Money Angst? You Might Consider a Financial Therapist

Unconscious beliefs and emotions can mess up how people handle their finances. The hard part is finding experts qualified to handle both money and the mind.

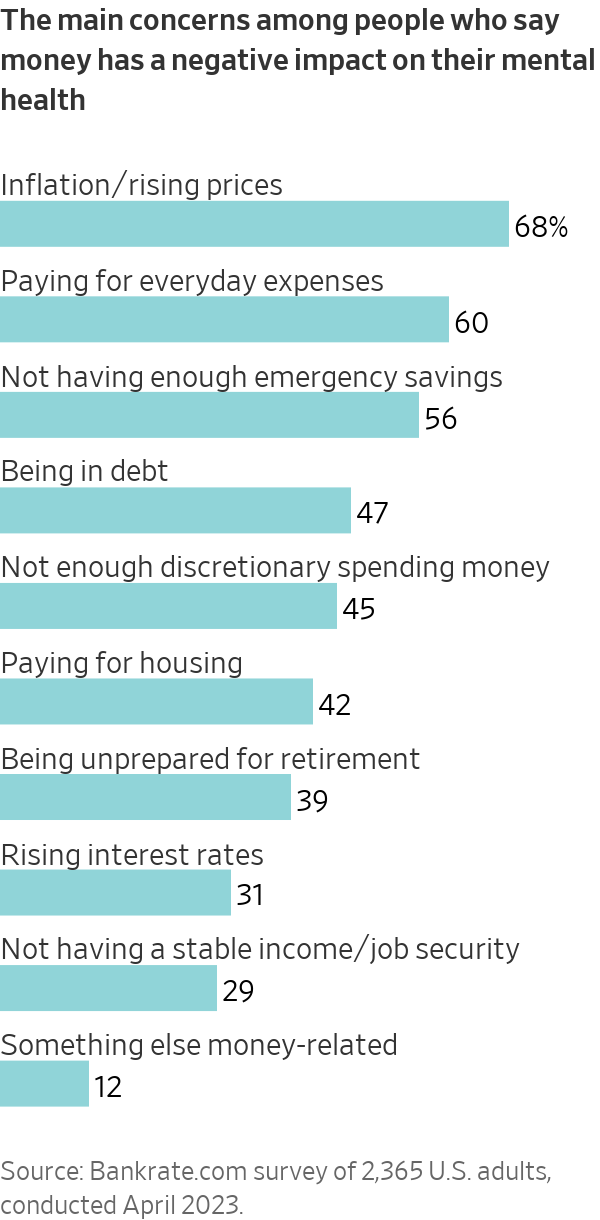

Do you worry a lot about higher food and gas bills? Fight with your spouse over spending splurges? Fear you’ll outlive your savings?

Some people seek to ease such money anxieties by hiring a financial therapist.

The goal of financial therapists ultimately is to help people make good financial decisions, typically by raising their clients’ awareness of how their emotions and unconscious beliefs have affected their sometimes messy experiences with money.

Needs for such help often arise following a job loss, bankruptcy or marital partner’s financial infidelity—when one spouse hides or misrepresents financial information from the other. Even something seemingly positive, such as getting a big inheritance or winning a lottery, can cause financial anxiety.

“Folks are craving help with financial well-being,’’ says Ashley Agnew , president of the Financial Therapy Association, a professional group launched in 2009.

Financial therapists tend to come from mental-health and financial-planning disciplines, and there are signs that their ranks are rising: The Financial Therapy Association has 430 members, up from 225 in 2015. Still, according to the group, fewer than 100 financial therapists have completed its certification process, introduced in 2019. You can be an association member without being certified by it.

The reason for the increased interest is clear: Many Americans are worried about their personal finances. In a survey of about 3,000 U.S. adults conducted last October by Fidelity Investments, more than one-third of respondents said they were in “worse financial shape” than in the previous year. Some 55% of those respondents blamed inflation and cost-of-living increases.

