Elon Musk Plays a Familiar Song: Robot Cars Are Coming

Tesla’s Robotaxi event excites faithful betting on the company’s future in robotics, while underwhelming those watching from afar

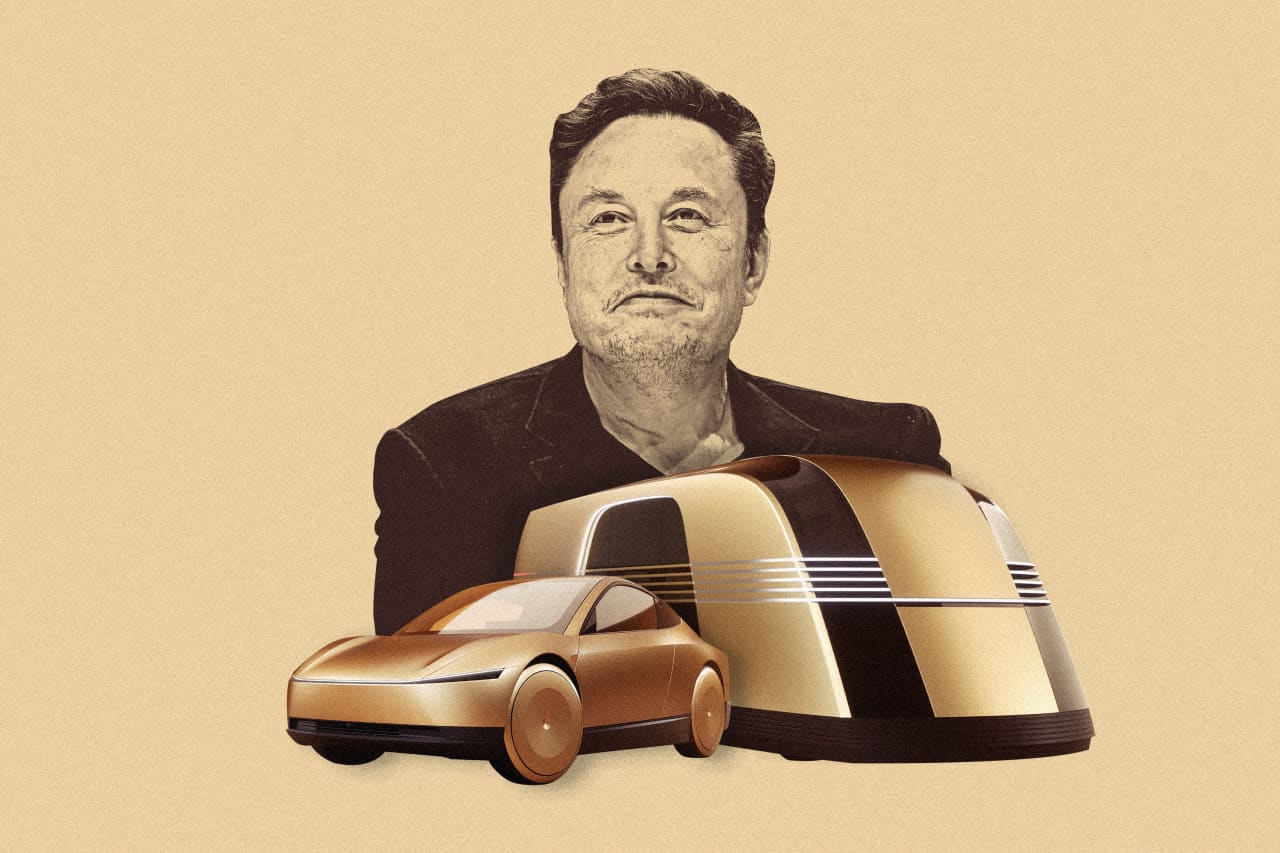

Elon Musk , dressed in a leather jacket in front of adoring fans, looked like an ageing rock star on stage playing one of his greatest hits.

Robot cars are coming.

Those fans at Thursday’s event swooned as they always have as he pushed out timelines for delivering robot cars and showed what those vehicles could look like. But outside the Hollywood-area venue, it wasn’t exactly clear that everyone believed his vision for the future is as near as he says.

Tesla stock fell almost 9% Friday amid investors frustrated with the continued lack of details for how the company is going to make the very complicated transition from maker of cars to maker of robots.

In essence, Thursday night’s much-hyped product reveal became something of a Rorschach test: Supporters, who point to everything Musk has accomplished with electric cars and other industries, heard a glorious future with driverless cars and humanoid robots. Critics—mindful of previous missed goals and maybe peeved by his contentious politics —saw more smoke and mirrors.

