The Complete Guide to Haggling in This Economy

From cars to hotels to medical bills, the cost of things we purchase every day is more negotiable than you might think. Here are strategies for asking for a discount.

Just thinking about haggling makes some people cringe. But things are way too expensive now to let an uncomfortable feeling stand in the way of a discount.

More is negotiable than you realise. Everything from your mortgage rate to your hotel room and medical bills is fair game. When you speak up, ask open-ended questions and do a little research, and you can save hundreds if not thousands of dollars.

To get in the right mind-set, think about what you might be able to offer the other party in your negotiation, perhaps in terms of future business. Humanise yourself (are you a poor student buying a present for Father’s Day?), practice with a script and always show respect, said Richard Shell, a professor at the Wharton School of the University of Pennsylvania who teaches negotiation.

Be strategic about timing. Getting the best deal for a car might be easier at the end of the month instead of the beginning if the salesperson has to meet a monthly quota.

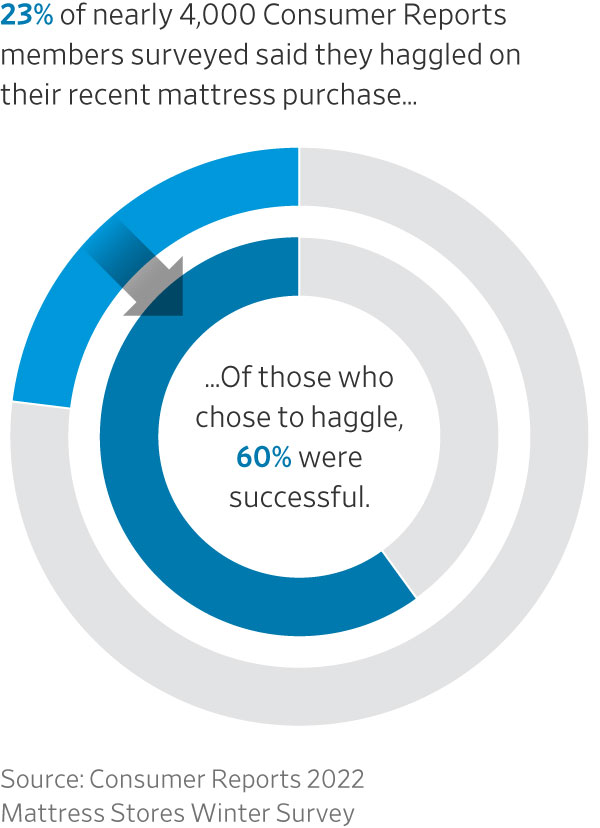

Haggling—an ancient practice among people in almost every culture—remains one of the best ways to save money. Take mattresses. Sixty percent of people who choose to haggle for a mattress succeeded—and saved a median of $245, according to a recent study by Consumer Reports.

Savvy shoppers such as Cameron Huddleston and her husband Alex Lebedinsky have been haggling for years, using a version of good cop, bad cop to score a deal.

When the Bowling Green, Ky., couple saw a $3,000 cream coloured sectional at a local home furnishing store, Lebedinsky said within earshot of the owner that it was nice but he didn’t want to spend that much money. Huddleston tried to “plead” her case (also so the owner would hear.) She said it was smart to invest in a high quality sofa that would last. But Lebedinsky wouldn’t budge.

Eventually, Huddleston asked the owner to help her out and the price came down quickly: $2,400.

“My husband is always my wingman when I buy furniture or anything expensive,” said Huddleston.

While it may not be possible to score a discount on everything (i.e. a grocery store clerk probably doesn’t have the authority to give you a better price on those eggs), it is viable in more places you would think, including big box stores that will often match a competitor’s advertised lower price.

“I tell people if they never hear no it means they haven’t been assertive enough,” said Linda Babcock, a professor at Carnegie Mellon University, who teaches negotiation.

Here are areas where you can haggle, rated on their return on haggling, or ROH. When it comes to haggling, there are only two questions to ask: How hard is this going to be and how much money can it save me? The ROH score is a number from one (it isn’t worth it) to 10 (you’re crazy not to try).

Each also has a degree of bargaining difficulty—beginner, intermediate and pro.

