Corporate Layoffs Spread Beyond High-Growth Tech Giants

Dow, IBM and SAP say they will lay off thousands of workers as belt-tightening becomes the new business priority

Dow Inc., International Business Machines Corp. and SAP SE announced plans to cut thousands of jobs to prepare for a darkening economic outlook, as the current wave of corporate layoffs spreads beyond high-growth technology companies.

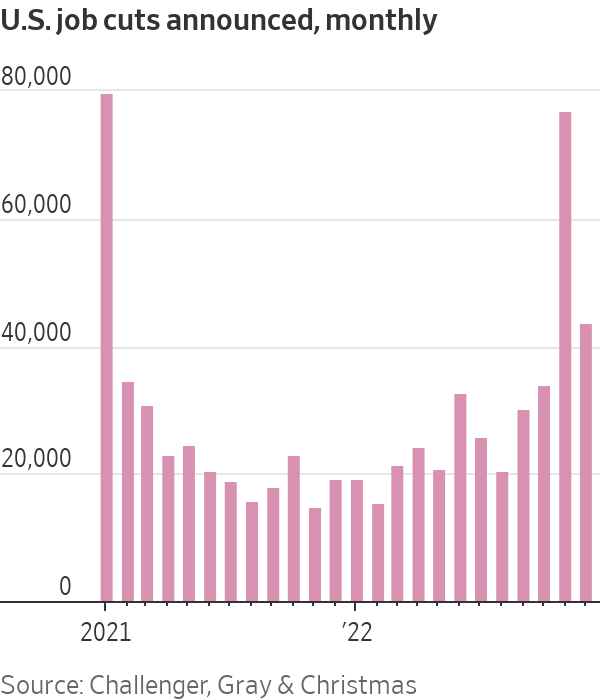

Together with layoffs announced by manufacturer 3M Co. this week, these companies are trimming more than 10,000 jobs, just a fraction of their total workforces. Still, the decisions mark a shift in sentiment inside executive suites, where many leaders have been holding on to workers after struggling to hire and retain them in recent years when the pandemic disrupted workplaces.

Unlike Microsoft Corp. and Google parent Alphabet Inc., which announced larger layoffs this month, these companies haven’t expanded their workforces dramatically during the pandemic. Instead, the leaders of these global giants said they were shrinking to adjust to slowing growth, or responding to weaker demand for their products.

“We are taking these actions to further optimise our cost structure,” Jim Fitterling, Dow chief executive, said in announcing the cuts, noting the company was navigating “macro uncertainties and challenging energy markets, particularly in Europe.”

The U.S. job market remains historically tight, with unemployment in December at 3.5% matching multi decade lows. The number of job openings still far outpaces the number of people looking for work. The Federal Reserve has been raising interest rates to tame growth and combat high inflation. But CEOs say many companies are beginning to scrutinise hiring more closely.

Slower hiring has already lengthened the time it takes Americans to land a new job. In December, 826,000 unemployed workers had been out of a job for about 3½ to 6 months, up from 526,000 in April 2022, according to the Labor Department.

“Employers are hovering with their feet above the brake. They’re more cautious. They’re more precise in their hiring,” said Jonas Prising, chief executive of ManpowerGroup Inc., a provider of temporary workers. “But they’ve not stopped hiring.”

Additional signs of a cooling economy emerged on Thursday when the Commerce Department said U.S. gross domestic product growth slowed to a 2.9% annual rate in the fourth quarter, down from a 3.2% annual rate in the third quarter.

Not all companies are in layoff mode. Walmart Inc., the country’s biggest private employer, said this week it was raising its starting wages for hourly U.S. workers to $14 from $12, amid a still tight job market for front line workers. Chipotle Mexican Grill Inc. said Thursday it plans to hire 15,000 new employees to work in its restaurants, while plane maker Airbus SE said it is recruiting over 13,000 new staffers this year. Airbus said 9,000 of the new jobs would be based in Europe with the rest spread among the U.S., China and elsewhere.

General Electric Co., which slashed thousands of aerospace workers in 2020 and is currently laying off 2,000 workers from its wind turbine business, is hiring in other areas. “If you know any welders or machinists, send them my way,” Chief Executive Larry Culp said this week.

Annette Clayton, CEO of North American operations at Schneider Electric SE, a Europe-headquartered energy-management and automation company, said the U.S. needs far more electricians to install electric-vehicle chargers and perform other tasks. “The shortage of electricians is very, very important for us,” she said.

Railroad CSX Corp. told investors on Wednesday that after sustained effort, it had reached its goal of about 7,000 train and engine employees around the beginning of the year, but plans to hire several hundred more people in those roles to serve as a cushion and to accommodate attrition that remains higher than the company would like.

Freeport-McMoRan Inc. executives said Wednesday they expect U.S. labor shortages to continue to crimp production at the mining giant. The company has about 1,300 job openings in a U.S. workforce of about 10,000 to 12,000, and many of its domestic workers are new and need training and experience to match prior expertise, President Kathleen Quirk told analysts.

“We could have in 2022 produced more if we were fully staffed, and I believe that is the case again this year,” Ms. Quirk said.

The latest layoffs are modest relative to the size of these companies. For example, IBM’s plan to eliminate about 3,900 roles would amount to a 1.4% reduction in its head count of 280,000, according to its latest annual report.

The planned 3,000 job cuts at SAP affect about 2.5% of the business-software maker’s global workforce. Finance chief Luka Mucic said the job cuts would be spread across the company’s geographic footprint, with most of them happening outside its home base in Germany. “The purpose is to further focus on strategic growth areas,” Mr. Mucic said. The company employed around 111,015 people on average last year.

