Fed Approves Quarter-Point Rate Hike, Signals More Increases Likely

Officials are slowing interest-rate increases as they debate when to pause

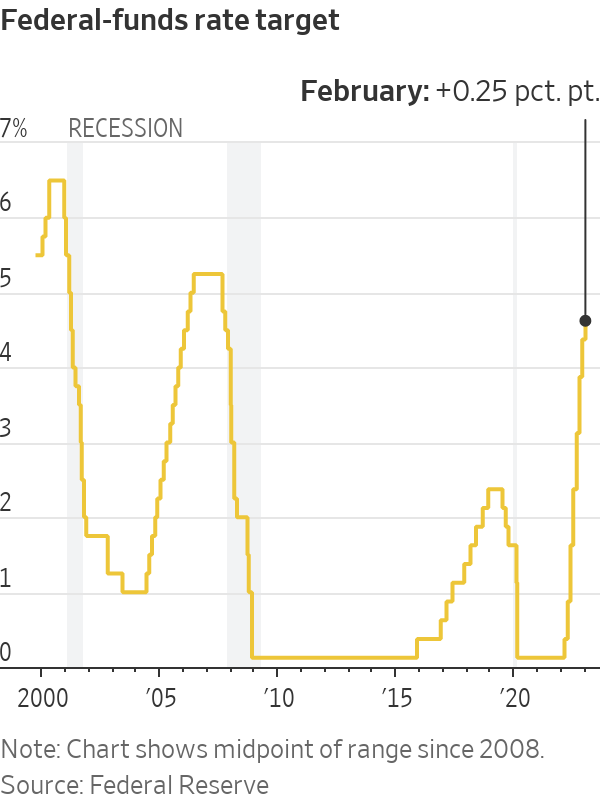

WASHINGTON—The Federal Reserve approved an interest-rate increase of a quarter-percentage-point and signalled plans to raise rates again next month to continue lowering inflation.

The decision Wednesday followed six consecutive rate rises that were larger, including an increase of a half-point in December and a 0.75-point increase in November.

Officials nodded to recent improvement in inflation readings but didn’t significantly alter their guidance in a policy statement released after the meeting regarding coming rate moves.

“The committee anticipates that ongoing increases” in interest rates “will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive,” said the statement, using the same language included in policy statements since last March.

The latest increase caps a year in which the Fed lifted its benchmark federal-funds rate from near zero to a range between 4.5% and 4.75%, a level last reached in 2007. That extends the central bank’s most rapid pace of rate increases since the early 1980s to fight inflation, which hit a 40-year high last year.

One big question heading into Wednesday’s meeting was the extent to which recent economic data had given Fed officials more confidence that inflation and wage pressures had peaked.

In December, most of them penciled in raising the fed-funds rate to a range between 5% and 5.25% this year. After the hike they approved Wednesday, that projection would imply additional quarter-point increases at the Fed’s meetings in March and May, followed by a pause in rate rises.

Many officials had repeated in recent weeks that they still saw such a rate path as appropriate given strong wage pressures, a tight labour market and high service-sector inflation. But officials also said they would base their decisions on how the economy performs in the coming months.

“We can now say for the first time, the disinflationary process has started,” said Fed Chair Jerome Powell at a news conference after Wednesday’s meeting. But he added, “The job is not fully done.”

Mr. Powell said the central bank was trying to manage the risk of raising rates too much and causing unnecessary economic harm with that of not doing enough to bring down inflation. In repeating his longstanding view that the latter mistake would be harder to fix, Mr. Powell said he didn’t want to be in a position where six or 12 months from now, after a halt to raising rates, the Fed would belatedly conclude that it hadn’t done enough to bring down inflation this year and would have to raise rates higher.

“We’re going to be cautious about declaring victory and sending signals that we think the game is won,” he said. “Certainty is just not appropriate here.”

The fed-funds rate influences other borrowing costs throughout the economy, including rates on mortgages, credit cards and auto loans. The Fed is raising rates to cool inflation by slowing economic growth. It believes those policy moves work through financial markets by tightening financial conditions, such as by raising borrowing costs or lowering prices of stocks and other assets.

Officials have been guarded in recent weeks about providing any guidance that might ignite market rallies that could undermine their efforts to fight inflation.

In recent weeks, markets have rallied partly because investors anticipated that the Fed would slow its rate increases this week and remove uncertainty over the rate outlook, which reduces interest-rate volatility. Lower volatility can ease financial conditions.

Markets have also been cheered by news that inflation and wage growth might have peaked last year, which could make the Fed more comfortable in pausing rate increases. Since Fed officials met in December, economic activity has been mixed. Consumer spending has moderated, and manufacturing activity has weakened. But hiring has held steady, pushing the unemployment down to 3.5% in December, a half-century low.

