America’s Billionaires Love Japanese Stocks. Why Don’t the Japanese?

Japan’s government wants cash-hoarding households to invest more

TOKYO—Japan’s government is on a mission to make buying stocks hot again.

Many of America’s biggest investors are bullish on Japan. Warren Buffett shared that he increased his investments in Japanese companies during an April visit to the country. Ken Griffin is preparing to reopen an office in Tokyo for his hedge fund, Citadel, and investment banks Goldman Sachs and Morgan Stanley have issued optimistic outlooks for Japan’s stock market.

Japan’s problem is this: There are few signs its estimated 125 million residents share in the excitement.

Burned by dismal returns since the bursting of Japan’s asset bubble in the late 1980s and early 1990s, generations of families here have stashed most of their money in low-yielding savings accounts rather than trying to increase their wealth through the stock market.

Japanese households put an average of just 11% of their savings into stocks and 54% in cash and bank deposits, according to Bank of Japan data released last month. That trails well behind the U.S., where households have about 39% of their money tied up in the market and only 13% in cash and bank deposits, according to Federal Reserve data.

Haruyo Arai, a 62-year-old office worker, began investing in the stock market just last month.

“I was brought up by parents who would say, ‘Don’t dabble in stocks,’ ” she said.

Japanese Prime Minister Fumio Kishida has pledged to double households’ asset incomes, in part by encouraging people to invest in risky assets like stocks. The government is raising caps for Japan’s tax-exempt investment system for small investors, the Nippon Individual Savings Account, with changes set to take effect in January. The Tokyo Stock Exchange has been urging companies to boost their valuations and increase shareholder returns.

Arai cited the upcoming expansion to NISA, along with a desire to save more money for the future, as some of the reasons she decided to begin taking investing more seriously. She has been taking weekend classes at Tokyo-based Financial Academy to learn more about stocks and waking up early every morning to watch a TV news program focused on the economy.

Some believe investors like Arai will prove to be the exception, not the rule. Stocks here haven’t hit a record in decades. There isn’t much buzz among ordinary people about investing in Japanese markets.

“I’ve got the impression that Japanese people don’t really think positively about the desire to make money,” said Takashi Kawaguchi, a 48-year-old office worker who, like Arai, has been learning about investing at Financial Academy.

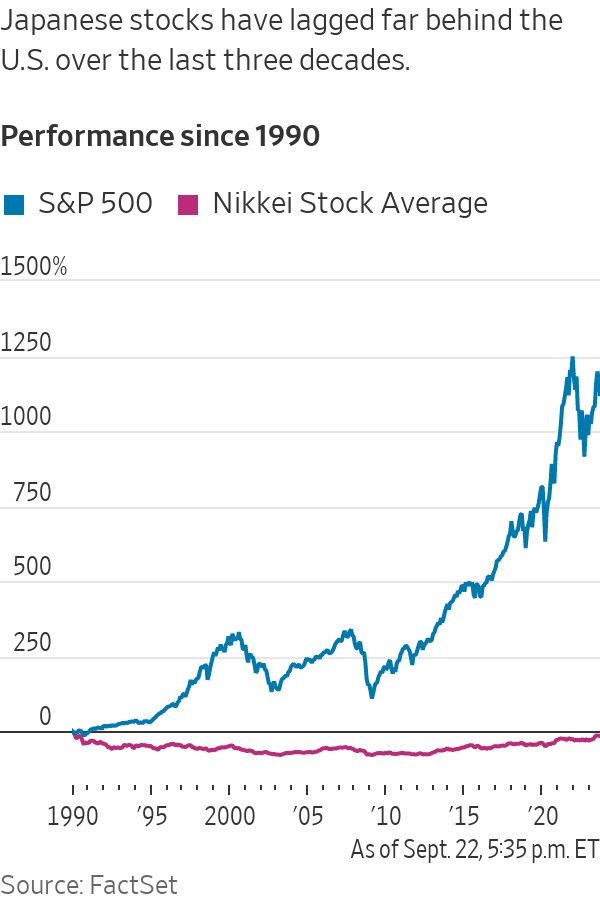

While the 2023 rally has helped lift Japanese stock indexes to 33-year highs, long-term returns pale in comparison to what an investor would have gotten by investing in U.S. stocks. The Nikkei closed at 32,402 on Friday, still 17% below its record hit in 1989. The S&P 500 has grown more than twelvefold over that time. That has made many investors here turn to foreign markets instead of focusing their bets within Japan.

“The Nikkei might hit 40,000, god knows when,” said Heihachiro “Hutch” Okamoto, foreign equity consultant at retail brokerage Monex. “But most of our investors prefer U.S. stocks.”

To Okamoto’s point, the most popular names traded on Monex daily aren’t Japanese stock indexes like the Topix or Nikkei, brand-name companies like Sony or even the “sogo shosha”—the trading houses that Buffett has invested in. Instead, they are all American names: companies like Nvidia, Tesla, Apple and Amazon.com, as well as funds tracking the S&P 500 and the Nasdaq-100.

