Why Is Everyone So Unhappy at Work Right Now?

U.S. employees are more dissatisfied than they were in the thick of the pandemic

Americans, by many measures, are unhappier at work than they have been in years.

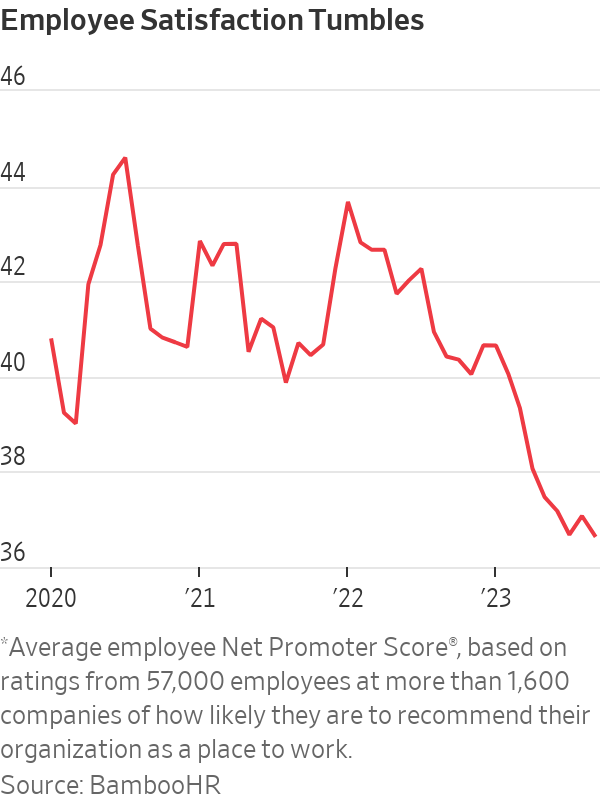

Despite wage increases, more paid time off and greater control over where they work, the number of U.S. workers who say they are angry, stressed and disengaged is climbing, according to Gallup’s 2023 workplace report. Meanwhile, a BambooHR analysis of data from more than 57,000 workers shows job-satisfaction scores have fallen to their lowest point since early 2020, after a 10% drop this year alone.

In interviews with workers around the country, it is clear the unhappiness is part of a rethinking of work life that began in 2020. The sources of workers’ discontent range from inflation, which is erasing much of recent pay gains, to the still-unsettled nature of the workday. People chafe against being micromanaged back to offices, yet they also find isolating aspects of hybrid and remote work. A cooling job market—especially in white-collar roles—is leaving many professionals feeling stuck.

Companies have largely moved on from pandemic operating mode, cutting costs and renewing a focus on productivity. The disconnect with workers has managers frustrated, and no quick fix seems to be at hand. Those in charge said they have given staff more money, flexibility and support, only to come up short.

The experiences of workers like Lindsey Leesmann suggest how expectations have shifted from just a few years ago. Leesmann, 38 years old, said she soured on a philanthropy job after having to return to the office two days a week earlier this year.

Prepandemic, she would have been happy working three days a week at home. “It would have been a dream come true.” Still, her team’s in-office requirements seemed like going backward, and made her feel that her professionalism and work quality were in doubt. Instead of collaborating more, she and others rarely left their desks, except for meetings or lunch, she said. Negative feelings followed her home on her hourlong commute, leaving her short-tempered with her kids.

“You try to keep work and home separate, but that sort of stuff is just impacting your mental health so much,” said Leesmann, who recently moved to a new job that requires five in-office days a month.

No more honeymoon

The discontent has business leaders struggling for answers, said Stephan Scholl, chief executive of Alight Solutions, a technology company focused on benefits and payroll administration. Many of the Fortune 100 companies on Alight’s client list boosted spending on employee benefits such as mental health, child care and well-being bonuses by 20% over the pandemic years.

“All that extra spend has not translated into happier employees,” Scholl said. In an Alight survey of 2,000 U.S. employees this year, 34% said they often dread starting their workday—an 11-percentage-point rise since 2020. Corporate clients have told him mental-health claims and costs from employee turnover are rising.

One factor is the share of workers who are relatively new to their roles after record levels of job-switching, said Benjamin Granger, chief workplace psychologist at software company Qualtrics. Many employers have focused more on hiring than situating new employees well, leaving many newbies feeling adrift. In other cases, workers discovered shiny-seeming new jobs weren’t a great fit.

