Eurozone Slides Into Recession as Inflation Hurts Consumption

Weaknesses in Germany and Ireland more than offset growth in other economies at the start of the year

The eurozone has slipped into recession as Germany, its largest economy, wobbled, suggesting that the impact of Russia’s war in Ukraine may have been deeper than expected earlier this year.

While the U.S. economy has so far brushed aside higher borrowing rates and continues to grow thanks to robust consumption, employment and an extended market rally, Europe is lagging ever further behind, stuck in the economic equivalent of long Covid. While the U.S. economy is now 5.4% larger than it was before the Covid-19 pandemic struck, the eurozone economy is just 2.2% bigger.

Inflation driven by a spike in energy costs and stubbornly high food prices has softened in Europe recently but remains much higher than policy makers would like and is affecting consumption negatively.

The weakness in Germany is a particular concern. In past decades, the country’s economy often managed to recover rapidly from economic shocks thanks to the strength of its highly competitive exporters.

But global trade has suffered under the Covid-19 pandemic and mounting geopolitical tensions, and it may not offer the same degree of support this time. Factory output in the country showed a steep drop in March. And the continuing war in Ukraine, a close neighbour, is another major source of uncertainty for the region.

Because of its size, the German economy on its own can drag the eurozone up or down. The eurozone’s slide into recession at the start of the year came in spite of growth in France, Italy and Spain, its other large economies.

Economists think all this points to a slow and protracted recovery for the continent later this year, where consumers and businesses are also feeling the drag from higher borrowing costs as the European Central Bank continues to raise interest rates to fight inflation. The eurozone’s slide into recession wasn’t so dramatic as to trigger a pause in the ECB’s rate-raising campaign, according to most analysts.

The European Union’s statistics agency said Thursday the combined gross domestic product of the countries that share the euro fell at an annualised 0.4% during the three months through March, having also declined in the final three months of last year.

Eurostat had previously estimated that the currency area’s economy grew slightly in the first quarter, but the sizeable change to the data from Germany and weakness in Ireland and Finland pushed it into contraction. This left the region with two consecutive quarters of shrinking output, matching the official definition of an economic recession.

Economists expect growth to resume in the three months through June as falling energy bills ease the pressure on household budgets, but any rebound is likely to be anaemic. The Organization for Economic Cooperation and Development on Wednesday said it expected the eurozone’s economy to grow 0.9% this year, roughly half as much as the U.S. economy.

The main difference between the eurozone and the U.S. is consumer spending. Americans are spending freely on the activities they skipped during pandemic lockdowns, such as travel, concerts and dining out. Unlike Europeans, they haven’t had to cut their spending on goods to be able to do so. In Europe, household spending fell in both the final quarter of last year, and the first quarter of 2023. Imports also fell sharply in both quarters, a sign that weakness in the eurozone is affecting businesses in other parts of the world.

One reason for the growing trans-Atlantic economic gap is the amount of savings Americans accumulated during the pandemic. Oxford Economics estimates that while excess savings in the U.S. stood at around 8.3% of annual economic output at the end of 2022, in the eurozone the equivalent was just over 5%. Americans have also been more willing to draw on those savings, with surveys showing Europeans are conscious of the uncertainties flowing from the war in Ukraine.

Back in Europe, while energy prices have normalised from their 2022 peaks, food prices have continued to rise at a rapid pace, weakening household spending on other goods and services. U.S. food prices have been rising half as quickly as their European equivalents so far this year.

The European Central Bank’s series of rate increases, which started in July last year, have now worked their way through the currency area’s financial system. The drag on growth from that source is likely to build during coming months, with the ECB signalling that it intends to raise its key interest rate for an eighth straight meeting next week.

“A peak in underlying inflation wouldn’t be sufficient to declare victory: We need to see convincing evidence that inflation returns to our 2% target in a sustained and timely manner,” ECB policy maker Isabel Schnabel said Wednesday. “We aren’t at that point yet.”

The OECD said it expects eurozone inflation to fall to 5.8% this year from 8.4% in 2022, but remain well above the ECB’s target at 3.2% in 2024.

One reason for the eurozone’s slide into recession is that Ireland—long the currency area’s fastest-growing economy—experienced a 44.7% decline in factory output during March, likely driven by U.S. pharmaceutical companies that operate in the country. That led to a 17.3% annualized fall in the country’s GDP during the first quarter.

Ireland’s statistics office hasn’t offered a reason for that drop in production, but figures it released Wednesday showed a rebound of 70.7% in April, suggesting the first-quarter contraction is unlikely to be sustained.

The eurozone’s poor economic performance so far this year partly reflects the costs of Moscow’s invasion of Ukraine last year. The Russian economy contracted 2% last year and the OECD expects it to shrink a further 1.5% this year and 0.4% in 2024. Ukraine’s economy shrank by a third in 2022, and is likely to have suffered further damage following the destruction of a dam and hydroelectric plant in the country’s south this week.

