Eurozone’s Economy Outpaced China and U.S. in 2022

The currency-area grew at a faster clip than its global peers, reversing traditional positions

The eurozone economy grew faster than China and the U.S. last year, underlining how the fading Covid-19 pandemic continues to scramble traditional patterns of global growth.

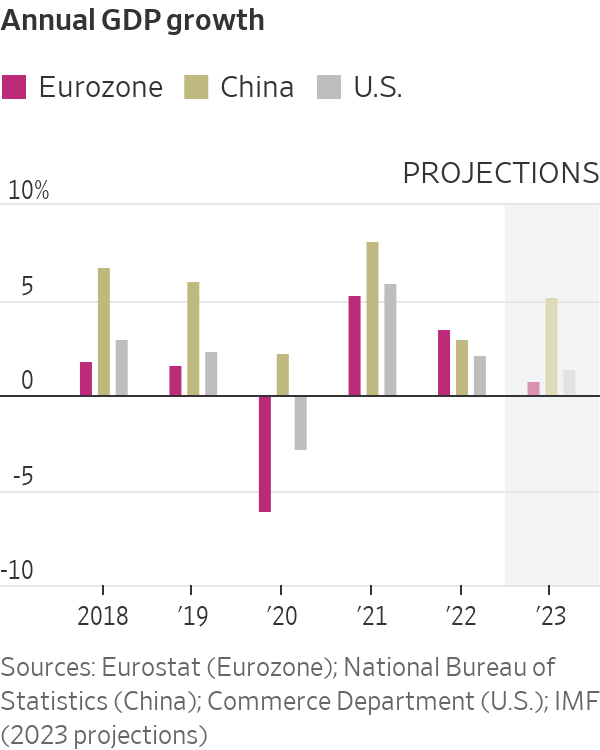

Figures released by the European Union’s statistics agency Tuesday showed the currency- area’s economy grew at an annualised rate of 0.5% as higher energy costs weighed on household spending. This translated into 3.5% growth in gross domestic product for 2022 as a whole, a faster rate than seen in either China or the U.S.

This is unusual. For decades, the big three engines of the global economy have had a pretty stable ranking: China grew fastest, followed by the U.S. and then the eurozone. This all changed last year because of the staggered manner in which major economies reopened in the wake of the pandemic.

Figures released Thursday showed the U.S. economy grew by 2.1% in 2022, a sharp slowdown from the 5.9% rate of expansion recorded in 2021. Earlier this month, China’s statistics agency released figures that showed the world’s second-largest economy grew by 3%, down from 8% the previous year.

The last time that the combined national economies that make up the eurozone grew at a faster pace than that of either China or the U.S. was in 1974. The U.S. economy has typically outpaced Europe’s over recent decades largely because its population has grown more quickly. More recently, the U.S. has led Europe in the development of fast-growing technology sectors.

Last year’s unusual growth ranking largely reflects the impact of the Covid-19 pandemic on the world economy, with the timing of lockdowns and re openings leading to big swings in growth, as well as high rates of inflation.

It is an effect that is unlikely to last. As China abandons its zero-Covid policy, it is likely to reclaim its position as the fastest-growing of the big three economic areas. And the war in Ukraine is having a bigger impact on the economy of Europe than that of the U.S. or China, as the slowdown in the last quarter of 2022 testifies.

“2022 was just a weird, weird year,” said European Central Bank President Christine Lagarde during a panel at the World Economic Forum’s annual meeting in Davos earlier this month. “Those are not normal numbers, this is not the usual ranking that you have.”

In the eurozone, the influence of the pandemic on the economy was so strong last year that it offset that of Russia’s invasion of Ukraine and the surge in energy prices it prompted.

While China experienced a series of lockdowns in pursuit of its zero-Covid policy, the eurozone enjoyed its first full year without tight restrictions, and a boost to activity that the U.S. had experienced a year earlier.

The big three economies locked down hard in 2020. But the U.S. reopened more fully from early 2021, outpacing the eurozone and China in the first three months of that year in particular. The eurozone’s reopening boost started later, and carried over into the first half of 2022 as its key tourism industry rebounded.

This year is likely to see the pandemic continue to have a big impact on growth—this time in China. The country lifted many of its zero-tolerance pandemic controls in early December in an abrupt change of course. While that led to an increase in Covid-19 infections and deaths, it also opened the door to a sharp economic rebound in the world’s second-largest economy.

For this year, the United Nations expects China’s economy to grow by 4.8%. It expects both the U.S. and the eurozone to slow, to 0.4% and 0.2% respectively. If it is correct, the normal growth ranking will be restored, although at lower-than-normal rates of growth. And from 2024, the pandemic’s impact is set to wane, unless a more deadly, rapidly-spreading coronavirus variant emerges.

“By 2024 we should be out of the woods,” said Hamid Rashid, head of the U.N.’s global economic monitoring unit. “We are still having the lingering impact of the pandemic in 2022 and 2023.”

High inflation rates, partly a legacy of the pandemic, are also expected to fade by 2024. Inflation rates began to surge in early 2021 as the reopening of the U.S. and other economies led to a surge in demand for goods and services at a time when global supply chains were still impaired.

According to a measure of supply-chain pressures compiled by the Federal Reserve Bank of New York, the blockages caused by the pandemic reached a peak at the end of 2021, and then eased steadily through the first nine months of last year. But that improvement in supply chains stalled in the final three months of 2022 as China imposed lockdowns to counter fresh outbreaks of Covid-19. Supply chains seem set to continue their slow return to prepandemic conditions in 2023 after the zero-tolerance strategy was abandoned.

Rates of inflation around the world appear to be easing, but it has taken unusually aggressive action by global central banks to get to that point. The Federal Reserve has raised interest rates by more than 4 percentage points since March, the largest move in a single year since 1980. The European Central Bank has moved at a slower pace, pushing up its policy rate by 2.5 percentage points starting in July, but that is the fastest increase since it was founded in 1998.

Both central banks are expected to raise their key interest rates this week, with the ECB likely to tighten more than the Fed. Further increases in borrowing costs will affect businesses and households not just in the U.S. and Europe, but around the world.

“The global effects are real, but they are not taken into account by the systemically important central banks,” said Mr. Rashid at the U.N., “it is harder for developing countries to borrow and invest.”

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.