Many Boards Are Playing Catch-Up on ESG and Green Issues

Company board directors say ESG efforts have brought about real benefits, but the political backlash has had an impact

Many corporate board directors aren’t confident about their ability—or their board’s—to oversee sustainability and social impact issues, even as companies pursue such goals and regulators want more disclosures on environmental, social and governance impact.

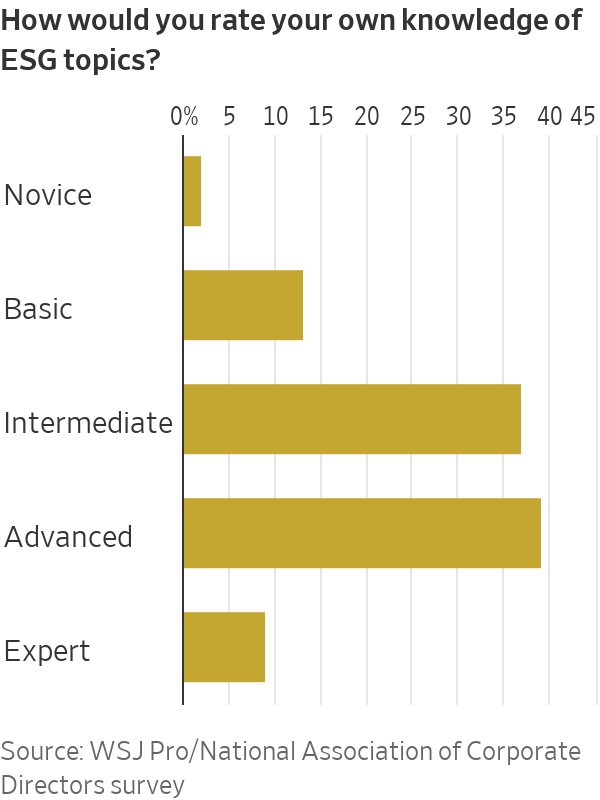

Eighty-three percent of directors surveyed said ESG topics were critical knowledge for directors, but less than half considered themselves to have “advanced” or “expert” level knowledge, according to a survey of board directors conducted in July by WSJ Pro in collaboration with the National Association of Corporate Directors.Directors of larger firms and listed companies expressed higher confidence, as did those in the energy industry.Respondents relied on external advisers to build their knowledge.

Other findings were that most believed sustainability efforts had brought real benefits and said ESG engagement with investors had been mostly positive. Directors also said the anti-ESG movement had an impact. They also reported that while about half of big companies had ESG targets—many linked to executive compensation—smaller, private companies lagged behind.

The survey’s 506 respondents covered a range of company sizes and included public, private and not-for-profit organizations from many sectors, with a concentration in financial services, industry, tech and energy. They said their ESG maturity level was across the spectrum: 4% self-identified as industry leaders, 27% as well developed, 36% as somewhat developed, 28% as early stage and 5% hadn’t started with ESG. Overall respondents rated their own ESG expertise slightly higher than that of their fellow board members.

Training up on sustainability

“As a board member, if you’re hoping that ESG is just a fad that will pass with time, we have enough data now from the last 2½ decades to know ESG is here to stay and boards need to be ready,” said Kristin Campbell, general counsel and chief ESG officer of Hilton Worldwide Holdings and board director at ODP and Regency Centers.

Campbell said boards must evaluate ESG as part of the company’s long-term strategy, otherwise activists, regulators, customers or someone else might do it for them, perhaps in a way that will be painful operationally or harmful to their reputation. “It’s that classic story of either you’re at the table or you’re on the menu,” said Campbell.

Alan Smith—responsible for the strategic management of the Church of England’s £10.1 billion (equivalent to $12.6 billion) perpetual endowment fund—said many boards had brushed up on ESG knowledge with in-house training, e-learning packages or advisers to run workshops. A former senior adviser at HSBC on climate and ESG risk and current First Church Estates Commissioner, Smith said he also found it helpful to see projects, such as offshore-wind farms, and speak to their operators in person.

“I think an integrated approach to board director education—of which one important part is getting on the ground and in the mud or on the boat—is very important,” he said.

