineering teams working on Apple’s modem chip have been slowed by technical challenges, poor communication and managers split over the wisdom of trying to design the chips rather than buy them, these people said. Teams were siloed in separate groups across the U.S. and abroad without a global leader. Some managers discouraged the airing of bad news from engineers about delays or setbacks, leading to unrealistic goals and blown deadlines.

“Just because Apple builds the best silicon on the planet, it’s ridiculous to think that they could also build a modem,” said former Apple wireless director Jaydeep Ranade, who left the company in 2018, the year the project began.

There were two reasons for the push, said former Apple executives and engineers familiar with the matter: Apple believed it could replicate the success of the microprocessor chips it designed for iPhones. Adoption of those chips fattened profit margins and improved performance for billions of devices. Second, Apple wanted to sever ties with Qualcomm, which it had accused in a 2017 lawsuit of overcharging for its patent royalties.

The companies settled the suit in 2019, and Apple, facing the expiration of its previous Qualcomm agreement, announced a deal last week to continue buying the company’s modem chips through 2026. Apple isn’t expected to produce a comparable chip until late 2025, people familiar with the matter said. There could be further delays, these people said, but the company believes it will eventually succeed.

Apple found that designing a microprocessor, essentially a tiny computer to run software, was easy by comparison. Modem chips, which transmit and receive wireless data, must comply with strict connectivity standards to serve wireless carriers around the world.

“These delays indicate Apple didn’t anticipate the complexity of the effort,” said Serge Willenegger, a former longtime Qualcomm executive who left the company in 2018 and doesn’t know the current state of the Apple chip. “Cellular is a monster.”

Apple’s push to build more of the various semiconductors used in its products stretches back more than a decade. In 2010, the company began using its own processing chips in iPhones and iPads. The chips helped Apple outperform many of its Android rivals, which relied on chips from Qualcomm, Taiwan-based MediaTek and other makers.

The company in 2020 began replacing processor chips from Intel, used for years in Mac computers, with a proprietary chip that allowed its laptops to run faster and generate less heat, improvements that helped boost flagging Mac sales. The Apple chip also saved the company an estimated $75 to $150 on every computer.

Credit for the success of Apple processor chips brought praise and increased authority to Johny Srouji, the company’s chip leader. “After shipping the first iPhone, we decided that the best way to deliver the best experience to our customers is to own and develop and design our silicon in-house,” Srouji said this year at Technion-Israel Institute of Technology, his alma mater.

Split screen

Apple code-named its modem chip project Sinope, after the nymph in Greek mythology who outsmarted Zeus. It began taking shape in 2018, following the directive of Cook, Srouji, and others for Apple to build its own wireless components, said Chris Deaver, a former Apple human-resources executive and co-founder of BraveCore consultants.

By then, Apple’s relationship with Qualcomm had turned ugly. The companies bickered and swapped accusations of lying, theft and monopolistic practices.

Rubén Caballero, Apple’s longtime head of wireless, supported the Intel chip partnership at the time, while Srouji, senior vice president of hardware technologies, backed the pursuit of a company-built chip, said people involved in the project. Caballero left Apple in 2019.

Many members of Caballero’s team who were versed in wireless chip design were placed under Srouji. Other employees engaged in complementary wireless work, such as antenna design, were split off into the hardware engineering group. One of the top project managers on Srouji’s team had no background in wireless technology, said people who worked on the project.

Apple, which had been poaching engineering talent from Qualcomm for years, stepped up those efforts in March 2019. The company announced a new engineering hub in San Diego, Qualcomm’s hometown, and planned to add around 1,200 local jobs. That summer, Apple announced the acquisition of Intel’s wireless team and a portfolio of wireless patents.

Srouji flew to Munich to greet Apple’s newly acquired Intel wireless employees in December 2019. He told a gathering that the modem-chip project would be a game changer for Apple, the next step in the company’s evolution, said people who watched the meeting. He said the chip would distinguish Apple devices, as Apple’s processors had done.

As Apple filled the project’s ranks with Intel engineers and others hired from Qualcomm, company executives set a goal to have the modem chip ready for fall 2023. It soon became apparent to many of the wireless experts on the project that meeting the goal was impossible.

Apple found that employing the brute force of thousands of engineers, a strategy successful for designing the computer brain of its smartphones and laptops, wasn’t enough to quickly produce a superior modem chip.

Tall order

Modem chips are trickier to make than processing chips because they must work seamlessly with 5G wireless networks, as well as the 2G, 3G and 4G networks used in countries around the world, each with its own technological quirks. Apple microprocessors run software programs designed solely for its iPhones and laptops.