“Let’s not get nuanced here,” the chief executive told the crowd as they peppered Musk with questions, a reminder that even among the faithful, time is ticking for him to play some new notes. And to deliver a big hit.

What he did show was cool. A two-seat car with doors that swung upward to open, inspired, in part, by the sci-fi movie “Demolition Man.”

Though as Musk talked about the vehicle, it wasn’t clear he had settled on a formal name. On stage, he called it the “Cybercab,” while the company released details on its website calling it the “Robotaxi.”

Whatever the name, the straight lines of the small car resembled what might be the offspring of the Cybertruck , the pickup the company brought out last year after some delays, and the new Roadster that was first revealed in 2017 and has yet to come to market. Those delays are examples of “ Elon Standard Time ,” or his practice of setting a target only to miss it.

Robot cars are coming.

The Cybercab/Robotaxi reveal also included what Musk says will be Tesla’s autonomous van, an art deco-inspired vehicle that resembled a giant toaster with an interior meant to feel like a spaceship and enough room for 20 passengers.

Like the small car, the van lacked a steering wheel—the sort of doodads currently required under regulations, though exceptions can be granted. The car could begin production “probably” in 2026, Musk said. He didn’t even suggest when the van might come.

The nearest timeline was deploying fully self-driving cars, through the company’s current offerings, next year in Texas and California.

Musk has been predicting driverless cars being just around the corner for several years, including in 2016 when he said Tesla would demonstrate a car driving itself from Los Angeles to New York City in 2017. That didn’t happen.

In 2019, he said he expected his robot taxis would arrive in 2020 . That didn’t happen.

But Tesla has pushed the envelope with its driver-assist system that is essentially a glorified cruise control—adjusting speed, keeping within a lane and other manoeuvres—but can’t technically drive the car itself. Tesla says the person behind the wheel is responsible for everything, though some drivers grow overconfident in its true abilities and act like the car is autonomous.

Musk likes to talk about how Tesla vehicles are collecting valuable real-world data that is used to train its AI systems.

After building Tesla into the world’s leading electric-car company, Musk in recent years has tried to position its future on robotics, saying it is focused on solving self-driving technology. “That’s really the difference between Tesla being worth a lot of money and being worth basically zero,” Musk said in 2022.

Despite that rhetoric, Tesla is behind in deploying cars on roadways without drivers. Alphabet ’s Waymo has deployed fully autonomous vehicles in places such as San Francisco, where paying customers can take its vehicles around the city without anyone sitting behind the wheel.

On Thursday night, Tesla demonstrated 50 vehicles, including the new two-seater, driving autonomously on private property of the Warner Bros. studios where Musk held his party for investors and supporters.

Detractors were quick to pounce.

“After over 10 years of Full Self-Driving development, Tesla is limited to a 20-30 acre geofenced 5mph 1950s Disneyland ride on a preprogrammed, premapped and heavily rehearsed route with no traffic and no pedestrians,” Dan O’Dowd , a critic of Tesla and founder of a rival software company, said in a statement. “Tesla robotaxi is nothing more than the latest work of fiction to come out of the Warner Bros. Studio.”

But Thursday night wasn’t about impressing the O’Dowds of the world. And maybe not even those watching on the livestreams through Musk’s social-media platform X—which counted more than 9 million views by Friday evening.

The real target were the hundreds of attendees at the event who spent the evening riding around in the cars and posting fawning videos of their experiences on social media, in turn, helping the event go even more viral and generating even more attention for the idea that Tesla is paving the way for a robot future.

Robot cars are coming.

Not only did party attendees enjoy rides, but they were entertained by the latest versions of Tesla’s humanoid robots Optimus, which Musk has said could one day add $25 trillion to the company’s market value.

Former Tesla board member Steve Jurvetson posted a video of himself playing rock, paper, scissors with one of the robots. “Optimus just beat me in rock paper scissors!” he tweeted .

Others shared videos of robots pouring drinks and dancing.

“The markets won’t get what happened last night at @tesla ,” Robert Scoble, a blogger and former Microsoft tech evangelist, posted on X. “I couldn’t be more impressed. @elonmusk laid out a bunch for next decade. I have been to a lot of product launches and never have been to one like this.”

Some even compared the evening to when the late Steve Jobs unveiled Apple ’s first iPhone, marking the beginning of a new technology era. It was an idea that Musk was quick to endorse.

“Yes, this marks a fork in the road,” he tweeted afterward.

Robot cars are coming.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

There has rarely, if ever, been so much tech talent available in the job market. Yet many tech companies say good help is hard to find.

What gives?

U.S. colleges more than doubled the number of computer-science degrees awarded from 2013 to 2022, according to federal data. Then came round after round of layoffs at Google, Meta, Amazon, and others.