The upshot is that the newest workers are among the least satisfied, Qualtrics data show—a reversal of the higher levels of enthusiasm that fresh hires typically voice. In its study of nearly 37,000 workers published last month, people less than six months into a job reported lower levels of engagement, feelings of inclusion and intent to stay than longer-tenured workers. They also scored lower on those metrics than new workers in 2022, suggesting the pay raises that lured many people to new jobs might not be as satisfying as they were a year or two ago.

“What happened to that honeymoon phase?” Granger said.

John Shurr, a 66-year-old former manufacturing engineer, took a job as an inventory manager at a heavy-equipment retailer in the spring in Missoula, Mont., after being laid off during the pandemic.

“It was a nice job title on a pretty rotten job,” said Shurr, who learned soon after starting that his duties would also include sales to walk-in customers.

When Shurr broached the subject, his boss asked him to give it a chance and said he was really needed on the showroom floor. Shurr, who describes himself as more of a computer guy, quit about a month later.

“I feel kind of trapped at the moment,” said Shurr, who has since taken a part-time job as a parts manager as he tries to find full-time work.

Bridging the distance

Long-distance relationships between bosses and staff might also be an issue. Nearly a third of workers at large firms don’t work in the same metro area as their managers, up from about 23% in February 2020, according to data from payroll provider ADP.

Distance has weakened ties among co-workers and heightened conflict, said Moshe Cohen, a mediator and negotiation coach who teaches conflict resolution at Boston University’s Questrom School of Business. He has noticed more employees calling co-workers or bosses toxic or impossible, signs that trust is thin.

Cohen’s corporate clients said their employees are increasingly transactional with one another. Some are coaching workers in the finer points of dialogue, such as saying hello first before jumping into the substance of a conversation.

“The idea of slowing down, taking the time, being genuine, trying to actually establish some sort of connection with the other person—that’s really missing,” Cohen said.

One Los Angeles-based consultant in his 20s, who asked to remain anonymous because he is seeking another job, said that when he started his job at a large company last year, his largely remote colleagues were focused on their own work, unwilling to show a new hire the ropes or invite him for coffee. Many leave cameras off for video calls and few people show up at the office, making it hard to build relationships.

“There’s zero humanity,” he said, noting that he is seeking another job with a strong office culture.

The share of U.S. companies mandating office attendance five days a week has fallen this year—to 38% in October from 49% at the start of the year—according to Scoop Technologies, a software firm that developed an index to monitor workplace policies of nearly 4,500 companies.

Some companies have reversed flexible remote-work policies—in large part, they said, to boost employee engagement and productivity—only to face worker backlash.

Not all the data point downward. A Conference Board survey in November 2022 of U.S. adults showed workers were more satisfied with their jobs than they had been in years. Key contingents among the happiest employees: people who voluntarily switched roles during the pandemic and those working a mix of in-person and remote days. But that poll was taken before a spate of layoffs at high-profile companies and big declines in the number of knowledge-worker and professional jobs advertised.

At Farmers Group, workers posted thousands of mostly negative comments on the insurer’s internal social-media platform after its new CEO nixed the company’s previous policy allowing most workers to be remote.

Employees like Kandy Mimande said they felt betrayed. “We couldn’t get the ‘why,’” said the 43-year-old, who had sold her car and spent thousands of dollars to redo her home office under the remote-work policy. She shelled out $10,000 for a used car for the commute. A company spokesperson said that not all employees will support every business decision and that Farmers hasn’t seen a significant impact on staff retention.

During a brief leave, Mimande realised she no longer felt a sense of purpose from her product-management job. She resigned last month after she and her wife decided they could live on one salary.

She now helps promote a band and pet-sits. “It’s so much easier for me to report to myself,” she said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Pure Amazon has begun journeys deep into Peru’s Pacaya-Samiria National Reserve, combining contemporary design, Indigenous craftsmanship and intimate wildlife encounters in one of the richest ecosystems on Earth.

Australia’s housing market defies forecasts as prices surge past pandemic-era benchmarks.

Selloff in bitcoin and other digital tokens hits crypto-treasury companies.

The hottest crypto trade has turned cold. Some investors are saying “told you so,” while others are doubling down.

It was the move to make for much of the year: Sell shares or borrow money, then plough the cash into bitcoin, ether and other cryptocurrencies. Investors bid up shares of these “crypto-treasury” companies, seeing them as a way to turbocharge wagers on the volatile crypto market.

