Rare NASA and WWI Artefacts Head to Auction

A range of rare historical artefacts, including astronaut-signed spacecraft hardware from NASA’s Apollo and Space Shuttle programs, will go under the hammer next month in Los Angeles.

Consisting of more than 250 objects, the one-day sale on Feb. 1 at Julien’s Auctions spans a dizzying range of categories, from collectibles signed by the world’s most famous politicians, writers, aviators, and scientists, to war regalia and other military accessories.

From the actual parts of the NASA Space Shuttle program that were flown in space to uniforms and accessories used in combat in the Great War as well as a collection of letters from the brilliant minds of our times, this is one of Julien’s most exceptional history auctions to date,” Martin Nolan, executive director and co-founder of Julien’s Auctions, tells Penta.

Julien’s Auctions

The items span more than 300 years and include artefacts from the first mission to the moon.

“Many of these important museum-worthy objects represent the powerful achievements of the great innovators and trailblazers whose impact helped create the modern age,” Nolan said in a news release.

Lots from some of history’s most iconic space journeys include an original, space-flown rocket booster lid and orbiter wing insulator panels. Also up for grabs is a selection of photographs signed by Apollo 11 crew members Neil Armstrong, Buzz Aldrin, and Michael Collins.

Hobbyists with a focus on military history and conflict can choose from uniforms, accessories, newspapers, and everyday objects from bygone eras. Original World War I items such as a British Army steel combat helmet, a U.S. Marine Corps wool uniform, and a spiked German Pickelhaube helmet all carry presale estimates between US$300 and US$500.

Julien’s Auctions

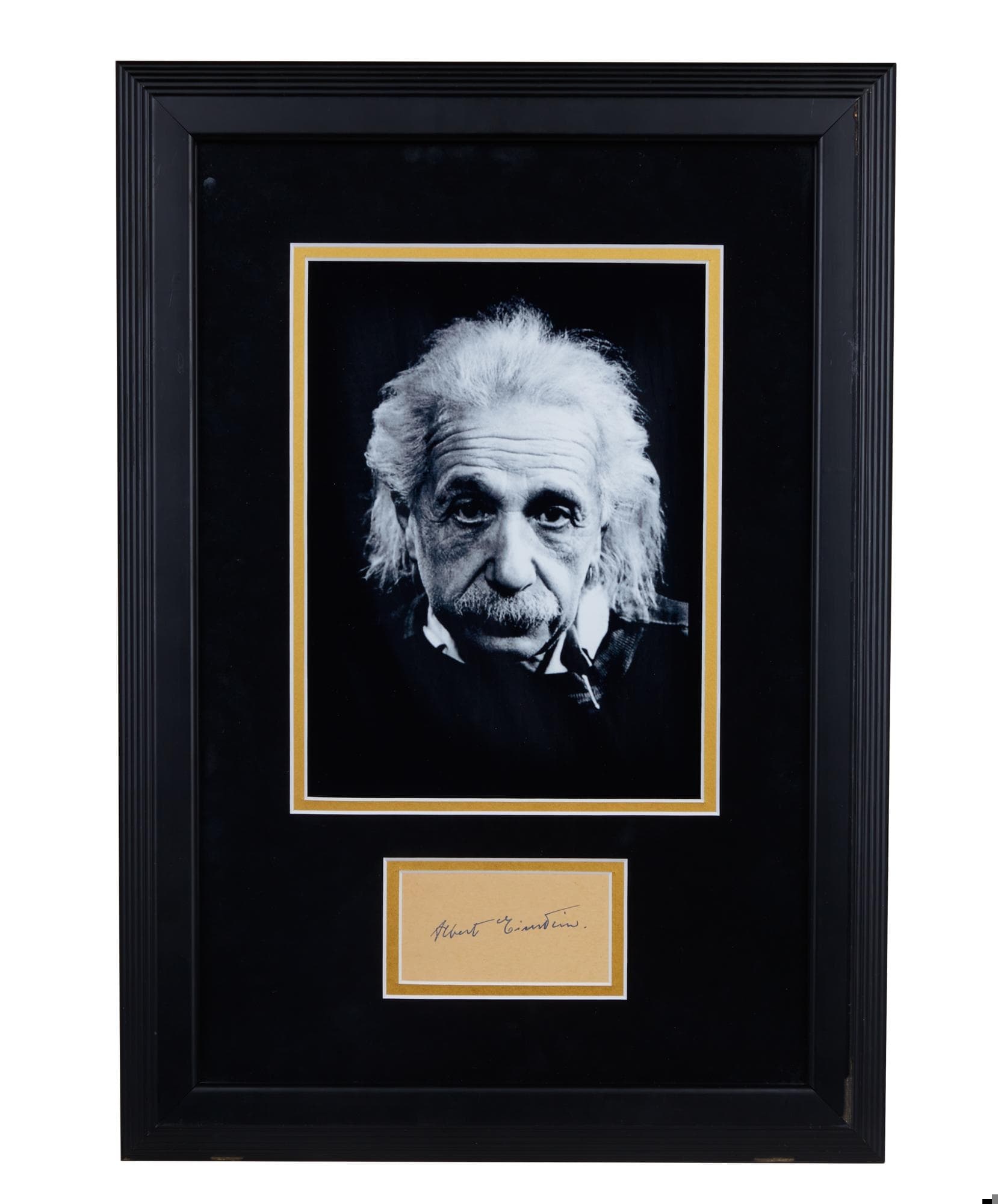

An assortment of literary greats, scientific pioneers, and influential politicians will be represented with signed notes and ephemera. Boldface names include Eleanor Roosevelt, the Dalai Lama, Carl Jung, Albert Einstein, and Dorothy Parker.

Among the more notable examples is a typed and signed Hunter S. Thompson letter dating from 1959, in which the notable author describes his short-lived attempt to earn money by driving a taxi cab and how his mother keeps asking him when he’s going to finish his book. Also available is a collection of eulogies and correspondence relating to the death of John F. Kennedy, featuring statements and appreciation cards from Richard Nixon, Nelson Rockefeller, and various members of the Kennedy family.

Other highlights include a Bell X-1 model rocket research plane signed by Chuck Yeager (presale estimate: US$600 to US$800), and a cloche hat from Amelia Earhart Fashions, the 1933 fashion line designed by the aviator to help fund her circumnavigation of the globe (estimate: US$2,000 to US$3,000).

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.