Twitter Stock’s Fall Isn’t Over, Analysts Warn

How much more could it tumble?

Now that Elon Musk has decided he would rather not own Twitter, Wall Street is scrambling to think through what happens from here, and what the company might be worth on a stand-alone basis.

Twitter shares plunged 11.3% on the news Monday, but still seemed priced to reflect the possibility a deal will still happen at a lower price. If there is no sale, Twitter stock could tumble another 30% from here, analysts say.

In a letter disclosed in an SEC filing late Friday afternoon, attorneys for Musk said that he is terminating his $54.20-a-share deal to buy Twitter (ticker: TWTR), asserting that the company breached the terms of their agreement by not fully disclosing details relating to the use of fake accounts on the site. Twitter denies withholding this information, and said that it will file suit to force Musk to complete the deal.

Twitter closed Monday at $32.65 a share, well below the bid price, but arguably still well above the company’s intrinsic value. Most Street analysts seem to think that Twitter as an independent company with no acquisition potential based on the current outlook would trade in the $25 to $30 a share range.

Keep in mind that 2022 has been a terrible year for social media stocks. While Twitter is off 23% for the year to date, that is a relatively modest decline compared with Pinterest (PINS), off 49%; Meta (META), off 51%; and Snap (SNAP), down 70%.

MKM Partners analyst Rohit Kulkarni notes that Snap, Pinterest and Meta are all trading at all-time low multiples of forward Ebitda, or earnings before interest, taxes, depreciation and amortization. Twitter, he notes, is trading at about 16 times, but troughed at 12 times at the March 2020 low, and previously dropped to 9 times in April 2016. Put a low-teens multiple of Ebitda on the stock, he says, and the shares would be in the $24 to $26 range. Other analysts draw the same conclusion.

There are differences of opinion on the Street about what happens from here, but they mostly fall into two camps.

A few analysts think the deal gets renegotiated at a lower price. Benchmark analyst Mark Zgutowicz asserts that US$37 would be a “good compromise,” and that a deal at that level would be in the best interest of shareholders. “We suspect neither party wants a long, drawn-out legal battle, and Twitter’s board must contemplate the potential harm to its employee and shareholder base of any additional internal data exposed in litigation. We do believe Elon Musk ultimately wants to run Twitter and believe the best course of action for both parties is a compromise.”

Mizuho analyst James Lee likewise asserts that “the most reasonable scenario” would be to negotiate a deal at a lower price, or a settlement that allows Musk to walk away, avoiding protracted litigation.

Others think Twitter is going to have to go it alone: CFRA analyst Angelo Zinino agrees that a settlement or revised offer would be the best-case scenario for both sides, but he also thinks Twitter would have a hard time accepting a price reduction large enough to satisfy Musk.

His view that the most likely scenario is that Twitter stays independent. But Zinino warns that the company faces a difficult advertising market for the second half and into 2023, and he also sees risk that the company could see a huge talent drain as doubts grow about the company’s future.

“With Musk officially walking away from the deal, we think Twitter’s business prospects and stock valuation are in a precarious situation,” Zinino writes. “We see risks from an uncertain advertising market, a damaged employee base, and concerns about the status of fake accounts/strategic direction as a stand-alone company.”

Wedbush analyst Dan Ives says the situation is a “nightmare” for Twitter, that results in an “Everest-like” uphill climb “to navigate the myriad of challenges ahead,” including employee turnover, advertising headwinds, and investor worries around the fake account issues, among other things.

JMP Securities analyst Andrew Boone asserts that his gut reaction is that Musk no longer wants to own Twitter, with macro conditions worsening and growing employee attrition. Boone writes in a research note that he “increasingly” thinks Twitter’s future will be to remain independent.

Other scenarios are possible. Conceivably, with the stock down sharply, an alternative bidder could emerge, though none has surfaced so far, and there are no obvious buyers.

It’s also possible that negotiations fail, resulting in protracted litigation, in which either Musk wins, and walks away from the deal, or Musk loses, and gets stuck paying the original price. In either litigation scenario, you can imagine endless appeals that could drag on for eons.

Reprinted by permission of Barron’s. Copyright 2021 Dow Jones & Company. Inc. All Rights Reserved Worldwide. Original date of publication: July 11, 2022.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A sharp rebound in tourism in Europe’s sunbelt powers its economic rebound as core manufacturing centres struggle to recover

Europe’s economy has a north-south divide—and now it’s the poorer south that is powering the region’s return to growth.

Southern Europe, which for decades has had lower growth, productivity and wealth than the north, powered an upside-down recovery on the continent at the start of the year. Buoyant tourism revenue around the Mediterranean helped to offset sluggishness in Europe’s manufacturing heartlands.

The south’s transformation from laggard into growth engine reflects both a rapid rebound in visitor numbers from the collapse during the Covid-19 pandemic and a series of blows the continent’s large manufacturing sector has suffered, from surging energy prices to trade conflicts.