Hotels

ROH Score: 5 most of the time, 3 this summer (It doesn’t take much time, aside from possibly having to interact with the concierge desk. The savings may be slim, especially during peak summer season.)

Degree of difficulty: Beginner

You wake up early in the morning on your vacation for a quick run on the treadmill in the hotel gym, only to find it is closed for renovations. That letdown can provide an opening to save money on your getaway.

When checking out after your stay, examine the line items on your invoice. There is a decent chance you’ll spot a so-called resort fee, even if you’re not staying at a five-star, luxury resort. The fees are ostensibly meant to cover services and perks a resort may offer, such as wireless internet or cabanas by the pool, but are sometimes tacked on even at more run-of-the-mill hotels.

“We have seen this for a decade at some of the lowest-priced hotels,” says Lauren Wolfe, counsel at Travelers United, a consumer-advocacy group. These tacked-on charges aren’t always flagged as resort fees—at low-cost hotels, they are often labeled as “safe fees” for the use of the in-room safes.

These fees can add up: A January analysis of pricing at more than 100 U.S. hotels by personal-finance website NerdWallet found that the average resort fee was more than $42 per night, or about 11% of the nightly cost for a room at a hotel that charges such a fee.

But travellers don’t need to stomach such nickel-and-diming. Yes, you can ask hotel operators to remove these fees from your bill.

If a resort fee wasn’t advertised as part of the room rate at the time of booking, Wolfe suggests negotiating with the concierge during checkout to have the added charge removed. Be firm and polite, she says.

If the resort fee is tied to specific amenities—such as a gym or pool—and those were inaccessible during your stay, use that as a bargaining chip. Play nice, and know that your attempt to get the fee scrapped may not succeed. “Don’t get in a fight with the person working at the front desk—that person did not set the policy,” Wolfe warns.

There are other ways to get a deal on a hotel stay. Before you book your vacation, try to negotiate a lower daily rate for a hotel room.

Start off by researching the prices for hotels in your destination across a variety of online travel agencies, and then compare those rates to the ones on the hotels’ own websites. Once you identify a hotel you wish to stay at, you’re going to have to pick up the phone.

Ask the representative for their best available rate, and see if they can match the rates offered by other nearby properties. Travellers may find more success with smaller, boutique resorts than with larger properties. Also ask if they have discounts for members of programs like AAA or AARP.

If the representative can’t offer you a discount, the hotel may be able to offer free parking or complimentary meal vouchers for breakfast at the hotel’s restaurant, says Jamie Larounis, a travel industry analyst with loyalty and rewards website UpgradedPoints.com.

Then at check in, be sure to ask if there are any upgrades available. These may come at a higher price, so have a sense of what the room rates are at the hotel to know if you’re getting a deal or not. If you know that the property isn’t sold out, there may be bargaining room.

Cars

ROH Score: 8 (Salespeople expect you to negotiate so if you do your homework, you can save thousands.)

Degree of difficulty: Intermediate

Preparing to haggle over a car purchase is enough to make your palms sweat and stomach turn. It also presents an opportunity to cut a deal on one of the most expensive purchases you’ll likely ever make.

Jay Austin is accustomed to negotiating as a former vice president in supply chain for a chemical company. Still, he used to dread trudging into a dealership to buy a car a decade ago.

“Let’s get our game face on,” the Medina, Ohio, resident would say to his wife as they rehearsed how they’d respond to different dealer tactics.

The state of haggling in the auto industry looks much different now. Shoppers can lay most of the deal-making groundwork even before coming face-to-face with a salesperson, comparing vehicle prices online and pitting offers against each other.

When Austin decided to sell his Lincoln MKC a couple of years ago, he surveyed online car retailers like Carvana and got $5,000 more than what his dealer offered him.

