The Loneliness of the American Worker

More meetings and faceless chats. Fewer work friends. How the modern workday is fueling an epidemic of isolation.

More Americans are profoundly lonely, and the way they work—more digitally linked but less personally connected—is deepening that sense of isolation.

Nick Skarda , 29 years old, works two jobs in logistics and office administration in San Diego to keep up with his bills. After a couple of years at the logistics job, he has one friend there. He says hi to co-workers at his office job but doesn’t really know any.

“I feel sort of an emptiness or lack of belonging,” he says. Juggling two jobs leaves Skarda exhausted, with little energy or time to grab drinks with co-workers . “It makes it harder to go in and give it your all if you don’t feel like anyone is there rooting for you,” he adds.

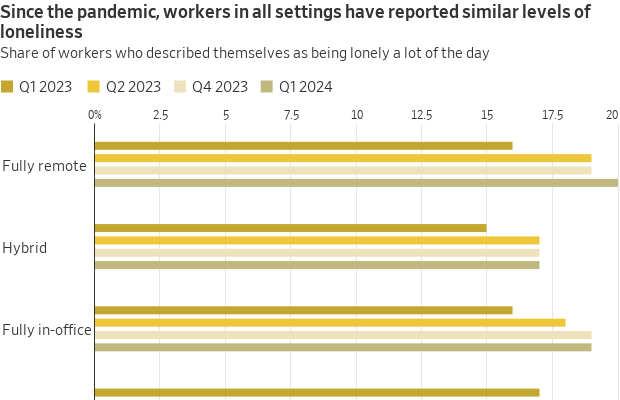

Employers and researchers are just beginning to understand how workplace shifts over the past four years are contributing to what the U.S. surgeon general declared a loneliness health epidemic last year. The alienation affects remote and in-person workers alike. Among 1-800-Flowers.com ’s 5,000 hybrid and fully on-site employees, for instance, the most popular community chat group offered by a company mental-health provider is simply called “Loneliness.”

Consider these phenomena of modern work:

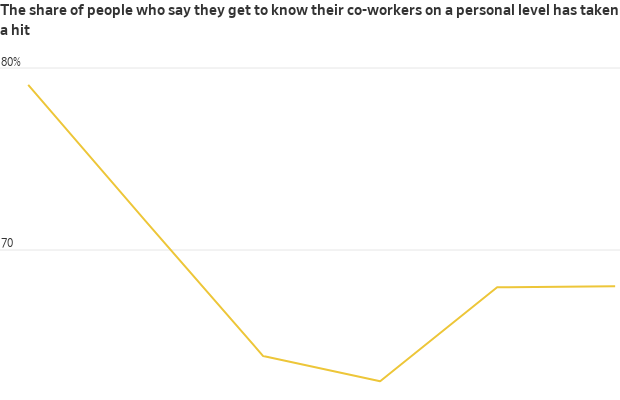

It is a marked shift from even a decade ago, when bonds fostered at work helped compensate for declining participation in church , community groups and other social institutions. As the American workday becomes more faceless and scheduled , the number of U.S. adults who call themselves lonely has climbed to 58% from 46% in 2018, according to a recent Cigna poll of 10,000 Americans.

The faceless workday

The disconnection is driving up staff turnover and worker absences, making it a business issue for more employers, executives and researchers say. Cigna, the health-insurance company, estimates that loneliness is costing companies $154 billion a year in absenteeism alone.

“Work is social, it’s a lot more than a paycheck,” says James McCann , founder and chairman of 1-800-Flowers.com.

Earlier this year, 1-800-Flowers.com moved from three days in the office to four to boost a sense of connectivity among workers. It has also begun tapping workers across teams to serve as designated hosts during lunchtime, encouraging people to sit with colleagues they don’t know in common areas and chat, and suggesting conversation topics.

While today’s workers have more ways to connect than ever, “there are only so many memes and jokes you can send over Slack,” says Maëlle Gavet , chief executive of Techstars, a pre-seed fund that has invested in 4,100 startups. “We tend to have more and more people with back-to-back calendars, more meetings and less connections.”

Gavet says that is especially the case for hybrid workers on in-office days, which they tend to use to dash from one meeting to the next.

Paradoxically, meetings can make people feel lonelier—and even more so if the meetings are virtual, behavioural researchers say. A 2023 survey by employee experience and analytics company Perceptyx found people who described themselves as “very lonely” tended to have heavier meeting loads than less-lonely staffers. More than 40% of those people spent more than half their work hours in meetings.

In Cincinnati, Kelly Roehm says she came to chafe at the meetings—sometimes as many as 12—consuming her day after joining a consulting company in 2021. She would often feel her eyes glazing over as she multitasked on other screens.

“It’s like you’re a zombie, there but not there,” says Roehm, who lived 10 minutes from the office but worked mostly remotely because she says few colleagues typically came in. It is a more common setup as companies distribute teams across more locations: At Microsoft , 27% of the company’s teams all worked in the same location last year, compared with 61% in 2019.

She compares that experience with her time more than a decade ago at a company now owned by AstraZeneca . There, she enjoyed lots of social outlets at work: a Weight Watchers group and a lunchtime crochet club.

“Now if I were to think about asking, ‘Hey, do you want to participate in something like this,’ it would just sound weird,” says Roehm, who left this year to focus on her own career-consulting business. “There wasn’t that emotional attachment that made it difficult to say, it’s time to move on.”

The power of small talk

Office chitchat, sometimes an unwanted distraction, seems to provide more benefits than many people realise, says Jessica Methot , an associate professor at Rutgers University who studies social ties at work.

In a study of 100 employees at different workplaces, Methot and fellow researchers surveyed participants at points throughout the day. They found those who had engaged in small talk reported less stress and more positivity toward co-workers.

Even exchanging pleasantries with a co-worker you barely know can help, says Sarah Wright , an associate professor at New Zealand’s University of Canterbury who studies worker loneliness.

“We used to think loneliness has to be overcome by developing meaningful relationships and having that degree of intimacy,” Wright says. “More and more, though, we’re seeing it’s these day-to-day weak ties and frequency of [interactions] with people that matters.”

Such interactions are substantially harder to replicate in a virtual environment. “The default now is, I have to schedule time with you, even if it’s five minutes, instead of just picking up the phone,” says Katie Tyson , president of Hive Brands, an online food retailer founded in 2020 as a fully remote company.

The frictions add up, she says. Last fall, the company added an office in New York where employees voluntarily gather a couple of times a week to foster more cohesion.

Coming to the office, even on a hybrid basis, tends to yield a roughly 20% to 30% boost in serendipitous connections, according to Syndezo, which analysed survey data and email and messaging traffic from more than two dozen large companies.

Yet there are diminishing returns to time in person, says Philip Arkcoll , founder of Worklytics, which analyses workforce data for Fortune 500 companies. Coming in once a month provides a significant boost in ties; two or three times a month adds a little more, Worklytics data show. Once or twice a week results in a smaller increase, though, and working in-person four or five days a week makes almost no difference.

A business priority

Ernst & Young has asked managers to use the first five minutes of team calls to engage in conversation “as real human beings,” says Frank Giampietro , whose title, chief well-being officer for the Americas, was created in 2021 to help support employees during the pandemic.

The professional-services firm is also training employees to spot and reach out to co-workers struggling with issues such as isolation. To date, more than 1,600 employees have taken the training.

One challenge is that American workers have sacrificed connection for productivity, says Julie Rice , co-founder of fitness chain SoulCycle. These days, with more business contacts preferring video calls, she finds breakfast meetings and coffee dates on her calendar have been replaced with Zoom. Though efficient, such video calls are less likely to yield conversations that can turn into useful professional connections or lasting friendships, she says.

“Even people I’m meeting with here in New York, we’ll just Zoom,” she says.

Last year, Rice co-founded Peoplehood, a company that runs “gathers” to improve connectivity and relationship skills, and employers are signing up. One, a beauty-services business with hundreds of field employees who never see each other, asked Peoplehood to host a series of gatherings for workers to meet and share job advice. Another, a marketing company with far-flung employees, requested help after surveys showed staff wanted to feel more connected.

“Whatever relationships we had pre-Covid have sort of run out of gas,” Rice says.

Good luck prodding employees to socialise, though. Nearly all the 150-odd staff at the Pleasanton, Calif., headquarters of Shaklee, the nutrition-supplements company, used to attend annual Earth Day gatherings, which involved community service, lunch and breaking early for the day, says Jonathan Ramot , the company’s North American human-resources director. Office happy hours, bowling outings and “mix and mingles” were also robustly attended.

Now that the workforce has gone remote, last year’s Earth Day event attracted 20 staffers, even though most workers live nearby.

“We have a lot of people asking for in-person events, but when we plan them, they don’t show up,” Ramot says. “Then they complain they’re lonely.”

This past April, Shaklee instead held a mandatory get-together with the chief executive, who had relocated to Florida during the pandemic and was in town. About 100 employees gathered at a brewery for food, drinks and conversation—and no speeches from the bosses.

There was a buzz in the air, Ramot says, as staff hugged and delighted in seeing each other, some for the first time. “People were saying, I miss this,” he says.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Records keep falling in 2025 as harbourfront, beachfront and blue-chip estates crowd the top of the market.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

Investors normally don’t talk about the risks of a bubble forming in the asset that they’re buying to hedge against a different bubble, but gold’s extraordinary surge is starting to trigger uncomfortable conversations about the yellow metal’s bullish prospects.

Gold prices have gained more than 55% this year, blowing past the $3,000 an ounce mark in early spring and topping the $4,000 threshold for the first time on record last month. Gold was up another 3.3% to $4,108.60 in Monday trading, a new record high.

Myriad reasons have been cited for the surge, including the slumping U.S. dollar, soaring tech stocks that have concentrated broader market risks into a handful of megacap tech names, purchases by central banks seeking to diversify away from the dollar, and renewed inflation risks tied to ongoing tariff and trade disputes.

Central bank buying has also been significant, with China alone adding 39.2 tons to its overall holdings since it returned to the market in November of last year.

“Central banks’ appetite for gold is driven by concerns from countries about Russian-style sanctions on their foreign assets in the wake of decisions made by the U.S. and Europe to freeze Russian assets, as well as shifting strategies on currency reserves,” said ING commodities strategist Ewa Manthey.

“The pace of buying by central banks doubled following Russia’s invasion of Ukraine in 2022.”

Gold-backed ETFs , meanwhile, are attracting billions in new investments, with overall additions likely to have topped 100 tons over the three months ending in September. That’s more than triple the quarterly average over the past eight years.

The combination of forces is likely to drive more gains for gold in the months ahead, according to Société Générale’s commodity research team, headed by Mike Haigh.

“Gold’s ascent to $5000 seems increasingly inevitable,” Haigh wrote in a note published Monday, citing both strong ETF flows and renewed central bank purchases.

Haigh also notes that ETF flows are tracking a rise in SocGen’s U.S. uncertainty index, which is now pegged at more than three times the level it reached over the five months before last year’s presidential election win for President Donald Trump.

“We cannot imagine a situation where we return to pre-Trump index uncertainty normalcy over our forecast horizon, so ETF flows are a key component to our price forecasting,” Haigh said. His $500o price target is pegged for the end of 2026.

Lisa Shalett, chief investment officer at Morgan Stanley Wealth Management, has a different take, tied in part to what she sees as a way for governments to “challenge the dollar’s stranglehold on global money movements.”

Gold holdings, Shalett argues, can “improve collateralisation of their fiat currencies and/or cryptocurrencies in a world where currency markets undefined may be remade by digital assets, cryptocurrencies, and stablecoins.”

The gold market’s mimicry of previous historic booms, however, has caught the attention of Bank of America analyst Paul Ciana, who cautioned in a note published last week that “prices have tended to pivot near round-number levels.”

Citing data showing “midway corrections” in long term bull markets for gold, Ciana sees the chances for a near-term pullback that “rhymes” with pullbacks of around 40% in the mid-1970s and 25% following the global financial crisis in 2008.

“This boom is about 10 years old, smaller in size than the 1970s and 2000s boom but nearly as old,” Ciana wrote. “This warrants caution into round number resistance at $4,000, or again later at $5,000.”

Gold isn’t likely a bubble. It’s hard for central banks to sell, and many of the countries encouraging its import, like China and India, also make it difficult for investors to move offshore.

But gold did lose around 60% of its value in the two decades that followed its 1970s boom, with bear markets following in 2008 and 2015.

This year’s really is still going strong, of course, but with gold’s advance tied to nearly all of the concerns currently gripping financial markets, maybe it’s worth asking if it’s being “all things to all people” is the best kind of hedge—or just another risky bet on rising prices.

An opulent Ryde home, packed with cinema, pool, sauna and more, is hitting the auction block with a $1 reserve.

A cluster of century-old warehouses beneath the Harbour Bridge has been transformed into a modern workplace hub, now home to more than 100 businesses.