Well Into Adulthood and Still Getting Money From Their Parents

Nearly 60% of parents provide financial help to their adult kids, a new study finds

Parents have always supported their children into adulthood, from funding weddings to buying a home. Now the financial umbilical cord extends much later into adulthood.

About 59% of parents said they helped their young adult children financially in the past year, according to a report released Thursday by the Pew Research Center that focused on adults under age 35. (This question hadn’t been asked in prior surveys.) More young adults are also living with their parents. Among adults under age 25, 57% live with their parents, up from 53% in 1993.

Parental support is continuing later in life because younger people now take longer to reach many adult milestones—and getting there is more expensive than it has been for past generations, economists and researchers said. There is also a larger wealth gap between older Americans and younger ones, giving some parents more means and reason to help. In short, adulthood no longer means moving off the parental payroll.

“That transition has gotten later and later, for a lot of different reasons. Now it’s age 25, 30, 35, 40,” said Sarah Behr, founder of Simplify Financial Planning in San Francisco.

Kami Loukipoudis, a 39-year-old director of design, and husband Adam Stojanik, a 39-year-old high-school teacher, knew they would need parental assistance to buy in New York’s expensive home market.

“We could pay a mortgage, but that down payment was the absolute crusher,” Stojanik said. “The idea of trying to save up on our own—as long as we were paying rents in NY, would’ve taken 300 years.”

Loukipoudis’s mother gave them the money for a 10% down payment on a two-bedroom apartment in the New York borough of Queens.

The young-adult allowance

Adult children aren’t necessarily getting larger checks from their parents, but they are staying on the parental payroll for longer than previous generations, according to Marla Ripoll, professor of economics at the University of Pittsburgh who studied the trend by analysing payments from parents to adult children over a 20-year span.

Ripoll found that 14% of adult children receive a transfer of money from their parents at least once in any given year, and roughly half get financial help at some point within that period. Those rates have been stable for years. What has changed is that the transfers now continue for much longer, she found. This longer-term help might be a drag on social mobility, as it becomes even harder for young people from lower-income families to catch up, researchers said.

Of the young adult children who said they received financial help from a parent in the past year, most said they put it toward day-to-day household expenses, such as phone bills and subscriptions to streaming services like Netflix, according to the Pew survey.

The amount of money and the frequency of help varies by age; those on the older end of the 18-to-34 cohort are far likelier to say they are completely financially independent from their parents compared with younger adult children, as many in the latter group are completing their education. Nearly a third of young adult children between the ages of 30 and 34 say they still get parental help.

Heather McAfee, a 33-year-old physical therapist in Austin, Texas, said she lived at home between 2019 and 2021; otherwise she wouldn’t have been able to make progress paying down her student loans while rent prices in her area remained so high. The plan worked—she has since reduced her student-debt balance from $83,000 to $15,000.

“It helped tremendously,” she said. “I didn’t have to take out more loans to pay for apartment living or anything like that. That stress was gone.”

Setting limits on financial help

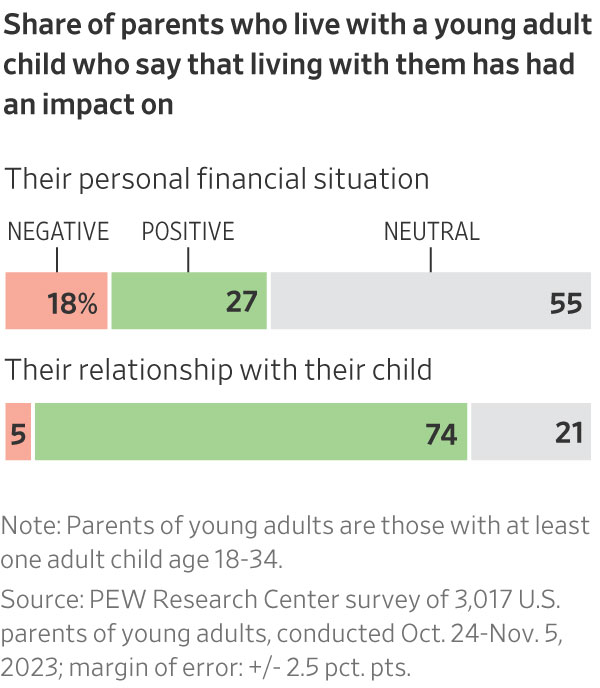

A little more than half of parents surveyed said that having their adult children home brought them closer together or improved their relationship, but nearly 20% said it dented their personal finances.

Financial advisers often find themselves in the tricky position of speaking to both ends of the equation: adult children who need assistance and the parents determined to help children well into middle age, within limits.