The Bureau of Labor Statistics predicts businesses will employ 6% fewer computer programmers in 2034 than they did last year.

All of this should, in theory, mean there is an ample supply of eager, capable engineers ready for hire.

But in their feverish pursuit of artificial-intelligence supremacy, employers say there aren’t enough people with the most in-demand skills. The few perceived as AI savants can command multimillion-dollar pay packages. On a second tier of AI savvy, workers can rake in close to $1 million a year .

Landing a job is tough for most everyone else.

Frustrated job seekers contend businesses could expand the AI talent pipeline with a little imagination. The argument is companies should accept that relatively few people have AI-specific experience because the technology is so new. They ought to focus on identifying candidates with transferable skills and let those people learn on the job.

Often, though, companies seem to hold out for dream candidates with deep backgrounds in machine learning. Many AI-related roles go unfilled for weeks or months—or get taken off job boards only to be reposted soon after.

Playing a different game

It is difficult to define what makes an AI all-star, but I’m sorry to report that it’s probably not whatever you’re doing.

Maybe you’re learning how to work more efficiently with the aid of ChatGPT and its robotic brethren. Perhaps you’re taking one of those innumerable AI certificate courses.

You might as well be playing pickup basketball at your local YMCA in hopes of being signed by the Los Angeles Lakers. The AI minds that companies truly covet are almost as rare as professional athletes.

“We’re talking about hundreds of people in the world, at the most,” says Cristóbal Valenzuela, chief executive of Runway, which makes AI image and video tools.

He describes it like this: Picture an AI model as a machine with 1,000 dials. The goal is to train the machine to detect patterns and predict outcomes. To do this, you have to feed it reams of data and know which dials to adjust—and by how much.

The universe of people with the right touch is confined to those with uncanny intuition, genius-level smarts or the foresight (possibly luck) to go into AI many years ago, before it was all the rage.

As a venture-backed startup with about 120 employees, Runway doesn’t necessarily vie with Silicon Valley giants for the AI job market’s version of LeBron James. But when I spoke with Valenzuela recently, his company was advertising base salaries of up to $440,000 for an engineering manager and $490,000 for a director of machine learning.

A job listing like one of these might attract 2,000 applicants in a week, Valenzuela says, and there is a decent chance he won’t pick any of them. A lot of people who claim to be AI literate merely produce “workslop”—generic, low-quality material. He spends a lot of time reading academic journals and browsing GitHub portfolios, and recruiting people whose work impresses him.

In addition to an uncommon skill set, companies trying to win in the hypercompetitive AI arena are scouting for commitment bordering on fanaticism .

Daniel Park is seeking three new members for his nine-person startup. He says he will wait a year or longer if that’s what it takes to fill roles with advertised base salaries of up to $500,000.

He’s looking for “prodigies” willing to work seven days a week. Much of the team lives together in a six-bedroom house in San Francisco.

If this sounds like a lonely existence, Park’s team members may be able to solve their own problem. His company, Pickle, aims to develop personalised AI companions akin to Tony Stark’s Jarvis in “Iron Man.”

Overlooked

James Strawn wasn’t an AI early adopter, and the father of two teenagers doesn’t want to sacrifice his personal life for a job. He is beginning to wonder whether there is still a place for people like him in the tech sector.

He was laid off over the summer after 25 years at Adobe , where he was a senior software quality-assurance engineer. Strawn, 55, started as a contractor and recalls his hiring as a leap of faith by the company.

He had been an artist and graphic designer. The managers who interviewed him figured he could use that background to help make Illustrator and other Adobe software more user-friendly.

Looking for work now, he doesn’t see the same willingness by companies to take a chance on someone whose résumé isn’t a perfect match to the job description. He’s had one interview since his layoff.

“I always thought my years of experience at a high-profile company would at least be enough to get me interviews where I could explain how I could contribute,” says Strawn, who is taking foundational AI courses. “It’s just not like that.”

The trouble for people starting out in AI—whether recent grads or job switchers like Strawn—is that companies see them as a dime a dozen.

“There’s this AI arms race, and the fact of the matter is entry-level people aren’t going to help you win it,” says Matt Massucci, CEO of the tech recruiting firm Hirewell. “There’s this concept of the 10x engineer—the one engineer who can do the work of 10. That’s what companies are really leaning into and paying for.”

He adds that companies can automate some low-level engineering tasks, which frees up more money to throw at high-end talent.

It’s a dynamic that creates a few handsomely paid haves and a lot more have-nots.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

Now complete, Ophora at Tallawong offers luxury finishes, 10-year defect insurance and standout value from $475,000.