Get Ready for the Richcession

Well-off Americans could get hurt more than usual in the next downturn

Economic downturns are usually horrible for poor people, bad for the middle class and an inconvenience for the rich. But if the economy enters a recession in 2023, or even if it manages to narrowly evade one, it might be the well-heeled who take a bigger hit than usual.

Call it the richcession.

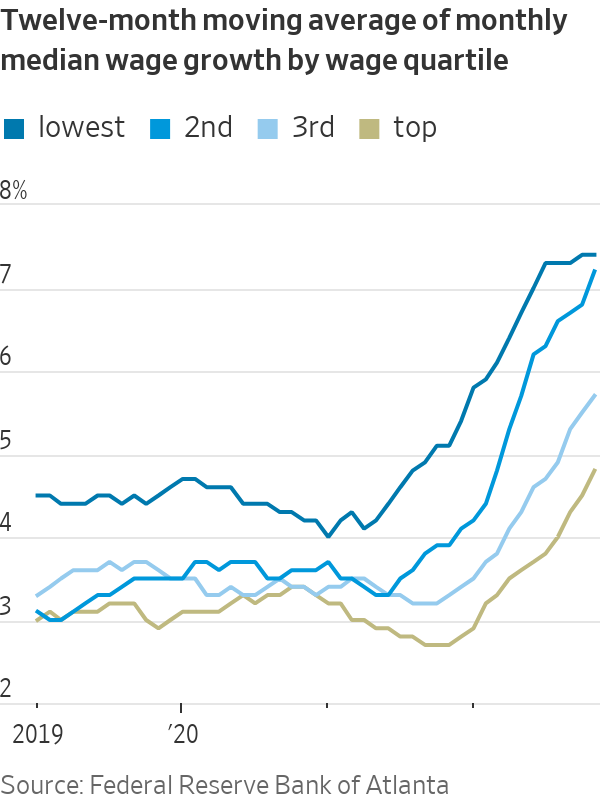

Other than a small number of ascetics, nobody likes being poor. Doing without, living with so little savings that setbacks such as illness or job loss can be debilitating, is an ever-present source of stress. But for many poorer people, the years since the Covid crisis struck have been a bit easier financially than the years that preceded it. Several rounds of government relief helped them weather the early stages of the pandemic, and now a tight job market is providing them with wage gains that are reducing inflation’s bite. Federal Reserve figures show that the net worth of households in the bottom fifth by income was 42% higher in the third quarter than at the end of 2019, and up 17% from the end of 2021.A wage tracker developed by the Federal Reserve Bank of Atlanta shows that the 12-month moving average of annualised monthly wage growth for workers in the bottom quartile by income was 7.4% as of November.

With the important caveat that they were starting off from much higher bases, percentage gains for the rich have been more muted. Household net worth for the top fifth was 22% higher in the third quarter than before the pandemic, and was down 7.1% from the end of 2021—a consequence of the falling stock market. Paychecks haven’t risen as much, either, with the Atlanta Fed measure showing average annualized monthly wage growth for workers in the top quartile was 4.8%.

Recent layoffs have also inordinately affected higher-income workers. Many of the tech companies that have made headlines with layoff announcements pay extremely well. Securities filings show that the median worker at Facebook parent Meta Platforms made $295,785 in 2021, for example, while the median worker at Twitter made $232,626. And layoffs at those places where the typical worker is less well paid, such as Amazon.com, have largely been aimed at white-collar workers.

The consolation for higher-income workers who are laid off is that it should be relatively easier for them to find new work than it is for poorer people who lose their jobs. That is because the job skills of the more highly educated are generally more transferable than the skills of other workers. But they will still be in for a period of belt tightening, and they might not get paid quite so well at their new jobs as they were at their old ones.

Meanwhile, even though big-company layoffs have been making headlines, so far they haven’t made much of a dent in overall employment statistics. This is in part because industries that aren’t as well-represented in the stock market, and that typically employ more lower- and middle-income workers, are still straining to hire workers. In November the leisure and hospitality sector was 980,000 jobs short of its February 2020 employment level. Employment in healthcare and social assistance only recovered to its prepandemic levels in September. This is a job category that, in part because of the needs of an ageing population, grew even when overall U.S. unemployment shot higher after the 2008 financial crisis. To return to its growth trend over the decade preceding the pandemic, it would need to add about 1.1 million jobs.

That need for workers—especially as more Americans engage in services such as dining out—is part of why even among those economists expecting a recession in the coming year, many don’t think the job market will take a severe hit. This makes poorer Americans better positioned than usual to handle a weak economy. Not only are their finances in relatively good condition, they might be less likely to experience severe job losses.

Heading into the new year, businesses that cater to the well-off might be in for disappointment, while those that favour the hoi polloi over the hoity-toity might do better. And if there is a recession, the economy could be on much more equal footing as it begins to recover than is usually the case.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.