Your Old Clothes Are Worth Billions

Secondhand apparel retail is a booming business, but turning a profit is harder than it sounds

Closets are full of unworn clothes ready for purging, thrifting is in vogue , and everybody’s looking for a good deal these days. It all sounds like a golden business opportunity—if anyone can figure it out.

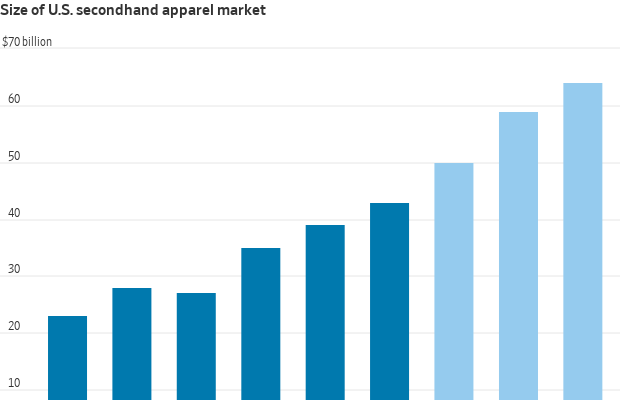

Americans on average throw away some 70 pounds of clothes a year, and thrifting is becoming more popular by the day—particularly among younger consumers. The U.S. secondhand apparel market was worth about $43 billion last year, according to an annual market report from the online apparel reseller ThredUp . It estimates that the market could grow about 11% a year on average through 2028. The market is fragmented, with about 74% of thrift stores being independently run, according to a report from Piper Sandler.

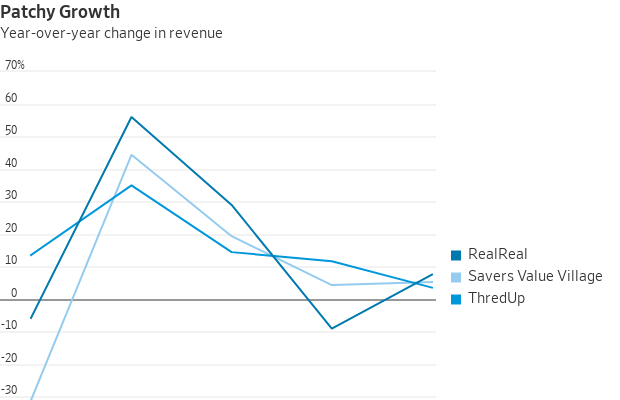

Companies specialising in thrift, though, are struggling to stitch together a compelling investment case. Shares of the online seller ThredUp and the bricks-and-mortar thrift-store chain Savers Value Village are each down around 29% year to date. The luxury online resale platform RealReal has fared better, but in large part thanks to a debt exchange it announced in late February to address liquidity concerns. ThredUp and RealReal are both down significantly from their peaks a few years back.

This could simply be air coming out of highly inflated expectations. ThredUp and the RealReal made their debuts with much fanfare in 2021 and 2019, respectively. Savers listed last year with a lofty valuation. But sales growth for all three companies has slowed, and they are all growing slower than the overall market.

Nonprofits such as Goodwill control a sizeable portion of the secondhand market, with a steady supply of donations, and eBay dominates the resale market online. ThredUp and RealReal’s bet is that consignors and buyers would be willing to pay a premium for a more convenient selling and buying experience. Sellers need only mail in or drop off their goods, and the platforms do the work of photographing, pricing and tagging each item by size, brand, colour and condition so that items are easily searchable. For RealReal, there is an extra human step of making sure the products aren’t fakes. A single-item distribution system is difficult to recreate and is therefore a powerful moat, says Dylan Carden, an equity analyst at William Blair, referring to ThredUp.

But the expensive process also means profitability is distant: Neither ThredUp nor RealReal is expected to turn a profit on the basis of generally accepted accounting principles for the next four years, according to analyst estimates polled by Visible Alpha.

Balancing the quantity of supply with quality has been difficult. ThredUp last year introduced fees that are subtracted from the payout customers receive if their items are sold on the platform. The change is meant to encourage consumers to send in high volumes of high-quality clothes. RealReal last year tweaked its commission structure to motivate consignors to send in expensive items priced above $100.

While these moves could attract higher quality, they might also divert consignors to platforms such as Poshmark and eBay, where selling involves more work but potentially higher payout. Notably, both of those marketplaces have authentication features for high-end items, and eBay has been trying to simplify sellers’ listing process through generative AI .

Meanwhile, the bricks-and-mortar Savers comes with the promise of a more efficient shopping experience than nonprofits. Piper Sandler estimates that its sales per store is nearly twice that of Goodwill and more than six times that of the Salvation Army. But the retailer faces similar quality challenges.

Only about half the items that Savers gets actually end up on the sales floor, and of those about half actually are sold, according to a company filing. Savers receives all of its items—whether directly or indirectly—by paying nonprofits by the pound for donated products. Savers has previously said that it might be able to snag higher-quality donations by placing its drop-off trailers—known as GreenDrop—near locations frequented by wealthier shoppers.

While Savers has been profitable for the past three years, same-store sales have unexpectedly slowed in recent quarters, and its investment case is highly dependent on new-store growth. This remains a risk. Previous management had trouble opening up stores because they weren’t able to procure enough supplies of secondhand clothing, notes Peter Keith, equity analyst at Piper Sandler, who is still confident about the company’s ability to expand.

Much like that shirt you only wore once, secondhand-apparel sellers so far hold more promise than substance.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

More than one fifth of Australians are cutting back on the number of people they socialise with

Australian social circles are shrinking as more people look for ways to keep a lid on spending, a new survey has found.

New research from Finder found more than one fifth of respondents had dropped a friend or reduced their social circle because they were unable to afford the same levels of social activity. The survey questioned 1,041 people about how increasing concerns about affordability were affecting their social lives. The results showed 6 percent had cut ties with a friend, 16 percent were going out with fewer people and 26 percent were going to fewer events.

Expensive events such as hens’ parties and weddings were among the activities people were looking to avoid, indicating younger people were those most feeling the brunt of cost of living pressures. According to Canstar, the average cost of a wedding in NSW was between $37,108 to $41,245 and marginally lower in Victoria at $36, 358 to $37,430.

But not all age groups are curbing their social circle. While the survey found that 10 percent of Gen Z respondents had cut off a friend, only 2 percent of Baby Boomers had done similar.

Money expert at Finder, Rebecca Pike, said many had no choice but to prioritise necessities like bills over discretionary activities.

“Unfortunately, for some, social activities have become a luxury they can no longer afford,” she said.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.