Is Now the Time to Invest in Emerging Markets?

Emerging-markets stock ETFs offer exposure to higher-growth markets, but they also can be volatile. Here is a look at the pros and cons of these investments.

For some investors seeking to diversify their portfolios, emerging markets are looking increasingly attractive.

There are 169 emerging-markets stock ETFs available to fund investors, with total assets of about $296 billion, according to fund researcher Morningstar Direct.

Some analysts and financial advisers say there is a lot to like about this sector right now. What is the argument for putting money into these exchange-traded funds? And what’s the argument for getting out, or not starting at all? Here’s a look at the pros and cons.

The Pros

One factor driving interest in emerging-markets ETFs is that emerging economies are growing faster than advanced economies, and that isn’t forecast to change soon. The International Monetary Fund forecasts real GDP growth of only 1.4% in advanced economies in 2024 due to inflation, monetary policy and other factors. In contrast, the IMF projects real GDP growth of 4.1% for emerging and developing economies, helped by countries such as India, which is expected to grow at a rate of 6.3%.

“The biggest reason to invest in emerging-markets ETFs today is to gain exposure to high-growth markets with burgeoning middle-class consumers such as China, India, Mexico, Taiwan, South Korea and Vietnam,” says Aniket Ullal, senior vice president and head of ETF data and analytics at CFRA Research. He says emerging markets are home to more than 4.3 billion people, and they account for about half of global GDP.

Another attraction is that valuations on emerging-markets stocks are low. While the price-to-earnings ratio of the S&P 500 was 22.4 based on trailing 12-month reported earnings as of July 31, the P/E ratio of the MSCI Emerging Markets—which includes the stock of most liquid large- and midcap companies in 25 emerging-market countries—was 14.13.

“This is a smart contrarian play for investors who want to diversify their portfolios geographically,” says Gabriel Shahin, president of Falcon Wealth Planning, an investment adviser in Los Angeles. “There is a fire sale going on in emerging-market stocks, and this is one of the smartest plays in equity investing right now.”

Some see these investments as a hedge, considering this year’s U.S. stock rally—dominated by a small number of large-cap technology companies—could end at any time.

Emerging-markets ETFs come in many varieties, so investors can choose those that align with their macroeconomic outlook and financial goals.

While some of these funds invest in a broad basket of emerging-market countries that span the globe such as the $72.1 billion iShares Core MSCI Emerging Markets ETF (IEMG), others invest in geographic regions such as Asia or Latin America or are country-specific.

The $64.2 million Franklin FTSE Latin America ETF (FLLA), for example, invests in large-cap and midcap companies in Brazil, Chile, Colombia and Mexico. It has returned more than 19% year-to-date through Aug. 29 and 15.6% over the past year. The $175.8 million Franklin FTSE Taiwan ETF (FLTW) invests in midcap and large-cap Taiwanese companies. It has a year-to-date return of 14.7% and a one-year-return of 8.2% as of Aug. 29.

For investors concerned about the economic slowdown in China, there are emerging-markets ETFs that exclude Chinese equities such as the $5.16 billion iShares MSCI Emerging Markets ex-China (EMXC). Its top holdings are Taiwan Semiconductor Manufacturing, Samsung Electronics and Reliance Industries.

Some emerging-markets ETFs target small- or large-cap stocks. One is the $34.2 million VanEck Brazil Small-Cap ETF (BRF), which is up about 32% year-to-date and 11.4% over one year as of Aug. 29. Others focus on industry sectors such as technology and e-commerce.

While most emerging-markets equity ETFs track indexes, an increasing number of newer funds are actively managed. Of the 11 emerging-markets ETFs that have launched this year, eight are actively managed, including Global X Brazil Active ETF (BRAZ), a $2.61 million fund that invests in Brazilian companies such as Petrobras, a multinational petroleum company, and Vale, the world’s largest iron-ore producer.

There are even emerging-markets ETFs that pay dividends, such as the $243.5 million SPDR S&P Emerging Market Dividend ETF (EDIV), which is up 28.2% year-to-date through Aug. 29 and has a dividend yield of 3.78%.

According to Morningstar Direct, the top-performing emerging market ETFs this year through Aug. 29 are VanEck Brazil Small-Cap, SPDR S&P Emerging Market Dividend and iShares MSCI Brazil Small-Cap (EWZS), which is up 24.1% so far this year and 5.7% over one year.

