He Stole Hundreds of iPhones and Looted People’s Life Savings. He Told Us How.

A convicted iPhone thief explains how a vulnerability in Apple’s software got him fast cash—and then a stint in a high-security prison

RUSH CITY, Minn.—Before the guards let you through the barbed-wire fences and steel doors at this Minnesota Correctional Facility, you have to leave your phone in a locker. Not a total inconvenience when you’re there to visit a prolific iPhone thief.

I wasn’t worried that Aaron Johnson would steal my iPhone, though. I came to find out how he’d steal it.

“I’m already serving time. I just feel like I should try to be on the other end of things and try to help people,” Johnson, 26 years old, told me in an interview we filmed inside the high-security prison where he’s expected to spend the next several years.

For the past year, my colleague Nicole Nguyen and I have investigated a nationwide spate of thefts, where thieves watch iPhone owners tap their passcodes, then steal their targets’ phones—and upend their financial and digital lives.

Johnson, along with a crew of others, operated in Minneapolis for at least a year during 2021 and 2022. In and around bars at night, he would befriend young people, slyly learn their passcodes and take their phones. Using that code, he’d lock victims out of their Apple accounts and loot thousands of dollars from their bank apps. Finally, he’d sell the phones themselves.

It was an elaborate, opportunistic scheme that exploited the Apple ecosystem and targeted trusting iPhone owners who figured a stolen phone was just a stolen phone.

Last week, Apple announced Stolen Device Protection, a feature that likely will protect against these passcode-assisted crimes.

Yet even when you install the software, due in iOS 17.3, there will be loopholes. The biggest loophole? Us. By hearing how Johnson did what he did, we can learn how to better secure the devices that hold so much of our lives.

How he got started

Johnson isn’t a sophisticated cybercriminal. He said he got his start pickpocketing on the streets of Minneapolis. “I was homeless,” he said. “Started having kids and needed money. I couldn’t really find a job. So that’s just what I did.”

Soon he realised the phones he was nabbing could be worth a lot more—if only he had a way to get inside them. Johnson said no one taught him the passcode trick, he just stayed up late one night fiddling with a phone and figured out how to use the passcode to unlock a bounty of protected services.

“That passcode is the devil,” he said. “It could be God sometimes—or it could be the devil.”

According to the Minneapolis Police Department’s arrest warrant, Johnson and the other 11 members of the enterprise allegedly accumulated nearly $300,000. According to him, it was likely more.

“I had a rush for large amounts at a time,” he said. “I just got too carried away.”

In March, Johnson, who had prior robbery and theft convictions, pleaded guilty to racketeering and was sentenced to 94 months. He told the judge he was sorry for what he did.

How he did it

Here’s how the nightly operation would go down, according to interviews with Johnson, law-enforcement officials and some of the victims:

Pinpoint the victim. Dimly lit and full of people, bars became his ideal location. College-age men became his ideal target. “They’re already drunk and don’t know what’s going on for real,” Johnson said. Women, he said, tended to be more guarded and alert to suspicious behaviour.

Get the passcode. Friendly and energetic, that’s how victims described Johnson. Some told me he approached them offering drugs. Others said Johnson would tell them he was a rapper and wanted to add them on Snapchat. After talking for a bit, they would hand over the phone to Johnson, thinking he’d just input his info and hand it right back.

“I say, ‘Hey, your phone is locked. What’s the passcode?’ They say, ‘2-3-4-5-6,’ or something. And then I just remember it,” Johnson described. Sometimes he would record people typing their passcodes.

Once the phone was in his hand, he’d leave with it or pass it to someone else in the crew.

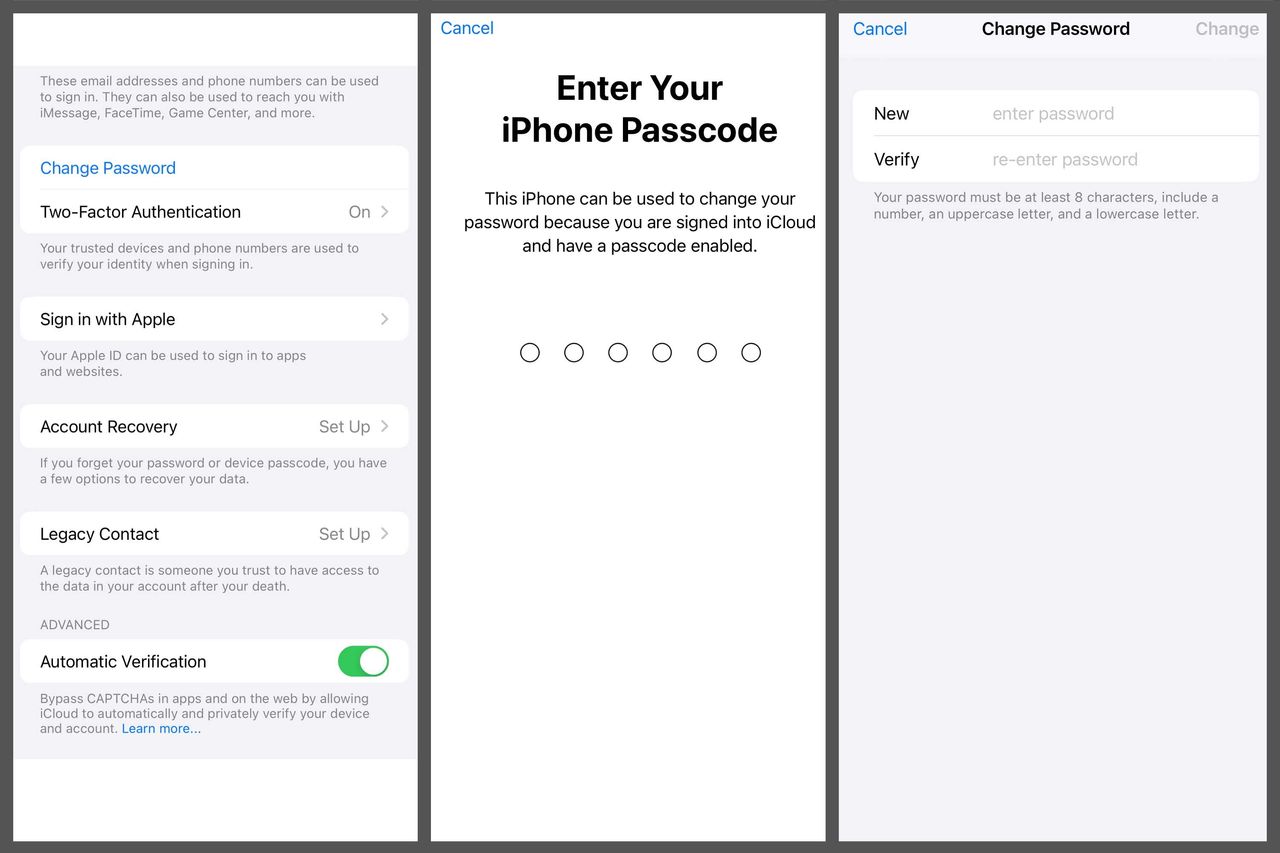

Lock them out—fast. Within minutes of taking the iPhones, Johnson was in the Settings menu, changing the Apple ID password. He’d then use the new password to turn off Find My iPhone so victims couldn’t log in on some other phone or computer to remotely locate—and even erase—the stolen device.

Johnson was changing passwords fast—“faster than you could say supercalifragilisticexpialidocious,” he said. “You gotta beat the mice to the cheese.”

Take the money. Johnson said he would then enrol his face in Face ID because “when you got your face on there, you got the key to everything.” The biometric authentication gave Johnson quick access to passwords saved in iCloud Keychain.

Savings, checking, cryptocurrency apps—he was looking to transfer large sums of money out. And if he had trouble getting into those money apps, he’d look for extra information, such as Social Security numbers, in the Notes and Photos apps.

By the morning, he’d have the money transferred. That’s when he’d head to stores to buy stuff using Apple Pay. He’d also use the stolen Apple devices to buy more Apple devices, most often $1,200 iPad Pro models, to sell for cash.

Sell the phones. Finally, he’d erase the phone and sell it to Zhongshuang “Brandon” Su who, according to his arrest warrant, sold them overseas.

While Johnson did steal some Android phones, he went after iPhones because of their higher resale value. At bars, he’d scope out the scene—looking for iPhone Pro models with their telltale trio of cameras. He said Pro Max with a terabyte of storage could get him $900. Su also bought Johnson’s purchased iPads.

Su pleaded guilty to receiving stolen property and was sentenced to 120 days at an adult corrections facility in Hennepin County, Minn. Neither Su nor his lawyer responded to requests for comment.

On a good weekend, Johnson said, he was selling up to 30 iPhones and iPads to Su and making around $20,000—not including money he’d taken from victims’ bank apps, Apple Pay and more.

How you can prevent it

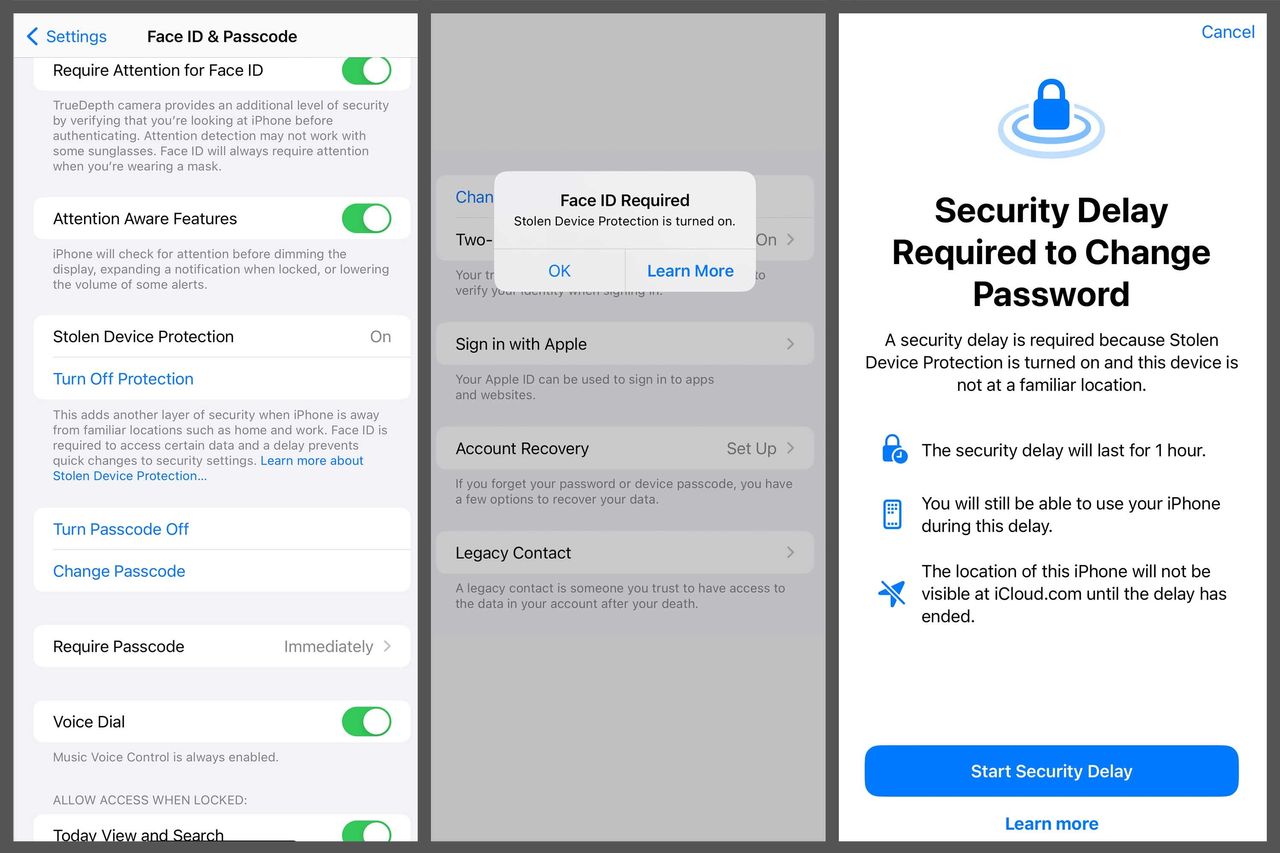

A week after my trip to Minnesota, Apple announced Stolen Device Protection. The security setting will likely foil most of Johnson’s tricks, but it won’t be turned on automatically.

If you don’t turn it on, you’re as vulnerable as ever. Switching it on adds a line of defence to your phone when away from familiar locations such as home or work.

To change the Apple ID password, a thief would need Face ID or Touch ID biometric scans—that is, your face or your finger. The passcode alone won’t work. And the process has a built-in hourlong delay, followed by another biometric scan. This same slow process is also required for adding a new Face ID and disabling Find my iPhone.

Some functions, such as accessing saved passwords in iCloud Keychain or erasing the iPhone, are available without the delay but still require Face ID or Touch ID.

A criminal might still be motivated to kidnap a person with lots of money, then slowly break through these layers of security. However, the protections will likely dissuade thieves who just want to grab phones and flee the scene.

So what loopholes remain? A thief who gets the passcode could still buy things with Apple Pay. And any app that isn’t protected by an additional password or PIN—like your email, Venmo, PayPal and more—is also vulnerable.

That’s why you should also:

- Add a distinct passcode to money apps, like Venmo and Cash App.

- Delete any notes or photos that include personal information such as passwords or Social Security numbers. Store that stuff in a secure note inside a third-party password manager, such as Dashlane or 1Password.

- Create a stronger iPhone passcode—one that uses letters and numbers.

The most obvious is Johnson’s advice: Watch your surroundings and don’t give your passcode out.

If this crime has taught us anything, it’s that a single device now contains access to our entire lives—our memories, our money and more. It’s on us to protect them.

—Nicole Nguyen contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.