Eight Questions to Ask Your Ageing Parents (and Yourself) to Keep Their Phones Safe From Hackers

People over 60 lose a lot of money to phone scams. Some simple steps can make them more secure.

Scammers have a lot of opportunities to bilk people during the holiday season. How do you make sure they aren’t tricking someone you love—particularly someone who is especially vulnerable to scams?

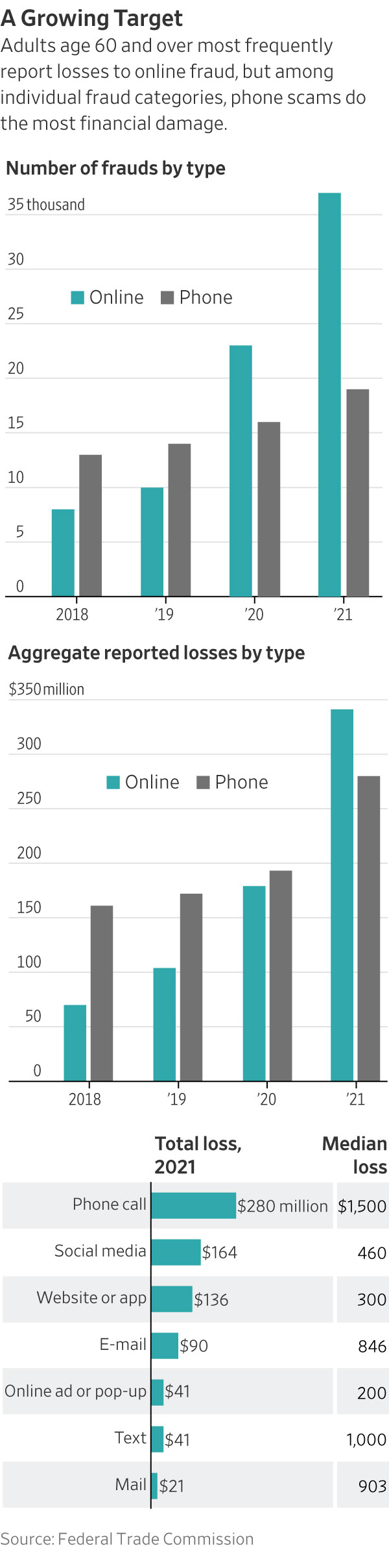

While swindlers will target people of all ages, older Americans have become the favoured mark. Adults 60 and over lose the most money to fraud each year, and phone scams do the most financial damage, according to a Federal Trade Commission report released in October 2022.

So, it is vital to make sure your older family members know how to keep their phones safe. The best way to start is by looking in the mirror. Figure out what security steps you take—or should take—with your own phone and how you could protect yourself better, and then help your relatives tighten up their defences. Remember, age might make some people more susceptible to these risks, but anybody can miss key security strategies. And no criminals will check your age before they hack you.

The holiday season—with its heightened spending and tension—is a prime time to think about smartphone fraud, says Mark Ostrowski, head of engineering at Check Point Software Technologies, an internet-security firm.

“Around this time, emotions run high,” he adds. “And that’s exactly what scammers want. They want an emotional response because that causes you to overlook something or make a bad decision.”

So how do you make sure your relatives are as safe as possible from hackers? You don’t want to be condescending. Instead, talk to them about their concerns, and yours. And during the discussion, make sure to ask them the following questions.

1. Is your phone password protected?

It may be tempting to not bother adding a lock screen to your smartphone, so you can bypass the hassle of punching in a number to get access. But having a four- or six-digit passcode is the first line of defense against hackers: If someone physically steals your phone, they won’t be able to get into the device easily without knowing your code.

Still, there are alternatives to PINs if those feel too cumbersome. Fingerprint scanning and Apple Inc.’s Face ID let you access your phone quickly without any codes, and some Android devices let you create a unique pattern on the screen that you then trace when you want to unlock the device. (Remember, though, that even if you have these types of defences, you will still have to type in your PIN when the phone restarts.)

“You would be surprised how many seniors don’t lock their device because of the inconvenience,” says Danielle Deibler, founder and chief security officer of Quad9, an online service that blocks cyber threats. “Make it so that they have to give consent for another person to get into their device.”

