Sam Bankman-Fried’s Lawyers Seek to Regain Ground in FTX Trial

Founder looks to rebound from cross-examination, with closing arguments expected to begin Wednesday

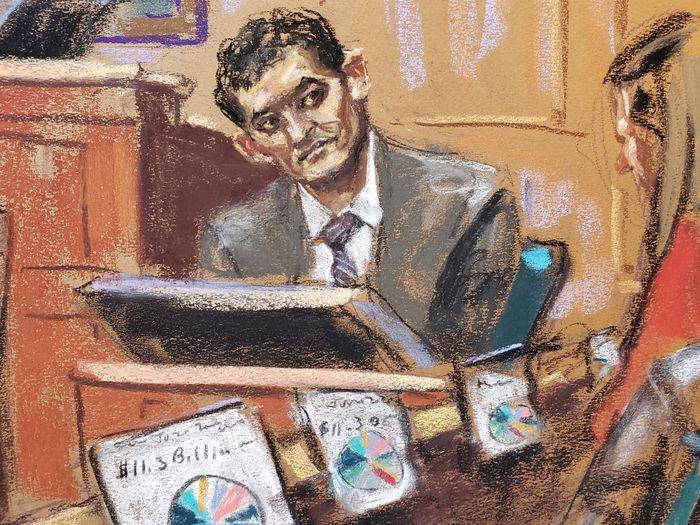

Sam Bankman-Fried’s lawyers rested their case Tuesday after seeking to rehabilitate the FTX founder’s credibility from the prosecutors’ two-day grilling.

Bankman-Fried, dressed in a grey suit, floundered through the end of Assistant U.S. Attorney Danielle Sassoon’s cross-examination.

For a second day, Sassoon walked Bankman-Fried through balance sheets, communications and tweets, again highlighting inconsistencies—or what she portrayed as outright lies—between the defendant’s public statements and his private knowledge.

Bankman-Fried repeatedly told jurors he couldn’t recall many of his past statements. He said he couldn’t remember the exact time line of things.

Defence attorney Mark Cohen sought to elicit testimony to explain his client’s evasiveness. He asked about reasons for his foggy memory and his use of a private jet and his contempt for regulation.

“You used the phrase ‘f— regulators,’ ” Cohen said, referring to a series of messages between Bankman-Fried and a Vox reporter. “Was that the full extent of the chain?”

It wasn’t, said Bankman-Fried, adding that he felt that his efforts to work with regulators might have only led to more bad regulation. “I was somewhat frustrated,” he said.

Cohen asked about the huge amount of evidence in the case—suggesting his client couldn’t possibly remember every document—and his many media interviews.

Bankman-Fried told the jury he talked to about 50 reporters during the time between FTX’s collapse and his arrest, typically preparing between 30 seconds and an hour for each interview. When he testified before Congress, others helped him prepare his testimony, he said.

Bankman-Fried’s testimony, which formed the bulk of his defence team’s presentation, is likely crucial to jurors’ determination of whether to find him guilty of fraud and other charges. Closing arguments are scheduled for Wednesday, clearing the way for the jury to likely get the case on Thursday.

About half of the jurors watched Bankman-Fried as he spoke. Some scribbled notes and others gazed at the floor. One man closed his eyes. Damian Williams, the Manhattan U.S. attorney who has given priority to prosecuting cryptocurrency cases, sat in the front row of the courtroom gallery.

Bankman-Fried again answered some of the prosecutor’s questions by quibbling with their premise. When asked about an $8 billion hole in the balance sheet of Alameda Research, FTX’s sister hedge fund, he said that “hole” wasn’t the word he would use. He said he couldn’t speak with exact confidence about whether some FTX customers, outside of its sister hedge fund, had special privileges.

Sassoon asked if it was Bankman-Fried’s practice to maximise making money even with the risk of going bust. “It depends on the context,” he replied. He later added, “With respect to some of them, yes.”

Sassoon concluded her cross-examination by playing a recording of a Nov. 9, 2022, all-hands meeting in which Caroline Ellison, the former chief executive of Alameda Research and Bankman-Fried’s former girlfriend, spoke with Alameda staffers. Ellison, her voice halting, said she had talked about Alameda’s use of customer funds with Bankman-Fried and two of his top deputies, Nishad Singh and Gary Wang.

“Ms. Ellison identified you, Gary and Nishad as her co-conspirators, correct?” Sassoon asked.

Sassoon showed jurors a document, from Dec. 25, 2022, in which Bankman-Fried appeared to be analysing his own potential legal jeopardy and assessing how the government viewed the alleged conspiracy. While it was public that Ellison and Wang were cooperating with prosecutors, Bankman-Fried wasn’t sure if Singh, a former FTX executive, would be charged.

“They don’t seem to be keeping a seat warm for him as a defendant,” the document said.

“You wrote that, Mr. Bankman-Fried?” asked Sassoon. “I think so,” he said.

Singh, who later pleaded guilty, testified for the government earlier in the trial.