Chemicals giant Dow said on Thursday it was trimming about 2,000 employees. The Midland, Mich., company said it currently employs about 37,800 people. Executives said they were targeting $1 billion in cost cuts this year and shutting down some assets to align spending with the macroeconomic environment.

3M, which had about 95,000 employees at the end of 2021, cited weakening consumer demand for its plans to eliminate 2,500 manufacturing jobs. The maker of Scotch tape, Post-it Notes and thousands of other industrial and consumer products said it expects lower sales and profit in 2023.

“We’re looking at everything that we do as we manage through the challenges that we’re facing in the end markets,” 3M Chief Executive Mike Roman said during an earnings conference call. “We expect the demand trends we saw in December to extend through the first half of 2023.”

Some companies still hiring now say the job cuts across the economy are making it easier to find qualified candidates. “We’ve got the pick of the litter,” said Bill McDermott, CEO of business-software provider ServiceNow Inc. “We have so many applicants.”

At Honeywell International Inc., CEO Darius Adamczyk said the job market remains competitive. With the layoffs in technology, though, Mr. Adamczyk said he anticipated that the labor market would likely soften, potentially also expanding the applicants Honeywell could attract.

“We’re probably going to be even more selective than we were before because we’re going to have a broader pool to draw from,” he said.

Across the corporate sphere, many of the layoffs happening now are still small relative to the size of the organisations, said Denis Machuel, CEO of global staffing firm Adecco Group AG.

“I would qualify it more as a recalibration of the workforce than deep cuts,” Mr. Machuel said. “They are adjusting, but they are not cutting the muscle.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

When will Berkshire Hathaway stop selling Bank of America stock?

Berkshire began liquidating its big stake in the banking company in mid-July—and has already unloaded about 15% of its interest. The selling has been fairly aggressive and has totaled about $6 billion. (Berkshire still holds 883 million shares, an 11.3% interest worth $35 billion based on its most recent filing on Aug. 30.)

The selling has prompted speculation about when CEO Warren Buffett, who oversees Berkshire’s $300 billion equity portfolio, will stop. The sales have depressed Bank of America stock, which has underperformed peers since Berkshire began its sell program. The stock closed down 0.9% Thursday at $40.14.

It’s possible that Berkshire will stop selling when the stake drops to 700 million shares. Taxes and history would be the reasons why.

Berkshire accumulated its Bank of America stake in two stages—and at vastly different prices. Berkshire’s initial stake came in 2017 , when it swapped $5 billion of Bank of America preferred stock for 700 million shares of common stock via warrants it received as part of the original preferred investment in 2011.

Berkshire got a sweet deal in that 2011 transaction. At the time, Bank of America was looking for a Buffett imprimatur—and the bank’s stock price was weak and under $10 a share.

Berkshire paid about $7 a share for that initial stake of 700 million common shares. The rest of the Berkshire stake, more than 300 million shares, was mostly purchased in 2018 at around $30 a share.

With Bank of America stock currently trading around $40, Berkshire faces a high tax burden from selling shares from the original stake of 700 million shares, given the low cost basis, and a much lighter tax hit from unloading the rest. Berkshire is subject to corporate taxes—an estimated 25% including local taxes—on gains on any sales of stock. The tax bite is stark.

Berkshire might own $2 to $3 a share in taxes on sales of high-cost stock and $8 a share on low-cost stock purchased for $7 a share.

New York tax expert Robert Willens says corporations, like individuals, can specify the particular lots when they sell stock with multiple cost levels.

“If stock is held in the custody of a broker, an adequate identification is made if the taxpayer specifies to the broker having custody of the stock the particular stock to be sold and, within a reasonable time thereafter, confirmation of such specification is set forth in a written document from the broker,” Willens told Barron’s in an email.

He assumes that Berkshire will identify the high-cost Bank of America stock for the recent sales to minimize its tax liability.

If sellers don’t specify, they generally are subject to “first in, first out,” or FIFO, accounting, meaning that the stock bought first would be subject to any tax on gains.

Buffett tends to be tax-averse—and that may prompt him to keep the original stake of 700 million shares. He could also mull any loyalty he may feel toward Bank of America CEO Brian Moynihan , whom Buffett has praised in the past.

Another reason for Berkshire to hold Bank of America is that it’s the company’s only big equity holding among traditional banks after selling shares of U.S. Bancorp , Bank of New York Mellon , JPMorgan Chase , and Wells Fargo in recent years.

Buffett, however, often eliminates stock holdings after he begins selling them down, as he did with the other bank stocks. Berkshire does retain a smaller stake of about $3 billion in Citigroup.

There could be a new filing on sales of Bank of America stock by Berkshire on Thursday evening. It has been three business days since the last one.

Berkshire must file within two business days of any sales of Bank of America stock since it owns more than 10%. The conglomerate will need to get its stake under about 777 million shares, about 100 million below the current level, before it can avoid the two-day filing rule.

It should be said that taxes haven’t deterred Buffett from selling over half of Berkshire’s stake in Apple this year—an estimated $85 billion or more of stock. Barron’s has estimated that Berkshire may owe $15 billion on the bulk of the sales that occurred in the second quarter.

Berkshire now holds 400 million shares of Apple and Barron’s has argued that Buffett may be finished reducing the Apple stake at that round number, which is the same number of shares that Berkshire has held in Coca-Cola for more than two decades.

Buffett may like round numbers—and 700 million could be just the right figure for Bank of America.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.