And that is just among those interested in investing in the first place. While in past years, everyday investors in Japan made a name for themselves with their forays into the foreign exchange market, the overall trading culture here has been one of hesitation.

“Most people here think investing is very risky,” said Hidekazu Ishida, a special adviser at FinCity.Tokyo, which works with the government and the financial industry to try to boost investment in Tokyo. Being into finance comes off as “kakkowarui,” he added, referencing a word for uncool.

Even some heads of companies are lukewarm about the idea of encouraging more individual investors to buy Japanese stocks.

“I’m neutral about that,” said Takeshi Niinami, chief executive officer of whisky and beverage giant Suntory, when asked if he thought it would be a good idea for more Japanese people to invest in the market. Stock investing is risky, he said. And many Japanese people remain wary of participating in the market, because of the severity of prior downturns.

“I think perhaps increasing interest rates is better for people,” he said.

—Chieko Tsuneoka and Alastair Gale contributed to this article

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

When will Berkshire Hathaway stop selling Bank of America stock?

Berkshire began liquidating its big stake in the banking company in mid-July—and has already unloaded about 15% of its interest. The selling has been fairly aggressive and has totaled about $6 billion. (Berkshire still holds 883 million shares, an 11.3% interest worth $35 billion based on its most recent filing on Aug. 30.)

The selling has prompted speculation about when CEO Warren Buffett, who oversees Berkshire’s $300 billion equity portfolio, will stop. The sales have depressed Bank of America stock, which has underperformed peers since Berkshire began its sell program. The stock closed down 0.9% Thursday at $40.14.

It’s possible that Berkshire will stop selling when the stake drops to 700 million shares. Taxes and history would be the reasons why.

Berkshire accumulated its Bank of America stake in two stages—and at vastly different prices. Berkshire’s initial stake came in 2017 , when it swapped $5 billion of Bank of America preferred stock for 700 million shares of common stock via warrants it received as part of the original preferred investment in 2011.

Berkshire got a sweet deal in that 2011 transaction. At the time, Bank of America was looking for a Buffett imprimatur—and the bank’s stock price was weak and under $10 a share.

Berkshire paid about $7 a share for that initial stake of 700 million common shares. The rest of the Berkshire stake, more than 300 million shares, was mostly purchased in 2018 at around $30 a share.

With Bank of America stock currently trading around $40, Berkshire faces a high tax burden from selling shares from the original stake of 700 million shares, given the low cost basis, and a much lighter tax hit from unloading the rest. Berkshire is subject to corporate taxes—an estimated 25% including local taxes—on gains on any sales of stock. The tax bite is stark.

Berkshire might own $2 to $3 a share in taxes on sales of high-cost stock and $8 a share on low-cost stock purchased for $7 a share.

New York tax expert Robert Willens says corporations, like individuals, can specify the particular lots when they sell stock with multiple cost levels.

“If stock is held in the custody of a broker, an adequate identification is made if the taxpayer specifies to the broker having custody of the stock the particular stock to be sold and, within a reasonable time thereafter, confirmation of such specification is set forth in a written document from the broker,” Willens told Barron’s in an email.

He assumes that Berkshire will identify the high-cost Bank of America stock for the recent sales to minimize its tax liability.

If sellers don’t specify, they generally are subject to “first in, first out,” or FIFO, accounting, meaning that the stock bought first would be subject to any tax on gains.

Buffett tends to be tax-averse—and that may prompt him to keep the original stake of 700 million shares. He could also mull any loyalty he may feel toward Bank of America CEO Brian Moynihan , whom Buffett has praised in the past.

Another reason for Berkshire to hold Bank of America is that it’s the company’s only big equity holding among traditional banks after selling shares of U.S. Bancorp , Bank of New York Mellon , JPMorgan Chase , and Wells Fargo in recent years.

Buffett, however, often eliminates stock holdings after he begins selling them down, as he did with the other bank stocks. Berkshire does retain a smaller stake of about $3 billion in Citigroup.

There could be a new filing on sales of Bank of America stock by Berkshire on Thursday evening. It has been three business days since the last one.

Berkshire must file within two business days of any sales of Bank of America stock since it owns more than 10%. The conglomerate will need to get its stake under about 777 million shares, about 100 million below the current level, before it can avoid the two-day filing rule.

It should be said that taxes haven’t deterred Buffett from selling over half of Berkshire’s stake in Apple this year—an estimated $85 billion or more of stock. Barron’s has estimated that Berkshire may owe $15 billion on the bulk of the sales that occurred in the second quarter.

Berkshire now holds 400 million shares of Apple and Barron’s has argued that Buffett may be finished reducing the Apple stake at that round number, which is the same number of shares that Berkshire has held in Coca-Cola for more than two decades.

Buffett may like round numbers—and 700 million could be just the right figure for Bank of America.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.