U.S. Companies Face EU Deforestation Rules on Coffee, Wood and Other Everyday Goods

Businesses are bracing for tough new regulations after voluntary corporate efforts failed

Companies selling everyday products such as leather shoes, coffee and chocolate in the European Union will soon need to prove their wares aren’t causing forest loss under a new law, after voluntary efforts largely failed.

The world’s toughest rules on deforestation come into force Thursday, meaning that companies have 18 months to prepare for proving the origin of seven commodities imported into the EU that are known to drive forest loss: cattle, cocoa, coffee, palm oil, soy, rubber and wood.

Almost 40% of the world’s 500 largest companies using the seven commodities covered by the new EU rules haven’t set a policy on forest loss, environmental nonprofit Global Canopy said in a report in February. The nonprofit estimates at least 37 big U.S.-based companies, including Starbucks and Kellogg, will be covered by the new rules.

“Our team is reviewing the regulations and working with our materials and ingredients suppliers to prepare,” a Kellogg spokeswoman said. Starbucks declined to comment.

Businesses will need to pinpoint the plot of land where the product came from and prove no forests have been cleared on the site since 2020. They will need to provide evidence of due diligence, which will likely include satellite imagery. Planet Labs and Airbus-owned Starling—two businesses that use satellites to monitor land use—said U.S. companies have shown interest in their services because of the new regulations.

Importers failing to meet the new rules face fines of up to 4% of their annual revenue in the bloc. The law requires the bloc’s national authorities to check 9% of shipments coming from countries it considers to have a high risk of deforestation, 3% for nations it labels standard risk and 1% from low risk nations.

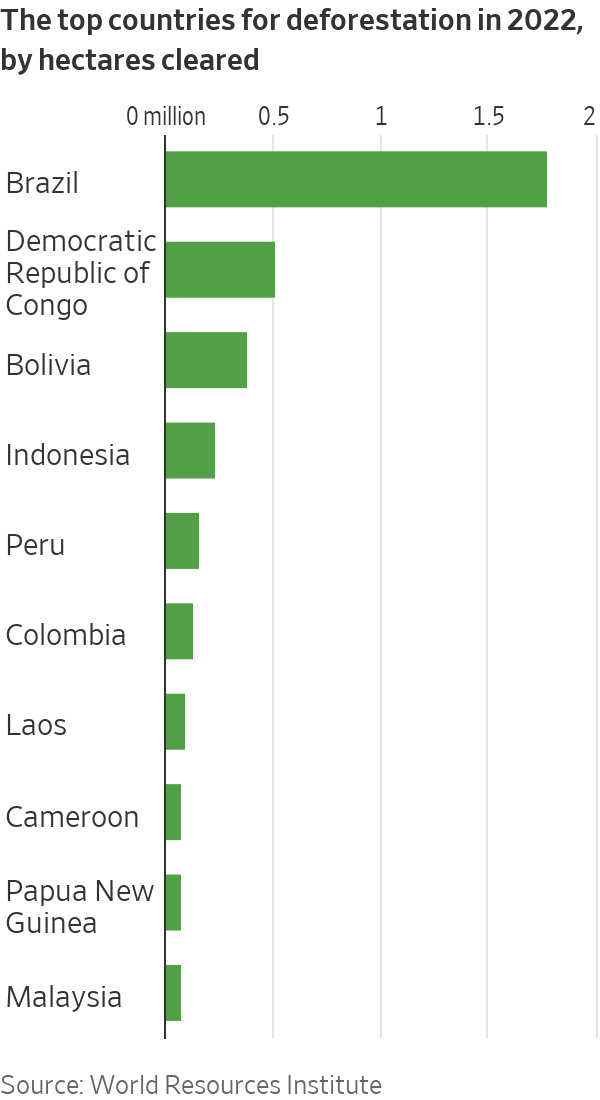

Companies are still waiting for the EU to provide a list of countries designated as high risk. Nations such as Brazil, Indonesia and Malaysia are lobbying against being classified as high risk, fearing the label will hurt trade.

