The worldwide trend Australia does not want to be following

Governments around the world are offering incentives to reverse a downward spiral that could threaten economic growth

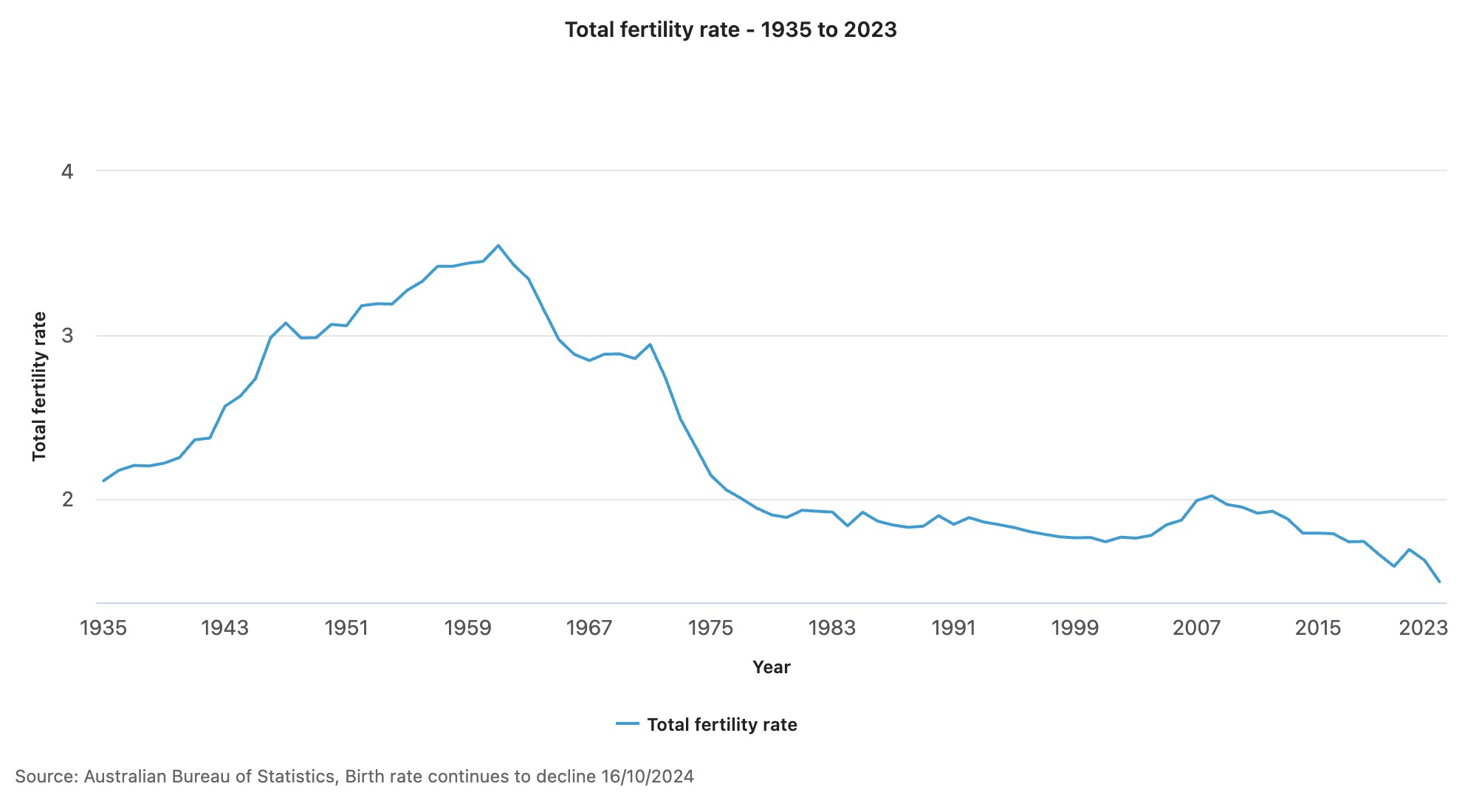

The Australian birth rate is at a record low, new data has shown.

Figures from the Australian Bureau of Statistics have revealed there were 286,998 births registered around the country last year, or 1.5 babies per woman.

Birth rates in Australia have been in a slow decline since the 1990s, down from 1.86 births per woman in 1993. Declining fertility rates among girls and women aged 15 to 19 years was most stark, down two thirds, while for women aged 40 to 44 years, the rate had almost doubled.