Michael Saylor pioneered the move in 2020 when he transformed a tiny software company, then called MicroStrategy , into a bitcoin whale now known as Strategy. But with bitcoin and ether prices now tumbling, so are shares in Strategy and its copycats. Strategy was worth around $128 billion at its peak in July; it is now worth about $70 billion.

The selloff is hitting big-name investors, including Peter Thiel, the famed venture capitalist who has backed multiple crypto-treasury companies, as well as individuals who followed evangelists into these stocks.

Saylor, for his part, has remained characteristically bullish, taking to social media to declare that bitcoin is on sale. Sceptics have been anticipating the pullback, given that crypto treasuries often trade at a premium to the underlying value of the tokens they hold.

“The whole concept makes no sense to me. You are just paying $2 for a one-dollar bill,” said Brent Donnelly, president of Spectra Markets. “Eventually those premiums will compress.”

When they first appeared, crypto-treasury companies also gave institutional investors who previously couldn’t easily access crypto a way to invest. Crypto exchange-traded funds that became available over the past two years now offer the same solution.

BitMine Immersion Technologies , a big ether-treasury company backed by Thiel and run by veteran Wall Street strategist Tom Lee , is down more than 30% over the past month.

ETHZilla , which transformed itself from a biotech company to an ether treasury and counts Thiel as an investor, is down 23% in a month.

Crypto prices rallied for much of the year, driven by the crypto-friendly Trump administration. The frenzy around crypto treasuries further boosted token prices. But the bullish run abruptly ended on Oct. 10, when President Trump’s surprise tariff announcement against China triggered a selloff.

A record-long government shutdown and uncertainty surrounding Federal Reserve monetary policy also have weighed on prices.

Bitcoin prices have fallen 15% in the past month. Strategy is off 26% over that same period, while Matthew Tuttle’s related ETF—MSTU—which aims for a return that is twice that of Strategy, has fallen 50%.

“Digital asset treasury companies are basically leveraged crypto assets, so when crypto falls, they will fall more,” Tuttle said. “Bitcoin has shown that it’s not going anywhere and that you get rewarded for buying the dips.”

At least one big-name investor is adjusting his portfolio after the tumble of these shares. Jim Chanos , who closed his hedge funds in 2023 but still trades his own money and advises clients, had been shorting Strategy and buying bitcoin, arguing that it made little sense for investors to pay up for Saylor’s company when they can buy bitcoin on their own. On Friday, he told clients it was time to unwind that trade.

Crypto-treasury stocks remain overpriced, he said in an interview on Sunday, partly because their shares retain a higher value than the crypto these companies hold, but the levels are no longer exorbitant. “The thesis has largely played out,” he wrote to clients.

Many of the companies that raised cash to buy cryptocurrencies are unlikely to face short-term crises as long as their crypto holdings retain value. Some have raised so much money that they are still sitting on a lot of cash they can use to buy crypto at lower prices or even acquire rivals.

But companies facing losses will find it challenging to sell new shares to buy more cryptocurrencies, analysts say, potentially putting pressure on crypto prices while raising questions about the business models of these companies.

“A lot of them are stuck,” said Matt Cole, the chief executive officer of Strive, a bitcoin-treasury company. Strive raised money earlier this year to buy bitcoin at an average price more than 10% above its current level.

Strive’s shares have tumbled 28% in the past month. He said Strive is well-positioned to “ride out the volatility” because it recently raised money with preferred shares instead of debt.

Cole Grinde, a 29-year-old investor in Seattle, purchased about $100,000 worth of BitMine at about $45 a share when it started stockpiling ether earlier this year. He has lost about $10,000 on the investment so far.

Nonetheless, Grinde, a beverage-industry salesman, says he’s increasing his stake. He sells BitMine options to help offset losses. He attributes his conviction in the company to the growing popularity of the Ethereum blockchain—the network that issues the ether token—and Lee’s influence.

“I think his network and his pizzazz have helped the stock skyrocket since he took over,” he said of Lee, who spent 15 years at JPMorgan Chase, is a managing partner at Fundstrat Global Advisors and a frequent business-television commentator.

From Italy’s $93,000-a-night villas to a $20,000 Bowral château, a new global ranking showcases the priciest Airbnbs available in 2026.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.