The End of Japan’s Negative Rates Will Be a Slow-Moving Tsunami

Long-term effects of positive Japanese rates could be profound—on everything from mortgage rates to U.S. government finances

Japan’s stocks have reached levels that haven’t been seen for 34 years . The country is likely to hit another milestone soon: Its central bank could raise interest rates for the first time in 17 years as soon as Tuesday.

Higher, and positive, Japanese rates won’t reshape markets overnight. But the long-term effects could be profound, particularly if U.S. growth heads structurally lower for any reason, further narrowing the yield advantage of many U.S. assets. Japan is the single largest overseas holder of U.S. Treasurys, a major overseas lender, and an export heavyweight whose corporate earnings—and stocks—have been significantly supported by the ultra cheap Japanese yen. More Japanese capital staying at home could eventually impact the price of everything from U.S. mortgages to infrastructure finance in the developing world.

For much of the past two years, Japan has swum against global monetary tides, maintaining its ultra low interest-rate regime. But now, as most other major central banks are about to cut rates, the Bank of Japan is poised to break the trend again. Domestic media reported over the weekend that Japan’s central bank will end its negative interest rates, which have been in place since 2016, during its policy board meeting on Monday and Tuesday.

The decision would come after mounting evidence that the job market is on an increasingly strong footing , after years of stagnant wage growth. Unions secured an average salary increase of 5.28% , according to the first-round results of Japan’s annual spring wage negotiations, the Japanese Trade Union Confederation said last week. For the entire decade ending in 2022, the final annual increase never exceeded 2.4%.

Much likely won’t change in the short term. The Bank of Japan will probably pace its rate increases slowly: The past couple of years have, if anything, reaffirmed its reputation for moving slowly and deliberately. Moreover, while inflation is still high by Japanese standards—2.2% in January—it has already cooled from the peaks of last year.

Japanese bond yields have picked up, but they are still substantially lower than in the U.S. The rate differential between 10-year government bonds in the U.S. and Japan stands at 3.5 percentage points. That is significantly lower than the 4.2-percentage-point gap of a few months ago, but still way higher than the 1.5 percentage points of three years ago.

Even so, a narrowing rate gap—especially if the Fed cuts rates later this year, as seems likely—will support the Japanese yen . That could damp enthusiasm for rip-roaring Japanese stocks . They would become more expensive in dollar terms for foreign investors, who have been significant drivers of the rally. A stronger yen would also hit profits at some Japanese companies , especially big exporters.

Likewise, gradual interest-rate increases in Japan probably won’t change investment flows much in the short term. But it could be a different story down the road if the shift back to positive rates proves sustainable.

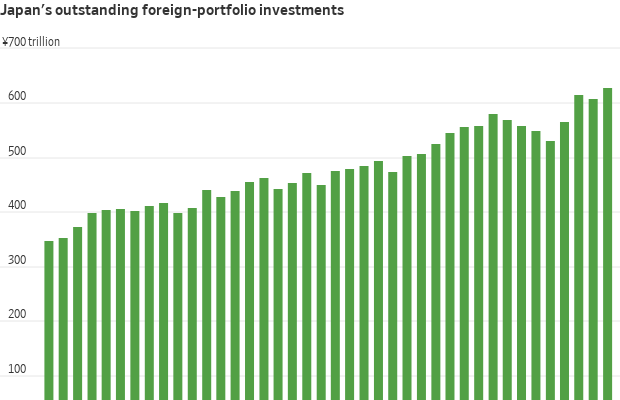

Japanese individuals and companies have been big investors abroad in search of higher yield for decades. The country’s foreign-portfolio investments stood at the equivalent of $4.2 trillion at the end of last year. A big chunk of that comes from Japanese pension funds and insurers, who would suddenly have more attractive options at home. Japanese investors, for example, hold around $1.1 trillion of Treasury bonds, making them the largest foreign owner.

Japanese investors have been scouring the globe for better returns for as long as most investors can remember. If that starts to change, the effects will be felt nearly everywhere—sooner or later.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.