Later, Bankman-Fried’s lawyer referenced a photograph of Bankman-Fried on a private jet, reclining with his eyes closed. The prosecution had showed the jury the photo as an example of excess spending. Cohen asked Bankman-Fried if he remembered the photo.

“A very flattering one,” Bankman-Fried said sarcastically, before agreeing that using a private jet was a valid business expense.

“It was very logistically difficult to travel between the Bahamas and a few places, chiefly Washington, D.C.,” the FTX founder told the jury.

After the defence attorney wrapped up, Sassoon told the judge she had no more questions. Bankman-Fried took a long swig from his water bottle as he stepped down for his final time from the witness stand.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A new report on the impact of cost of living pressures reveals a stark contrast between age groups in investment strategies

Four in five Australians say they have changed their investment and savings goals over the past 12 months, with 44 percent doing so primarily to make ends meet during the cost–of–living crisis. A further 25 percent say they’ve switched strategies to protect their wealth against inflation, according to a new survey by financial advisory firm, Findex.

The Superannuation and Retirement Insights report shows Australians have also changed their goals to grow their wealth (31 percent), to create a regular income stream (29 percent) and to reduce taxes (17 percent). Transferring wealth to their children or other family members has motivated 10 percent of Australians to alter their investment plans, which is likely reflective of the increasing role played by the Bank of Mum and Dad in young people’s first home purchases.

The report found that traditional investment avenues, such as property and superannuation, remain the most popular choices, with more than eight out of 10 survey respondents ranking these asset classes highly. But there is also an increasing inclination towards investments that offer the potential for quicker returns, additional perceived safety, and better liquidity or accessibility to funds.

Eighty percent of survey respondents also nominated bank savings as among their top five investment choices right now, followed by shares (66 percent) and cash (51 percent).

“This shift reflects a broader strategy to mitigate current financial uncertainties, balancing the pursuit of long-term wealth accumulation with the need for immediate financial security,” the report says.

While superannuation is considered a cornerstone investment for retirement and long-term wealth accumulation, 85 percent of Australians are exploring investments outside superannuation. The most common investments outside super are bank savings (64 percent), property (38 percent), cash (35 percent) and shares (34 percent).

However, when the data is broken down by generation, stark differences are revealed in how each age cohort chooses to invest their spare income and why.

Most popular investments outsider super and the motivations to invest by generation

Baby Boomers (born 1965-1964)

Outside superannuation, Baby Boomers prefer to invest in bank savings (60 percent), property (50 percent) and shares (46 percent).

By far, their primary motivation for investing is planning for retirement (80 percent). They also want to build wealth (51 percent) and support their children or other family members (25 percent). Other motivations include preserving wealth to beat inflation (22 percent) and paying off a mortgage or other debt (20 percent). They are the least likely generation to be saving for an investment property.

Gen Xers (born 1965–1980)

Gex Xers prefer to invest in bank savings (57 percent), property (43 percent) and shares (36 percent).

They are motivated to invest for retirement (66 percent), to build wealth (50 percent), to save for emergencies (36 percent), and to pay off a mortgage or other debt (30 percent). Interestingly, Gen X is the generation most concerned with supporting their children or family members (33 percent). This may be because Gen Xers have grown up during Australia’s long-standing property boom that began in the late 1990s and continues today.

Millennials (born 1981-1996)

Millennials have the strongest interest in bank savings as an investment avenue (70 percent), followed by property at 41 percent. They also like cash (35 percent) and shares (33 percent). Millennials have the highest uptake of exchange-traded funds (ETFs) at 21 percent. ETFs are a relatively new type of asset class, with the first ones trading on the ASX in 2001. ETFs are a basket of shares that can be purchased in a single transaction for instant diversification. Millennials are also the generation most interested in cryptocurrencies, with 22 percent invested.

Their biggest motivations for investing are to build wealth (55 percent), save for emergencies (50 percent) and plan for retirement (49 percent). They also want to support their kids (32 percent) and pay off their mortgage (32 percent). Millennials are the generation most likely to be saving for an investment property (28 percent) rather than a first home (17 percent).

Gen Zs (born 1997-2009)

Gen Zs spread their money across more asset classes than their elders. They like investing in bank savings (66 percent), cash (42 percent), shares (22 percent), ETFs (17 percent), property (14 percent) and cryptocurrencies (13 percent).

While Gen Zs are the youngest age cohort within the survey, they also have long-term goals just like their elders. The biggest motivation to invest among Gen Zs is to build wealth (52 percent). More Gen Zs are saving for a first home than any other generation, with 42 percent pursuing this goal. They are also the generation most concerned with preserving wealth to beat inflation (29 percent). Gen Zs also want short-term security, with 46 percent saving for emergencies. They’re also the generation most likely to be saving for other major purchases like a car or holiday (41 percent) and investing just for enjoyment (26 percent).

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

This stylish family home combines a classic palette and finishes with a flexible floorplan