Yacht Buyers Are Getting Younger, Says Azimut/Benetti Exec

In the rarefied world of luxury yacht construction and design, the Viareggio, Italy-based Azimut/Benetti Group ranks high on the list of storied and sought-after names. The company’s clients include multi-millionaires and billionaires globally, and boldfacers such as Bill Gates have chartered its watercrated.

The company comprises two brands: Azimut, which produces smaller yachts that range in length from 10 to 35 meters, and Benetti, a mega- and superyacht producer behind ships from 37 to more than 100 meters long. It’s known for its technological innovations, including the extensive use of carbon fiber as well as hybrid diesel-electric vessels. Prices for the yachts between both brands range from US$1 million to more than US$300 million. Azimut/Benetti has four shipyards, three in Italy and one in Brazil, with the largest in Livorno, in Italy’s Tuscany region.

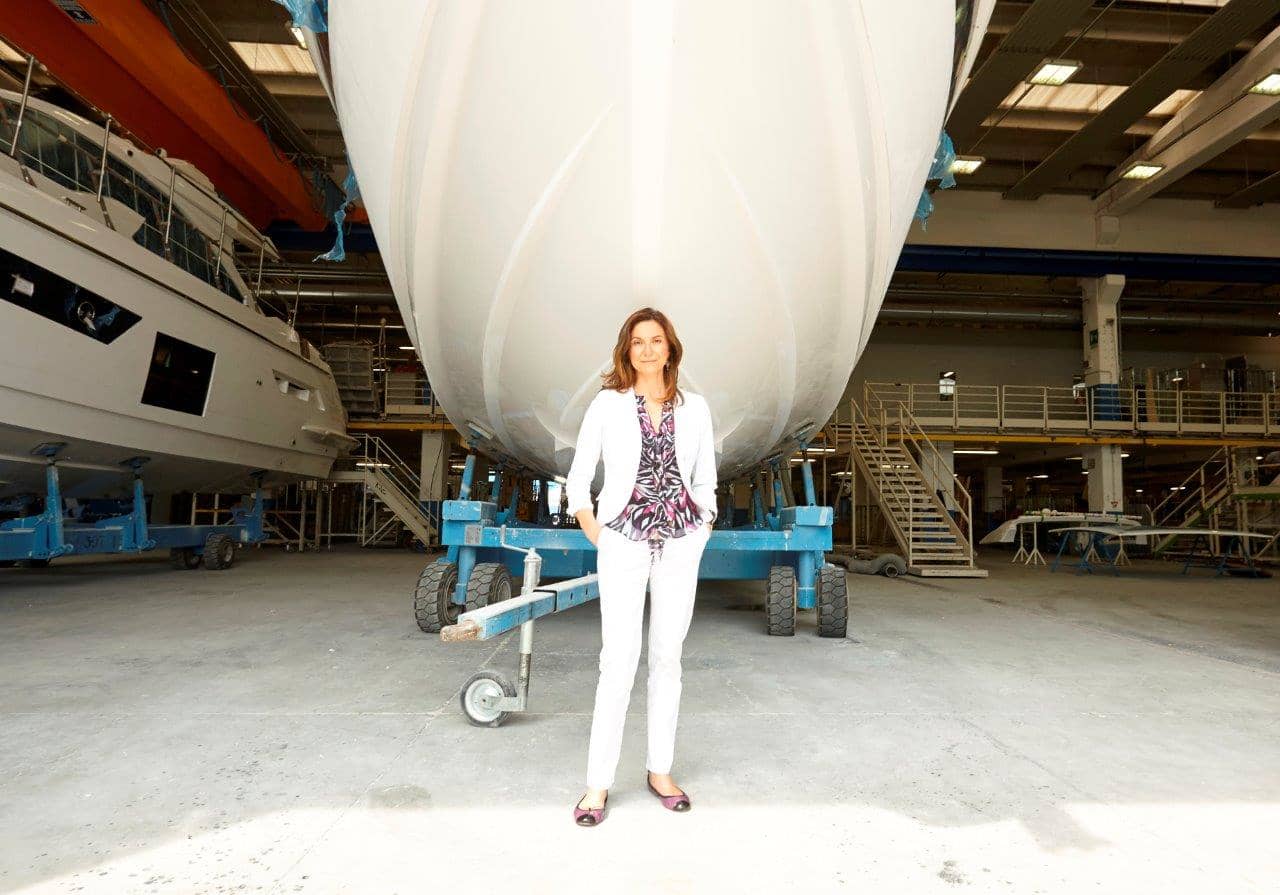

Paolo Vitelli founded Azimut in 1969 and acquired Benetti in 1985 to form Azimut/Benetti Group. His daughter, Giovanna Vitelli, 48, leads the family-run enterprise today. She spoke with Penta recently about how demand for yachts has increased as of late, its changing customer base, and the amenities on ships that owners most want today.