In the U.S., unlike in Europe, a weakening of the jobs market is required before the National Bureau of Economic Research, an academic group, declares a recession. That has yet to happen in the eurozone, with employment increasing 0.6% during the first quarter.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

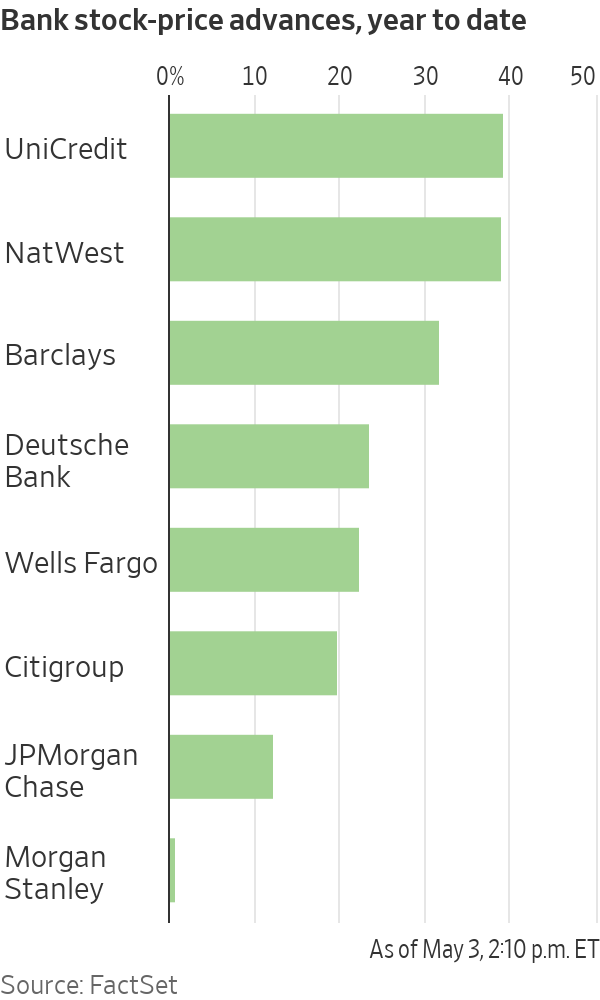

Shares in European banks such as UniCredit have been on a tear

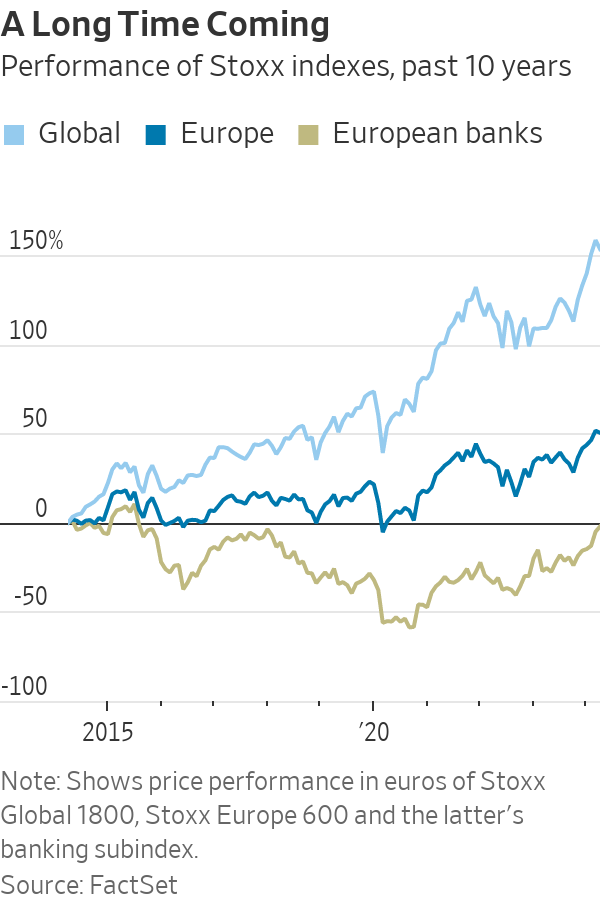

After years in the doldrums, European banks have cleaned up their balance sheets, cut costs and started earning more on loans.

The result: Stock prices have surged and lenders are preparing to hand back some $130 billion to shareholders this year. Even dealmaking within the sector, long a taboo topic, is back, with BBVA of Spain resurrecting an approach for smaller rival Sabadell .

The resurgence is enriching a small group of hedge funds and others who started building contrarian bets on European lenders when they were out of favour. Beneficiaries include hedge-fund firms such as Basswood Capital Management and so-called value investors such as Pzena Investment Management and Smead Capital Management.

It is also bringing in new investors, enticed by still-depressed share prices and promising payouts.

“There’s still a lot of juice left to squeeze,” said Bennett Lindenbaum, co-founder of Basswood, a hedge-fund firm based in New York that focuses on the financial sector.