Investors in bond markets increasingly expect that the Fed will cut interest rates later this year because of a sharp slowdown in economic activity that lowers inflation faster than policy makers expect.

Fed officials and some economists, meanwhile, are concerned that the recent decline in inflation could reflect the long-anticipated easing of supply-chain bottlenecks—and that might not be enough to bring inflation down to the Fed’s 2% goal.

“I’m somewhat worried that the market view is based more on hope,” said Karen Dynan, an economist at Harvard University who served in the Obama administration. “Labor markets still look really tight.”

Officials’ deliberations over how much more to raise rates this year and how long to hold rates at some higher level could hinge over how much they think their past increases will slow the economy this year. Debates could also turn on the degree to which wage and price pressures might slow without significant weakness in the job market.

Officials agreed to slow rate rises to gain more time to study the effects of their moves.

Inflation fell to 4.4% in December from 5.2% in September, as measured by the 12-month change in the personal consumption expenditures price index excluding food and energy. Though still above the Fed’s 2% goal, it moderated in the October-to-December period to an annualised 2.9% rate.

“Inflation has eased somewhat but remains elevated,” said the Fed’s policy statement.

Overall inflation is slowing largely because prices of energy and other goods are falling. Large increases in housing costs have slowed, but haven’t filtered through to official price gauges yet. As a result, Mr. Powell and several colleagues shifted attention recently toward a narrower subset of labor-intensive services by excluding prices for food, energy, shelter and goods.

Mr. Powell has said prices in this category, which rose 4% in December from a year earlier, offer the best gauge of higher wage costs passing through to consumer prices.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

An original watercolour illustration for the cover of Harry Potter and the Philosopher’s Stone, 1997 — the first book in J.K. Rowling’s hit series—could sell for US$600,000 at a Sotheby’s auction this summer.

The illustration is headlining a June 26 sale in New York that will also feature big-ticket items from the collection of the late Dr. Rodney P. Swantko, a surgeon and collector from Indiana, including manuscripts by poet Edgar Allan Poe and Arthur Conan Doyle, author of the Sherlock Holmes books

The Harry Potter illustration, which introduced the young wizard character to the world, is expected to sell for between US$400,000 to US$600,000, which would make it the highest-priced item ever sold related to the Harry Potter world. This is the second time the illustration has been sold, however—it was on the auction block at Sotheby’s in London in 2001, where it achieved £85,750 (US$107,316).

The artist of the illustration, Thomas Taylor, was 23 years old at the time and a graduate student working at a children’s bookshop. According to Sotheby’s, Taylor took a “professional commission from an unknown author to visualise a unique wizarding world,” Sotheby’s said in a news release. He depicted Harry Potter boarding the train to Hogwarts on platform9 ¾ platform, and the illustration became the “universal image” of the Harry Potter series, Sotheby’s said.

“It is exciting to see the painting that marks the very start of my career, decades later and as bright as ever! It takes me back to the experience of reading Harry Potter for the first time—one of the first people in the world to do so—and the process of creating what is now an iconic image,” Taylor said in the release.

