Rocket Stock Is the New Meme Trade. Move Over, GameStop.

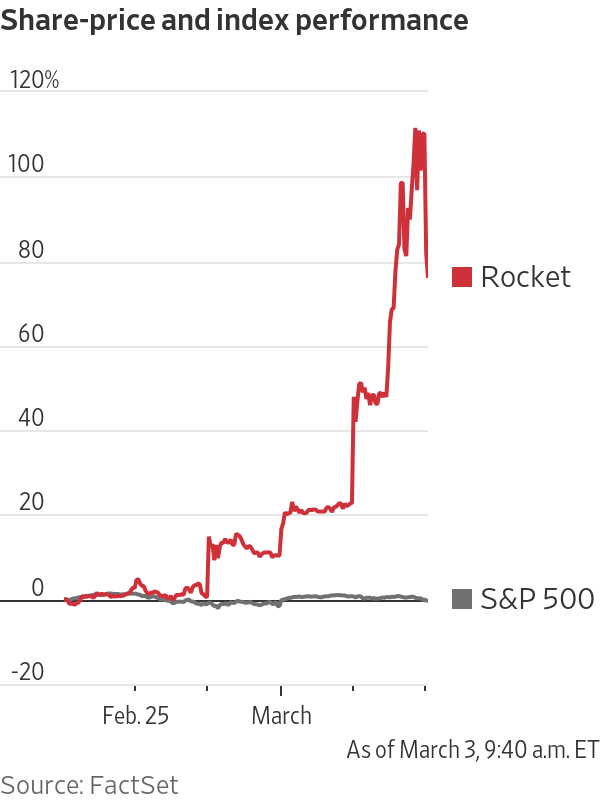

Rocket, the parent of Quicken Loans, has surged 28% this week.

The individual investors that powered GameStop Corp.’s meteoric rise have a new target: Rocket Cos., the parent company of Quicken Loans.

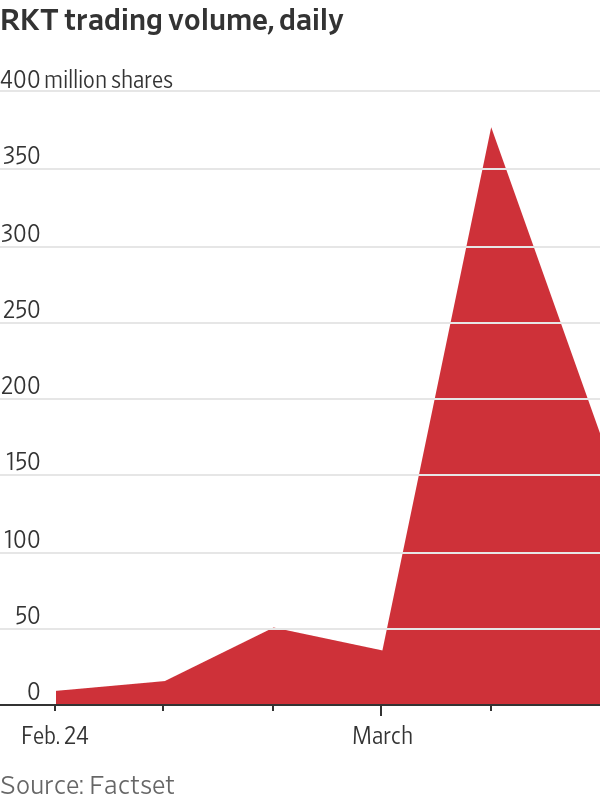

Shares of the mortgage lender surged 28% since the end of last week. Nearly 377 million shares traded hands on Tuesday alone, more than a 10-fold increase from the previous day. After surging 71% on Tuesday, the stock lost some steam on Wednesday, falling 33%, or $13.59, to $28.01.

Like GameStop, Rocket is heavily shorted. As of this week, 46% of its shares available for trading were being shorted by investors betting the price would fall, according to S3 Partners, a data-analytics firm. That was up from about 33% in late January and 17% in mid-September, according to FactSet.

Trading of Rocket shares was halted several times this week because of its volatility.

