Inflation Victory Is Proving Elusive, Challenging Central Banks and Markets

In the U.S. and Europe, underlying inflation has stopped falling or edged higher recently, weakening the case for rate cuts

Inflation is proving stickier than expected in the U.S. and Europe, creating a headache for central bankers and sowing doubts on whether investors are too optimistic about the world economy.

The decline in inflation from highs of around 9% to 10% across advanced economies in 2022 represent the easy gains, as supply-chain blockages eased and commodity prices, especially for energy, normalised.

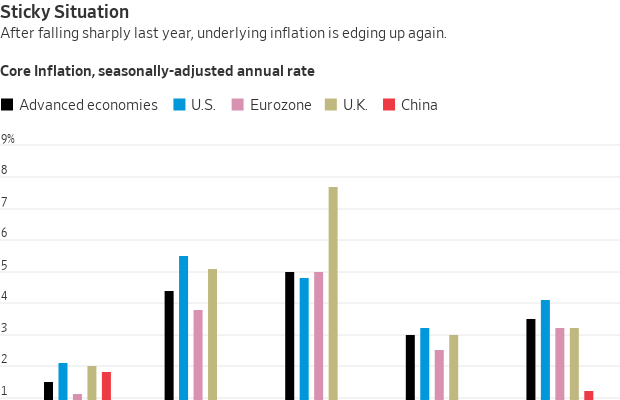

The “last mile” is proving tougher . Underlying inflation, which excludes volatile food and energy prices, slowed to 3% in the second half of last year across advanced economies but has since moved up to 3.5%, according to JP Morgan estimates.

That is forcing investors to rethink bets that inflation would steadily decline to central banks’ targets, generally around 2%. There are even concerns it could surge again, mirroring the second wave that characterised the high inflation of the 1970s.

Economists’ and central banks’ forecasts of sustained falling inflation depend on “strong gravitational forces that are not yet validated in global labor costs, short-term expectations, or in recent signals from commodity markets,” JP Morgan wrote in a note. Services inflation remains elevated while goods prices, which had fallen last year, are now moving higher, it noted.

Waiting on the last mile

Central bankers say they expected the last mile of falling inflation to be bumpy. Yet they are also signalling their willingness to wait before cutting interest rates. Fewer, or no, rate cuts would have sweeping repercussions for the global economy and markets, whose recent rally began after a narrow majority of Federal Reserve officials recently reaffirmed projections to cut interest rates three times this year.

On Friday, the U.S. Commerce Department reported that the price index of personal-consumption expenditures, the Fed’s preferred indicator of inflation, rose a relatively tame 2.5% in the 12 months through February, up modestly from 2.4% in January. Beneath the surface, the trend was less comforting. The index excluding food and energy climbed by 3.5% on an annualised basis in the three months through February, up from around 2% late last year.

“These shorter-term inflation measures are now telling me that progress has slowed and may have stalled,” Fed governor Christopher Waller said in a speech Thursday, before the latest inflation data.

“In my view, it is appropriate to reduce the overall number of rate cuts or push them further into the future,” Waller said.

Fed Chair Jerome Powell struck a more balanced note Friday, saying inflation is on a sometimes bumpy path toward 2%, and strong economic growth allows policymakers to wait. “Is progress on inflation going to slow for more than two months?…We’re just going to have to let the data tell us that,” Powell said in an interview at the San Francisco Fed.

Joachim Nagel , president of Germany’s Bundesbank and a member of the European Central Bank’s rate-setting committee said in late February that underlying inflation in the eurozone was still 2 percentage points higher than its 1999 to 2019 average.

“If we reduce interest rates too early or too sharply, we run the risk of missing our target,” and might need to raise interest rates again, he said. He highlighted a recent International Monetary Fund report that found four out of every 10 inflation shocks since the 1970s had yet to be overcome even after five years.

In Italy, underlying inflation climbed to 2.4% in March from 2.3% the previous month, according to data published Friday. French headline inflation cooled to 2.3% in March, but services prices remained sticky, rising by 3% from a year earlier.

Why is inflation proving stubborn?

Despite the sharp interest-rate increases of the past two years, economic growth is resilient, especially in the U.S. The Atlanta Fed said Friday its real-time indicator of first quarter U.S. economic growth ticked up to 2.3% from 2.1%. Consumer spending, adjusted for inflation, increased by around 5% on an annual basis in February, the Commerce Department said.

“The unexpected strength of real consumption” means “there is still no rush to cut interest rates,” said Paul Ashworth , an economist with Capital Economics.

While Europe’s growth has stalled since late 2022, recent business surveys suggest the outlook is brightening. Meanwhile, job creation has been strong on both sides of the Atlantic, and wage growth remains high, partly reflecting tight labor markets. Wages are an important input to services-price inflation in the eurozone, which has been running at a 4% annual rate since November.

March inflation data for the entire eurozone will be published on Wednesday. ECB officials have indicated they could start to cut interest rates in June from the current 4% level, while the subsequent pace of cuts after that is unclear.

Central banks may be part of the problem

Central banks themselves may be inadvertently adding to inflation pressure. By signalling a pivot toward interest-rate cuts last fall, they pushed global borrowing costs down and asset prices up, supporting spending.

Some factors favour inflation declining further. In both the U.S. and Europe, a surge of immigration could help keep a lid on wage increases.

The U.S.—but not Europe—is also seeing big increases in productivity, that is output per worker, which helps to offset high wage growth. It is unclear, however, how long that will last. The pandemic might have changed how Americans work and use technology, but “once we have made those changes, they’re done, so I don’t see this as a driver of sustained productivity growth,” the Fed’s Waller said.

Meanwhile, oil prices have risen recently, which could push up headline inflation.

To offset a slumping property market, China has dramatically boosted manufacturing capacity and exports, which have weighed on global goods inflation. But its export prices have recently started to increase, according to JP Morgan.

If central banks react to stubborn inflation by backing away from rate cuts, that would put pressure on both heavily indebted governments and employers. That could test central banks’ will to finish the last mile and push inflation all the way to target.

Higher government spending on defence and green energy, and geopolitical tensions that crimp global trade, are likely to pressure central banks to tolerate higher inflation over the coming years, according to a Brookings Institution paper published in March.

“A strengthening of central bank independence combined with a more credible public debt policy is likely needed,” said the paper, by economist Kenneth Rogoff of Harvard University and three co-authors.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.