The World’s Biggest Crypto Firm Is Melting Down

‘Every battle is a do-or-die situation,’ Binance co-founder Yi He writes

After FTX crashed, the world of crypto seemed to belong to the largest exchange, Binance. Less than a year later, Binance is the one in distress.

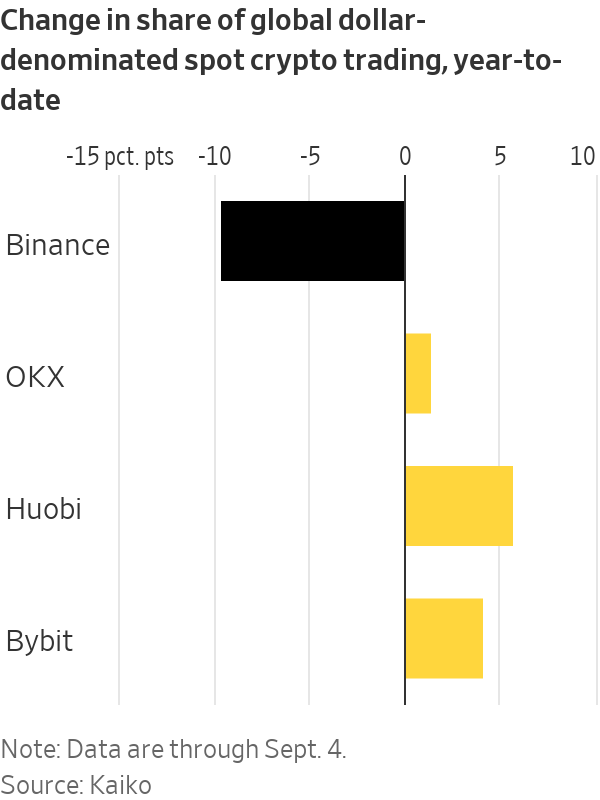

Under threat of enforcement actions by U.S. agencies, Binance’s empire is quaking. Over the past three months, more than a dozen senior executives have left, and the exchange has laid off at least 1,500 employees this year to cut costs and prepare for a decline in business. And while Binance still looms large in crypto, its dominance is dwindling.

Binance now handles about half of all trades where cryptocurrencies are directly bought and sold, down from about 70% at the start of the year, according to data provider Kaiko.

What happens to Binance will have immense implications for the crypto industry because the exchange is so big. Industry players and watchers say other exchanges would fill the void if Binance were to collapse. But in the short term, liquidity in the market could evaporate, driving the price of tokens sharply down.

One institutional trader told The Wall Street Journal that his company has conducted fire drills to withdraw its assets from Binance quickly in the event of a meltdown.

Yi He, Binance’s co-founder and chief marketing officer, vowed to overcome the troubles in a message to Binance staff last month.

“Every battle is a do-or-die situation, and the only thing that can defeat us is ourselves,” she wrote in the message viewed by the Journal. “We have won countless times, and we need to win this time as well.”

Binance is a frequent investor in third-party crypto projects and beyond. Binance has invested in X, formerly known as Twitter. Binance co-founder Changpeng Zhao—or CZ as his 8.6 million X followers know him—is the biggest face of crypto.

“You just can’t quantify what would happen to the industry if Binance disappeared, given it has been responsible for fostering a huge amount of innovation and growth,” said Anthony Georgiades, a general partner at Innovating Capital, a fund that invests in early-growth companies.

The U.S. Justice Department has undergone a years long investigation that could result in criminal charges for Binance and Zhao as well as billions of dollars of fines, according to people familiar with the probe.

Binance also faces a Securities and Exchange Commission lawsuit that alleges it and Zhao operated illegally in the U.S. and misused customers’ funds. The firm has acknowledged past mistakes but says customer money is safe and it is committed to compliance.

“We have worked tirelessly not just to learn the lessons of the past, but also to continue to invest in the teams and systems that ensure user protection,” a spokesman said.

Binance launched in China in 2017, though it claims to be based nowhere, with staff scattered around the world. Its global website is accessible by traders almost everywhere, but that number is falling as its presence has been forbidden in many countries. In Europe, more countries are shutting their doors to the exchange.