The Cons

Some advisers, however, say investors looking at emerging-markets equity funds should proceed with caution.

“Emerging-markets equity ETFs are more volatile than international ETFs that focus on stocks in advanced economies,” says Lan Anh Tran, a research analyst at Morningstar Direct. Over the past 10 years ended July 31, 2023, the standard deviation of the MSCI Emerging Market Index was 16.2% higher than the MSCI World Index—a proxy for global developed-market stocks, she notes. Standard deviation measures volatility, with a higher number representing more volatility.

That’s because any sudden geopolitical event (such as the war in Ukraine) or any economic shock (like soaring inflation or a global supply-chain disruption) can have a jarring effect on emerging-market economies that are dependent on commodity exports, tourism and the health of advanced economies, investment strategists say.

There also is the risk of government influence and regulation on emerging-markets stocks, says Tran. A government, for example, can decide to nationalize an industry at any time, or exercise control over an industry sector.

Currency movements are another risk factor to consider, says CFRA’s Ullal. “If the dollar strengthens against local currencies, your fund returns will erode,” he says.

“It’s important that investors understand this is a high-risk, high-reward investment before they dive into them,” says Andrew J. Feldman, the founder of A.J. Feldman Financial in Chicago. “These funds can be highly volatile due to a host of systemic risks in emerging-market countries, including economic risk, geopolitical risk, currency risk and liquidity risk.”

These challenges make some investors skittish about investing in emerging-markets ETFs, says Kevin Shuller, founder and chief investment officer of Cedar Peak Wealth Advisors in Denver. “They believe that companies domiciled in the U.S. do a lot of business in emerging markets, so if you own the S&P 500 or MSCI EAFE index you have all the exposure you need.”

“It’s a good counterargument,” he says, “but [it] doesn’t take into account that the party in the U.S. stock market may not go on forever.”

Many investment advisers instead suggest individual investors take a step-by-step approach when choosing an emerging-markets ETF and allocate 5% to 10% of their equity portfolio in such vehicles.

“Country selection matters most so check the fund’s geographic exposure,” says Perth Tolle, founder of Life + Liberty Indexes and the $625.4 million Freedom 100 Emerging Markets ETF (FRDM), which invests in about 100 companies in 10 countries that aren’t autocracies but freer markets such as Chile, Poland, South Korea and Taiwan.

Also look at the methodologies and metrics the ETF uses when choosing stocks for its index or portfolio, as well as the fund fees. The average expense ratio for this ETF group is 0.51%, according to Morningstar Direct.

“A good way to assess a fund’s value is to look at its weighted average price to cash flow,” a measure of the price of a company’s stock relative to how much cash flow it generates, says Kevin Grogan, chief investment officer at Buckingham Wealth Partners in St. Louis. It gives a pulse reading on how cheap or expensive the emerging-markets stocks are in the fund.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Governments around the world are offering incentives to reverse a downward spiral that could threaten economic growth

