The Primary Breadwinner Is Disappearing From More Homes

The economics of marriage are changing, but women still take on more of the unpaid labour

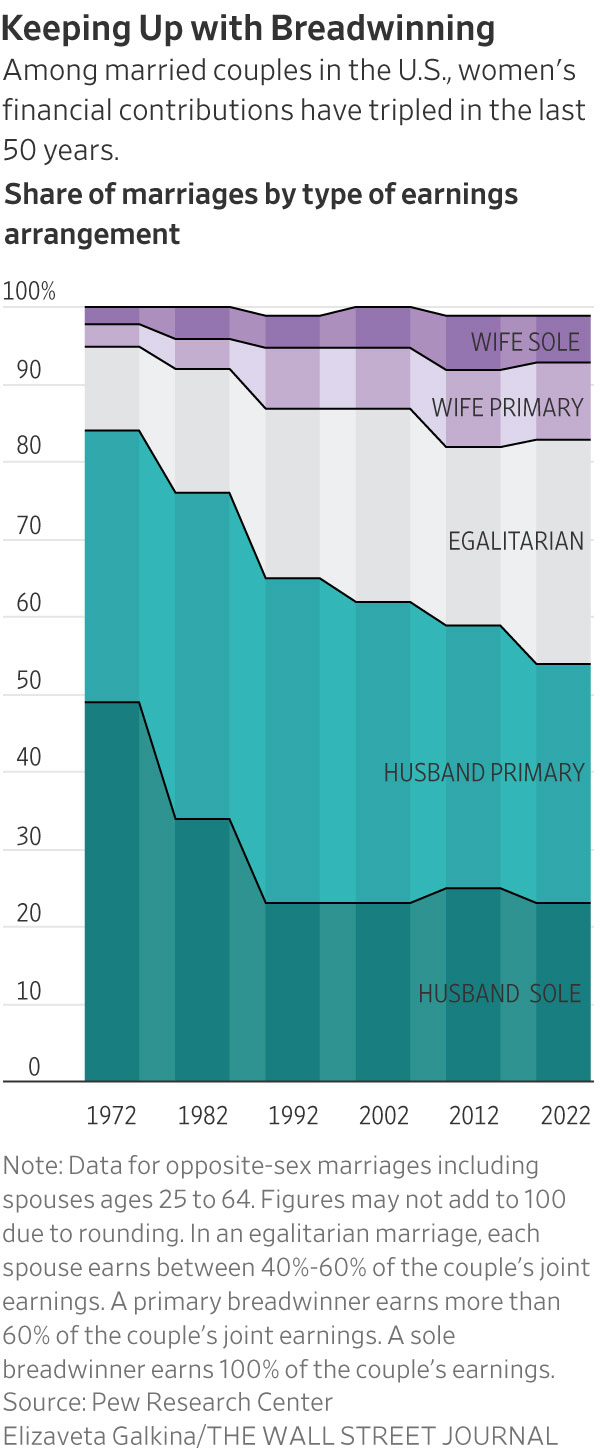

Nearly a third of marriages today have no primary breadwinner, as women continue to make strides toward greater equality at work and home.

About 30% of U.S. opposite-sex marriages are egalitarian in earnings, according to new data from Pew Research Center, meaning each spouse earns somewhere between 40% and 60% of the couples’ joint earnings. One of the main drivers of the shift is younger women making more money, said Pew.

The share of women earning more than their husbands has more than tripled from 5% to 16% over the last 50 years. In 1972, 49% of husbands were the sole breadwinner, meaning the husband had positive earnings and the wife had no earnings. By 2022, that share had dropped to 23% of opposite-sex marriages.

But the larger financial contributions by women don’t mean that relationships are more equal or women are better off in every realm of life, said Richard Fry, senior researcher at Pew Research Center.

Even when women earn as much as their husbands, they still put in around two more hours a week on caregiving than their husbands do, plus another 2.5 hours more on housework, according to Pew. In those same relationships, men spend nearly 3.5 more hours on leisure activities, such as watching television or playing video games, than their wives do.

Women’s economic role in marriages continues to rise despite a persistent gender pay gap and declining labor-force participation, Mr. Fry said. “In spite of some trends that would suggest to me that women’s economic role would not be growing, what we found was ‘No, it still is,’” he said.

Financial advisers and researchers say the changing money dynamic can cause marital strife, or in some cases, divorce.

Changes in breadwinner status “can lead to a lot of frustrations and arguments and resentment,” said Stacy Francis, president and chief executive of wealth-management firm Francis Financial and founder of a financial-education nonprofit.

When Ms. Francis, who often works with breadwinning women, surpassed her husband in earnings, she said the pair celebrated. After years of bearing the burden of bringing home most of the bacon, her husband was somewhat relieved to turn the job over to her, she said.

But Ms. Francis, now 48, soon found herself spending more time in the kitchen, throwing herself into the local parent-teacher association and planning her son’s prom—all, she said, in an effort to somehow compensate for other work and time spent away.

“It made me feel less feminine to earn more than my husband,” she said. “I realised, looking back, that I myself had to get comfortable with that role.”

Men remain the breadwinner in most marriages, meaning they earn more than 60% of the total earnings, Pew found.

The marriages with the highest total income are those in which both spouses are bringing in money. Marriages in which women are the primary breadwinners earn more than those in which men hold the same role: $145,000 in median income compared with $121,000 for marriages overall, according to the Pew data. A primary breadwinner in Pew’s research occurs when one spouse earns more than 60% of the household earnings.

