Crypto Might Have an Insider Trading Problem

Anonymous wallets buy up tokens right before they are listed and sell shortly afterward.

Public data suggests that several anonymous crypto investors profited from inside knowledge of when tokens would be listed on exchanges.

Over six days last August, one crypto wallet amassed a stake of $360,000 worth of Gnosis coins, a token tied to an effort to build blockchain-based prediction markets. On the seventh day, Binance—the world’s largest cryptocurrency exchange by volume—said in a blog post that it would list Gnosis, allowing it to be traded among its users.

Token listings add both liquidity and a stamp of legitimacy to the token, and often provide a boost to a token’s trading price. The price of Gnosis rose sharply, from around $300 to $410 within an hour. The value of Gnosis traded that day surged to more than seven times its seven-day average.

Four minutes after Binance’s announcement, the wallet began selling down its stake, liquidating it entirely in just over four hours for slightly more than $500,000—netting a profit of about $140,000 and a return of roughly 40%, according to an analysis performed by Argus Inc., a firm that offers companies software to manage employee trading. The same wallet demonstrated similar patterns of buying tokens before their listings and selling quickly after with at least three other tokens.

The crypto ecosystem is increasingly grappling with headaches that the world of traditional finance tackled decades ago. The collapse of a so-called stablecoin from its dollar peg earlier this month stemmed from crypto’s version of a bank run. How cryptocurrency exchanges prevent market-sensitive information from leaking has also become a growing topic of concern. The focus comes as regulators are raising questions about the market’s fairness for retail users, many of whom just booked major losses on steep declines in crypto assets.

The wallet buying Gnosis was among 46 that Argus found that purchased a combined $17.3 million worth of tokens that were listed shortly after on Coinbase, Binance and FTX. The wallets’ owners can’t be determined through the public blockchain.

Profits from sales of the tokens that were visible on the blockchain totalled more than $1.7 million. The true profits from the trades is likely significantly higher, however, as several chunks of the stakes were moved from the wallets into exchanges rather than traded directly for stablecoins or other currencies, Argus said.

Argus focused only on wallets that exhibited repeated patterns of buying tokens in the run-up to a listing announcement and selling soon after. The analysis flagged trading activity from February 2021 through April of this year. The data was reviewed by The Wall Street Journal.

Coinbase, Binance and FTX each said they had compliance policies prohibiting employees from trading on privileged information. The latter two said they reviewed the analysis and determined that the trading activity in Argus’s report didn’t violate their policies. Binance’s spokesperson also said none of the wallet addresses were linked to its employees.

Coinbase said it conducts similar analyses as part of its attempts to ensure fairness. Coinbase executives have posted a series of blogs touching on the issue of front running.

“There is always the possibility that someone inside Coinbase could, wittingly or unwittingly, leak information to outsiders engaging in illegal activity,” Coinbase Chief Executive Brian Armstrong wrote last month. The exchange, he said, investigates employees that appear linked to front running and terminates them if they are found to have aided such trades.

Paul Grewal, Coinbase’s chief legal officer, followed up with a blog post Thursday. The company has seen information about listings leak before announcements through traders detecting digital evidence of exchanges testing a token before a public announcement, he said. Coinbase has taken steps to mitigate that in addition to its efforts to prevent employee insider trading, he said.

Wallets like these have caused debate in the crypto community over whether targeted buying of specific tokens ahead of listings on exchanges points to insider trading. The crypto markets are largely unregulated. In recent years, regulators have looked more closely at the market’s fairness for individual investors. The largest cryptocurrency bitcoin has fallen 24% in May, causing steep losses for individual investors across the market.

Insider trading laws bar investors from trading stocks or commodities on material nonpublic information, such as knowledge of a coming listing or merger offer.

Some lawyers say that existing criminal statutes and other regulations could be used to go after those trading cryptocurrencies with private information. But others in the cryptocurrency industry say a lack of case precedent specific to crypto insider trading has created uncertainty over whether and how regulators might seek to tackle it in the future.