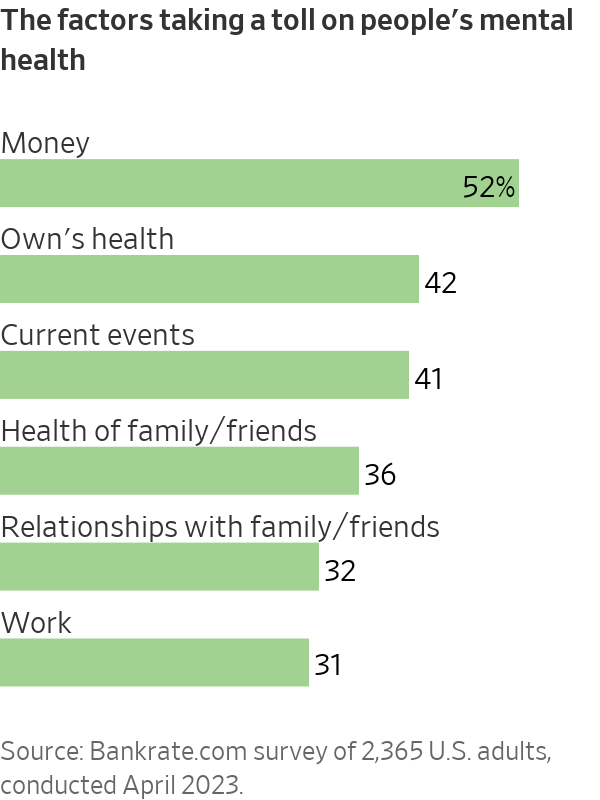

Similarly, 52% of 2,365 Americans polled for Bankrate.com said money negatively affected their mental health in 2023. That is 10 percentage points higher than in 2022. Financially anxious and stressed individuals are less likely to plan for retirement, prior research has concluded.

Messy divorce

New York advisory firm Francis Financial hired financial therapist Allen Sakon last November to aid individual clients. Many are divorced or widowed women with complicated money problems.

Certain clients “don’t believe they have enough resources, even though objectively they do,” says Sakon, who is a certified financial therapist, financial planner and accountant. Meanwhile, others with limited means mistakenly believe “they can live as extravagantly as they want,’’ she says.

Sakon currently counsels a recently divorced woman who is struggling with her dramatically lower income and the imminent sale of the family’s suburban New York home. “Her world has been turned upside down” by a financially messy divorce, Sakon says.

Though the woman has stressful new money responsibilities, she long avoided financial decisions, according to Sakon. “A money-avoidant grown-up is typically someone who was excluded from money discussions as a child,” she says.

Sakon says she hopes to eventually help this client feel capable of making financial decisions based on her resources and the financial plan that Sakon created for her.

Nate Astle , a certified financial therapist in Kansas City, Mo., met nine times from May 2023 to February 2024 with Andrea and Gianluca Presti , a 30-something Texas couple who were having persistent spats over money. Andrea Presti , an email marketer, says she believed that “if we didn’t go to financial therapy, I was going to question our entire relationship and whether we could continue.”

The wife cites an argument over the possible purchase of an expensive new car to replace their decade-old vehicle as an example of the couple’s financial conflicts. They disagreed over whether to give up a car that still worked well.

The husband, Gianluca Presti, a music producer, says financial therapy taught him and his wife to communicate better through active listening. He says he stopped being the couple’s money gatekeeper, became more open-minded about spending—and agreed to pay up to $45,000 cash for a new car. “We have to be a team if we want to solve financial issues,” he now realises.

Astle helped the Prestis revamp their household budget as well. It now reflects each spouse’s interests by including expenditures, investments and savings.

Astle, who is also a marriage and family therapist, says he has seen his financial-therapy clients more than double to 43 since 2022.

Possible pitfalls

Still, there are possible pitfalls when hiring a financial therapist. One major drawback: Anyone can claim they are qualified to practice financial therapy.

No government agency regulates the young profession. Candidates for certification by the Financial Therapy Association must take online courses designed by the association covering financial and therapeutic techniques, counsel clients for 250 hours and pass a 100-question test. But you can call yourself a financial therapist and not be certified by the association.

Meanwhile, the cost of financial therapy varies widely—from $125 to $350 an hour, Agnew estimates. Insurance rarely covers the tab.

In addition, there is no broad evidence that financial therapy works well. No large-scale studies demonstrating the field’s effectiveness have been conducted.

Another potential downside is that financial therapists with mental-health backgrounds typically lack extensive financial-planning experience—and vice versa. It is wise to interview at least three financial therapists, experts suggest. Then, pick someone who admits the limits of their expertise.

“I am very upfront about my boundaries,” says practitioner Aja Evans , a licensed mental-health counsellor who isn’t certified in financial therapy. Evans adds that she failed the certification test but plans to take it again during 2024—and before she becomes Financial Therapy Association president in January.

She says she feels well-qualified to help clients recognise how their upbringing affects their money beliefs today. “But I am in no shape or form going to be advising you about your investments, money moves or creating a financial plan,” Evans says. For clients who want that assistance, she says, she refers them to certified financial planners and accountants she knows well.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.