China’s Small Businesses Are Hit Hard as Economic Recovery Falters

Beijing pushes banks to extend loans to small businesses, with limited success

China’s small businesses are cutting staff, struggling to pay off debt and nervous about the future. Their plight paints a grim picture of the country’s flagging recovery.

The country’s small and medium-size enterprises are crucial to the economy; they employed around 233 million people by the end of 2018, which was the last time this data was made public. But official data, recent disclosures from lenders and interviews with small-business owners show that many of these companies are suffering.

“The biggest problem for small and micro enterprises now is survival,” said Ji Shaofeng, the founder of a micro loan trade association based in China’s eastern Jiangsu province.

The struggles of China’s small businesses make clear how far the country has to go before it fully recovers from a series of lockdowns, which were part of Beijing’s strict response to the coronavirus.

When the government finally brought an end to its strict zero-Covid policy late last year, many economists expected a strong recovery. It hasn’t arrived. Consumer spending, factory orders and exports are among many indicators showing signs that the recovery is losing steam.

A recent survey of manufacturing purchasing managers in China showed a second consecutive month of contraction for small companies. China’s small-enterprise purchasing managers index is now at 47.9; a reading below 50 shows business activity is slowing.

Scott Yang, a wine and tea seller in Wenzhou, a city in China’s wealthy Zhejiang province, said many local business owners he knows are laying off employees and trying to cut costs, in response to a drop in factory orders.

Small enterprises started to add jobs at the end of the first quarter, when there was still some optimism about a recovery. But a PMI subindex showed employment at small enterprises was 48.7 in May, meaning these companies are either cutting staff or not replacing those who leave.

Huang Yiwen, who sells furniture online in Foshan, in southern China’s Guangdong province, said his business has been hurt by the weak property market, since new-home buyers are a reliable source of demand for furniture makers. Annual home sales fell to a six-year low in 2022, after a slump in the property sector that also led to debt defaults by some of China’s largest developers.

“It’s so hard to sell,” said Huang, regarding furniture.

Less than 40% of small and medium-size enterprises are operating at full capacity, which means producing all of the goods they can, according to the latest survey conducted by the China Association of Small and Medium Enterprises, which sends questionnaires to 3,000 SMEs in the country every month.

Economists warn that the problems facing small businesses can’t be isolated from the wider economy. Because small businesses are such a major source of employment, particularly in large cities, their struggles reflect—and could worsen—wider economic strains.

“If SMEs do not recover, it will be difficult for urban areas to create enough employment and income, which will have a significant impact on low- and middle-income families,” said Dan Wang, chief economist of Hang Seng Bank (China).

Chinese government officials are becoming uneasy about the economy and are planning a series of moves to stimulate growth, The Wall Street Journal recently reported. That could include billions of dollars of infrastructure spending and a loosening of rules in the property sector.

So far, Beijing’s attempts to prop up small businesses have focused mainly on making it easier for them to get funding. That has had limited success.

Since early 2020, Chinese regulators have pushed banks and other financial institutions to extend loans to small businesses that were hurt by the pandemic. In some parts of the country, local divisions of China’s central bank have sought to help small businesses by establishing teams to answer funding-related questions, as well as visiting factories and farms to assess their needs. The government has provided other targeted-relief measures such as tax exemptions and temporary rent reductions.

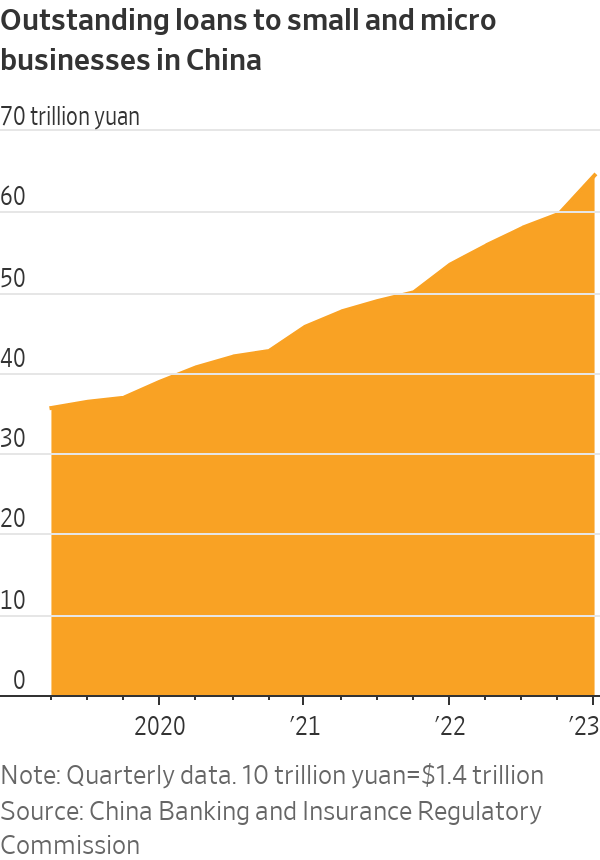

The total outstanding balance of loans to small and micro enterprises has been climbing, reaching the equivalent of $9 trillion at the end of March, according to data from China’s banking regulator.

Many small businesses in China don’t want to secure new financing unless it helps them clear previous debts. Yang, the wine seller, said that while financing is relatively cheap and easy to get, most local businesses he knows are borrowing only to stay afloat and not to expand.

Lufax, a Chinese internet-lending platform that caters mostly to small-business owners, said last month that about 5.7% of the total loans it facilitated were more than 30 days past due at the end of March. Its loan-delinquency rates, which are higher for unsecured loans, have risen for six consecutive quarters.

MYbank, an internet lender that serves small businesses, said in its latest annual report that the balance of its loans that were more than 30 days past due more than doubled last year. The company, an affiliate of the Chinese fintech giant Ant Group, said the impact of the pandemic and weak consumption last year caused many small- and micro-business owners to face continuous pressure.

Many commercial banks have given borrowers more time to repay their loans, extending their forbearance for small businesses to this year. Small businesses whose loans were due in the fourth quarter of 2022 will have until the end of this month to repay, according to a notice from the central bank and a group of regulators.

Chinese banks have allowed some small businesses to roll over their loans, but if these small businesses are unable to repay in the future, they will eventually have to be recognized as bad loans, said Jay Guo, a former banker and current dean at the Ningbo China Institute for Supply Chain Innovation.

“It only makes sense to extend loans if the economy rebounds and SMEs are able to sell their goods,” said Guo.

Ji, of the micro loan trade association, said that while some sectors such as tourism and catering have rebounded in the past few months, small businesses in manufacturing, trade and other industries are still under pressure as demand remains well below where it used to be.

Small businesses are falling victim to a vicious cycle that is affecting the wider economy, said Xiangrong Yu, chief China economist at Citigroup. The poor performance of some private companies is leading to a loss of confidence, and that low confidence is making it hard for those companies to do better, he said.

“Lack of confidence is both a symptom of the problem and the root cause of the problem,” said Yu.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.