Sole-breadwinner couples, or marriages in which one spouse has earnings and the other has none, make significantly less, with median incomes of around $75,000. Such couples also are more likely to be below the poverty line.

When women are the sole breadwinners, men spend more time on caregiving and a more equal amount of housework, compared with egalitarian marriages. But women still spend roughly the same amount of time on caregiving and household work, regardless of whether they are in egalitarian marriages or are sole or primary breadwinners, Pew found. Women without children are more likely to be the primary breadwinner than those with children.

Spouses within same-sex couples, however, tend to split the domestic labor more equally than their heterosexual counterparts, research shows.

Some researchers say one reason for the housework divide is that most of these gender roles have been built up over generations. There is a fear from some women that stopping this work could risk their marriage.

“We still see that there are remnants and large cultural issues associated with the sensitivity of women’s economic success, as a thing that destroys relationships,” said Johanna Rickne, professor of economics at the Swedish Institute for Social Research at Stockholm University.

Both husbands and wives can work to address these imbalances, said Jennifer Clark, a 34-year-old digital marketer based outside Chicago.

While her husband, a director of an audio-production company, has earned more than Ms. Clark for much of their 10-year marriage, she sets the monthly budget and manages household finances.

“It doesn’t feel like he has a larger share of the finances even though he is earning that money,” she said.

Throughout their marriage, Ms. Clark worked in freelance and part-time roles while her husband had full-time jobs. During those periods, she said, she bore a greater share of the household and caregiving responsibilities for their two children. But talking about their finances and making decisions together helped them remain equal partners.

“I would say I’ve always had a pretty good sense of financial autonomy, even with money I didn’t necessarily earn, because we make those decisions collaboratively,” she said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

When will Berkshire Hathaway stop selling Bank of America stock?

Berkshire began liquidating its big stake in the banking company in mid-July—and has already unloaded about 15% of its interest. The selling has been fairly aggressive and has totaled about $6 billion. (Berkshire still holds 883 million shares, an 11.3% interest worth $35 billion based on its most recent filing on Aug. 30.)

The selling has prompted speculation about when CEO Warren Buffett, who oversees Berkshire’s $300 billion equity portfolio, will stop. The sales have depressed Bank of America stock, which has underperformed peers since Berkshire began its sell program. The stock closed down 0.9% Thursday at $40.14.

It’s possible that Berkshire will stop selling when the stake drops to 700 million shares. Taxes and history would be the reasons why.

Berkshire accumulated its Bank of America stake in two stages—and at vastly different prices. Berkshire’s initial stake came in 2017 , when it swapped $5 billion of Bank of America preferred stock for 700 million shares of common stock via warrants it received as part of the original preferred investment in 2011.

Berkshire got a sweet deal in that 2011 transaction. At the time, Bank of America was looking for a Buffett imprimatur—and the bank’s stock price was weak and under $10 a share.

Berkshire paid about $7 a share for that initial stake of 700 million common shares. The rest of the Berkshire stake, more than 300 million shares, was mostly purchased in 2018 at around $30 a share.

With Bank of America stock currently trading around $40, Berkshire faces a high tax burden from selling shares from the original stake of 700 million shares, given the low cost basis, and a much lighter tax hit from unloading the rest. Berkshire is subject to corporate taxes—an estimated 25% including local taxes—on gains on any sales of stock. The tax bite is stark.

Berkshire might own $2 to $3 a share in taxes on sales of high-cost stock and $8 a share on low-cost stock purchased for $7 a share.

New York tax expert Robert Willens says corporations, like individuals, can specify the particular lots when they sell stock with multiple cost levels.

“If stock is held in the custody of a broker, an adequate identification is made if the taxpayer specifies to the broker having custody of the stock the particular stock to be sold and, within a reasonable time thereafter, confirmation of such specification is set forth in a written document from the broker,” Willens told Barron’s in an email.

He assumes that Berkshire will identify the high-cost Bank of America stock for the recent sales to minimize its tax liability.

If sellers don’t specify, they generally are subject to “first in, first out,” or FIFO, accounting, meaning that the stock bought first would be subject to any tax on gains.

Buffett tends to be tax-averse—and that may prompt him to keep the original stake of 700 million shares. He could also mull any loyalty he may feel toward Bank of America CEO Brian Moynihan , whom Buffett has praised in the past.

Another reason for Berkshire to hold Bank of America is that it’s the company’s only big equity holding among traditional banks after selling shares of U.S. Bancorp , Bank of New York Mellon , JPMorgan Chase , and Wells Fargo in recent years.

Buffett, however, often eliminates stock holdings after he begins selling them down, as he did with the other bank stocks. Berkshire does retain a smaller stake of about $3 billion in Citigroup.

There could be a new filing on sales of Bank of America stock by Berkshire on Thursday evening. It has been three business days since the last one.

Berkshire must file within two business days of any sales of Bank of America stock since it owns more than 10%. The conglomerate will need to get its stake under about 777 million shares, about 100 million below the current level, before it can avoid the two-day filing rule.

It should be said that taxes haven’t deterred Buffett from selling over half of Berkshire’s stake in Apple this year—an estimated $85 billion or more of stock. Barron’s has estimated that Berkshire may owe $15 billion on the bulk of the sales that occurred in the second quarter.

Berkshire now holds 400 million shares of Apple and Barron’s has argued that Buffett may be finished reducing the Apple stake at that round number, which is the same number of shares that Berkshire has held in Coca-Cola for more than two decades.

Buffett may like round numbers—and 700 million could be just the right figure for Bank of America.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.