It Just Had an Energy Crisis, Now Europe Faces a Food Shock

Food prices continue to rise at a rapid pace, surprising central banks and pressuring debt-laden governments

LONDON—Fresh out of an energy crisis, Europeans are facing a food-price explosion that is changing diets and forcing consumers across the region to tighten their belts—literally.

This is happening even though inflation as a whole is falling thanks to lower energy prices, presenting a new policy challenge for governments that deployed billions in aid last year to keep businesses and households afloat through the worst energy crisis in decades.

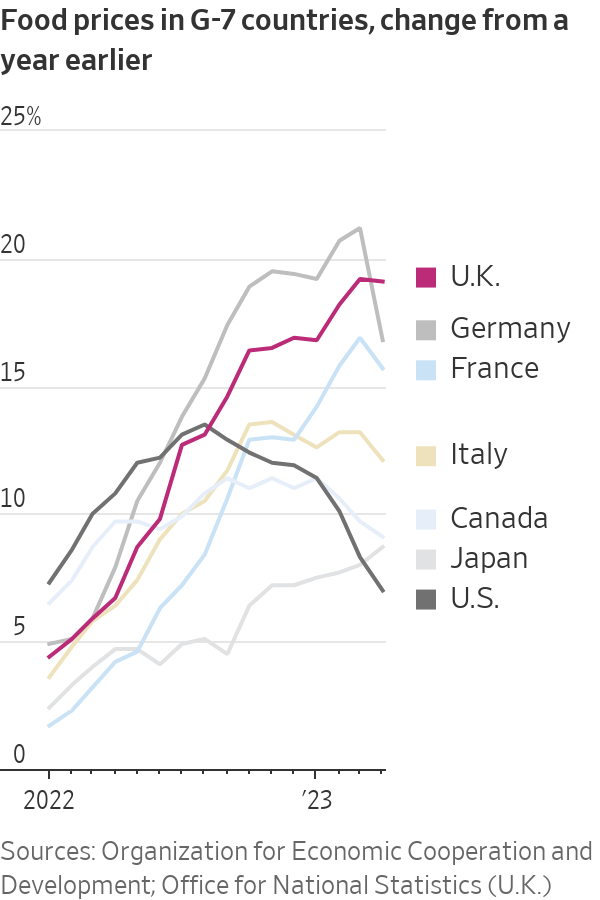

New data on Wednesday showed inflation in the U.K. fell sharply in April as energy prices cooled, following a similar pattern around Europe and in the U.S. But food prices were 19.3% higher than a year earlier.

The continued surge in food prices has caught central bankers off guard and pressured governments that are still reeling from the cost of last year’s emergency support to come to the rescue. And it is pressuring household budgets that are also under strain from rising borrowing costs.

In France, households have cut their food purchases by more than 10% since the invasion of Ukraine, while their purchases of energy have fallen by 4.8%.

In Germany, sales of food fell 1.1% in March from the previous month, and were down 10.3% from a year earlier, the largest drop since records began in 1994. According to the Federal Information Centre for Agriculture, meat consumption was lower in 2022 than at any time since records began in 1989, although it said that might partly reflect a continuing shift toward more plant-based diets.

Food retailers’ profit margins have contracted because they can’t pass on the entire price increases from their suppliers to their customers. Markus Mosa, chief executive of the Edeka supermarket chain, told German media that the company had stopped ordering products from several large suppliers because of rocketing prices.

A survey by the U.K.’s statistics agency earlier this month found that almost three-fifths of the poorest 20% of households were cutting back on food purchases.

“This is an access problem,” said Ludovic Subran, chief economist at insurer Allianz, who previously worked at the United Nations World Food Program. “Total food production has not plummeted. This is an entitlement crisis.”

Food accounts for a much larger share of consumer spending than energy, so a smaller rise in prices has a greater impact on budgets. The U.K.’s Resolution Foundation estimates that by the summer, the cumulative rise in food bills since 2020 will have amounted to 28 billion pounds, equivalent to $34.76 billion, outstripping the rise in energy bills, estimated at £25 billion.

“The cost of living crisis isn’t ending, it is just entering a new phase,” Torsten Bell, the research group’s chief executive, wrote in a recent report.

Food isn’t the only driver of inflation. In the U.K., the core rate of inflation—which excludes food and energy—rose to 6.8% in April from 6.2% in March, its highest level since 1992. Core inflation was close to its record high in the eurozone during the same month.

Still, Bank of England Gov. Andrew Bailey told lawmakers Tuesday that food prices now constitute a “fourth shock” to inflation after the bottlenecks that jammed supply chains during the Covid-19 pandemic, the rise in energy prices that accompanied Russia’s invasion of Ukraine, and surprisingly tight labor markets.

Europe’s governments spent heavily on supporting households as energy prices soared. Now they have less room to borrow given the surge in debt since the pandemic struck in 2020.

Some governments—including those of Italy, Spain and Portugal—have cut sales taxes on food products to ease the burden on consumers. Others are leaning on food retailers to keep their prices in check. In March, the French government negotiated an agreement with leading retailers to refrain from price rises if it is possible to do so.

Retailers have also come under scrutiny in Ireland and a number of other European countries. In the U.K., lawmakers have launched an investigation into the entire food supply chain “from farm to fork.”

“Yesterday I had the food producers into Downing Street, and we’ve also been talking to the supermarkets, to the farmers, looking at every element of the supply chain and what we can do to pass on some of the reduction in costs that are coming through to consumers as fast as possible,” U.K. Treasury Chief Jeremy Hunt said during The Wall Street Journal’s CEO Council Summit in London.

The government’s Competition and Markets Authority last week said it would take a closer look at retailers.

“Given ongoing concerns about high prices, we are stepping up our work in the grocery sector to help ensure competition is working well,” said Sarah Cardell, who heads the CMA.

Some economists expect that added scrutiny to yield concrete results, assuming retailers won’t want to tarnish their image and will lean on their suppliers to keep prices down.

“With supermarkets now more heavily under the political spotlight, we think it more likely that price momentum in the food basket slows,” said Sanjay Raja, an economist at Deutsche Bank.

It isn’t entirely clear why food prices have risen so fast for so long. In world commodity markets, which set the prices received by farmers, food prices have been falling since April 2022. But raw commodity costs are just one part of the final price. Consumers are also paying for processing, packaging, transport and distribution, and the size of the gap between the farm and the dining table is unusually wide.

The BOE’s Bailey thinks one reason for the bank having misjudged food prices is that food producers entered into longer-term but relatively expensive contracts with fertilizer, energy and other suppliers around the time of Russia’s invasion of Ukraine in their eagerness to guarantee availability at a time of uncertainty.

But as the pressures being placed on retailers suggest, some policy makers suspect that an increase in profit margins may also have played a role. Speaking to lawmakers, Bailey was wary of placing any blame on food suppliers.

“It’s a story about rebuilding margins that were squeezed in the early part of last year,” he said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.