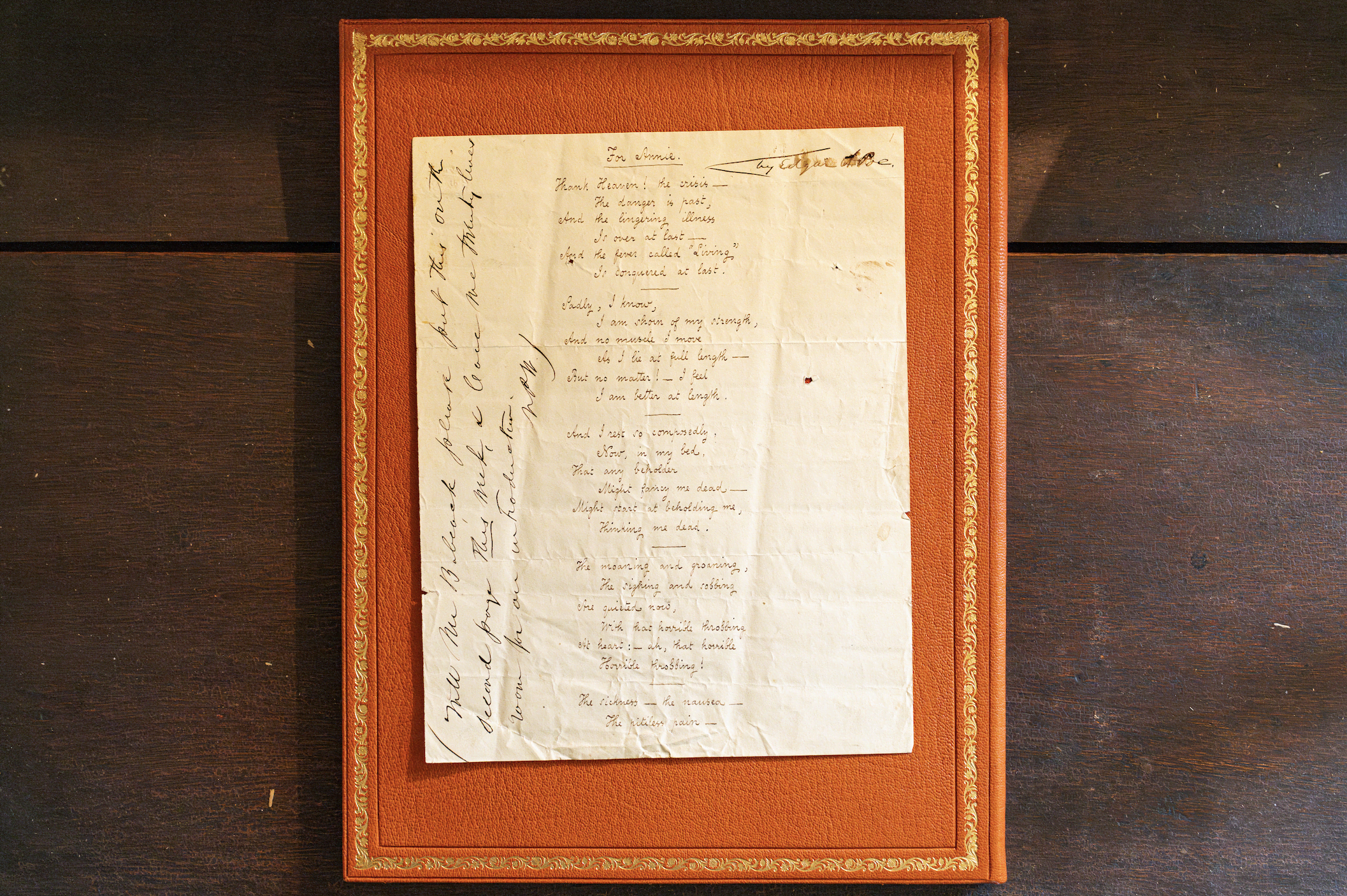

Meanwhile, to commemorate the 175th anniversary of Edgar Allan Poe’s For Annie , 1849, Sotheby’s recently reunited the autographed manuscript of the poem with the author’s home, Poe Cottage, in the Bronx.

The cottage is where the author lived with his wife, Virginia, and mother-in-law, Maria Clemm, from 1846 until he died in 1849. The manuscript, also from the Swantko collection, will remain at the home until it is offered at auction at Sotheby’s on June 26 with an estimate between US$400,000 and US$600,000.

Matthew Borowick for Sotheby’s

Poe Cottage, preserved and overseen by the Bronx County Historical Society, is home to many of the author’s famous works, including Eureka , 1948, and Annabel Lee , 1927.

“To reunite the For Annie manuscript with the Poe Cottage nearly two centuries after it was first composed brought to life literary history for a truly special and unique occasion,” Richard Austin , Sotheby’s Global Head of Books & Manuscripts, said in a news release.

For Annie was one of Poe’s most important compositions, and was addressed to Nancy “Annie” L. Richmond, one of the several women Poe pursued after his wife Viriginia’s death from tuberculosis in 1847.

In a letter to Richmond herself, Poe proclaimed For Annie was his best work: “I think the lines For Annie much the best I have ever written.”

The poem was composed in 1849, only months before Poe’s death, Sotheby’s said in the piece, Poe highlights the romantic comfort he feels from a woman named Annie while simultaneously grappling with the darkness of death, with lines like “And the fever called ‘living’ is conquered at last.”

Matthew Borowick for Sotheby’s

In the margins of the manuscript are the original handwritten instructions by Nathaniel P. Willis, co-editor of the New York Home Journal, where Poe published other poems such as The Raven and submitted For Annie on April 20, 1849.

Willis added Poe’s name in the top right and instructions about printing and presenting the poem on the side. The poem was also published in the Boston Weekly that same month.

Another piece of literary history included in the Swantko sale could surpass US$1 million. Conan Doyle’s autographed manuscript of the Sherlock Holmes tale The Sign of Four , 1889, is estimated to achieve between US$800,000 and US$1.2 million.

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

This stylish family home combines a classic palette and finishes with a flexible floorplan