Christian Dior’s $57 Handbags Have a Hidden Cost: Reputational Risk

An Italian investigation is shining a harsh light on the supply chain of luxury brands

Christian Dior struck gold when it found a supplier willing to assemble a €2,600 handbag, equivalent to around $2,816, for just €53 a piece—or did it? Cleaning up the reputational damage may not come cheap.

A Milan court named LVMH -owned Dior and Giorgio Armani as two brands whose products were made in sweatshop-like conditions in Italy. Images of an unkempt facility where designer handbags were produced, which was raided as part of an investigation into Italy’s fashion supply chain, are worlds apart from those the luxury industry likes to show its customers.

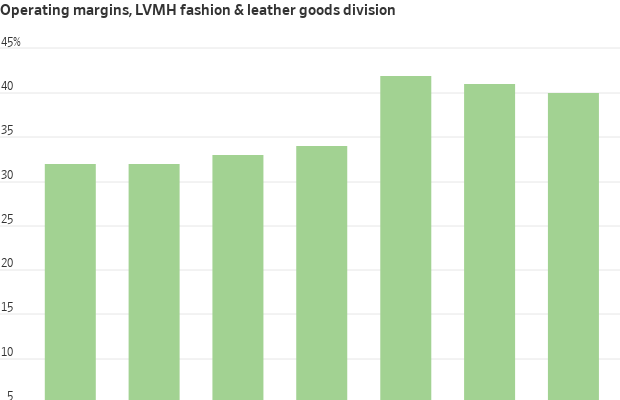

To keep up with the strong demand for their goods, some high-end brands rely on independent workshops to supplement their in-house factories. Sales at LVMH’s leather goods division have almost doubled since 2019.

While more outsourced manufacturing is understandable in a boom, brands may also have taken cost-saving measures too far in a push to juice profits. Some of Dior’s production was contracted out directly to a Chinese-run factory in Italy, where workers assembled the bags in unsafe conditions, according to a translated court order. In other instances, Dior’s suppliers subcontracted work out to low-cost factories that also used irregular labour.

Nipping the problem in the bud would require hundreds of millions of dollars worth of investment in new facilities to bring more manufacturing in-house. The alternative is for Dior to pay its suppliers more and keep them on a tighter leash. Either way, the result seems likely to be lower profits than shareholders have grown accustomed to.

Top luxury brands such as Christian Dior can have very high margins because consumers are willing to pay steep prices for goods they see as status symbols. They also can spread high fixed costs, such as expensive advertising campaigns over a large volume of sales.

For the LVMH group overall, the cost of making the products it sells—everything from Champagne to watches to cosmetics—amounted to 31% of sales in 2023. But the margins on big-brand handbags are probably at the high end of the spectrum.

Bernstein analyst Luca Solca estimates that a €10 billion luxury fashion label, roughly Dior’s size, may spend just 23% of its sales on the raw materials and labour that go into its products. This implies a €2,600 Dior purse would cost €598 to make, equivalent to $US647 for a roughly $US2,800 product at current exchange rates.

In reality, the cost may be even lower, based on the results of the Italian investigation. The €53-a-piece assembly price it cited, equivalent to around $US57, didn’t include the cost of the leather and hardware, but that would add only another €150 or so, according to one Italian supplier.

Advertising fees are a further €156 per handbag, according to Bernstein’s analysis, and depreciation of the company’s assets is €156. Running the brand’s stores—including paying the rent on some of the most exclusive shopping streets in the world—and head-office costs come to an additional €390. This leaves €1,300 of pure operating profit for Dior, or a 50% margin.

“This is the reality of the business,” says Solca. “The retail price for the goods of major luxury brands is typically between eight and 12 times the cost of making the product.”

LVMH hasn’t commented on the investigation, which first made headlines nearly a month ago. Meanwhile, a public-relations storm is brewing. Luxury influencers on social media are asking what exactly people are paying for when they shell out for a fancy purse. Recent price increases also make the cheap manufacturing costs hard to stomach. A mini Lady Dior bag that cost $3,500 in 2019 will set shoppers back $5,500 today, a 57% increase.

A dozen other luxury labels that remain unnamed are under investigation for similar issues in their Italian supply chains, so this may be a much wider problem.

Profits will take a hit if the industry decides to clean up its act. But the cost of doing nothing might be higher. Luxury brands that charge customers thousands of dollars and rely on a reputation for quality can’t afford to be cheap.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Powerhouse real estate couple Avi Khan and Kaylea Sayer welcome their daughter while balancing record-breaking careers, proving success and family can grow side by side.

Warmer minimalism, tactile materials and wellness focused layouts are redefining luxury interiors as homeowners design for comfort, connection and lasting appeal.

The social-media company’s revenue increased 14%, falling short of estimates.

Pinterest shares tumbled after the company projected that revenue growth would slow in the first quarter, amid an advertiser pullback that weighed on its fourth-quarter earnings.

Shares slid 18.5% to $15.10 in after-hours trading after closing the market session down 2.9% at $18.54.

Pinterest reported a 14% increase in fourth-quarter revenue to $1.32 billion, up from $1.15 billion a year earlier, but short of analysts’ estimate of $1.33 billion, according to FactSet. The company posted 17% revenue growth in the third quarter.

The company expects growth to decelerate further in the current first quarter, projecting growth between 11% and 14%. It’s forecasting revenue between $951 million and $971 million.

Chief Executive Officer William Ready said the company needs to broaden its revenue mix and accelerate sales going forward.

“We are not satisfied with our Q4 revenue performance and believe it does not reflect what Pinterest can deliver over time,” he told analysts on a call Thursday. “We are moving with urgency to return over time to the mid-to-high-teens growth, or better than what we have been consistently delivering.”

Pinterest on Thursday recorded a profit of $277.1 million, or 41 cents a share, compared with its profit of $1.85 billion, or $2.68 a share, a year earlier. The $1.85 billion profit in 2024 included a $1.6 billion benefit from deferred tax assets.

Stripping out certain one-time items, Pinterest logged adjusted earnings of 67 cents a share, in line with analyst expectations, according to FactSet.

Ready said the company continues to see headwinds from larger retailers pulling back on advertising spending to protect their margins amid the impact from President Trump’s tariffs.

“We saw continued softness from this cohort of large retailers,” Ready said. “While we see opportunity over the long term, the near-term outlook for this cohort on our platform remains pressured given these headwinds.”

Ready said the company has expanded its footprint among mid-market and small-to-medium business advertisers, as well as international businesses. Still, he said Pinterest had a ways to go to offset the headwinds from larger advertisers, which may become even more pronounced in the current quarter.

Chief Financial Officer Julia Donnelly added that the company is looking to increase its investments in sales and research and development related to artificial-intelligence following the launch of its restructuring effort in January. Pinterest said last month that it would cut about 15% of its workforce, or approximately 700 jobs.

When the Writers Festival was called off and the skies refused to clear, one weekend away turned into a rare lesson in slowing down, ice baths included.

BMW has unveiled the Neue Klasse in Munich, marking its biggest investment to date and a new era of electrification, digitalisation and sustainable design.