2. Do you update your phone’s software?

Smartphone software updates often include security patches to close loopholes that are potentially accessible to hackers. Third-party apps send out these types of changes, too. Make sure your loved ones—and you—know how to update their smartphone’s operating system and apps when prompted. And show them where to find and download the updates in their settings.

“There’s always security goodies embedded inside of those updates,” says Karim Toubba, chief executive of password-management service LastPass. “You would be surprised at how much value you get out of something that simple.”

Also remember that apps frequently offer multi-factor authentication, providing more security than websites on mobile browsers, says David Nuti, senior vice president at Nord Security, an internet-privacy company. That means to log in, you must provide at least two distinct forms of identification—such as a password and confirmation code via text—to gain access to an account. Help your loved ones set this up for banking and other apps, and be sure to do it for your own.

3. Do you have spam filters set up?

Turning on spam-protection software can prevent your loved ones from falling prey to phone scams. Apple devices running iOS 13 and later and Android phones running Android 6.0 or later can automatically silence unknown callers, and mobile providers can add another layer of protection: AT&T, T-Mobile and Verizon all offer features for detecting robocalls.

4. Do you get alerts from your bank?

Many banking apps offer text alerts for transactions when money enters or leaves an account, so you can tell immediately if you are being robbed. Ask if your family members need help navigating their mobile-banking apps to set those up.

But you shouldn’t rely solely on text messages for security. Scammers can send phishing texts posing as a bank to steal personal and financial information, for instance. So, remind your relatives to not click any text-message links that seemingly come from banks, and to not share sensitive information with someone who says they are calling or texting from a bank.

Instead, instruct them to call the number on the back of their card if they have questions. They can also run any suspicious texts or emails by you.

“Make yourself a firewall for online activity they’re unsure about,” Mr. Nuti says.

5. Have you added a trusted backup contact?

Find out if your relatives have named people to help them access their online accounts if they forget their password. You don’t have to know their password, and security experts say it is often best that you don’t because shared passwords carry more security risks than private ones.

With Apple’s recovery contacts, for instance, you can help validate your parents’ or grandparents’ identities to regain access to their iPhone and iCloud accounts. When they are locked out, they can follow the steps on their devices to share on-screen instructions with a recovery contact; the contact will get a six-digit code that will unlock the device and let them reset their Apple ID password.

For Google accounts, people can add your email address as a backup recovery option. If they get locked out of their Gmail account, they can have Google send you a verification code. Give them the code, and they can reset their passwords.

6. How do you track your passwords?

Keeping up with passwords can be a challenge for people of all ages. For some, pencil-and-paper records stored somewhere safe can be the best option, but password managers can also help.

Reputable digital password managers can be simple to set up and use. Apple’s iCloud Keychain for iOS and Google’s Password Manager for Android offer free, built-in options that store your passwords and sometimes other information such as addresses and credit cards. Both work in apps and web browsers.

Third-party password managers are solid options, too, with many offering additional features such as support across multiple operating systems. You have to remember only one password—the one for the password manager itself. Then, when logging into a website, the password manager automatically fills in your credentials, similar to the Apple and Google offerings.

7. What do you want to happen to your tech when you die?

No one wants to think about their loved ones dying—let alone themselves—but it is smart for them to have a plan about what will happen to their various accounts and devices.

Apple’s Legacy Contacts gain access to photos, contacts, documents, notes and more, all of which would be inaccessible without knowing their relative’s iCloud password.

Google offers an Inactive Account Manager, which will notify designated contacts if an account hasn’t been used for a set period ranging from three to 18 months. Facebook‘s Memorialization Settings let users choose someone to look after their profile when they die. The designated custodian can’t log into that account directly but can request that it be either “memorialised” or deleted.

8. Does anything concern you?

To make sure you haven’t missed anything, it’s helpful to find out if there are concerns that your relatives have but never mentioned. After all, scammers are evasive and find new ways to deploy old tricks.

Ask your family members if they have come across any messages on social media, shopped on new websites or gotten phone calls asking for their banking information that made them feel uncomfortable.

“Find out if they’re noticing new types of offers in their emails, or anything concerning,” Ms. Deibler says. “It can be a positive thing to reinforce things they’ve been skeptical about.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.