Stocks Suffer Worst Day Since June 2020

Annual inflation eased to 8.3% in August but came in higher than economists anticipated

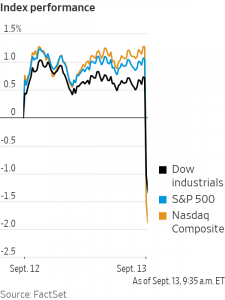

Stocks suffered their worst day in more than two years after hotter-than-expected inflation data dashed investors’ hopes that cooling price pressures would prompt the US Federal Reserve to moderate its campaign of interest-rate increases.

Investors sold everything from stocks and bonds to oil and gold. All 30 stocks in the Dow Jones Industrial Average declined, as did all 11 sectors in the S&P 500. Only five stocks in the broad benchmark finished the session in the green. Facebook parent Meta Platforms dropped 9.4%, BlackRock declined 7.5% and Boeing fell 7.2%.

The Dow fell 1276.37 points, or 3.9%, to 31104.97. The S&P 500 declined 177.72 points, or 4.3%, to 3932.69. The Nasdaq Composite slid 632.84 points, or 5.2%, to 11633.57.

All three indexes posted their steepest one-day losses since June 11, 2020. The declines left the Dow industrials down 14% in 2022, while the S&P 500 has lost 17% and the Nasdaq Composite has retreated 26%.

Investors had eagerly anticipated Tuesday’s release of the consumer-price index, which provided a last major look at inflation before the central bank’s interest-rate-setting committee meets next week. Expectations for the path of monetary policy have held sway over the markets as investors factor higher rates into asset prices and try to project how well the economy will hold up as rates rise.

“It increases the probability of recession if the Fed has to move more significantly to address inflation,” said Chris Shipley, chief investment strategist for North America at Northern Trust Asset Management.

The new data showed the consumer-price index rose 8.3% in August from the same month a year ago. That was down from 8.5% in July and 9.1% in June—the highest inflation rate in four decades.

The figures show inflation is easing, but at a slower pace than investors and economists had anticipated. Economists surveyed by The Wall Street Journal had been expecting consumer prices to rise 8% annually in August.

Analysts had hoped that officials would consider easing their pace of interest-rate increases if data continued to show inflation subsiding. The data undercut those hopes, seeming to settle the case for the Fed to raise rates by at least 0.75 percentage point next week. After the release, stock futures fell, bond yields rose and the dollar rallied.

Traders began to consider the possibility that the central bank will raise interest rates by a full percentage point next week.

As of Tuesday afternoon, they assigned a 34% probability to a 1-percentage-point increase at that meeting, up from a 0% chance a day earlier, according to CME Group’s FedWatch Tool.

The market-based probability of a half-percentage-point increase, by contrast, fell to 0% from 9% on Monday, according to the CME data.

The most likely scenario remained an increase of 0.75 percentage point.

Beyond next week, the suggestion that inflation is sticking around raises the possibility that the Fed might ultimately raise rates higher than markets had been anticipating.

“That’s really the challenge,” said Matt Forester, chief investment officer of Lockwood Advisors at BNY Mellon Pershing. “The Fed might have to do a lot more work in order to contain inflation.”

Fed Chairman Jerome Powell said earlier this month that the central bank is squarely focused on bringing down high inflation to prevent it from becoming entrenched as it did in the 1970s.

With Tuesday’s declines, the S&P 500 is up 7.3% from its June low. While investors broadly expect volatility to continue shaking the stock market, some suspect the economy remains strong enough to avert a major leg lower from here.

“We think a lot of the weakness is likely in the price at this stage,” said Holly MacDonald, chief investment officer at Bessemer Trust.

Still, the reaction to the new inflation reading could be seen across asset classes on Tuesday.

The communication services, technology and consumer discretionary sectors of the S&P 500 all fell more than 5%. Semiconductor stocks were particularly hard hit: Nvidia, Advanced Micro Devices and Micron Technology declined more than 7%.

In bond markets, the yield on the benchmark 10-year U.S. Treasury note jumped to 3.422%—near its highest level of 2022—from 3.361% Monday. Meanwhile, the yield on the two-year note, which is more sensitive to near-term rate expectations, settled at 3.754%, the highest since 2007. Yields and prices move in opposite directions. The rise in bond yields was an additional sign that investors were expecting higher interest rates after the data.

Brent crude, the international benchmark for oil prices, fell 0.9% to $93.17 a barrel. Gold prices declined 1.3%.

The U.S. dollar, by contrast, rallied Tuesday. The WSJ Dollar Index, which measures the greenback against a basket of other currencies, rose 1.4% in its largest one-day gain since March 2020. The strong dollar has weighed on the value of other currencies against the greenback this year.