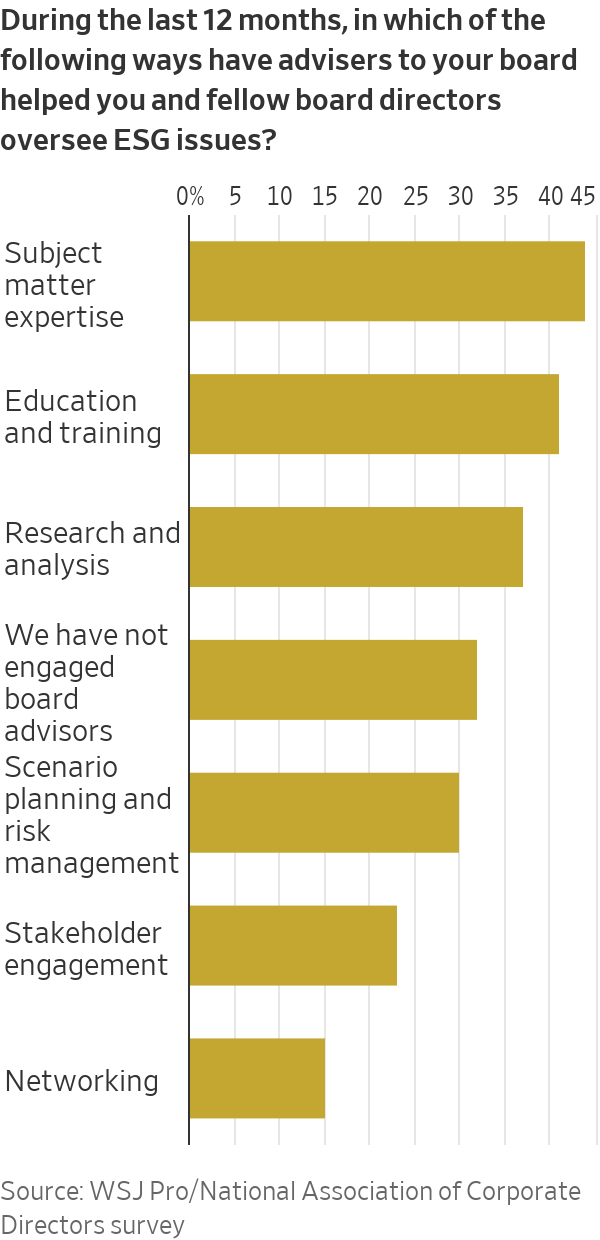

More than two thirds of directors said their organisations brought in external advisers to complement or build board’s ESG skills, with most advisers providing subject matter expertise (44%), education and training (41%), or research and analysis (37%).

“What we know about ESG will change today and will probably change tomorrow,” Hilton’s Campbell said. “It’s the job of an external adviser to know what’s going to happen next week and next year, which is useful in keeping the board ahead of the game.”

Stakeholder engagement

Overall, investors were the most influential stakeholders on board decisions related to ESG strategy, followed by company executives, regulators and customers. For public companies investors were most influential, followed by regulators, while directors of private businesses ranked their customers as top with investors in second place.

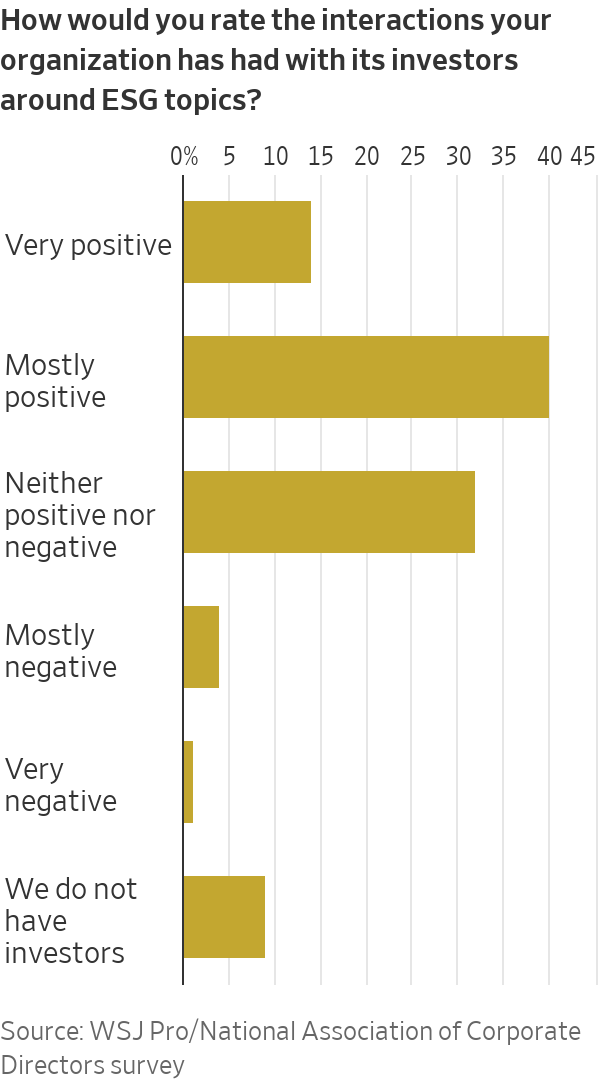

Respondents ranked their ESG-related interactions with investors as largely positive or neutral. Seventy-one percent of directors of organisations with investors said their largest ones had engaged with the board over the past 12 months on ESG topics.