“The long-term decline in fertility of younger mums as well as the continued increase in fertility of older mums reflects a shift towards later childbearing,” said Beidar Cho, ABS head of demography statistics. “Together, this has resulted in a rise in median age of mothers to 31.9 years, and a fall in Australia’s total fertility rate.”

The fall in the Australian birth rate is in keeping with worldwide trends, with the United States also seeing fertility rates hit a 32-year low. The Lancet reported earlier this year that, based on current trends, by 2100 more than 97 percent of the world’s countries and territories “will have fertility rates below what is necessary to sustain population size over time”.

On a global scale, the Lancet reported that the total fertility rate had “more than halved over the past 70 years” from about five children per female in the 1950s to 2.2 children in 2021. In countries such as South Korea and Serbia, the rate is already less than 1.1 child for each female.

Governments around the world have tried to incentivise would-be parents, offering money, increased access to childcare and better paid maternity leave.

Experts have said without additional immigration, lower birth rates and an ageing population in Australia could put further pressure on young people, threaten economic growth and create economic uncertainty. However, a study released earlier this year by the University of Canberra showed the cost of raising a child to adulthood was between $474,000 and $1,097,000.

A long-standing cultural cruise and a new expedition-style offering will soon operate side by side in French Polynesia.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The pandemic-fuelled love affair with casual footwear is fading, with Bank of America warning the downturn shows no sign of easing.

The boom in casual footware ushered in by the pandemic has ended, a potential problem for companies such as Adidas that benefited from the shift to less formal clothing, Bank of America says.

The casual footwear business has been on the ropes since mid-2023 as people began returning to office.

Analyst Thierry Cota wrote that while most downcycles have lasted one to two years over the past two decades or so, the current one is different.

It “shows no sign of abating” and there is “no turning point in sight,” he said.

Adidas and Nike alone account for almost 60% of revenue in the casual footwear industry, Cota estimated, so the sector’s slower growth could be especially painful for them as opposed to brands that have a stronger performance-shoe segment. Adidas may just have it worse than Nike.

Cota downgraded Adidas stock to Underperform from Buy on Tuesday and slashed his target for the stock price to €160 (about $187) from €213. He doesn’t have a rating for Nike stock.

Shares of Adidas listed on the German stock exchange fell 4.5% Tuesday to €162.25. Nike stock was down 1.2%.

Adidas didn’t immediately respond to a request for comment.

Cota sees trouble for Adidas both in the short and long term.

Adidas’ lifestyle segment, which includes the Gazelles and Sambas brands, has been one of the company’s fastest-growing business, but there are signs growth is waning.

Lifestyle sales increased at a 10% annual pace in Adidas’ third quarter, down from 13% in the second quarter.

The analyst now predicts Adidas’ organic sales will grow by a 5% annual rate starting in 2027, down from his prior forecast of 7.5%.

The slower revenue growth will likewise weigh on profitability, Cota said, predicting that margins on earnings before interest and taxes will decline back toward the company’s long-term average after several quarters of outperforming. That could result in a cut to earnings per share.

Adidas stock had a rough 2025. Shares shed 33% in the past 12 months, weighed down by investor concerns over how tariffs, slowing demand, and increased competition would affect revenue growth.

Nike stock fell 9% throughout the period, reflecting both the company’s struggles with demand and optimism over a turnaround plan CEO Elliott Hill rolled out in late 2024.

Investors’ confidence has faded following Nike’s December earnings report, which suggested that a sustained recovery is still several quarters away. Just how many remains anyone’s guess.

But if Adidas’ challenges continue, as Cota believes they will, it could open up some space for Nike to claw back any market share it lost to its rival.

Investors should keep in mind, however, that the field has grown increasingly crowded in the past five years. Upstarts such as On Holding and Hoka also present a formidable challenge to the sector’s legacy brands.

Shares of On and Deckers Outdoor , Hoka’s parent company, fell 11% and 48%, respectively, in 2025, but analysts are upbeat about both companies’ fundamentals as the new year begins.

The battle of the sneakers is just getting started.

A cluster of century-old warehouses beneath the Harbour Bridge has been transformed into a modern workplace hub, now home to more than 100 businesses.

Hand-built in Melbourne and limited to just 10 cars a year, the Zeigler/Bailey Z/B 4.4 is reshaping what a modern collector car can be.