Don’t Count on China to Save the World Economy

Early signs suggest the country’s economic revival will mostly be felt in service industries at home

The world is counting on an economic bounceback from China to power global growth and help keep recession at bay. Don’t bank on it.

China’s recovery after years of Covid-19 lockdowns will likely look a lot different from previous ones. And for many parts of the world, economists warn, it could be less potent than governments and businesses hope.

China has historically relied on government stimulus and heavy investment to power itself out of slumps. That mix helped yank the global economy out of the doldrums after the 2008 financial crisis.

This time, China is deeply in debt, its housing market is in distress, and much of the infrastructure the country needs is already built. As a result, its latest revival will be led by consumers, who are casting off almost three years of public-health restrictions and travel bans after the government abruptly dismantled its zero-tolerance policy toward Covid-19.

Data shows that people are again venturing out and shopping in big cities, and there are signs that the worst of China’s Covid outbreak might be behind it. Like their American counterparts, Chinese consumers squirrelled away cash during lockdowns. But consumer confidence remains low. While wealthier Chinese are opening their wallets, many others are choosing to save more than spend.

Early indications suggest the biggest effects of China’s rebound will be felt at home, rather than abroad. Official data, including business surveys, sales and public transit numbers, suggest the strongest growth will come from service industries such as restaurants, bars and travel.

That means that while an accelerating China is good news for fragile global growth, especially as the U.S. and Europe are set to slow, the direct effects of its revival will likely be less pronounced elsewhere than in the stimulus-led expansions of the past.

“China will deliver a powerful economic recovery, but the growth spillover to the rest of the world will be much more muted in this cycle because of the nature of the economic rebound,” said Frederic Neumann, chief Asia economist at HSBC.

The U.S. economy is unlikely to feel much benefit at all, some analysts say, since it has limited exposure to China’s service industries. U.S. growth might even be squeezed if China’s reopening pushes up demand for energy and raises global energy prices, adding to inflationary pressures.

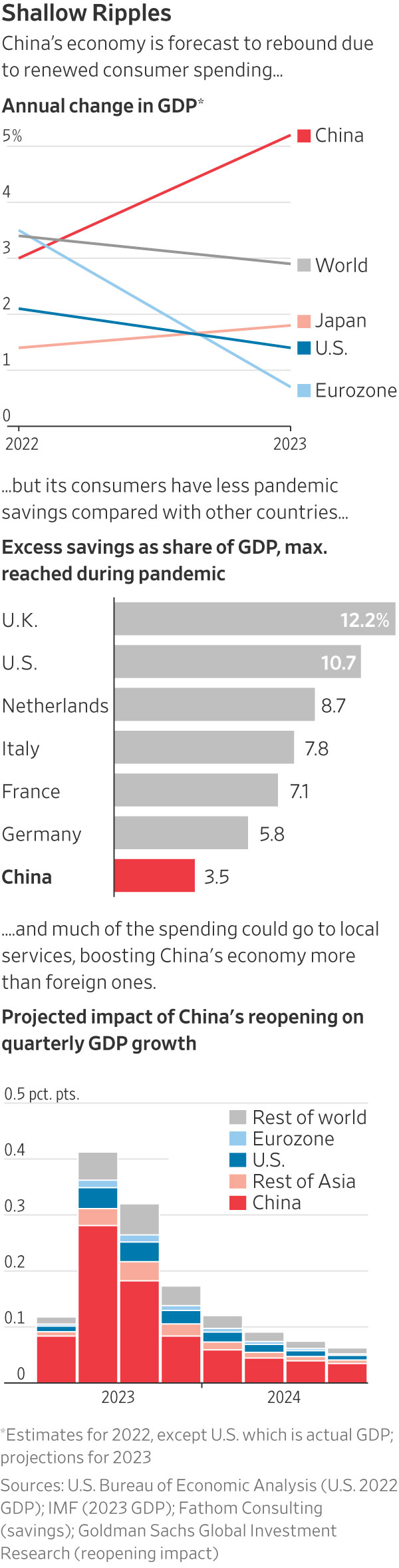

China’s economy is set to expand 5.2% in 2023, according to the International Monetary Fund’s latest forecasts, easily outpacing the 1.4% growth rate expected in the U.S. and 0.7% in Europe’s 20-nation common currency area.

The IMF predicts China will account for around a third of global growth this year, compared with just 10% for the U.S. and Europe combined. That would take China back to the kind of share it had in the five years before the pandemic, IMF data show. In 2022, when the U.S. grew at 2.1%, China’s economy expanded 3%, its second-worst performance since the death of Mao Zedong in 1976. China’s share of global growth sank to 16%.

“It’s so important that China rebounds this year because the U.S. and Europe are expected to slow down sharply,” said Hoe Ee Khor, chief economist at the Asean+3 Macroeconomic Research Office, an economic research organisation that provides policy advice and technical assistance to economies in East and Southeast Asia. “It provides the support that’s missing among those three pillars.”

Wealthier Chinese could help boost the global economy with spending on European luxury goods and vacations in places such as Southeast Asia. Swiss watchmaker Swatch Group AG said in January that based on the rebound in sales it experienced in China immediately after reopening, it expects a record year for revenue, powered by sales in China, Hong Kong and Macau as travel resumes.