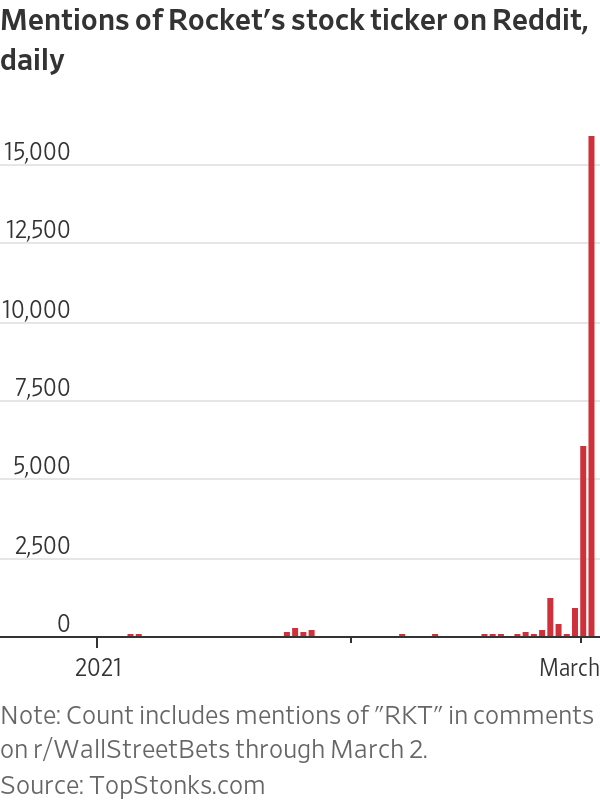

Individual investors on WallStreetBets, the Reddit community that gave birth to GameStop’s rise, have been encouraging each other to buy the stock in recent days and sharing evidence of their own massive gains. They have relished in the company’s name——Rocket——an apt one for their goal of higher prices.

“The $RKT is fueled and ready for liftoff,” one user wrote early this week.

The company stock symbol, RKT, was mentioned in nearly 16,000 Reddit comments on Tuesday, according to data from TopStonks.com, a website that tracks equities mentioned on Reddit. That is up from just over 6,000 on Monday and less than 1,000 on most days last week.

Rocket announced last week it would pay a one-time dividend of $1.11 per share later this month, citing its “highly profitable and capital light business model.” Some investors saw the move as a way to fend off short sellers. Short sellers are obliged to pay any dividends to the broker they borrowed shares from.

The company’s excess capital at the end of the fourth quarter made the dividend possible, Rocket CEO Jay Farner said at a conference Wednesday morning.

“We were pretty proud to be able to offer that to our shareholders,” Mr Farner said. “We think more of dividends as special dividends because we want that flexibility to make the right investment for the long-term growth of the organisation.”

Rocket has other upsides. Rising mortgage rates are boosting earning potential for mortgage lenders just as the crucial spring home-selling season kicks off. The average rate on the 30-year fixed-rate mortgage rose to 2.97% recently, its highest level since August.

Detroit-based Rocket is the largest mortgage lender in the U.S., according to research firm Inside Mortgage Finance. Its $323 billion in home loans in 2020 easily surpassed the $221 billion originated by its closest competitor, Wells Fargo & Co. Its large size and strong brand—it ran two Super Bowl commercials—set it apart from other non-bank lenders.

Before Rocket’s blastoff, shares of nonbank mortgage lenders had done little to impress investors in recent months. Some of the lenders that listed their shares on the public market in recent months significantly downsized their offerings. Some never made it to market because of tepid investor interest.

Shares of Rocket hadn’t strayed too far from their listing price of $18 in the seven months since the company’s IPO. The stock soared to more than $31 in its first month but quickly returned to near $20.

The first sign of liftoff came late last week, when Rocket reported impressive fourth-quarter results. Shares rose almost 10% on Friday. The news of a sizable dividend prompted Rocket’s initial jump in stock price, said KBW analyst Bose George.

“The initial move made some sense, but since then, fundamentals haven’t been driving it,” Mr George said. “It’s other factors that we have a harder time assessing.”

Shortly before its public-market debut last summer, Rocket announced an ambitious expansion target: cornering 25% of the mortgage market over the next decade. Its market share currently stands at about a third of that, according to Inside Mortgage Finance.

Rocket said last week that its mortgage originations more than doubled in 2020. It said it expects continued high origination levels despite weakening margins.

The amount lenders earn when they sell each loan has started to drop. Quicken’s gain-on-sale margin was 4.41% in the fourth quarter, down from the third quarter but well above the 3.41% it recorded a year earlier. It expects its first-quarter margin to be between 3.6% and 3.9%.

Cleveland Cavaliers owner Dan Gilbert helped found Quicken Loans in the 1980s and still holds the majority of its shares.

Ali Habhab has watched the stock’s recent ride with interest but doesn’t plan to sell his shares any time soon. Mr. Habhab, who is 25 years old, instead hopes his returns will bring him closer to his goal of retiring at 40. He bought 1,000 shares in Rocket shortly after the company’s IPO in August.

Mr. Habhab, who works in automotive manufacturing, said he was familiar with Quicken Loans long before parent company Rocket decided to go public. Mr. Habhab lives in Detroit, where Rocket is based, and has friends who started careers at the company or one of its subsidiaries.

“With all that factored in, it was a no-brainer to put some of my money where it belongs and where it will grow,” Mr Habhab said.

Another major nonbank mortgage lender, UWM Holdings Corp. is up 27% so far this week.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.