Penta: Has the demand for your yachts changed over the last few years?

Giovanna Vitelli: Despite initial predictions, the pandemic significantly boosted the yacht industry due to unforeseen mobility restrictions. The desire for freedom led to a surge in demand, and immediately after the COVID-19 lockdowns, every available boat, regardless of size, was sold out. Today, the demand has normalized, but the perception of what a yacht can offer has changed. As a result, our orders stretch to 2028.

Who are your primary customers, and how have they evolved over time?

Owners are now trending 10 years younger than before; they are typically men in their 50s. They are still very wealthy and successful, but unlike the past, where yacht ownership may have primarily symbolized opulence, today’s owner seeks something deeper: a private space to share with family and friends, a floating home with all the personal comforts, to enjoy a closer connection with the sea.

Can you share the amenities your customers want most on their yachts and how they differ from the past?

We are seeing a growing shift toward a more relaxed lifestyle on board. Owners seek areas ideal for sharing with loved ones. They have a preference for longer stays at anchor and want amenities that provide a comfortable, at-home experience. Popular requests include large social bars, extensive wine cellars, full office spaces for remote work, spa facilities, larger storage for water toys, and gym areas. These features blend luxury with functionality.

What are some of the unusual amenities or other requests your customers have requested?

We’ve added unique features such as a wood-burning pizza oven and a flower refrigerator. We even recreated a copy of the Sistine Chapel fresco over the dining table on a Benetti yacht. Another had spectacular interiors made with Lalique glass.

Tell us about the design features of your yachts. What aesthetic do you favor?

Twenty years ago, we began seeking designers from the luxury residential, hospitality, and fashion sectors rather than just the yachting industry. This brought a contemporary twist to a traditionally conservative sector. Each designer infuses the yacht with its own soul, but all have a simple elegance. Our most recent collaboration was with Matteo Thun and Antonio Rodriguez, inventors of eco-resorts, with whom we explored new frontiers for eco-friendly materials on Azimut’s Seadeck motoryachts .

One design concept that has influenced the lifestyle on board is the Benetti Oasis Deck. Previously, the stern was high and closed, but now, a lowered stern opens to the sea, enhancing the onboard experience.

How does sustainability figure into your designs?

Sustainability has been a core principle for us for over 20 years, and we started investing early on in technology to reduce fuel consumption. This philosophy continues to drive our innovations. Today, almost our entire fleet offers hybrid technology.

The newly launched Azimut Seadeck 6 became the most efficient and sustainable yacht ever produced by our group. In fact, the Azimut Seadeck Series can reduce carbon-dioxide emissions by as much as 40% in one year of average use compared to traditional yachts of similar size.

Our next goal is to further optimize consumption and emissions from onboard systems, especially for larger boats that spend around 90% of their time at anchor.

Also, our company has an agreement with the energy company Eni to use HVOlution, a biofuel made entirely from renewable raw materials.

Can you explain the concept of shadow yachts and tell us if they’re becoming more prevalent?

Shadow yachts, also known as support yachts or shadow vessels, are auxiliary vessels that accompany a main superyacht, providing additional storage for water toys, helicopters, and vehicles, as well as housing extra crew and guests. Currently, they represent less than 1% of the market.

Where do you see the future of yachts going?

I expect demand to continue at a steady pace in the coming years, especially as more people view yachts as residences rather than just for short trips. We have customers who’ve bought large yachts who anchor them and live in them for several months a year. They might dock in Monaco for six months, for example, and go to the Caribbean for the rest of the year.

This interview has been edited for length and clarity.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

There has rarely, if ever, been so much tech talent available in the job market. Yet many tech companies say good help is hard to find.

What gives?

U.S. colleges more than doubled the number of computer-science degrees awarded from 2013 to 2022, according to federal data. Then came round after round of layoffs at Google, Meta, Amazon, and others.

The Bureau of Labor Statistics predicts businesses will employ 6% fewer computer programmers in 2034 than they did last year.

All of this should, in theory, mean there is an ample supply of eager, capable engineers ready for hire.