Apple executives who didn’t have experience with wireless chips set tight timelines that weren’t realistic, former project engineers said. Teams had to build prototype versions of the chips and certify they would work with the many wireless carriers worldwide, a time-consuming job.

Executives better understood the challenge after Apple tested its prototypes late last year. The results weren’t good, according to people familiar with the tests. The chips were essentially three years behind Qualcomm’s best modem chip. Using them threatened to make iPhone wireless speeds slower than its competitors.

The company scratched plans to use the chips in Apple’s 2023 models, and the planned rollout was moved to 2024. Eventually, Apple executives realized the company wouldn’t meet that goal either. Apple instead opened negotiations with Qualcomm to continue supplying the modem chips. Apple’s licensing deal with Qualcomm expires in April 2025, though it can be extended for another two years.

Apple has the cash and the desire to keep pursuing its modem chip, according to people involved with the project.

“Apple isn’t going to give up,” said Edward Snyder, a managing director of Charter Equity Research and a wireless industry expert. “They hate Qualcomm’s living guts.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

Investors normally don’t talk about the risks of a bubble forming in the asset that they’re buying to hedge against a different bubble, but gold’s extraordinary surge is starting to trigger uncomfortable conversations about the yellow metal’s bullish prospects.

Gold prices have gained more than 55% this year, blowing past the $3,000 an ounce mark in early spring and topping the $4,000 threshold for the first time on record last month. Gold was up another 3.3% to $4,108.60 in Monday trading, a new record high.

Myriad reasons have been cited for the surge, including the slumping U.S. dollar, soaring tech stocks that have concentrated broader market risks into a handful of megacap tech names, purchases by central banks seeking to diversify away from the dollar, and renewed inflation risks tied to ongoing tariff and trade disputes.

Central bank buying has also been significant, with China alone adding 39.2 tons to its overall holdings since it returned to the market in November of last year.

“Central banks’ appetite for gold is driven by concerns from countries about Russian-style sanctions on their foreign assets in the wake of decisions made by the U.S. and Europe to freeze Russian assets, as well as shifting strategies on currency reserves,” said ING commodities strategist Ewa Manthey.

“The pace of buying by central banks doubled following Russia’s invasion of Ukraine in 2022.”

Gold-backed ETFs , meanwhile, are attracting billions in new investments, with overall additions likely to have topped 100 tons over the three months ending in September. That’s more than triple the quarterly average over the past eight years.

The combination of forces is likely to drive more gains for gold in the months ahead, according to Société Générale’s commodity research team, headed by Mike Haigh.

“Gold’s ascent to $5000 seems increasingly inevitable,” Haigh wrote in a note published Monday, citing both strong ETF flows and renewed central bank purchases.

Haigh also notes that ETF flows are tracking a rise in SocGen’s U.S. uncertainty index, which is now pegged at more than three times the level it reached over the five months before last year’s presidential election win for President Donald Trump.

“We cannot imagine a situation where we return to pre-Trump index uncertainty normalcy over our forecast horizon, so ETF flows are a key component to our price forecasting,” Haigh said. His $500o price target is pegged for the end of 2026.

Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, has a different take, tied in part to what she sees as a way for governments to “challenge the dollar’s stranglehold on global money movements.”

Gold holdings, Shalett argues, can “improve collateralisation of their fiat currencies and/or cryptocurrencies in a world where currency markets undefined may be remade by digital assets, cryptocurrencies, and stablecoins.”

The gold market’s mimicry of previous historic booms, however, has caught the attention of Bank of America analyst Paul Ciana, who cautioned in a note published last week that “prices have tended to pivot near round-number levels.”

Citing data showing “midway corrections” in long term bull markets for gold, Ciana sees the chances for a near-term pullback that “rhymes” with pullbacks of around 40% in the mid-1970s and 25% following the global financial crisis in 2008.

“This boom is about 10 years old, smaller in size than the 1970s and 2000s boom but nearly as old,” Ciana wrote. “This warrants caution into round number resistance at $4,000, or again later at $5,000.”

Gold isn’t likely a bubble. It’s hard for central banks to sell, and many of the countries encouraging its import, like China and India, also make it difficult for investors to move offshore.

But gold did lose around 60% of its value in the two decades that followed its 1970s boom, with bear markets following in 2008 and 2015.

This year’s really is still going strong, of course, but with gold’s advance tied to nearly all of the concerns currently gripping financial markets, maybe it’s worth asking if it’s being “all things to all people” is the best kind of hedge—or just another risky bet on rising prices.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.