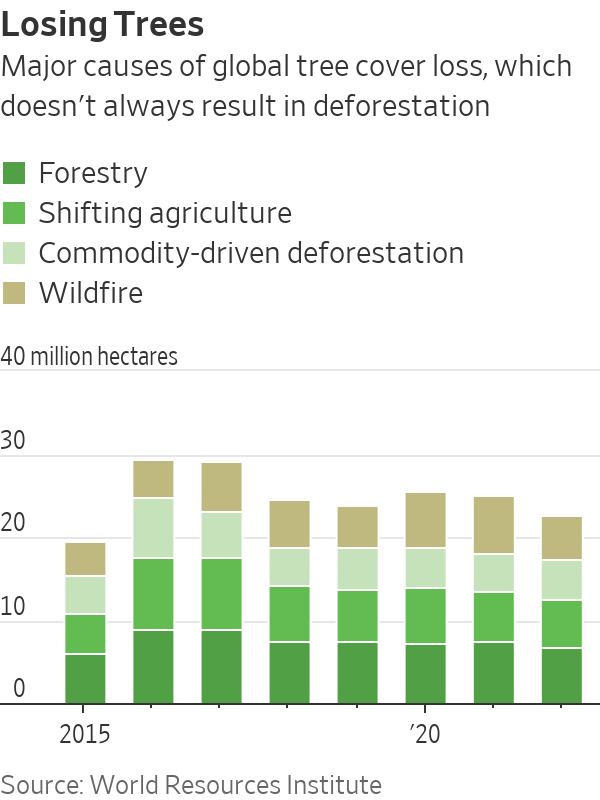

Loss of tropical primary, or mature, forests globally totalled 4.1 million hectares in 2022, the equivalent of losing 11 soccer fields of forest a minute, according to the World Resources Institute.

Many companies struggle to police their supply chains. Voluntary deforestation ambitions have failed, including the Consumer Goods Forum’s 2010 pledge to “achieve net zero deforestation” by 2020. In 2014, more than 200 companies pledged in the New York Declaration on Forests to eliminate deforestation by 2030, but they missed an interim target to halve deforestation by 2020.

Kellogg backed both initiatives and in a 2020 report identified a variety of reasons for the failure, including a lack of coordination between organisations, inconsistent regulations and opaque supplier ownership. It is among the companies working to fulfil the longer-term commitment of the New York Declaration on Forests to eliminate deforestation by 2030.

In 2021, leaders from more than 100 countries agreed to a deal at the COP26 climate summit aiming to end and then reverse deforestation by 2030.

The EU’s regulations aim to reduce the destruction of forests for economic activity and fight global warming. Trees absorb carbon dioxide, and forest loss and damage has caused around 10% of global warming, according to nonprofit World Wildlife Fund.

“Combating deforestation is an urgent task for this generation, and a great legacy to leave behind for the next,” Frans Timmermans, the EU official overseeing the bloc’s climate plans, said when political agreement on the regulations was reached in December.

The EU rules apply to companies meeting the bloc’s broad definition of an “operator,” which includes a business importing into the EU, exporting from it, or putting products on the bloc’s market. Operators can be big agribusinesses such as Cargill and Bunge supplying companies in the bloc, but also EU subsidiaries importing commodities to manufacture and sell products.

Guillaume Croisant, a Brussels-based lawyer at Linklaters, said that because the rules will be enforced by national officials, there could be discrepancies as “some authorities may be harsher.”

The EU has estimated the combined yearly due-diligence costs for importers to comply with the new rules could be as high as €2.6 billion a year, equivalent to roughly $2.8 billion.

Fast-moving consumer goods companies using coffee, cocoa, palm oil and soy could be hit with big compliance costs from the reporting requirements to trace precise geolocations as well as potential reorganisation of supply chains that are unable or unlikely to be compliant, according to an analyst report from Barclays.

The EU rules are expected to become stricter over time. A review on expanding them is scheduled in two years and some policy makers are pushing to have corn added to the list of commodities covered and for the financial sector to be regulated under the rules.

In the U.S., Democrats in Congress are pushing for similar legislation called the Forest Act. Sen. Brian Schatz, a Hawaii Democrat who is spearheading the effort, said the U.S. needs to follow the EU in enacting deforestation regulations on trade.

“If we do nothing, the U.S. market will become a dumping ground for commodities that can no longer make their way into Europe,” he said. “While companies talk a big game on preventing deforestation, we can no longer allow them to police themselves.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.