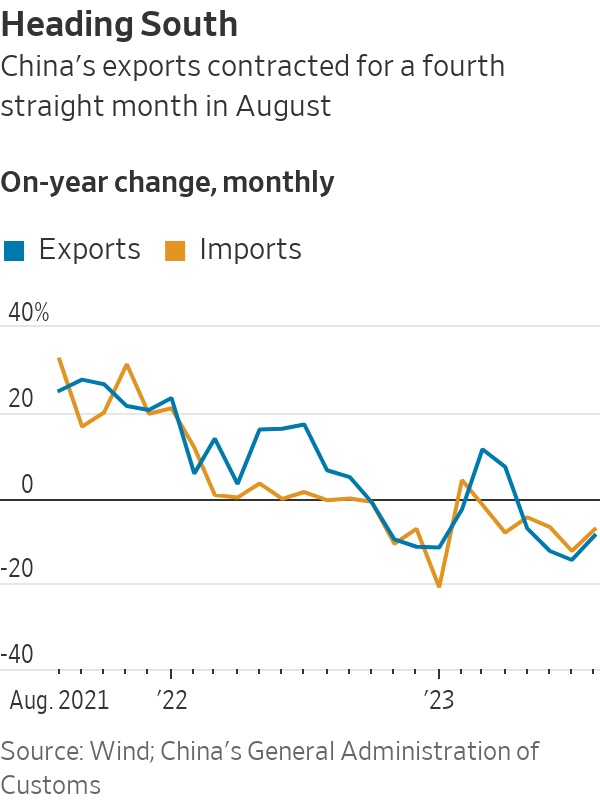

China Exports Fall for a Fourth Month as Once-Reliable Growth Engine Sputters

Property sector’s downturn has pushed imports to their 11th month of declines in the past year

HONG KONG—China’s exports to the rest of the world dropped for a fourth straight month in August, bringing little relief to the country from a deepening economic malaise and weighing on the global trade outlook.

China has struggled to sustain a wave of overseas demand for Chinese-made goods that carried it through much of the three years of the pandemic, particularly as Western consumers tilted their spending back toward services and away from smartphones, furniture and other goods. Higher borrowing rates in the U.S. and other developed countries also hit consumer appetite.

Meanwhile, Chinese imports continued to shrink in August, a reflection of lacklustre consumer demand even after the country loosened its longstanding Covid-related restrictions. A downturn in China’s property market has also sapped demand for raw materials used in construction.

Taken together, the sluggish trade data released Thursday by Beijing provides new evidence that the world’s second-largest economy is struggling to revive domestic demand.

That would ripple through the global economy as China’s slowdown weighs on oil prices and hurts commodity-exporting countries such as Australia, Brazil and Canada. Chinese manufacturers have been under pressure to cut prices to retain market share, potentially sending disinflationary currents around the world.

While Chinese policy makers have trimmed key interest rates and made new attempts to revive home-buying sentiment, economists have widely dismissed these efforts as too piecemeal to revive growth given the speed with which sentiment has soured.

“There’s still a steep hill to climb to get the all-clear on stabilisation for China,” said Frederic Neumann, chief Asia economist at HSBC.

China’s outbound shipments declined 8.8% in August from a year earlier, China’s General Administration of Customs said Thursday. The reading narrowed from the 14.5% year-over-year drop in exports in July, which marked the worst such result since February 2020.

Imports to China, including intermediate components, commodities and consumer products, fell 7.3% in August from a year earlier, slower than July’s 12.4% drop.

Even with the better-than-feared trade data, economists generally agree that exports’ ability to provide support for China’s sputtering recovery remains a distant prospect, particularly given that global trade is expected to contract this year.

“We expect exports to decline over the coming months before bottoming out toward the end of the year,” research firm Capital Economics told clients in a note Thursday.

Apart from the general slowdown in trade, China is facing a raft of other economic headwinds. After a brief spurt of spending in traveling and dining out upon reopening early this year, consumers tightened their purse strings, dragging consumer prices into deflationary territory in July. China is set to report August inflation data on Saturday.

Factory activity, meantime, reported a fifth straight month of contraction in August, while a years long downturn in the housing market has only deepened in recent months. Private investment remains depressed, while the youth jobless rate climbed to a series of record highs in the summer before Beijing decided to discontinue releasing the data to the public.

More broadly, the run of downbeat data during the summer months has sparked growing concerns over China’s long-term growth trajectory and prompted several investment banks to trim their growth forecasts for gross domestic product to below 5% for the year, compared with the official government target of around 5%, which was set in March.

Meeting with Southeast Asian leaders this week, Chinese Premier Li Qiang struck back against widespread pessimism about the country’s near-term economic outlook, saying the country is on track to hit its growth target for the year.

While Chinese policy makers have rolled out a batch of stimulus measures in recent weeks, including trimming interest rates for businesses and home buyers and extending tax relief to households, many economists have questioned whether the policies will be enough to turn around weak consumer sentiment.

China’s reduced appetite for imports—which have fallen for 11 of the past 12 months—reflects in large part the knock-on effects of the country’s continuing property crisis. Both property investment and new construction starts have plunged in recent months amid a loss of confidence in home prices; that in turn has curbed China’s appetite for commodities such as iron ore.

The export data, meanwhile, offers more evidence of China’s shifting trade patterns.

As ties have soured between Beijing and Washington, many U.S. companies have begun to redirect supply chains away from China and toward other Asian countries such as India, leading to a sharp decline in America’s reliance on goods from China.

Rising operational uncertainty, made most clear during China’s pandemic-era lockdowns, which disrupted domestic and global production and logistics, heightened the urgency for many multinationals.

In the first half of the year, China accounted for 13.3% of U.S. goods imports, down from a high of 21.6% in 2017 and representing the lowest level since 2003.

Meanwhile, trade with the 10-member Association of Southeast Asian Nations has grown over the past year to become China’s largest export market, ahead of the U.S. and European Union, according to a recent report by HSBC.

China’s warmer trade relations with Asian countries will help buffer the impact of softening Chinese exports to advanced economies. But economists say Beijing won’t be immune if the U.S. and other advanced economies tip into recession.

Global goods trade is expected to drop by 1.5% this year in part due to tightening global monetary and credit conditions before staging a modest recovery of 2.3% growth in 2024, according to estimates by Adam Slater, lead economist at Oxford Economics.

China’s weakening trade activities, meanwhile, is likely to ripple across Asia, slowing industrial expansion and hitting commodity prices, he added.

—Xiao Xiao in Beijing contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.