The Stocks Investors Are Putting Under the Tree

Shares of retailers including Victoria’s Secret and Foot Locker are surging despite mixed holiday updates

Retailers are making modest predictions about the holiday shopping season—and their stocks are going gangbusters in response.

Victoria’s Secret, Foot Locker, Ulta Beauty and Dollar Tree are among the companies that offered somewhat mixed assessments of the state of the shopper last week. Yet each received an ovation from investors.

Traders have piled into stocks en masse since a softer-than-expected inflation reading on Nov. 14 bolstered wagers that the Federal Reserve is done raising interest rates and is poised to cool the economy without tipping it into a recession. Treasury yields have sharply declined as well, giving equities a second wind.

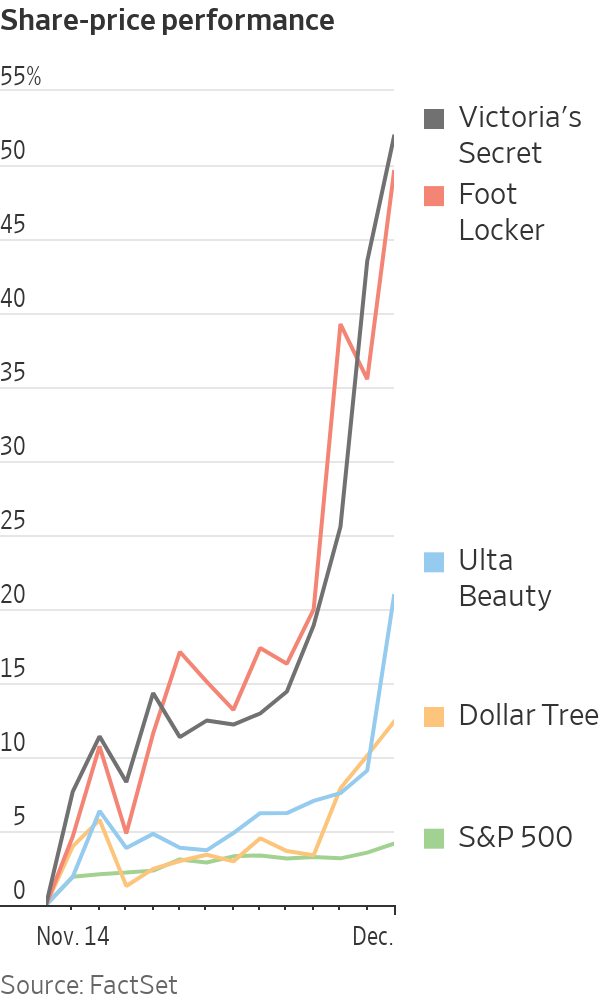

The S&P 500 has risen 4.1% since the report, extending its gains for the year to almost 20%.

Many depressed sectors of the market, such as retailers, have risen even faster. The SPDR S&P Retail exchange-traded fund—which includes 78 retailers, from department stores and other apparel companies, to automotive and drugstores—has jumped about 13%. Victoria’s Secret has soared 52%, Foot Locker is up 50%, Ulta has risen 21% and Dollar Tree has added 12%. (Three of the four stocks have suffered double-digit percentage declines this year.)

Americans slowed their spending in October, according to last week’s consumer-spending data from the Commerce Department. But the early readings from the holiday shopping season have been more encouraging. U.S. shoppers spent $38 billion during the five days from Thanksgiving through the following Monday, up 7.8% from the same period last year, according to Adobe Analytics.

Many investors closely watch consumer spending because it is a major driver of economic growth. If spending is too strong, the Fed could be forced to raise interest rates again. Whereas, if spending is too weak, it could be a sign that the economy is entering a recession.

In the coming days, investors will look at U.S. service-sector activity for November and Friday’s monthly jobs report as they try to assess the strength of the economy and the market’s trajectory.

“The consumer has been resilient throughout it all,” said Jay Woods, chief global strategist at Freedom Capital Markets. “The economic news is now starting to back that up, that, ‘OK, we aren’t going to be in a recession. Things are getting a little bit better.’ And these stocks that had been beaten-down are finally catching a bid.”

Victoria’s Secret posted its second consecutive quarterly loss Wednesday, with the lingerie retailer facing a continued slump in sales. But the company forecast higher sales in the current quarter, sending shares up 14% the next day, their largest one-day percentage gain in more than two years. The stock is down 20% in 2023.

Footwear retailer Foot Locker said Wednesday that Black Friday sales were strong and it forecast an upbeat holiday shopping period, while reporting lower sales and profit for the third quarter. Its shares rose 16% that day, their biggest gain in more than a year, trimming their 2023 decline to 21%.

Cosmetic retailer Ulta on Thursday posted stronger-than-expected sales in the third quarter and raised the lower end of its sales and profit outlook for the year. The shares rose 11% in the following session, their best day since May 2022. They are up 0.6% for the year.

Dollar Tree reported Wednesday that same-store sales growth was weaker than analysts expected, but investors appeared to be encouraged that the discount retailer is seeing increases in customer traffic, even if basket sizes are shrinking. Its shares rose 4.4% that day and are off 11% in 2023.

Another reason why retail stocks have rallied? Warehouses have reduced merchandise, and store shelves aren’t spilling over with discounted goods.

John Augustine, chief investment officer at Huntington Private Bank, said higher interest rates and oil prices made him bearish on retail stocks over the summer. But with an easing macro environment, he believes retailers could be poised to do well.

“It seems like traffic is gonna be there for the holidays,” Augustine said. “Now can retailers make the same profit, earnings per share, with tighter inventory?”

Short sellers are licking their wounds after the recent rally. They lost about $120 million in November betting against the SPDR S&P Retail ETF, according to financial-analytics firm S3 Partners. That compares with a loss of $2.8 million through the first 10 months of the year. Short sellers borrow shares and sell them, expecting to repurchase them at lower prices and collect the difference as profit.

Many retail stocks still generally look cheap compared with the broader market. Victoria’s Secret is trading at 11.8 times its projected earnings over the next 12 months, while Foot Locker is at 16.2. The S&P 500’s multiple is 18.8.

Despite the recent excitement in markets, many investors caution that it is too soon to count on a soft landing for the economy. Jamie Dimon, chief executive of JPMorgan Chase, recently cautioned that inflation could rise further and a recession isn’t off the table.

In the past 11 Fed rate-hiking cycles, recessions have typically started around two years after the Fed begins raising interest rates, according to Deutsche Bank. This hiking cycle started last March.

“It’s not an all-clear resurgence trade that we’re in right now,” said Brock Campbell, head of global research at Newton Investment Management. “This is gonna be a much more idiosyncratic stock picker’s group for a while.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.