But in their feverish pursuit of artificial-intelligence supremacy, employers say there aren’t enough people with the most in-demand skills. The few perceived as AI savants can command multimillion-dollar pay packages. On a second tier of AI savvy, workers can rake in close to $1 million a year .

Landing a job is tough for most everyone else.

Frustrated job seekers contend businesses could expand the AI talent pipeline with a little imagination. The argument is companies should accept that relatively few people have AI-specific experience because the technology is so new. They ought to focus on identifying candidates with transferable skills and let those people learn on the job.

Often, though, companies seem to hold out for dream candidates with deep backgrounds in machine learning. Many AI-related roles go unfilled for weeks or months—or get taken off job boards only to be reposted soon after.

Playing a different game

It is difficult to define what makes an AI all-star, but I’m sorry to report that it’s probably not whatever you’re doing.

Maybe you’re learning how to work more efficiently with the aid of ChatGPT and its robotic brethren. Perhaps you’re taking one of those innumerable AI certificate courses.

You might as well be playing pickup basketball at your local YMCA in hopes of being signed by the Los Angeles Lakers. The AI minds that companies truly covet are almost as rare as professional athletes.

“We’re talking about hundreds of people in the world, at the most,” says Cristóbal Valenzuela, chief executive of Runway, which makes AI image and video tools.

He describes it like this: Picture an AI model as a machine with 1,000 dials. The goal is to train the machine to detect patterns and predict outcomes. To do this, you have to feed it reams of data and know which dials to adjust—and by how much.

The universe of people with the right touch is confined to those with uncanny intuition, genius-level smarts or the foresight (possibly luck) to go into AI many years ago, before it was all the rage.

As a venture-backed startup with about 120 employees, Runway doesn’t necessarily vie with Silicon Valley giants for the AI job market’s version of LeBron James. But when I spoke with Valenzuela recently, his company was advertising base salaries of up to $440,000 for an engineering manager and $490,000 for a director of machine learning.

A job listing like one of these might attract 2,000 applicants in a week, Valenzuela says, and there is a decent chance he won’t pick any of them. A lot of people who claim to be AI literate merely produce “workslop”—generic, low-quality material. He spends a lot of time reading academic journals and browsing GitHub portfolios, and recruiting people whose work impresses him.

In addition to an uncommon skill set, companies trying to win in the hypercompetitive AI arena are scouting for commitment bordering on fanaticism .

Daniel Park is seeking three new members for his nine-person startup. He says he will wait a year or longer if that’s what it takes to fill roles with advertised base salaries of up to $500,000.

He’s looking for “prodigies” willing to work seven days a week. Much of the team lives together in a six-bedroom house in San Francisco.

If this sounds like a lonely existence, Park’s team members may be able to solve their own problem. His company, Pickle, aims to develop personalised AI companions akin to Tony Stark’s Jarvis in “Iron Man.”

Overlooked

James Strawn wasn’t an AI early adopter, and the father of two teenagers doesn’t want to sacrifice his personal life for a job. He is beginning to wonder whether there is still a place for people like him in the tech sector.

He was laid off over the summer after 25 years at Adobe , where he was a senior software quality-assurance engineer. Strawn, 55, started as a contractor and recalls his hiring as a leap of faith by the company.

He had been an artist and graphic designer. The managers who interviewed him figured he could use that background to help make Illustrator and other Adobe software more user-friendly.

Looking for work now, he doesn’t see the same willingness by companies to take a chance on someone whose résumé isn’t a perfect match to the job description. He’s had one interview since his layoff.

“I always thought my years of experience at a high-profile company would at least be enough to get me interviews where I could explain how I could contribute,” says Strawn, who is taking foundational AI courses. “It’s just not like that.”

The trouble for people starting out in AI—whether recent grads or job switchers like Strawn—is that companies see them as a dime a dozen.

“There’s this AI arms race, and the fact of the matter is entry-level people aren’t going to help you win it,” says Matt Massucci, CEO of the tech recruiting firm Hirewell. “There’s this concept of the 10x engineer—the one engineer who can do the work of 10. That’s what companies are really leaning into and paying for.”

He adds that companies can automate some low-level engineering tasks, which frees up more money to throw at high-end talent.

It’s a dynamic that creates a few handsomely paid haves and a lot more have-nots.

From Italy’s $93,000-a-night villas to a $20,000 Bowral château, a new global ranking showcases the priciest Airbnbs available in 2026.

Australia’s market is on the move again, and not always where you’d expect. We’ve found the surprise suburbs where prices are climbing fastest.