Anime Is Japan’s Next Global Champion

As Japanese animation and comics go global, opportunities abound for investors

Move over, Marvel. The next blockbuster entertainment franchise might come from Japan.

Anime is shaping up as the country’s next big export industry, beyond cars and electronics. This once-niche entertainment form is entering the worldwide mainstream , and its growth could light up investors’ portfolios.

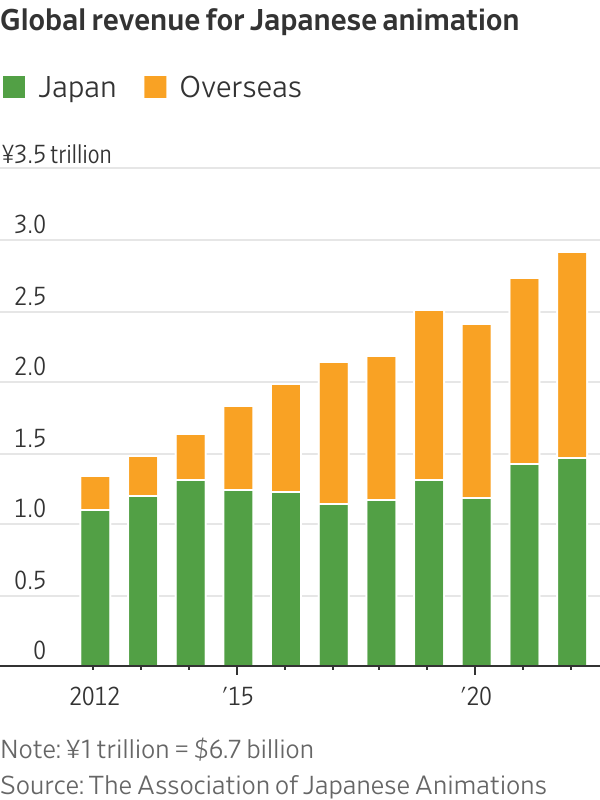

The global market for Japanese animation, known as anime, and its related products has more than doubled between 2012 and 2022 to 2.9 trillion yen, equivalent to $20 billion, according to the Association of Japanese Animations. The overseas market has been driving that growth. Markets outside of Japan made up around half of the total in 2022, compared with around 18% a decade earlier.

Streaming companies such as Netflix are certainly taking notice. Its live-action series “One Piece,” based on a Japanese comic, was its most-watched show in the second half of 2023. In fact, anime content on Netflix in the period logged 14% viewing growth from the first half of 2023, compared with a 4% drop overall, according to Jefferies. These streaming platforms will continue to introduce more anime-related content to their global audiences.

Japan’s anime and manga, the Japanese word for comics, have created many well-known characters and franchises over the years, such as Pokémon. And it looks to be getting even more mainstream. The anime market in North America has grown from $1.6 billion in 2018 to $4 billion this year, according to Jefferies. And Asia, which has long been more receptive to anime, will likely continue to grow strongly, especially in China. Anime has also been popular on Chinese streaming platforms such as Bilibili .

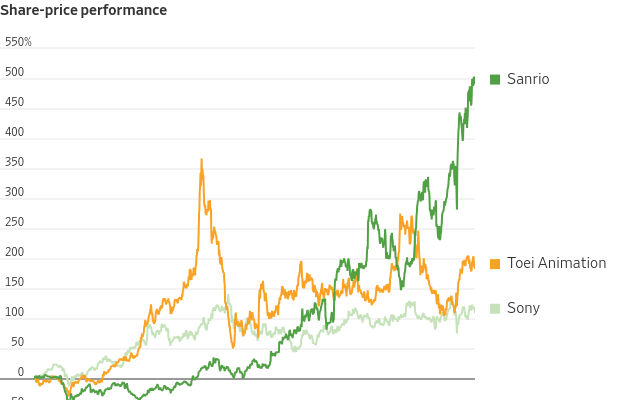

Apart from streaming, selling merchandise can be even more lucrative. Sanrio , which owns characters like Hello Kitty , has reported record profits, with its share price rising nearly sixfold over the past five years.