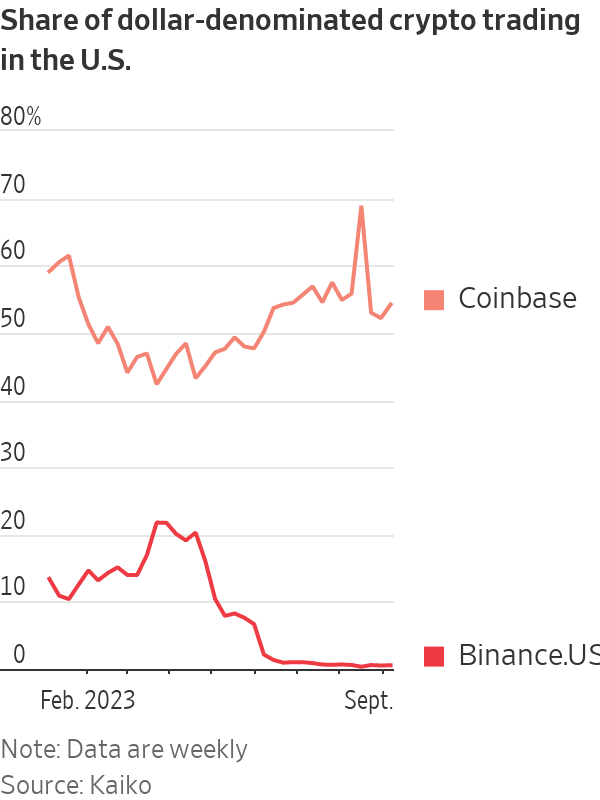

In the U.S., activity at its local exchange, Binance.US, has basically dissipated. Its chief executive officer, legal chief and risk head all left recently.

In a virtual Binance.US meeting days before his departure earlier this month, Binance.US CEO Brian Shroder said revenue at the exchange had fallen 70% year to date, according to a presentation viewed by the Journal. Executives looked on with dismay.

Shroder told employees Zhao would need to resolve “his regulatory matters, put his .US holdings in a blind trust, or sell his shares” in order for the U.S. platform to maintain its growth initiative. Those steps would allow the company to unblock banking relationships and get licenses, he said. Zhao is the majority owner of Binance.US and the global exchange.

A spokeswoman for Binance.US declined to comment.

Binance and the DOJ have been talking for months, according to people familiar with the discussions, and inside Binance, there have been discussions on whether Zhao should step down.

Zhao’s insistence in remaining at the helm of the company has frustrated some executives who believed him leaving would improve the chances of the company surviving, the Journal previously reported.

The company upheaval has also hurt employee morale.

Employees confronted Zhao in a summer meeting following layoffs, according to messages viewed by the Journal, in a rare showing of criticism.

“Some ppl laid off were given 0 days notice and/or found out they got laid off because they couldn’t login to the system anymore. How is that treating them respectfully? Is 2 weeks severance respectful?” one anonymous employee asked Zhao in the all-hands meeting chat. Nine others upvoted that. The question went unanswered.

A further stumbling block for Binance came in late August, when the Journal published an article on Binance customers’ use of sanctioned Russian banks. The DOJ has also been investigating Binance in connection with possible violations of U.S. sanctions on Russia, the Journal has reported.

Following the Journal story, the Justice Department questioned Binance about the banks’ usage, and Binance’s chief compliance officer, Noah Perlman, met with department officials to discuss their concerns, a person with direct knowledge of the matter said.

Pressure from the DOJ was partly responsible for Zhao’s decision to begin winding down Binance’s business in Russia, once one of its most important markets, the person said. Over the following two weeks, Binance barred customers from using the sanctioned banks and forced out the executives managing its Russia business. It said it was considering a full withdrawal from Russia.

Zhao publicly remained defiant. “We are one community,” he wrote on X on the day the Russia executives left. “Keep building!”

But behind closed doors, Zhao has been bringing new lawyers to handle the DOJ case, according to people familiar with the move. And Zhao has been staying put in his home in the United Arab Emirates, which doesn’t have a mutual extradition treaty with the U.S.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

JPMorgan Chase has a ‘strong bias’ against adding staff, while Walmart is keeping its head count flat. Major employers are in a new, ultra lean era.