Overseas, the pan-continental Stoxx Europe 600 fell about 1.5%. In Asia, major indexes closed mixed. South Korea’s Kospi Composite rallied 2.7% , while Hong Kong’s Hang Seng declined 0.2%.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

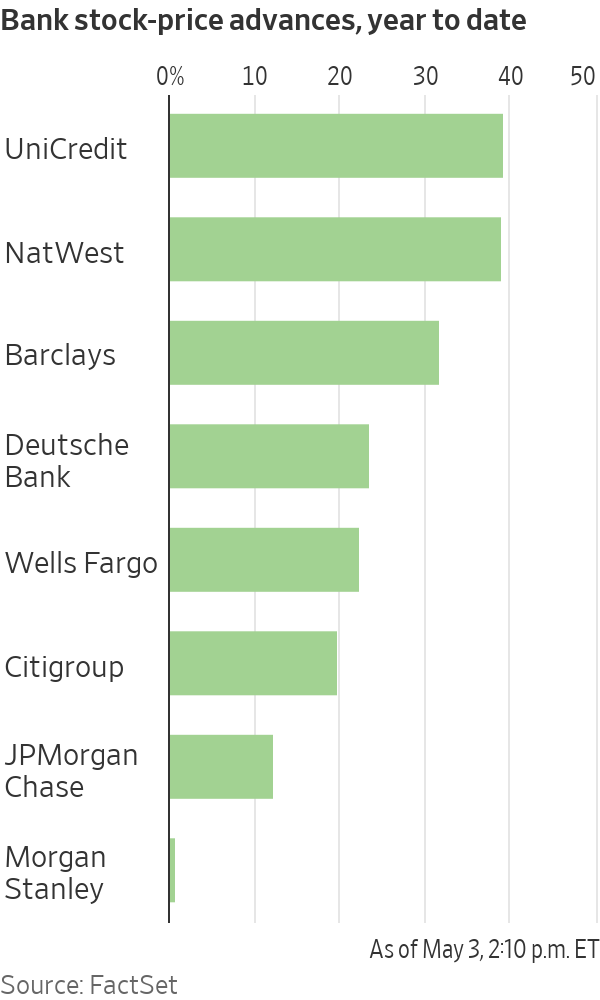

Shares in European banks such as UniCredit have been on a tear

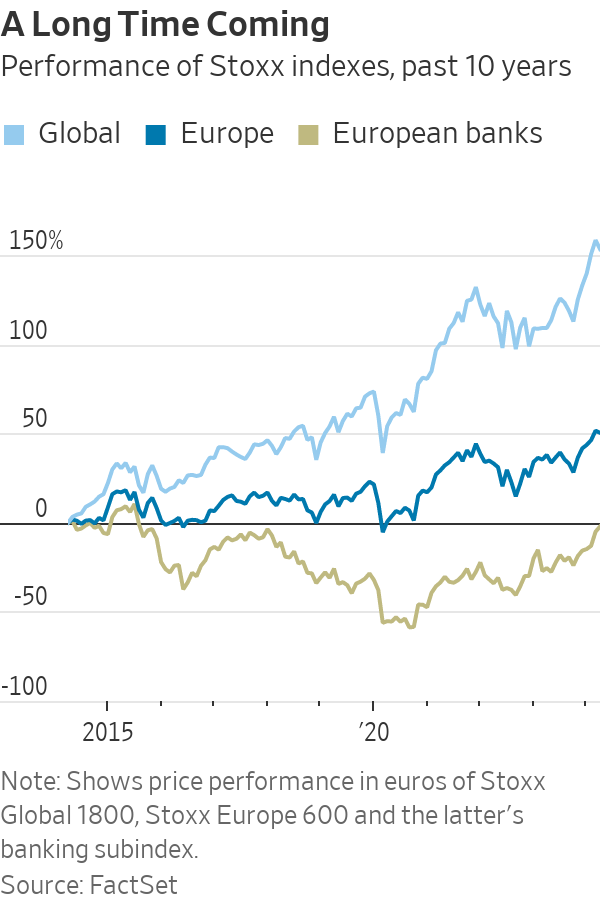

After years in the doldrums, European banks have cleaned up their balance sheets, cut costs and started earning more on loans.

The result: Stock prices have surged and lenders are preparing to hand back some $130 billion to shareholders this year. Even dealmaking within the sector, long a taboo topic, is back, with BBVA of Spain resurrecting an approach for smaller rival Sabadell .

The resurgence is enriching a small group of hedge funds and others who started building contrarian bets on European lenders when they were out of favour. Beneficiaries include hedge-fund firms such as Basswood Capital Management and so-called value investors such as Pzena Investment Management and Smead Capital Management.

It is also bringing in new investors, enticed by still-depressed share prices and promising payouts.

“There’s still a lot of juice left to squeeze,” said Bennett Lindenbaum, co-founder of Basswood, a hedge-fund firm based in New York that focuses on the financial sector.

