Don’t Roll Your Eyes: Looking the Part Could Land You That Job

Applying to be a programmer? Better grab a pair of glasses. Different jobs favour certain looks, new research shows.

Think appearances don’t matter if you’re applying for a job online? New research shows that looking the part is very much part of the equation.

Your credentials and referrals may get you on the shortlist. Even if the whole process takes place online, though, it’s rare that a hiring manager won’t check out your LinkedIn profile. Making the final cut can come down to nailing a specific professional look, according to a new study published by the Harvard Business School.

Analysing 63,000 job openings and the more than 160,000 freelancers who applied for them over a six-month period, researchers found that certain accessories or physical features gave candidates an edge in landing the job—even after controlling for race, age and gender. Researchers used computer vision technology and machine learning to help classify which attributes made someone be perceived as a better fit for a job, then examined what role that played in hiring.

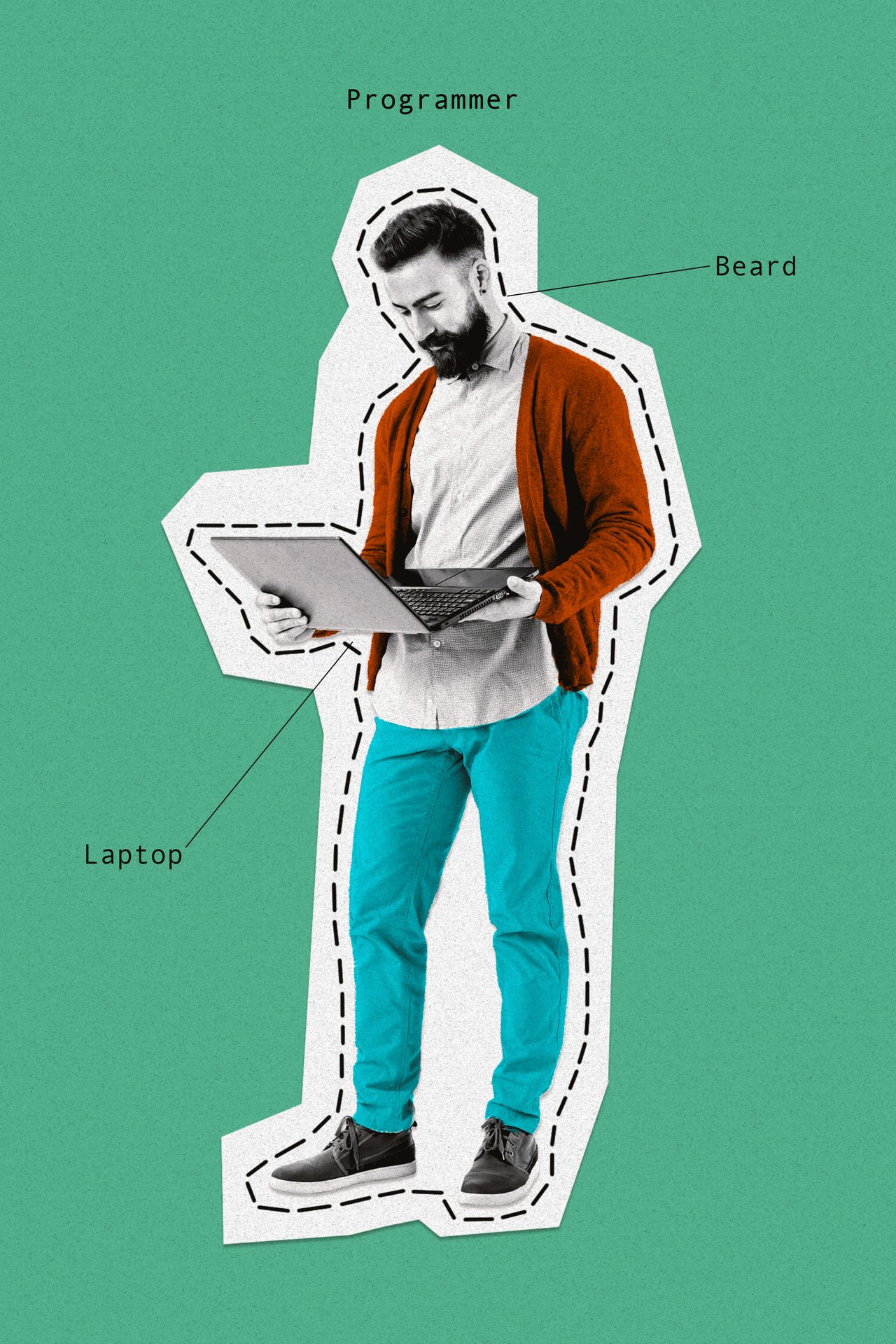

Different jobs favoured certain looks. The analysis showed that men wearing glasses and having a computer visible in the photo were perceived to be a better fit for a software programming assignment than men without glasses, boosting their chances of getting it. A beard gave them a slight edge, too.

