Elton John Fans Pay US$8 Million for His Treasures at Auction

The aptly named “opening night” at Christie’s for the eclectic mix of art, photography, costumes, and objects that filled Elton John’s Atlanta home drew a crowd of bidding fans who snapped up everything on offer for a total of US$8 million.

Among items the lucky winners snagged was a collector’s edition of a pinball machine signed by John that plays 16 full-length studio master tracks of his hit songs and features interactive LED lights and LCD displays; a 1990 Bentley Continental two-door convertible; a pair of silver leather platform boots; and silver rocket-shaped cocktail shakers.

Many of the collectible treasures in the 49-lot sale sold above estimates, in total achieving 155% of the low-end of anticipated prices. According to Christie’s, 40% of bidders and buyers were new to Christie’s.

Before the sale, the auction house shared that a heart-shaped collage by Damien Hirst that was made for John and his husband, David Furnish—expected to fetch up to US$450,000—would be withdrawn as the family decided to retain the piece.

The biggest sale of the evening was a painting by Banksy that John acquired directly from the elusive British graffiti artist. Flower Thrower Triptych , 2017, sold for US$1.55 million, US$1.925 million with fees.

Wednesday’s evening auction was the first of two live and six online sales that are filled with a total of nearly 900 items that spoke to John’s passions, style, and vision.

Courtesy Christie’s Images Ltd. 2024

Many lots sparked brisk back-and-forth bidding between collectors in the packed saleroom, on the phone with specialists, and online. The auction house generated excitement from the get-go with a pair of 1975 prescription Sir Winston Eyeware sunglasses that sold for a hammer price of US$18,000, six times a presale high estimate. With fees, the sunglasses sold for US$22,680.

That opening lot was followed by the sale of a pair of Elizabeth II silver cocktail shakers shaped like rockets, made by Mark of Theo Fennell in London in 1993, that fetched US$40,000, four times the high estimate, after vigorous bidding. With fees, the shakers cost US$50,400.

Then came a pair of silver leather tall platform boots, circa 1971, that sold for US$70,000—seven times the high estimate, and US$94,500 with fees.

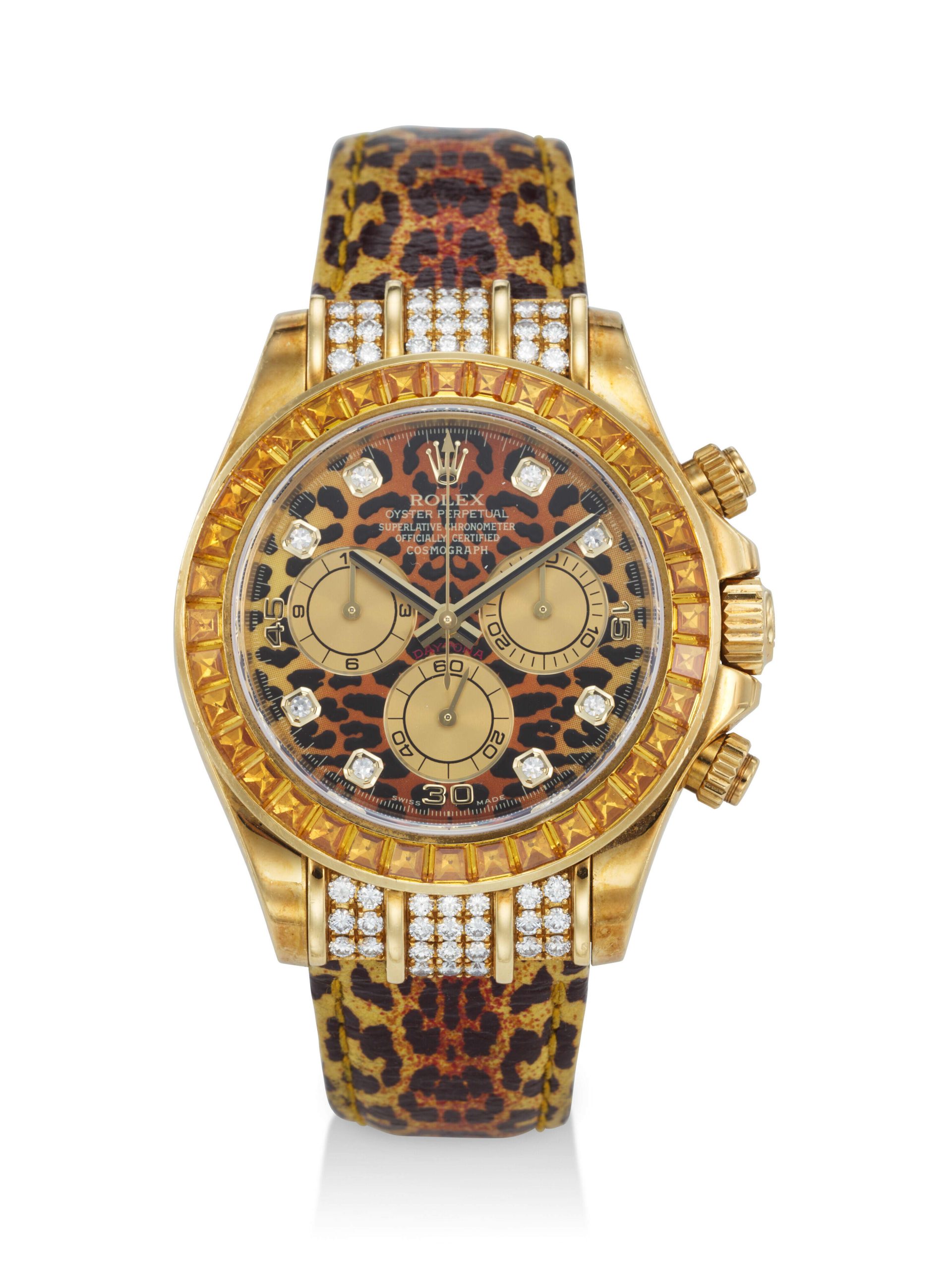

Glittery watches and jewellery also stole the show. An “exuberant and rare” 18K gold, diamond, and yellow sapphire-set automatic chronograph Rolex with a leopard-print dial sold for US$140,000, more than double a high estimate. The total with fees was US$176,500.

A Cartier “crash” model watch from 1991, sold for US$220,000, above a US$100,000 high estimate, or US$227,200 with fees.

Courtesy Christie’s Images Ltd. 2024

The sale also featured photography from Robert Mapplethorpe, Richard Avedon, Helmut Newton, Andy Warhol, and Cindy Sherman, among others. There was also art by Keith Haring, Sol Lewitt, and Julian Schnabel.

John’s conservatory grand piano, a Yamaha Model C6F, circa 1992, that had taken centre stage in his home sold for US$160,000, more than three times a high estimate; with fees, it fetched US$201,600.

The evening auction ended with the sale of John’s 1990 Bentley continental two-door convertible for US$350,000 (10 times the high estimate), or US$441,00 with fees, and the sale of the pinball machine, which fetched US$55,000, or US$69,300 with fees.

Elton John fans have plenty of opportunities to bid again on the singer’s collectibles, including more costumes, watches, fine and decorative arts, and jewellery. Another 281 items will be sold at a live sale at Christie’s on Thursday, and there are six online auctions continuing through next week.

One online sale features John’s friendship with Versace, and including couture, decorative arts, photographs, and jewellery; another titled “Honky Château” celebrates the singer’s aesthetic with brightly coloured art glass, painting, and sculpture.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.