Argus CEO Owen Rapaport said that internal compliance policies in crypto can be undercut by a lack of clear regulatory guidelines, the libertarian ethos of many who work in the space and the lack of institutionalized norms against insider trading in crypto compared with those in traditional finance.

“Firms have real challenges with making sure the code of ethics against insider trading—which almost every firm has—is actually followed rather than being an inert piece of paper,” Mr. Rapaport said.

Securities and Exchange Commission Chairman Gary Gensler said Monday that he saw similarities between the influx of individual investors into crypto markets and the stock boom of the 1920s that presaged the Great Depression, which led to the creation of the SEC and its mandate to protect investors.“The retail public had gotten deeply into the markets in the 1920s and we saw how that came out,” Mr. Gensler said. “Don’t let somebody say ‘Well, we don’t need to protect against fraud and manipulation.’ That’s where you lose trust in markets.”

Spokespeople for the exchanges said that they have policies to ensure that their employees can’t trade off of sensitive information.

A Binance spokeswoman said that employees have a 90-day hold on any investments they make and that leaders in the company are mandated to report any trading activity on a quarterly basis.

“There is a longstanding process in place, including internal systems, that our security team follows to investigate and hold those accountable that have engaged in this type of behaviour, immediate termination being minimal repercussion,” she said.

FTX CEO Sam Bankman-Fried said in an email that the company explicitly bans employees from trading on or sharing information related to coming token listings and has a policy in place to prevent that. The trading highlighted in Argus’s analysis didn’t result from any substantive violations of company policy, Mr. Bankman-Fried said.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A sharp rebound in tourism in Europe’s sunbelt powers its economic rebound as core manufacturing centres struggle to recover

Europe’s economy has a north-south divide—and now it’s the poorer south that is powering the region’s return to growth.

Southern Europe, which for decades has had lower growth, productivity and wealth than the north, powered an upside-down recovery on the continent at the start of the year. Buoyant tourism revenue around the Mediterranean helped to offset sluggishness in Europe’s manufacturing heartlands.

The south’s transformation from laggard into growth engine reflects both a rapid rebound in visitor numbers from the collapse during the Covid-19 pandemic and a series of blows the continent’s large manufacturing sector has suffered, from surging energy prices to trade conflicts.

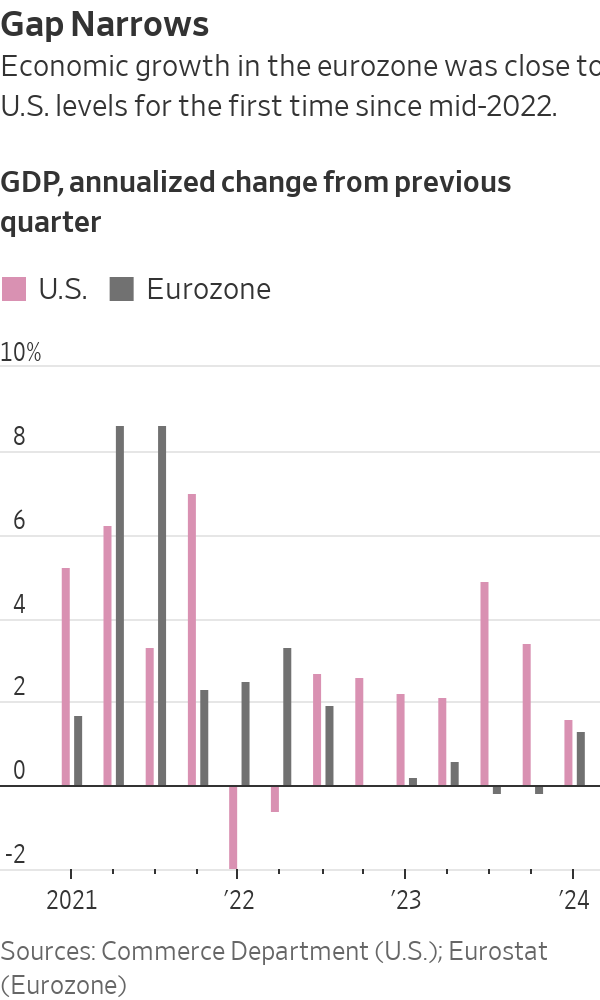

Now growth in the south is more than offsetting the north’s manufacturing malaise: As a whole, the eurozone economy grew at an annualised rate of 1.3% in the first quarter, ending nearly 18 months of economic stagnation in a sign that the currency area is recovering from the damage done by Russia’s invasion of Ukraine.

