Chinese Leaders Vow to Step Up Support for Flagging Economy

Pledges on government spending and monetary support come as data points to slowing growth

Chinese leaders vowed to increase government spending and monetary support for the economy at an annual gathering, signalling they plan to stick with a measured approach to stimulus despite calls for bolder action.

The Central Economic Work Conference, which ended Tuesday, capped a bruising year for the country’s economy, which has struggled with a drawn-out housing crunch and weak consumption.

The trouble shows no sign of abating. After a pickup in the third quarter, data in recent weeks has pointed to slowing growth again as exports struggle, activity in the services sector slows and deflation deepens.

Still, Chinese leaders offered few specifics Tuesday on how they intend to reignite consumer and business confidence and reinvigorate growth.

Chinese leader Xi Jinping presided over the two-day meeting, where leaders urged officials to increase fiscal stimulus and help expand domestic demand, according to Chinese state media. They also acknowledged economic challenges, including “excess capacity in certain industries and weak sentiment in the society,” according to a readout of the meeting.

Chinese leaders also called for strengthening the resilience of industrial supply chains and accelerating the development of artificial intelligence, as well as other strategic industries such as aerospace and biotechnology.

The closed-door meeting, which is typically held in December each year to map out plans for economic policy-making, sets out the leadership’s growth ambitions for the following year, though the detailed targets won’t be released until March, during the National People’s Congress.

Though the overall tone of the conference was pro-growth, “it is still not a call for massive stimulus,” economists at Société Générale said in a note to clients after the readout was published. Instead, officials are emphasising the need to stabilise the economy and stem risks to growth, they said.

Many economists expect Beijing to anchor its growth target at around 5% in 2024, taking their cue from a meeting last week of the Communist Party’s Politburo, its body of top leaders. Policy makers emphasised the importance of economic progress, saying the country needed to “pursue stability through growth.”

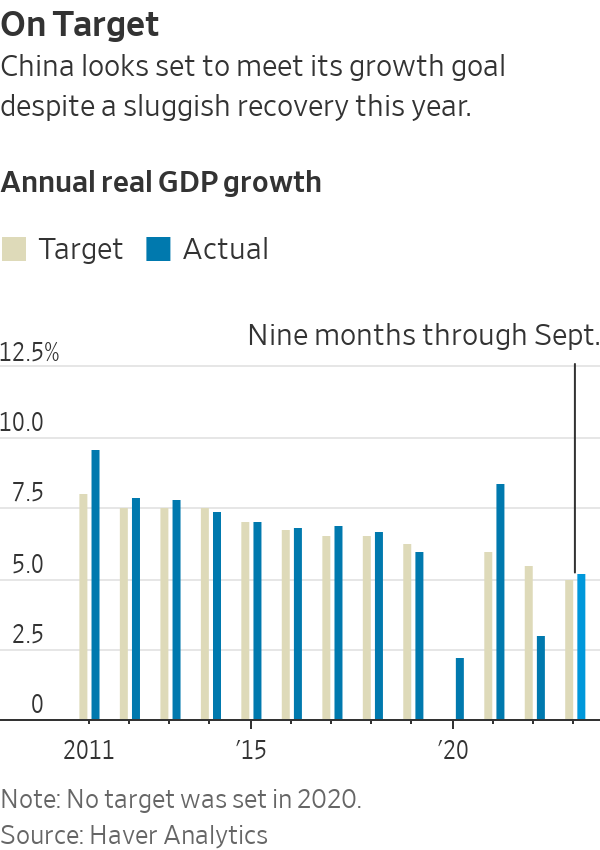

This year’s target was also set at around 5%. Despite its difficulties, the economy looks set to hit that goal this year, but economists say maintaining that pace will be tough without bigger measures to stimulate the economy.

Beijing has taken some measures this year including interest rate cuts and channeling cheaper loans to firms to arrest the downturn but has so far failed to reverse a broad-based loss of confidence.

China’s difficult year contrasts with surprising resilience in the U.S., where buoyant consumer and government spending have kept the economy motoring despite aggressive increases in interest rates by the Federal Reserve. The latest data on jobs and inflation has stoked optimism that the U.S. will avoid recession and instead enjoy a “soft landing,” in which price growth slows to target without a steep rise in unemployment. That marks a reversal in expectations from earlier in the year when China was expected to easily outpace a cooling U.S. economy.

And there are fresh signs of trouble for China.

Business surveys showed factory activity slid deeper into contraction in November as domestic and foreign orders dried up, while activity in the services sector shrank for the first time this year as consumers cut back spending.

Exports rose just 0.5% on the year last month after shrinking for six months, highlighting the drag from slowing growth in the U.S. and Europe.

Weak domestic spending and bloated industrial capacity caused consumer prices in China to fall in November for the second straight month, deepening a bout of deflation that economists say could prove hard to shake if the economy doesn’t pick up soon.

China’s slow-motion property crunch shows few signs of abating. Some developers have defaulted on their debts and construction has stalled on millions of homes. Home prices fell in October and new investment in the sector is shrinking.

A central question for investors and economists is whether Beijing will experiment with novel stimulus approaches to shore up battered confidence among households and businesses.

At the meeting, Chinese leaders vowed to expand consumption and raise income for both urban and rural residents but offered little sign that they may pivot to giving cash handouts to households, despite repeated calls from policy advisers and economists to do so.

Instead, the government is seen as more likely to step up efforts to resolve the crisis in the property market, which remains a major drag on overall growth.

Chinese leaders called for equal treatment for developers to meet their financing needs—a likely reference to the perception that banks favour state-backed developers over private ones. They also urged accelerating the construction of government-subsidised affordable housing and urban village renovation projects.

Still, the meeting didn’t spell out a plan to help cash-strapped developers finish tens of millions of uncompleted apartments, a crucial step that economists believe will help restore household’s confidence in the government.

While officials aren’t expected to disclose a growth target until a political gathering next spring, economists and investors are already debating how aggressive Beijing will be with its 2024 goal.

Economists from J.P. Morgan predicted that policy makers will likely maintain a goal of around 5%, to signal a renewed focus on the economy. Robin Xing, chief China economist at Morgan Stanley, said he expects Beijing to set a target of 4.5% to 5% and pursue a stronger fiscal stimulus.

Others believe Beijing will stick to a more conservative target because of the headwinds facing the economy. Ting Lu, chief China economist at Nomura, said he expects China to aim for around 4.5%.

“I still think the Chinese government is quite rational,” said Lu, who cautioned that the economy hasn’t bottomed out and the actual growth rate could slip to 4% in 2024 from Nomura’s 5.2% forecast for 2023.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.