Whereas previous generations would step into a greater sense of financial independence in their early 20s, young adult children today are often unable to reach similar markers of such independence—living on their own or buying their first home, for example—without greater financial resources.

Families typically don’t set concrete rules around when financial help will happen and what the money is used for, which can result in surprises down the road, Behr said.

In one case, Behr’s clients received the down payment they needed to purchase a condo from a generous mother-in-law. Years later, that same mother-in-law told them she expected a payout once the couple sold the home.

The hand-me-down payment

Down-payment help from parents—a given for many first-time home buyers—is growing thanks to higher home prices and elevated mortgage rates.

About a fifth of first-time home buyers said they got help from a relative or friend when pulling together the money needed for a down payment, according to a 2023 survey of home buyers and sellers from the National Association of Realtors. And 38% of home buyers under age 30 received help with the down payment from their parents, according to a survey this spring by Redfin.

Wealthy families often go further than helping with the down payment. They become a true bank of mom and dad and write a mortgage. The Internal Revenue Service sets minimum levels of interest for such loans, which remain significantly cheaper than current mortgage rates.

Timothy Burke, chief executive at National Family Mortgage, which facilitates such loans, said parents are often frustrated on behalf of their house-hunting children. High interest rates and the cutthroat housing market are holding their children back from reaching a milestone the parents themselves were more easily able to access.

Mei Chao, a 41-year-old stay-at-home mom, and her husband, William Chao, a 44-year-old information-technology specialist, bought their first house as a couple in 2017. They relied on financial help from her husband’s two sisters and his mother to help them bridge a gap in their house-buying timeline. While they waited to sell William’s Manhattan condo, they used the money from the family to purchase the new house in Queens.

The structure of the agreements got tricky. After selling the condo in Manhattan, Mei and her husband were able to repay his sisters in full. But they didn’t have enough money left over from the sale to do the same for Mei’s mother-in-law. So they kept the mother-in-law’s name on the deed to the house—a concession Mei said they were both more than happy to make.

“Ultimately, it all worked out. I’m glad his mother pushed us,” Mei said. “Without her help, I could not say we would have this home.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Exclusive eco-conscious lodges are attracting wealthy travellers seeking immersive experiences that prioritise conservation, community and restraint over excess.

Margot Robbie and Jacob Elordi star in an adaptation of the classic novel that respects the romance’s slow burn.

The social-media company’s revenue increased 14%, falling short of estimates.

Pinterest shares tumbled after the company projected that revenue growth would slow in the first quarter, amid an advertiser pullback that weighed on its fourth-quarter earnings.

Shares slid 18.5% to $15.10 in after-hours trading after closing the market session down 2.9% at $18.54.

Pinterest reported a 14% increase in fourth-quarter revenue to $1.32 billion, up from $1.15 billion a year earlier, but short of analysts’ estimate of $1.33 billion, according to FactSet. The company posted 17% revenue growth in the third quarter.

The company expects growth to decelerate further in the current first quarter, projecting growth between 11% and 14%. It’s forecasting revenue between $951 million and $971 million.

Chief Executive Officer William Ready said the company needs to broaden its revenue mix and accelerate sales going forward.

“We are not satisfied with our Q4 revenue performance and believe it does not reflect what Pinterest can deliver over time,” he told analysts on a call Thursday. “We are moving with urgency to return over time to the mid-to-high-teens growth, or better than what we have been consistently delivering.”

Pinterest on Thursday recorded a profit of $277.1 million, or 41 cents a share, compared with its profit of $1.85 billion, or $2.68 a share, a year earlier. The $1.85 billion profit in 2024 included a $1.6 billion benefit from deferred tax assets.

Stripping out certain one-time items, Pinterest logged adjusted earnings of 67 cents a share, in line with analyst expectations, according to FactSet.

Ready said the company continues to see headwinds from larger retailers pulling back on advertising spending to protect their margins amid the impact from President Trump’s tariffs.

“We saw continued softness from this cohort of large retailers,” Ready said. “While we see opportunity over the long term, the near-term outlook for this cohort on our platform remains pressured given these headwinds.”

Ready said the company has expanded its footprint among mid-market and small-to-medium business advertisers, as well as international businesses. Still, he said Pinterest had a ways to go to offset the headwinds from larger advertisers, which may become even more pronounced in the current quarter.

Chief Financial Officer Julia Donnelly added that the company is looking to increase its investments in sales and research and development related to artificial-intelligence following the launch of its restructuring effort in January. Pinterest said last month that it would cut about 15% of its workforce, or approximately 700 jobs.

The sports-car maker delivered 279,449 cars last year, down from 310,718 in 2024.

When the Writers Festival was called off and the skies refused to clear, one weekend away turned into a rare lesson in slowing down, ice baths included.