It was the eurozone’s strongest performance since the third quarter of 2022, and approached the U.S. economy’s 1.6% first-quarter growth rate, which was a slowdown from a racy pace of 3.4% at the end of last year.

In the 2010s, Germany helped to drag the continent out of its debt crisis thanks to strong exports of cars and capital goods. Between 2021 and 2023, Italy, Spain, Greece and Portugal contributed between a quarter and half of the European Union’s annual growth, according to a report last year by French credit insurer Coface —a trend now confirmed and amplified in the latest data.

In the first quarter, Spain was the fastest-growing of the big eurozone economies. It and Portugal recorded growth of 0.7% in the three months through the end of March from the previous quarter, while Italy’s economy grew by 0.3%. France and Germany both grew by 0.2%, the latter rebounding from a 0.5% quarter-on-quarter contraction at the end of last year.

This means Germany’s economy has grown by 0.3% in total since the end of 2019, compared with 8.7% for the U.S., 4.6% for Italy and 2.2% for France, according to UniCredit data.

In Spain, strong growth “seems to have been entirely due to strong tourism numbers,” said Jack Allen-Reynolds, an economist with Capital Economics. Tourism accounts for around 10% of the economies of Spain, Italy, Greece and Portugal.

The euro rose by about a quarter-cent against the dollar, to $1.0725, after the latest growth and inflation data were published.

The recovery comes as the European Central Bank signals it is preparing to reduce interest rates in June after a historic run of increases since mid-2022 that took it the key rate to 4%. Inflation in the eurozone remained at 2.4% in April, while underlying inflation cooled slightly, from 2.9% to 2.7%, according to separate data published Tuesday.

“The ECB hawks will point to the strong GDP number as [an] argument that ECB can take its rates lower gradually,” said Kamil Kovar, senior economist at Moody’s Analytics.

The eurozone economy has flatlined since late 2022 as Russia’s attack on its neighbor sent food and energy prices soaring in Europe and sapped business and household confidence. Gross domestic product fell in both the third and fourth quarters of last year, meeting a definition of recession widely used in Europe, but not in the U.S.

Southern Europe is one of only a handful of regions where international tourist arrivals returned to pre pandemic levels last year, according to United Nations data. Tourism revenue across the EU was one-quarter higher in the three months through the end of last June than in the same period in 2019, according to Coface data.

The recovery in international tourism was “notably driven by the arrival of many Americans who…were able to take advantage of favorable exchange rates,” Coface analysts wrote. “On the other hand, the end of the zero-Covid policy in China has initiated a gradual return of Chinese tourists, although remaining below 2019 levels.”

In Portugal, the number of foreign tourists hit a record of more than 18 million last year, up 11% compared with the prepandemic year of 2019, official data showed in January. American tourists in particular have returned to Europe in force.

Tourist numbers in Asia Pacific and the Americas continued to lag 2019 levels by 35% and 10% last year, respectively, the data show.

It is unclear how much further the tourism boom can run, but economists expect the region’s economic recovery to strengthen later this year as cooling inflation boosts household spending power and lower energy costs aid factory output.

Recent surveys point to an improved outlook for growth. Consumer confidence has risen to its highest level in two years, and a leading business-sentiment index has shown steady improvement from the start of 2024.

“We think that the combination of a robust labor market, comparatively strong wage hikes and lower inflation compared with last year will finally lead to a moderate recovery in consumer spending in the next few quarters,” said Andreas Rees , an economist with UniCredit in Frankfurt.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.