Basswood began accumulating positions around 2018. European banks were plagued by issues including political turmoil in Italy and money-laundering scandals . Meanwhile, negative interest rates had hammered profits.

Still, Basswood’s team figured valuations were cheap, lenders had shored up capital and interest rates wouldn’t stay negative forever. The firm set up a European office and scooped up stock in banks such as Deutsche Bank , UniCredit and BNP Paribas .

Fast forward to 2024, and European banking stocks are largely beating big U.S. banks this year. Shares in many, such as Germany’s largest lender Deutsche Bank , have hit multiyear highs .

A long-only version of Basswood’s European banks and financials strategy—which doesn’t bet on stocks falling—has returned approximately 18% on an annualised basis since it was launched in 2021, before fees and expenses, Lindenbaum said.

The industry’s turnaround reflects years spent cutting costs and jettisoning bad loans, plus tougher operating rules that lifted capital levels. That meant banks were primed to profit when benchmark interest rates turned positive in 2022.

On a key measure of profitability, return on equity, the continent’s 20 largest banks overtook U.S. counterparts last year for the first time in more than a decade, Deutsche Bank analysts say.

Reflecting their improved health, European banks could spend almost as much as 120 billion euros, or nearly $130 billion, on dividends and share buybacks this year, according to Bank of America analysts.

If bank mergers pick up, that could mean takeover offers at big premiums for investors in smaller lenders. European banks were so weak for so long, dealmaking stalled. Acquisitive larger banks like BBVA could reap the rewards of greater scale and cost efficiencies, assuming they don’t overpay.

“European banks, in general, are cheaper, better capitalised, more profitable and more shareholder friendly than they have been in many years. It’s not surprising there’s a lot of new investor interest in identifying the winners in the sector,” said Gustav Moss, a partner at the activist investor Cevian Capital, which has backed institutions including UBS .

As central banks move to cut interest rates, bumper profits could recede, but policy rates aren’t likely to return to the negative levels banks endured for almost a decade. Stock prices remain modest too, with most far below the book value of their assets.

Among the biggest winners are investors in UniCredit . Shares in the Italian lender have more than quadrupled since Andrea Orcel became chief executive in 2021, reaching their highest levels in more than a decade.

Under the former UBS banker, UniCredit has boosted earnings and started handing large sums back to shareholders , after convincing the European Central Bank the business was strong enough to make large payouts.

Orcel said European banks are increasingly attracting investors like hedge funds with a long-term view, and with more varied portfolios, like pension funds.

He said that investor-relations staff initially advised him that visiting U.S. investors was important to build relationships—but wasn’t likely to bear fruit, given how they viewed European banks. “Now Americans ask you for meetings,” Orcel said.

UniCredit is the second-largest position in Phoenix-based Smead Capital’s $126 million international value fund. It started investing in August 2022, when UniCredit shares traded around €10. They now trade at about €35.

Cole Smead , the firm’s chief executive, said the stock has further to run, partly because UniCredit can now consider buying rivals on the cheap.

Sentiment has shifted so much that for some investors, who figure the biggest profits are to be made betting against the consensus, it might even be time to pull back. A recent Bank of America survey found regional investors had warmed to European banks, with 52% of respondents judging the sector attractive.

And while bets on banks are now paying off, trying to bottom-fish in European banking stocks has burned plenty of investors over the past decade. Investments have tied up money that could have made far greater returns elsewhere.

Deutsche Bank, for instance, underwent years of scandals and big losses before stabilising under Chief Executive Christian Sewing . Rewarding shareholders, he said, is now the bank’s priority.

U.S. private-equity firm Cerberus Capital Management built stakes in Deutsche Bank and domestic rival Commerzbank in 2017, only to sell a chunk when shares were down in 2022. The investor struggled to make changes at Commerzbank.

A Cerberus spokesman said it remains “bullish and committed to the sector,” with bank investments in Poland and France. It retains shares in both Deutsche and Commerzbank, and is an investor in another German lender, the unlisted Hamburg Commercial Bank.

Similarly, Capital Group also invested in both Deutsche Bank and Commerzbank, only to sell roughly 5% stakes in both banks in 2022—at far below where they now trade. Last month, Capital Group disclosed buying shares again in Deutsche Bank, lifting its holding above 3%. A spokeswoman declined to comment.

U.S.-based Pzena, which manages some $64 billion in assets, has backed banks such as UBS and U.K.-listed HSBC , NatWest and Barclays .

Pzena reckoned balance sheets, capital positions and profitability would all eventually improve, either through higher interest rates or as business models shifted. Still, some changes took longer than expected. “I don’t think anyone would have thought the ECB would keep rates negative for eight or nine years,” said portfolio manager Miklos Vasarhelyi.

Some Pzena investments date as far back as 2009 and 2010, Vasarhelyi said. “We’ve been waiting for this to turn for a long time.”

Consumers are going to gravitate toward applications powered by the buzzy new technology, analyst Michael Wolf predicts

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.