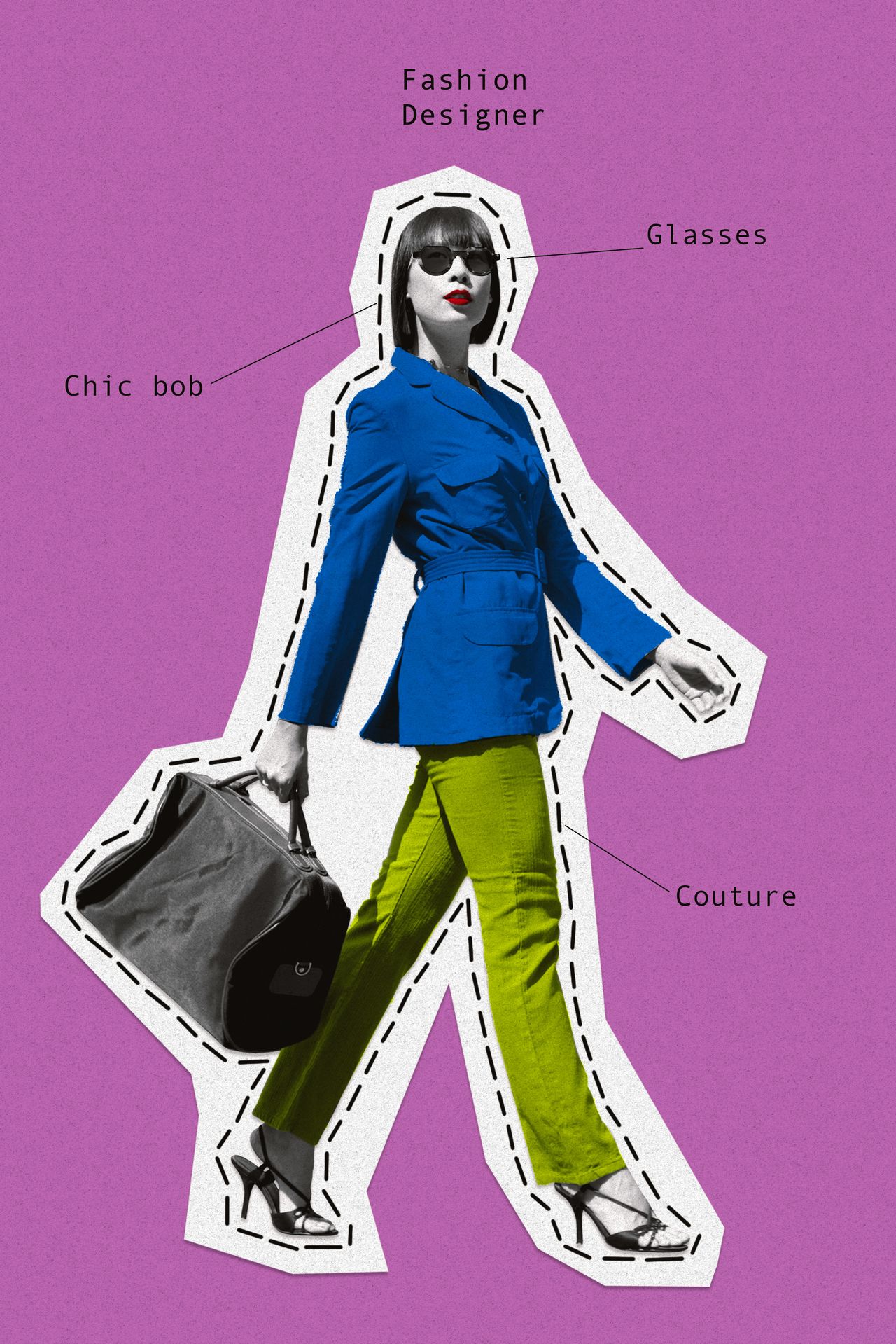

With design and media-related jobs—one of two broad job categories examined in the study—flashing a smile and using a photo with high image quality was also important. Women sporting reading glasses and an “artistic” look were seen as a better fit for graphic design jobs than other women.

The researchers, from Harvard and the University of Southern California, found that certain photo features could tilt the selection process when profiles included equally high ratings from previous clients. The advantage could be roughly the equivalent of a 5% pay differential.

On the other hand, the study suggests that looking the part for a job doesn’t rely just on a candidate’s gender, ethnicity and age. Rather, paying attention to the details of a profile photo can go a long way, recruiters say.

“We would be fooling ourselves to say it’s not part of the package,” says Jessica Vann, founder of Maven Recruiting Group, a San Francisco job-placement firm. While not as important as job or communication skills, “it’s a piece, for sure.”

It’s generally a good idea to have a neutral background and no children, pets or celebrities in the photo. Vann, whose firm specialises in placing executive assistants and chiefs of staff at Silicon Valley companies, says she has counselled job seekers to eschew an obviously AI-generated photo or tone down the makeup.

In a CivicScience poll of more than 2,000 people conducted online last week, about half of respondents said they had used a professional-looking photo of themselves in some capacity; 82% agree that appearance makes a difference in a job offer.

Title VII of the Civil Rights Act of 1964 prohibits employers from discriminating because of race, gender and religion, among other factors. But other aspects of personal appearance—whether height, weight or hairstyle—aren’t necessarily covered by the federal statute, says Steven Pearlman, a labor attorney at Proskauer Rose in Chicago. Plus, it’s often difficult to legally prove whether such biases were the reason for a candidate’s rejection.

Brent McCreary, a theatre ticketing director in New York, has found certain photo details can swing a hiring manager’s decision either way. His professional profile picture usually shows him with a favourite celebrity. At one point it was Britney Spears. Now it’s Kelly Clarkson.

The choice worked against him when he lost out on a revenue management job at a theme park three years ago. In the rejection note, the interviewer suggested a more professional LinkedIn photo.

A month later, though, the executive director of a San Francisco-based streaming platform contacted him. The job he’d applied for was already filled but she noticed his photo. “Your personality and background seem so fun and special,” she wrote in a LinkedIn message. When another project-management job opened soon after, McCreary got it. The job turned out to be a better fit for him, too, he says.

“The company I ended up working for was one where I kind of jelled with the organisation,” he says.

Looking the part is often informed by stories and stereotypes, career coaches say. “You see it in books and movies,” says Catherine Fisher, a LinkedIn career expert who studies data and trends on the professional social media network.

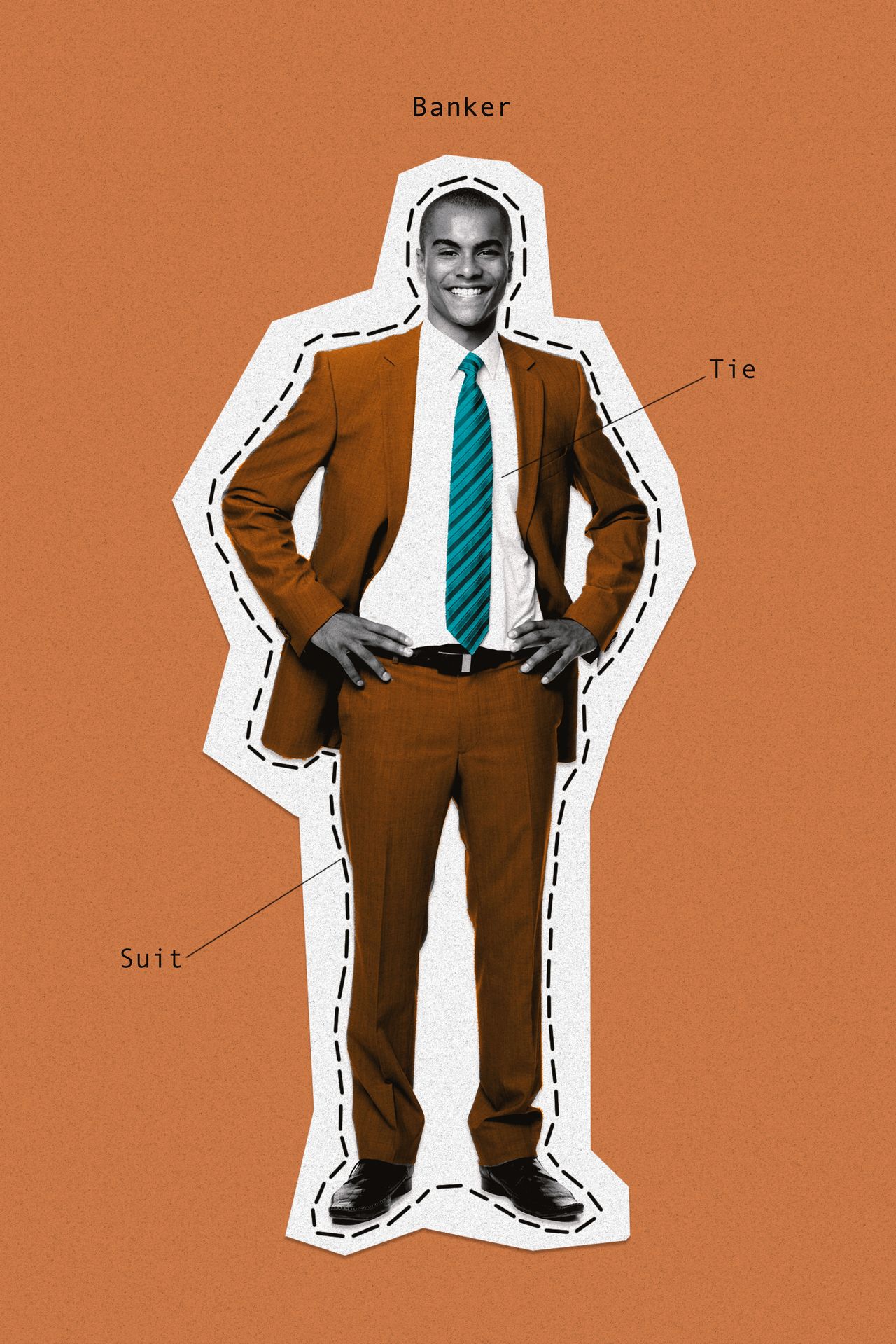

Every industry has its own sartorial vibe, from the fleeced vests and sweatshirts of Silicon Valley to the traditionally suited-up finance crowd in New York.

“You always think hoodies are related to tech companies, but that doesn’t mean I have to wear one,” Fisher says. By the same token, angular bobs and big sunglasses have come to be associated with the fashion industry, though “not everyone in fashion looks like Anna Wintour,” she says.

That’s rapidly changing as home and work life become more mixed, Fisher says. More than half of working Americans say that how they present themselves at work has changed since the pandemic, according to a poll of 2,000 people conducted last year by LinkedIn. Two-thirds said they thought that managers and co-workers were more accepting of different ways of dressing and styling than several years ago.

Alice Stephenson, a 42-year-old lawyer, says that for much of her early career, she dressed the part and concealed her piercings and tattoos. “I wore a stereotype of what a professional looked like,” she says. “I never felt comfortable or able to express my own individuality or creativity through my appearance.”

That changed after she started her own law firm. In her photo on the firm’s website, in her email signature and on LinkedIn, she is wearing a friendly smile, a blue sleeveless dress and a visible sleeve of tattoos.

“I want to look friendly and approachable,” says Stephenson, who lives in Amsterdam. “That’s key to my brand.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.