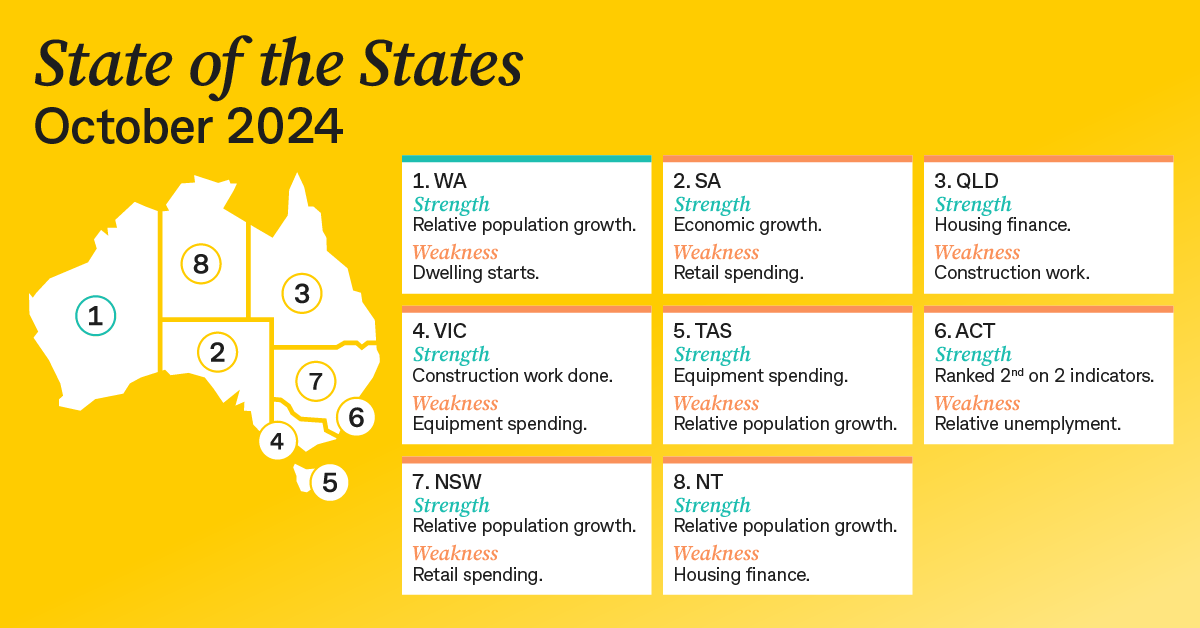

The Australian state economy outperforming the rest for the first time in a decade

The top state took first place on three key economic indicators while one east coast state languished near the bottom of the table

For the first time in a decade, Western Australia has the best performing economy in the country, new data has revealed. CommSec’s State of the State report showed the state held the top position this quarter in three of the eight economic indicators — retail spending, relative unemployment and relative population growth.

By contrast, the eastern states languished, with Victoria taking fourth position and NSW in seventh position, just ahead of the Northern Territory economy. The report said persistently high borrowing costs, based on interest rates maintained by the RBA to curb inflation, were having a negative impact on the rate sensitive NSW market.

This looks unlikely to change in a hurry with the report also examining annual growth rates across the eight indicators. It found WA has the strongest growth momentum, followed by Queensland, which is fuelled by strong relative unemployment figures and housing finance. The economic outlook for the Northern Territory is also positive given it now sits in second place on three economic indicators.

Western Australia edged out South Australia as the top performing state economy, after two quarters in first position.

Chief CommSec Economist Ryan Felsman said the resilient job market and steady population growth was continuing to underpin all state and territory economies.

“However, an extended period of elevated interest rates to counter persistent inflation is pressuring consumers and slowing economic momentum,” he said. “The path forward will largely depend on the ongoing strength of the labour market, trajectory for monetary policy and China’s economic recovery.”

While WA’s strong performance was based on ‘robust economic fundamentals’, Mr Felsman said the other states and territories were not far behind.

“WA is well positioned for sustained future performance; however, the competition remains intense, particularly among the top three states with Queensland moving quickly up the rankings,” he said.

CommSec is the digital broking arm of the Commonwealth Bank, Australia’s largest mortgage lender. It assesses the performance of each state and territory on a quarterly basis using eight key indicators including economic growth, retail spending, equipment investment, unemployment, construction work done, population growth, housing finance, and dwelling commencements.

A long-standing cultural cruise and a new expedition-style offering will soon operate side by side in French Polynesia.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The boom in casual footware ushered in by the pandemic has ended, a potential problem for companies such as Adidas that benefited from the shift to less formal clothing, Bank of America says.

The casual footwear business has been on the ropes since mid-2023 as people began returning to office.

Analyst Thierry Cota wrote that while most downcycles have lasted one to two years over the past two decades or so, the current one is different.

It “shows no sign of abating” and there is “no turning point in sight,” he said.

Adidas and Nike alone account for almost 60% of revenue in the casual footwear industry, Cota estimated, so the sector’s slower growth could be especially painful for them as opposed to brands that have a stronger performance-shoe segment. Adidas may just have it worse than Nike.

Cota downgraded Adidas stock to Underperform from Buy on Tuesday and slashed his target for the stock price to €160 (about $187) from €213. He doesn’t have a rating for Nike stock.

Shares of Adidas listed on the German stock exchange fell 4.5% Tuesday to €162.25. Nike stock was down 1.2%.

Adidas didn’t immediately respond to a request for comment.

Cota sees trouble for Adidas both in the short and long term.

Adidas’ lifestyle segment, which includes the Gazelles and Sambas brands, has been one of the company’s fastest-growing business, but there are signs growth is waning.

Lifestyle sales increased at a 10% annual pace in Adidas’ third quarter, down from 13% in the second quarter.

The analyst now predicts Adidas’ organic sales will grow by a 5% annual rate starting in 2027, down from his prior forecast of 7.5%.

The slower revenue growth will likewise weigh on profitability, Cota said, predicting that margins on earnings before interest and taxes will decline back toward the company’s long-term average after several quarters of outperforming. That could result in a cut to earnings per share.

Adidas stock had a rough 2025. Shares shed 33% in the past 12 months, weighed down by investor concerns over how tariffs, slowing demand, and increased competition would affect revenue growth.

Nike stock fell 9% throughout the period, reflecting both the company’s struggles with demand and optimism over a turnaround plan CEO Elliott Hill rolled out in late 2024.

Investors’ confidence has faded following Nike’s December earnings report, which suggested that a sustained recovery is still several quarters away. Just how many remains anyone’s guess.

But if Adidas’ challenges continue, as Cota believes they will, it could open up some space for Nike to claw back any market share it lost to its rival.

Investors should keep in mind, however, that the field has grown increasingly crowded in the past five years. Upstarts such as On Holding and Hoka also present a formidable challenge to the sector’s legacy brands.

Shares of On and Deckers Outdoor , Hoka’s parent company, fell 11% and 48%, respectively, in 2025, but analysts are upbeat about both companies’ fundamentals as the new year begins.

The battle of the sneakers is just getting started.

The megamansion was built for Tony Pritzker, heir to the Hyatt Hotel fortune and brother of Illinois Gov. JB Pritzker.

From Tokyo backstreets to quiet coastal towns and off-grid cabins, top executives reveal where they holiday and why stepping away makes the grind worthwhile.