Sony would be another major beneficiary of this trend . The company owns animation streaming service Crunchyroll, which had 15 million subscribers as of June. That compared with around 3 million subscribers when Sony announced the acquisition of the streaming service from AT&T for nearly $1.2 billion in 2020. This contrasts with Sony’s approach in online streaming for other content: It acts more like an “arms dealer,” selling movies and shows to platforms such as Netflix and Amazon.com . That means the company could benefit more directly from the anime boom. And anime also has strong synergies with its movie and game businesses .

Anime maker Toei Animation, which owns popular franchises such as “One Piece” and “Dragon Ball,” is another listed company that would benefit. It makes anime itself, but more important for the overseas markets, it also earns licensing revenue from the copyrights to popular franchises that it owns. Sales outside of Japan accounted for more than half of its total revenue in the latest fiscal year ended in March. Season two for Netflix’s “One Piece” is already in production. Toei stock has nearly tripled since the end of 2019.

Anime has blockbuster potential, not just for audiences but for investors as well.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A long-standing cultural cruise and a new expedition-style offering will soon operate side by side in French Polynesia.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The boom in casual footware ushered in by the pandemic has ended, a potential problem for companies such as Adidas that benefited from the shift to less formal clothing, Bank of America says.

The casual footwear business has been on the ropes since mid-2023 as people began returning to office.

Analyst Thierry Cota wrote that while most downcycles have lasted one to two years over the past two decades or so, the current one is different.

It “shows no sign of abating” and there is “no turning point in sight,” he said.

Adidas and Nike alone account for almost 60% of revenue in the casual footwear industry, Cota estimated, so the sector’s slower growth could be especially painful for them as opposed to brands that have a stronger performance-shoe segment. Adidas may just have it worse than Nike.

Cota downgraded Adidas stock to Underperform from Buy on Tuesday and slashed his target for the stock price to €160 (about $187) from €213. He doesn’t have a rating for Nike stock.

Shares of Adidas listed on the German stock exchange fell 4.5% Tuesday to €162.25. Nike stock was down 1.2%.

Adidas didn’t immediately respond to a request for comment.

Cota sees trouble for Adidas both in the short and long term.

Adidas’ lifestyle segment, which includes the Gazelles and Sambas brands, has been one of the company’s fastest-growing business, but there are signs growth is waning.

Lifestyle sales increased at a 10% annual pace in Adidas’ third quarter, down from 13% in the second quarter.

The analyst now predicts Adidas’ organic sales will grow by a 5% annual rate starting in 2027, down from his prior forecast of 7.5%.

The slower revenue growth will likewise weigh on profitability, Cota said, predicting that margins on earnings before interest and taxes will decline back toward the company’s long-term average after several quarters of outperforming. That could result in a cut to earnings per share.

Adidas stock had a rough 2025. Shares shed 33% in the past 12 months, weighed down by investor concerns over how tariffs, slowing demand, and increased competition would affect revenue growth.

Nike stock fell 9% throughout the period, reflecting both the company’s struggles with demand and optimism over a turnaround plan CEO Elliott Hill rolled out in late 2024.

Investors’ confidence has faded following Nike’s December earnings report, which suggested that a sustained recovery is still several quarters away. Just how many remains anyone’s guess.

But if Adidas’ challenges continue, as Cota believes they will, it could open up some space for Nike to claw back any market share it lost to its rival.

Investors should keep in mind, however, that the field has grown increasingly crowded in the past five years. Upstarts such as On Holding and Hoka also present a formidable challenge to the sector’s legacy brands.

Shares of On and Deckers Outdoor , Hoka’s parent company, fell 11% and 48%, respectively, in 2025, but analysts are upbeat about both companies’ fundamentals as the new year begins.

The battle of the sneakers is just getting started.

From mud baths to herbal massages, Fiji’s heat rituals turned one winter escape into a soul-deep reset.

Ophora Tallawong has launched its final release of quality apartments priced under $700,000.