Basswood began accumulating positions around 2018. European banks were plagued by issues including political turmoil in Italy and money-laundering scandals . Meanwhile, negative interest rates had hammered profits.

Still, Basswood’s team figured valuations were cheap, lenders had shored up capital and interest rates wouldn’t stay negative forever. The firm set up a European office and scooped up stock in banks such as Deutsche Bank , UniCredit and BNP Paribas .

Fast forward to 2024, and European banking stocks are largely beating big U.S. banks this year. Shares in many, such as Germany’s largest lender Deutsche Bank , have hit multiyear highs .

A long-only version of Basswood’s European banks and financials strategy—which doesn’t bet on stocks falling—has returned approximately 18% on an annualised basis since it was launched in 2021, before fees and expenses, Lindenbaum said.

The industry’s turnaround reflects years spent cutting costs and jettisoning bad loans, plus tougher operating rules that lifted capital levels. That meant banks were primed to profit when benchmark interest rates turned positive in 2022.

On a key measure of profitability, return on equity, the continent’s 20 largest banks overtook U.S. counterparts last year for the first time in more than a decade, Deutsche Bank analysts say.

Reflecting their improved health, European banks could spend almost as much as 120 billion euros, or nearly $130 billion, on dividends and share buybacks this year, according to Bank of America analysts.

If bank mergers pick up, that could mean takeover offers at big premiums for investors in smaller lenders. European banks were so weak for so long, dealmaking stalled. Acquisitive larger banks like BBVA could reap the rewards of greater scale and cost efficiencies, assuming they don’t overpay.

“European banks, in general, are cheaper, better capitalised, more profitable and more shareholder friendly than they have been in many years. It’s not surprising there’s a lot of new investor interest in identifying the winners in the sector,” said Gustav Moss, a partner at the activist investor Cevian Capital, which has backed institutions including UBS .

As central banks move to cut interest rates, bumper profits could recede, but policy rates aren’t likely to return to the negative levels banks endured for almost a decade. Stock prices remain modest too, with most far below the book value of their assets.

Among the biggest winners are investors in UniCredit . Shares in the Italian lender have more than quadrupled since Andrea Orcel became chief executive in 2021, reaching their highest levels in more than a decade.

Under the former UBS banker, UniCredit has boosted earnings and started handing large sums back to shareholders , after convincing the European Central Bank the business was strong enough to make large payouts.

Orcel said European banks are increasingly attracting investors like hedge funds with a long-term view, and with more varied portfolios, like pension funds.

He said that investor-relations staff initially advised him that visiting U.S. investors was important to build relationships—but wasn’t likely to bear fruit, given how they viewed European banks. “Now Americans ask you for meetings,” Orcel said.

UniCredit is the second-largest position in Phoenix-based Smead Capital’s $126 million international value fund. It started investing in August 2022, when UniCredit shares traded around €10. They now trade at about €35.

Cole Smead , the firm’s chief executive, said the stock has further to run, partly because UniCredit can now consider buying rivals on the cheap.

Sentiment has shifted so much that for some investors, who figure the biggest profits are to be made betting against the consensus, it might even be time to pull back. A recent Bank of America survey found regional investors had warmed to European banks, with 52% of respondents judging the sector attractive.

And while bets on banks are now paying off, trying to bottom-fish in European banking stocks has burned plenty of investors over the past decade. Investments have tied up money that could have made far greater returns elsewhere.

Deutsche Bank, for instance, underwent years of scandals and big losses before stabilising under Chief Executive Christian Sewing . Rewarding shareholders, he said, is now the bank’s priority.

U.S. private-equity firm Cerberus Capital Management built stakes in Deutsche Bank and domestic rival Commerzbank in 2017, only to sell a chunk when shares were down in 2022. The investor struggled to make changes at Commerzbank.

A Cerberus spokesman said it remains “bullish and committed to the sector,” with bank investments in Poland and France. It retains shares in both Deutsche and Commerzbank, and is an investor in another German lender, the unlisted Hamburg Commercial Bank.

Similarly, Capital Group also invested in both Deutsche Bank and Commerzbank, only to sell roughly 5% stakes in both banks in 2022—at far below where they now trade. Last month, Capital Group disclosed buying shares again in Deutsche Bank, lifting its holding above 3%. A spokeswoman declined to comment.

U.S.-based Pzena, which manages some $64 billion in assets, has backed banks such as UBS and U.K.-listed HSBC , NatWest and Barclays .

Pzena reckoned balance sheets, capital positions and profitability would all eventually improve, either through higher interest rates or as business models shifted. Still, some changes took longer than expected. “I don’t think anyone would have thought the ECB would keep rates negative for eight or nine years,” said portfolio manager Miklos Vasarhelyi.

Some Pzena investments date as far back as 2009 and 2010, Vasarhelyi said. “We’ve been waiting for this to turn for a long time.”

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts