Inflation trends upwards ahead of RBA meeting

Mortgage holders are not out of the woods as the spectre of further interest rate hikes looms

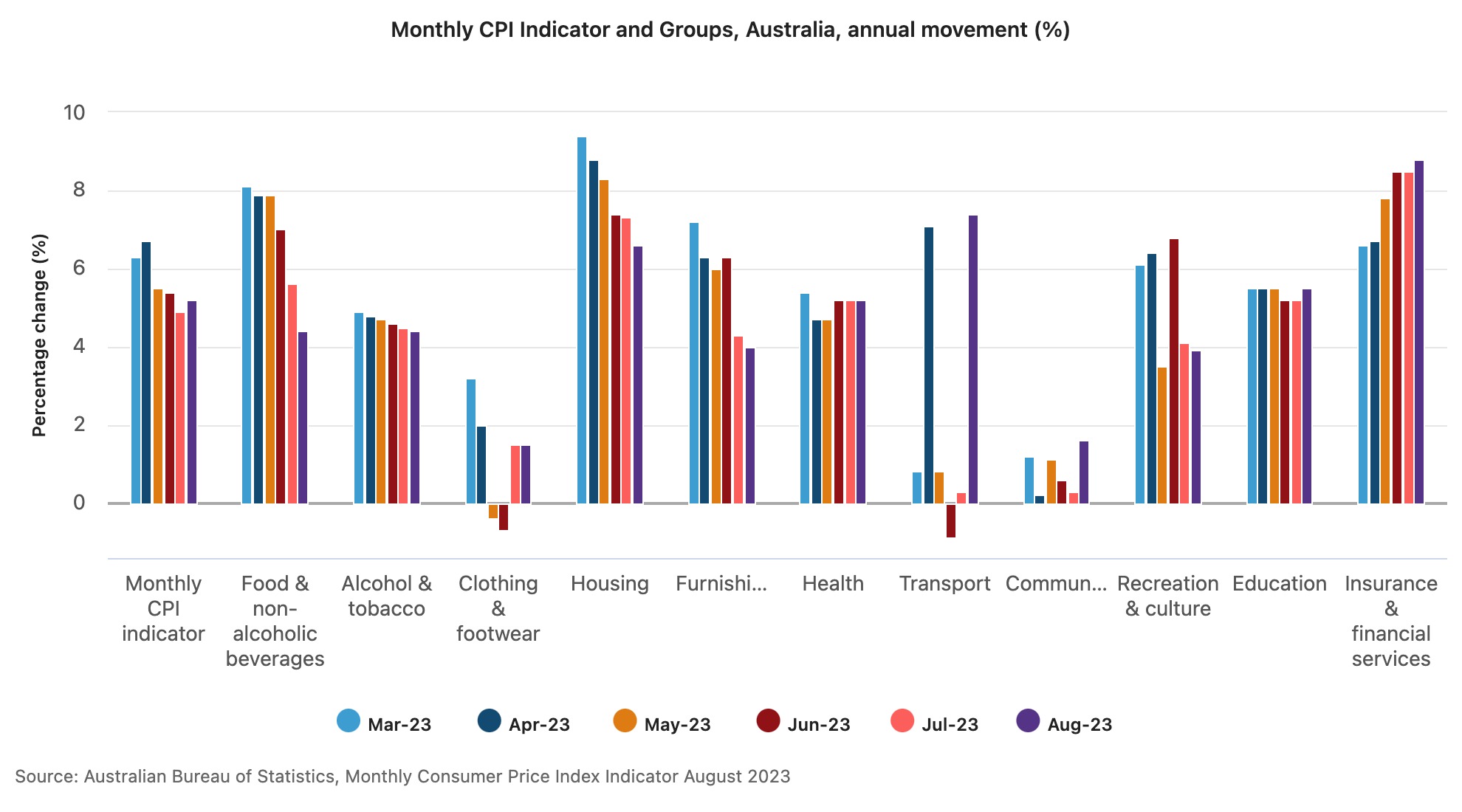

After trending downwards in recent months, inflation went up last month, fuelling fears of further rate rises. Data released today shows the Consumer Price Index rose to 5.2 percent in August, up from 4.9 percent in July.

The cost of housing, transport, food and non-alcoholic beverages as well as insurance and financial services rose the most according to data from the Australian Bureau of Statistics. While the acceleration in prices was anticipated, it could put pressure on the RBA Board to raise interest rates when they meet next month, despite community expectation that further increases were off the table.

Specific areas of concern had a familiar ring to them, with fuel prices showing an increase of 9.1 percent in August and the cost of housing up 6.6 percent. Higher costs associated with reinsurance and the impacts of natural disasters accounted for an annual rise in costs of 14.7 percent in August, up from 14.2 percent in July. The ABS noted: “This is the highest annual price movement since the beginning of the monthly CPI indicator.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.