Asics Stock Catches Fire Along With Its Dad Sneakers

Shares in the Japanese running-shoe maker have just about quadrupled

Asics , the 75-year-old Japanese sneaker brand, is having a moment. So are its shares.

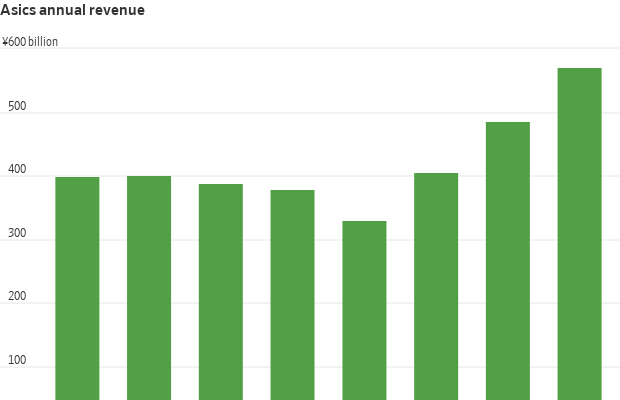

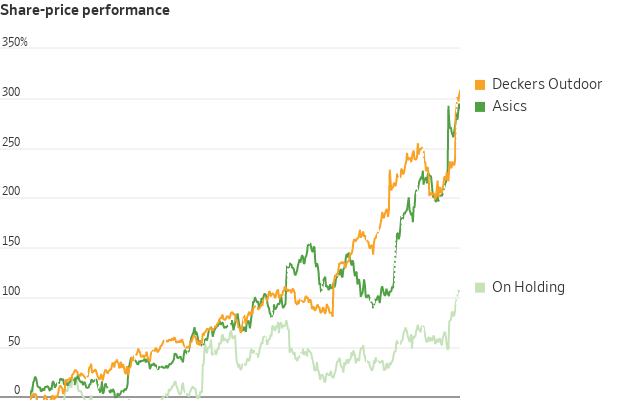

The running-shoe maker’s stock price has quadrupled in total return terms over the past two years. Its financial performance is strong: Revenue in its last reported quarter grew 14% from a year earlier while its operating profit surged 53%.

Asics has long been a well-loved brand among the running community. Around a quarter of 54,000 runners who finished the Paris Marathon sported a pair of Asics, including both winners in the men’s and women’s races, according to the company.

In fact, even Nike can trace its roots back to the Japanese company. Nike began its business in the 1960s by importing and distributing shoes from Asics, then known as Onitsuka, in the U.S. Onitsuka Tiger remains a high-end fashion brand within Asics.

Asics has benefited from the Covid-19 pandemic: More people picked up running as a hobby when they had nothing else to do. At the same time, people working from home began giving priority to comfort in their footwear—discovering that lightweight shoes with cushioned soles designed for running are pretty comfortable for walking around in, too. Running-shoe upstarts such as Hoka and On Holding have also seen explosive growth in the past few years. Hoka’s sales in the quarter ended in March surged 34% from a year earlier, pushing shares of its owner , Deckers Outdoor , to record highs.

The performance running shoes segment is Asics’ largest by revenue, and it has tried to maintain a close-knit community of runners. Asics acquired Runkeeper, a popular fitness-tracking app among runners, in 2016. In recent years, it has been acquiring race-registration companies, including Njuko Sas in Europe and Register Now in Australia. Its loyalty program has nearly 15 million members globally.

But outside of runners and Onitsuka Tiger, Asics was perhaps best known for “dad sneakers” —a style of shoes that are picked more for practicality than aesthetics. Lately, however, some old Asics designs have become unlikely fashion symbols. Youngsters have apparently eschewed conventional beauty standards and embraced the uncool: Crocs and Hoka are some other examples of “ugly shoes” that have seen an explosion in popularity.

Asics has done its fair bit, too. Its collaboration with designers from Vivienne Westwood to Cecilie Bahnsen have generated lots of buzz on social media. For example, its redesign of its 2008 Gel-Kayano 14 sneaker with Canadian design studio JJJJound has been a smash hit . The shoe can sell for more than $1,000 on online marketplace StockX. Asics was the fifth most-traded brand on StockX last year, rising from No. 10 the year before. Revenue for the company’s more fashion-minded SportStyle division grew 52% year over year in the last reported quarter.

Even better news for investors is that the company has been more profitable, too. Operating margin in its quarter ended in March was 19.4%, compared with 9.5% two years earlier. Partly that is because the company has shifted its product mix to more premium products. It has also been selling more directly to customers than through wholesalers. Around 64% of its sales were through wholesale in the first quarter, down from 74% three years earlier. E-commerce sales have risen from 13% to 17% of sales.

Asics trades at 34 times forward earnings, according to S&P Global Market Intelligence. That is a similar multiple as Deckers Outdoor but higher than bigger peer Nike, which trades at 25 times. The premium could be justified if Asics could keep growing its sales with better margins.

Asics is sprinting ahead. It still has room to run.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.