It’s the corporate gamble of the moment: Can you run a company, increasing sales and juicing profits, without adding people?

American employers are increasingly making the calculation that they can keep the size of their teams flat—or shrink through layoffs—without harming their businesses.

Part of that thinking is the belief that artificial intelligence will be used to pick up some of the slack and automate more processes. Companies are also hesitant to make any moves in an economy many still describe as uncertain.

JPMorgan Chase’s chief financial officer told investors recently that the bank now has a “very strong bias against having the reflective response” to hire more people for any given need. Aerospace and defense company RTX boasted last week that its sales rose even without adding employees.

Goldman Sachs , meanwhile, sent a memo to staffers this month saying the firm “will constrain head count growth through the end of the year” and reduce roles that could be more efficient with AI. Walmart , the nation’s largest private employer, also said it plans to keep its head count roughly flat over the next three years, even as its sales grow.

“If people are getting more productive, you don’t need to hire more people,” Brian Chesky , Airbnb’s chief executive, said in an interview. “I see a lot of companies pre-emptively holding the line, forecasting and hoping that they can have smaller workforces.”

Airbnb employs around 7,000 people, and Chesky says he doesn’t expect that number to grow much over the next year. With the help of AI, he said he hopes that “the team we already have can get considerably more work done.”

Many companies seem intent on embracing a new, ultralean model of staffing, one where more roles are kept unfilled and hiring is treated as a last resort. At Intuit , every time a job comes open, managers are pushed to justify why they need to backfill it, said Sandeep Aujla , the company’s chief financial officer. The new rigor around hiring helps combat corporate bloat.

“That typical behavior that settles in—and we’re all guilty of it—is, historically, if someone leaves, if Jane Doe leaves, I’ve got to backfill Jane,” Aujla said in an interview. Now, when someone quits, the company asks: “Is there an opportunity for us to rethink how we staff?”

Intuit has chosen not to replace certain roles in its finance, legal and customer-support functions, he said. In its last fiscal year, the company’s revenue rose 16% even as its head count stayed flat, and it is planning only modest hiring in the current year.

The desire to avoid hiring or filling jobs reflects a growing push among executives to see a return on their AI spending. On earnings calls, mentions of ROI and AI investments are increasing, according to an analysis by AlphaSense, reflecting heightened interest from analysts and investors that companies make good on the millions they are pouring into AI.

Many executives hope that software coding assistants and armies of digital agents will keep improving—even if the current results still at times leave something to be desired.

The widespread caution in hiring now is frustrating job seekers and leading many employees within organizations to feel stuck in place, unable to ascend or take on new roles, workers and bosses say.

Inside many large companies, HR chiefs also say it is becoming increasingly difficult to predict just how many employees will be needed as technology takes on more of the work.

Some employers seem to think that fewer employees will actually improve operations.

Meta Platforms this past week said it is cutting 600 jobs in its AI division, a move some leaders hailed as a way to cut down on bureaucracy.

“By reducing the size of our team, fewer conversations will be required to make a decision, and each person will be more load-bearing and have more scope and impact,” Alexandr Wang , Meta’s chief AI officer, wrote in a memo to staff seen by The Wall Street Journal.

Though layoffs haven’t been widespread through the economy, some companies are making cuts. Target on Thursday said it would cut about 1,000 corporate employees, and close another 800 open positions, totaling around 8% of its corporate workforce. Michael Fiddelke , Target’s incoming CEO, said in a memo sent to staff that too “many layers and overlapping work have slowed decisions, making it harder to bring ideas to life.”

A range of other employers, from the electric-truck maker Rivian to cable and broadband provider Charter Communications , have announced their own staff cuts in recent weeks, too.

Operating with fewer people can still pose risks for companies by straining existing staffers or hurting efforts to develop future leaders, executives and economists say. “It’s a bit of a double-edged sword,” said Matthew Martin , senior U.S. economist at Oxford Economics. “You want to keep your head count costs down now—but you also have to have an eye on the future.”

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

An opulent Ryde home, packed with cinema, pool, sauna and more, is hitting the auction block with a $1 reserve.