Investors Grow More Confident Fed Will Pull Off a Soft Landing

Mutual funds and hedge funds are putting money in stocks that would benefit from slowing inflation, falling rates

A few months ago, Wall Street rebuffed the idea that the Federal Reserve would be able to pull off a soft landing.

Now, a growing crowd is betting on exactly that happening.

Mutual funds and hedge funds managing roughly $4.8 trillion in assets have been putting money into stocks that stand to benefit from inflation cooling, interest rates going down and the U.S. economy avoiding a recession, according to an analysis by Goldman Sachs Group Inc.

The investors have larger-than-average positions in shares of industrial, materials and energy companies, Goldman’s analysis found. All three groups tend to be sensitive to changes in the economy, meaning investors’ bets should eventually pay off if the U.S. can avoid a deep and prolonged downturn, or a “hard landing.”

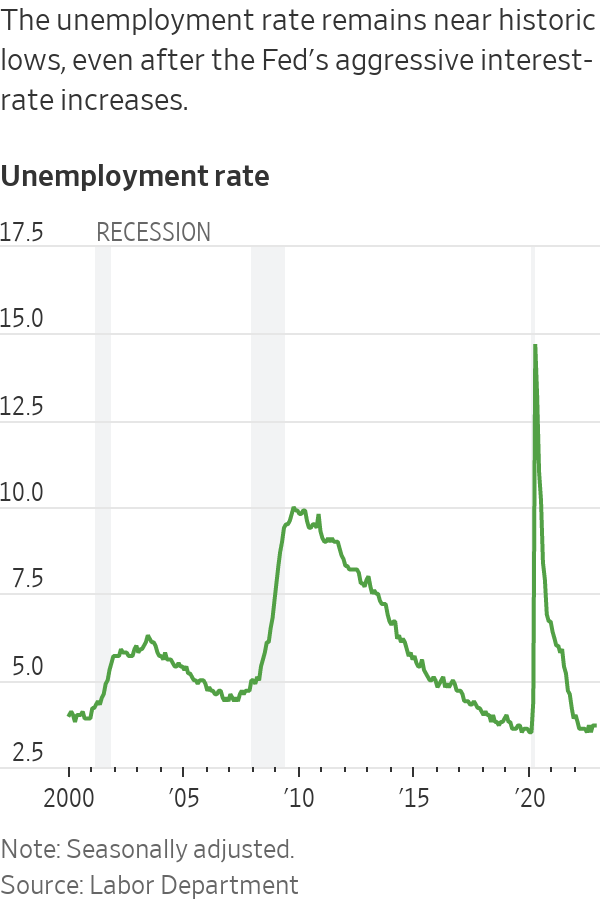

Recent data have offered investors some hope for that scenario. The labour market has remained strong, with the unemployment rate clocking in at a historically low 3.7% last month. Consumer spending is up. And there are signs that inflation is easing. Consumer prices rose 7.7% last month, a brisk clip but nevertheless the smallest year-over-year gain since January.

It is looking increasingly likely that the U.S. will be spared “the typical scar tissue of a steep economic downturn,” Katie Nixon, chief investment officer for Northern Trust Wealth Management, said in written comments.

The debate still rages on Wall Street, of course, and other investors say a deeper recession could be looming.

There are additional challenges remaining—one of them being a red-hot labour market. In a speech last month, Federal Reserve Chair Jerome Powell implied that wages are still growing too quickly to allow inflation to return to the central bank’s 2% target.

Investors might get some clarity on both inflation and the Fed’s thinking in coming days.

The Labor Department will release its November reading for the consumer-price index Tuesday. The report will offer the Fed its last look at inflation before it announces its final interest-rate decision of the year on Wednesday.

The central bank is widely expected to raise rates by half a percentage point. That would mark its smallest rate increase since March, when it began tightening monetary policy once again. But a surprisingly strong inflation reading could throw into question the Fed’s plans to slow its pace of interest-rate increases in 2023. Stocks fell Friday and suffered weekly losses after data showed producer prices rose more than expected in November.

“Everybody is going to be looking at the direction of that CPI number,” said Brian Overby, senior markets strategist at Ally. “As long as we’re going in the right direction, it doesn’t even have to be a big number to the downside.”

History doesn’t favour the Fed. Data from the central bank show the economy fell into recession nine of the past 12 times the Fed tightened monetary policy.

A downturn would likely put more pressure on an already beaten-down market.

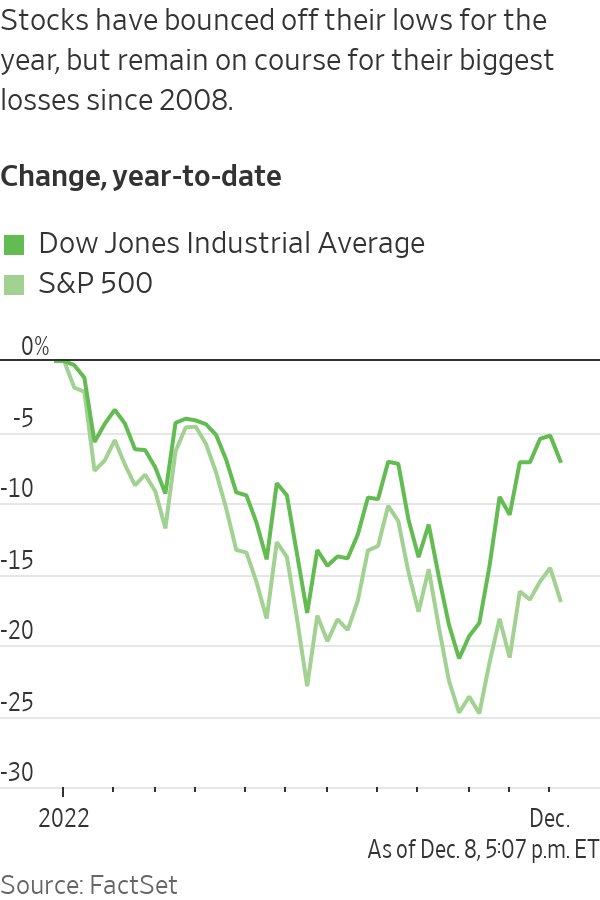

Stocks are up significantly from their October lows. Butthe S&P 500 is still down 17% for the year, on course for its worst annual performance since the 2008 financial crisis.

The stock market has typically fallen roughly 30% in recessions going back to 1929, according to Dow Jones Market Data.

Still, analysts and economists at a number of firms, including Goldman Sachs, BMO Wealth Management and Credit Suisse Group AG, are predicting the economy will be able to avoid a hard landing next year.

“The most significant challenges to consumer spending are most likely in the past,” Goldman economist Joseph Briggs wrote in a note. The bank expects inflation to continue moderating next year, but the unemployment rate rising only to around 4.1% from the current 3.7%.

Whether there winds up being a recession or not, many say they are in agreement on one thing: Markets are likely to remain volatile for some time.

“2022 wasn’t a picnic, but it was clear that [the Fed] had to tighten policy,” said Christopher Smart, chief global strategist at Barings and head of the Barings Investment Institute.

The Fed’s path over the coming months—and consequently, the markets’ outlook—looks less straightforward, Mr. Smart said.

He added that, in the near term, he is recommending that clients hold on to extra cash to navigate swings in the markets.

“It depends on how low inflation will go and how long it will take to get there. And that determines what kind of potential damage will come along the way,” Mr. Smart said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.