Bernard Arnault, chairman and chief executive of luxury goods giant LVMH Moët Hennessy Louis Vuitton SE, told analysts and reporters on Jan. 26 that stores are full in Macau. “The change is quite spectacular,” he said.

“This is a serious bump for everybody,” David Calhoun, chief executive officer of Boeing Inc., said last month on a call with investors, describing China’s reopening as “a major event in aviation.” He said the company is aiming to get idled aircraft back in the air and is hopeful on further deliveries to China, as Chinese carriers will need Boeing’s 737 MAX aircraft to meet rebounding demand for flights.

Other companies are more circumspect. Chinese households received far less in fiscal support from their government during the pandemic than workers in advanced economies, and many consumers remain worried about a weak job market and the continuing real-estate slump.

Colgate-Palmolive Co. Chief Executive Officer Noel Wallace told analysts late last month that despite the euphoria about reopening, sales of the company’s household goods in China remain soft. “China is a big question mark,” he said.

Yum China Holdings Inc., which manages restaurant chains including Kentucky Fried Chicken and Pizza Hut in China, said it saw a bump in sales during China’s recent Lunar New Year holidays but it is wary about the outlook. “While all these happy improvements are happening, we are also cautious that the value for money, the cautious spending is also happening,” Chief Executive Joey Wat said on a Feb. 7 call with analysts.

In previous years of stimulus-fuelled growth, when China plowed money into real estate, infrastructure and factories to turn its economy around, its ravenous demand for commodities and machinery was felt all over the world—among tool makers in Germany, copper producers in Latin America, makers of excavators in Japan and coal producers in Australia.

In 2009, China expanded 9.4% thanks to a $586 billion stimulus package, providing a powerful counterweight to advanced economies hit hard by the global financial crisis.

Economists at Goldman Sachs estimate China’s reopening will add 1 percentage point to global economic growth this year, primarily through higher demand for energy, higher imports and international travel. The biggest beneficiaries are likely to be oil exporters and China’s neighbours in Asia, they said.

Modelling by Oxford Economics implies a smaller boost to global growth. The consulting firm said if Chinese gross domestic product grows 5% this year with the end of Covid restrictions, that would lift global growth to just 1.5%, a gain of 0.2 percentage point compared with their previous forecast.

Goldman Sachs estimates the direct effect of China’s reopening on U.S. growth to be slightly negative, perhaps shaving about 0.04 percentage point off 2023 growth, as the effect of higher oil prices offsets any increase in exports or tourists. The U.S. and other economies less exposed to the reopening might still benefit from indirect effects, though, if China’s revival lifts global trade and business activity overall or contributes to easier financing for households and businesses.

Even if its growth rebounds sharply, underlying issues remain in China’s economy. Local governments are saddled with debt, limiting their ability to finance infrastructure spending. China has taken steps to boost the real-estate industry, such as easing lending curbs on overstretched developers, but such policies aren’t expected to reverse China’s drop in home sales soon because falling prices mean families are still cautious about home purchases, said Tommy Wu, chief China economist at Commerzbank AG. That will limit China’s appetite for commodities such as iron ore, he said.

Other policy goals could weigh on Chinese demand for imports. Beijing is eager to produce more sophisticated capital goods domestically, rather than buy them from Japan and Germany, and has been reining in polluting industries such as steel to meet climate goals.

Steel production fell 2.1% in 2022 from the previous year, and iron ore imports dropped by 1.5%. BHP Group Ltd., the world’s largest miner by market value, said in January that it expects China to be a stabilizing force for commodity demand in 2023. But it isn’t predicting a rebound to pre-pandemic rates of growth, saying Chinese steel output will likely plateau this half-decade after what was possibly the peak in production in 2020.

While domestic flights in China have picked up quickly, it will take some time before flights to Europe and the U.S. begin to approach pre-pandemic levels, said Olivier Ponti, vice president insights at ForwardKeys, a consulting firm that tracks travel industry data.

In January, the number of flights to destinations outside mainland China was about 15% of where they were in 2019. The most popular destinations are relatively nearby, including Macau, Hong Kong, Tokyo and Seoul.

For now, Chinese travellers to Thailand, a popular destination, are mostly businesspeople or affluent independent tourists. Thai officials say they expect a slow uptick of visitors as more flight routes open and group tours resume from Feb. 6, but that it could take years for arrivals to return to the levels they were before Covid struck.

China’s contribution to the global economy will ultimately depend on the durability of Chinese consumption. For now, even though Chinese households accumulated $2.6 trillion in fresh savings last year, less than 30% of the money is available to spend straight away. The rest is socked away in long-term savings accounts. The job market is still weak and the real-estate slump is sapping household wealth.

The consumption recovery will be “shallow and short-lived,” according to Logan Wright, director of China markets research at Rhodium Group, a research firm based in New York. He predicts that after a quick surge in growth around the second quarter, the recovery in consumer spending will quickly lose steam.

—Nick Kostov, Eric Sylvers, Feliz Solomon, Rhiannon Hoyle and Jeffrey Sparshott contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.