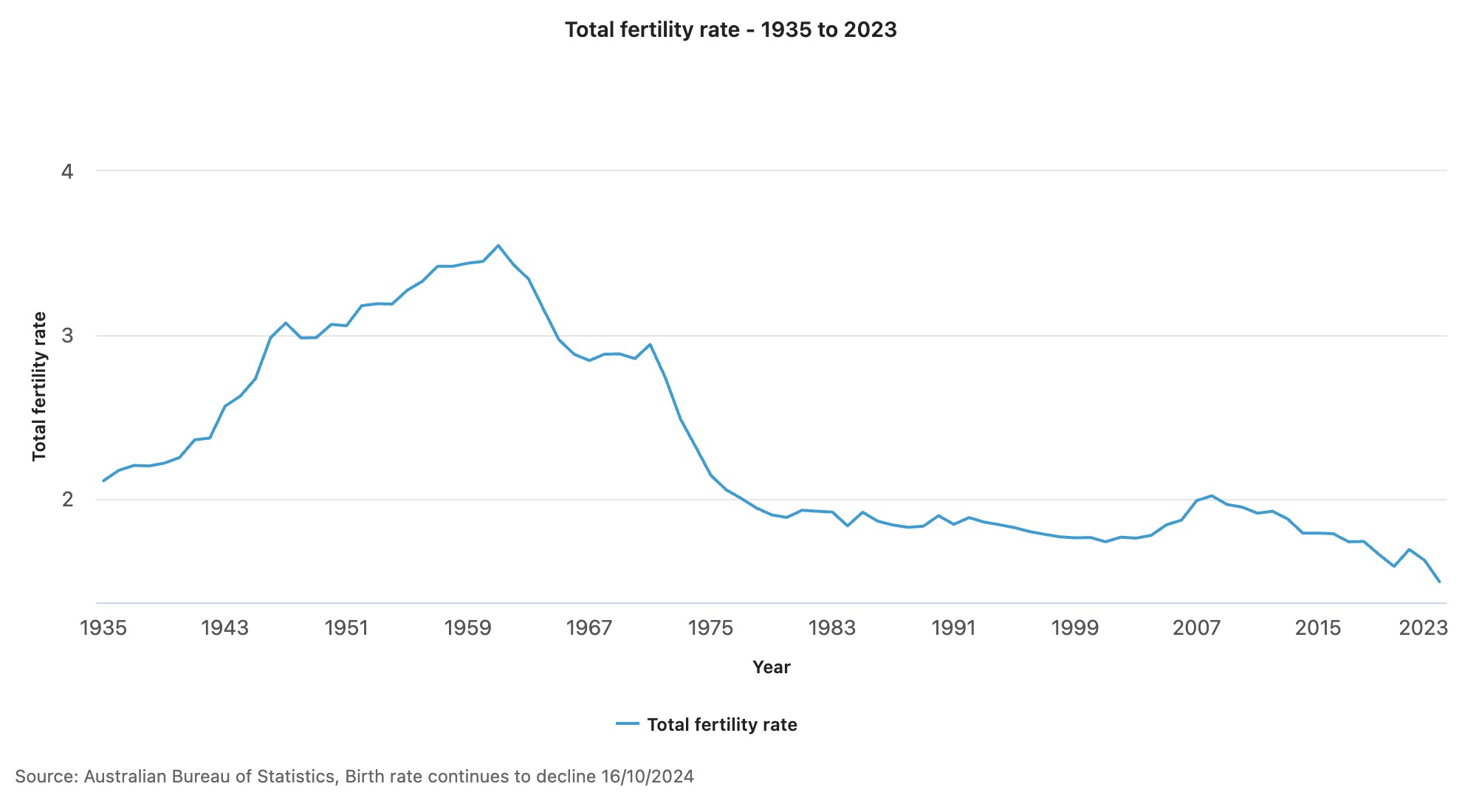

The Australian birth rate is at a record low, new data has shown.

Figures from the Australian Bureau of Statistics have revealed there were 286,998 births registered around the country last year, or 1.5 babies per woman.

Birth rates in Australia have been in a slow decline since the 1990s, down from 1.86 births per woman in 1993. Declining fertility rates among girls and women aged 15 to 19 years was most stark, down two thirds, while for women aged 40 to 44 years, the rate had almost doubled.

“The long-term decline in fertility of younger mums as well as the continued increase in fertility of older mums reflects a shift towards later childbearing,” said Beidar Cho, ABS head of demography statistics. “Together, this has resulted in a rise in median age of mothers to 31.9 years, and a fall in Australia’s total fertility rate.”

The fall in the Australian birth rate is in keeping with worldwide trends, with the United States also seeing fertility rates hit a 32-year low. The Lancet reported earlier this year that, based on current trends, by 2100 more than 97 percent of the world’s countries and territories “will have fertility rates below what is necessary to sustain population size over time”.

On a global scale, the Lancet reported that the total fertility rate had “more than halved over the past 70 years” from about five children per female in the 1950s to 2.2 children in 2021. In countries such as South Korea and Serbia, the rate is already less than 1.1 child for each female.

Governments around the world have tried to incentivise would-be parents, offering money, increased access to childcare and better paid maternity leave.

Experts have said without additional immigration, lower birth rates and an ageing population in Australia could put further pressure on young people, threaten economic growth and create economic uncertainty. However, a study released earlier this year by the University of Canberra showed the cost of raising a child to adulthood was between $474,000 and $1,097,000.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.