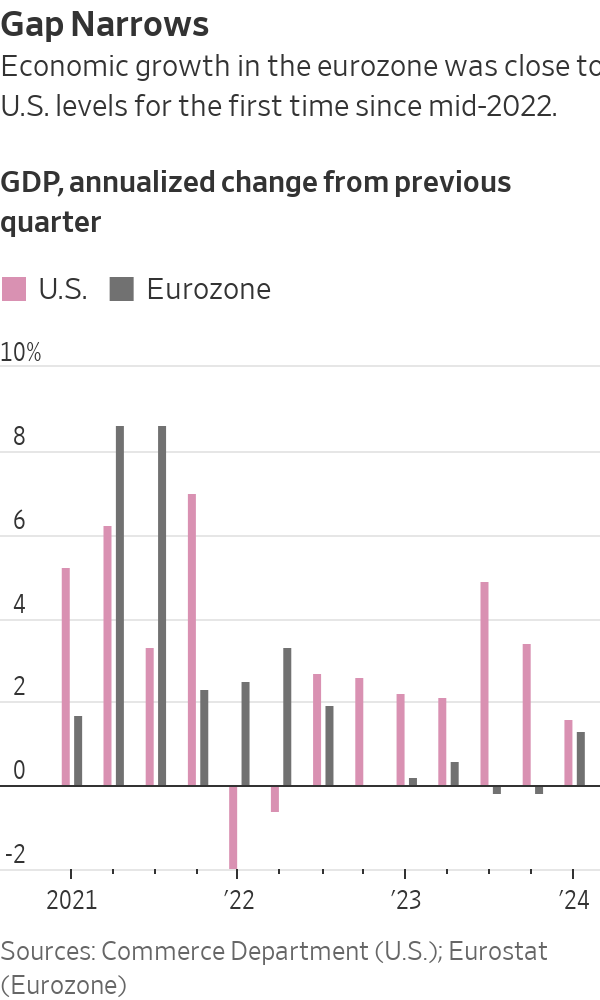

Now growth in the south is more than offsetting the north’s manufacturing malaise: As a whole, the eurozone economy grew at an annualised rate of 1.3% in the first quarter, ending nearly 18 months of economic stagnation in a sign that the currency area is recovering from the damage done by Russia’s invasion of Ukraine.

It was the eurozone’s strongest performance since the third quarter of 2022, and approached the U.S. economy’s 1.6% first-quarter growth rate, which was a slowdown from a racy pace of 3.4% at the end of last year.

In the 2010s, Germany helped to drag the continent out of its debt crisis thanks to strong exports of cars and capital goods. Between 2021 and 2023, Italy, Spain, Greece and Portugal contributed between a quarter and half of the European Union’s annual growth, according to a report last year by French credit insurer Coface —a trend now confirmed and amplified in the latest data.

In the first quarter, Spain was the fastest-growing of the big eurozone economies. It and Portugal recorded growth of 0.7% in the three months through the end of March from the previous quarter, while Italy’s economy grew by 0.3%. France and Germany both grew by 0.2%, the latter rebounding from a 0.5% quarter-on-quarter contraction at the end of last year.

This means Germany’s economy has grown by 0.3% in total since the end of 2019, compared with 8.7% for the U.S., 4.6% for Italy and 2.2% for France, according to UniCredit data.

In Spain, strong growth “seems to have been entirely due to strong tourism numbers,” said Jack Allen-Reynolds, an economist with Capital Economics. Tourism accounts for around 10% of the economies of Spain, Italy, Greece and Portugal.

The euro rose by about a quarter-cent against the dollar, to $1.0725, after the latest growth and inflation data were published.

The recovery comes as the European Central Bank signals it is preparing to reduce interest rates in June after a historic run of increases since mid-2022 that took it the key rate to 4%. Inflation in the eurozone remained at 2.4% in April, while underlying inflation cooled slightly, from 2.9% to 2.7%, according to separate data published Tuesday.

“The ECB hawks will point to the strong GDP number as [an] argument that ECB can take its rates lower gradually,” said Kamil Kovar, senior economist at Moody’s Analytics.

The eurozone economy has flatlined since late 2022 as Russia’s attack on its neighbor sent food and energy prices soaring in Europe and sapped business and household confidence. Gross domestic product fell in both the third and fourth quarters of last year, meeting a definition of recession widely used in Europe, but not in the U.S.

Southern Europe is one of only a handful of regions where international tourist arrivals returned to pre pandemic levels last year, according to United Nations data. Tourism revenue across the EU was one-quarter higher in the three months through the end of last June than in the same period in 2019, according to Coface data.

The recovery in international tourism was “notably driven by the arrival of many Americans who…were able to take advantage of favorable exchange rates,” Coface analysts wrote. “On the other hand, the end of the zero-Covid policy in China has initiated a gradual return of Chinese tourists, although remaining below 2019 levels.”

In Portugal, the number of foreign tourists hit a record of more than 18 million last year, up 11% compared with the prepandemic year of 2019, official data showed in January. American tourists in particular have returned to Europe in force.

Tourist numbers in Asia Pacific and the Americas continued to lag 2019 levels by 35% and 10% last year, respectively, the data show.

It is unclear how much further the tourism boom can run, but economists expect the region’s economic recovery to strengthen later this year as cooling inflation boosts household spending power and lower energy costs aid factory output.

Recent surveys point to an improved outlook for growth. Consumer confidence has risen to its highest level in two years, and a leading business-sentiment index has shown steady improvement from the start of 2024.

“We think that the combination of a robust labor market, comparatively strong wage hikes and lower inflation compared with last year will finally lead to a moderate recovery in consumer spending in the next few quarters,” said Andreas Rees , an economist with UniCredit in Frankfurt.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.