However, public and private businesses approached this engagement quite differently. Private company investors most often engaged with the full board or directly with management, whereas public company investors worked most often with individual directors or sometimes with the full board, but rarely with management.

Anti-ESG impact

The survey also examined the impact of the rising anti-ESG movement in the U.S. Many boards started their ESG journey in 2020, but, particularly in the last six to 12 months, the extent of the political backlash in the U.S. has made it more complicated, said Smith. “You had a wind that was giving companies and boards energy, and now you have a countervailing wind of political backlash,” Smith said.

As the pressure has mounted, there have been numerous reports of green-hushing—when a company scales back what it says about its climate and social initiatives in corporate communications. The survey found evidence to support this: 7% of directors said their company no longer publicly communicates about its ESG activities, and 14% said their board and management no longer use the term ESG when referring to relevant activities.

Respondents report substantive changes too. One in five said their companies are reassessing their approach to ESG, 12% said they have deprioritised ESG as a critical business issue, and 15% of directors, primarily in smaller private businesses, believe ESG is negatively affecting their business decisions and strategy.

Despite those changes, half of respondents believe ESG will continue to be an important driver of their business decisions and strategy. Nearly as many say their board and management remain committed to ESG as an opportunity for growth and a driver of long-term risk reduction.

Driving ESG performance

While most respondents said ESG is critical knowledge for directors, only 37% of their organisations have set a climate-impact reduction target, although that was 54% for large organisations. Nine out of 10 of those companies with a target said their boards monitored their progress toward those goals and four out of five believed they were achievable.

To encourage management to hit targets, over one quarter of respondents said their company had linked executive pay to ESG goals, and a further 29% were considering doing so in the next 12 months.

“If we’re going to be more serious about ESG and building it into a company’s long-term strategy then I think it needs to be tied to executive compensation like any other [key performance indicator],” Campbell said.

Nearly a fifth of directors surveyed said reducing the impact of climate change is a priority regardless of financial performance. Almost half said it is a priority but not at the cost of financial performance, while the remaining third said it isn’t a priority at all.

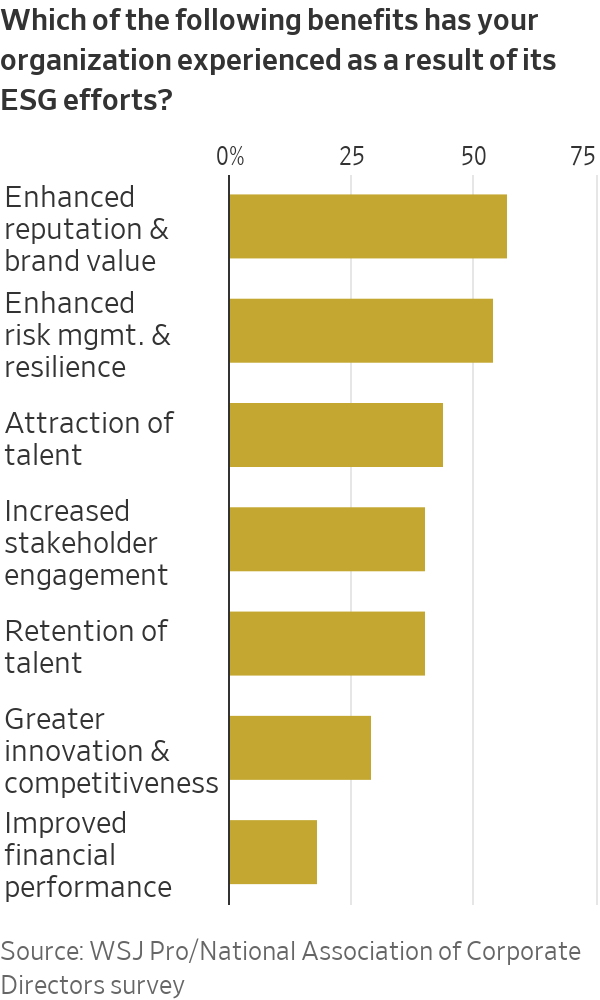

Many directors report real benefits from their ESG efforts. In particular it has enhanced their company’s reputation and brand value (57%), risk management and resilience (54%), and ability to attract and retain talent (44% and 40%, respectively).

Climate change was talked about more frequently in 43% of the boardrooms, while in 31% it actually decreased. The topic was discussed at most or every board meeting for 29% of respondents, 36% said it came up at some meetings, and 23% said it was rarely talked about. Only 11%—primarily small, private companies—hadn’t discussed it at all.

Smith said it was particularly important for smaller companies to keep climate change front of mind: “Those that say they aren’t doing anything yet are paradoxically the ones that may be hit first because they’re downstream of big companies setting more immediate net zero carbon neutral targets.”

As well as calling it a business differentiator for small businesses, Smith said a focus on climate impact reduction was “a survival mechanism.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.