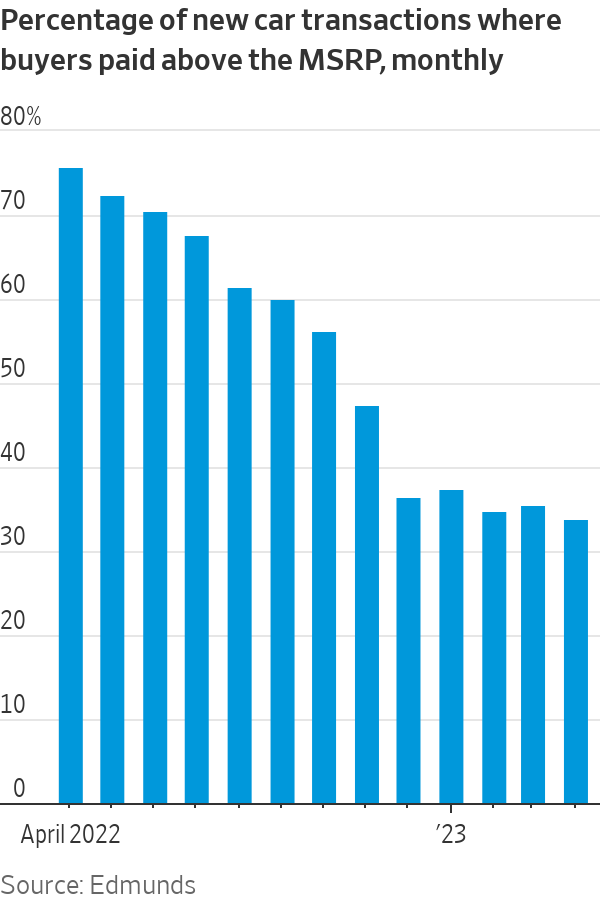

While there is more information at shoppers’ fingertips now, the car market is trickier to navigate. An inventory crunch sent vehicle prices flying, and buyers routinely paid hundreds of dollars over listed prices last year, according to Edmunds, a car-buying research firm. Pre pandemic, the average transaction price for a set of wheels was typically $2,000 or more below sticker price.

Still, haggling isn’t out of the question. One of the keys to having the upper hand now is to be flexible in what type of vehicle you’re willing to buy, say dealers and car brokers. If you’re hoping to get an “Arctic White” Corvette, and won’t settle for any other colour, be prepared to wait, and pay more.

Dealers have strategies to keep the customer paying a premium. For example, it isn’t wise to immediately tell a dealer you’re planning on trading in your vehicle. They can lowball you on its value, a practice called “stealing the trade,” said Earl Stewart, who owns a Toyota dealership in Florida. When you finalise the terms of your sale, you can alert the dealer that you would actually like to trade in for another vehicle, he said.

When shopping around for different offers, you can even go incognito by using a fake email or phone number, Stewart said. This will keep incessant follow-up calls from salespeople at bay.

Most of all, keep your cool if you’re trying to negotiate the price of a car down, he said.

“One of the mistakes that people make is they show up to the dealership kind of with the boxing gloves on ready to go to battle,” said Tom McParland, who runs a consulting business where he assists customers with the car-buying process. If you start acting rudely to a salesperson, you can probably kiss a good bargain goodbye.

Some buyers got creative during the pandemic in their pursuit of a deal, including flying across the country to snag a reasonably priced set of wheels. One buyer even created a haggling tipsheet, including a last-ditch measure: bring your grandma to the dealership to cry.

Home mortgages

ROH Score: 7 (It can feel awkward to ask a zillion questions to parse the terms of a mortgage loan, but you could score tens of thousands of dollars in savings over decades by landing a lower rate.)

Degree of difficulty: Intermediate

If you’re shopping for something complex, say a mortgage, beware of the human tendency to go on autopilot and accept the first price you’re offered, said Samantha Lamas, senior behavioural researcher at fund-research firm Morningstar.

Lenders may be counting on you to choose the easiest route because you feel overwhelmed, she said.

But here’s a reminder: Shopping around is haggling and pays off.

Borrowers who applied with two different lenders reduced their mortgage rate by an average of 0.10 percentage point, according to research from Freddie Mac that examined purchases between 2010 and 2021.

Take a $450,000 home price where the buyer puts 20% down and is looking at current mortgage rates ranging from 6.5% to about 7.5%. Over 30 years, the difference between 6.5% and 7.5% could add up to roughly $87,000 savings in interest, said Ted Rossman, a consumer-spending analyst at Bankrate.

Lenders are far more willing to work with borrowers these days. For one, they aren’t as busy as they used to be. Mortgage underwriting has slowed to a crawl in recent months as rates are keeping many prospective home buyers on the sidelines.

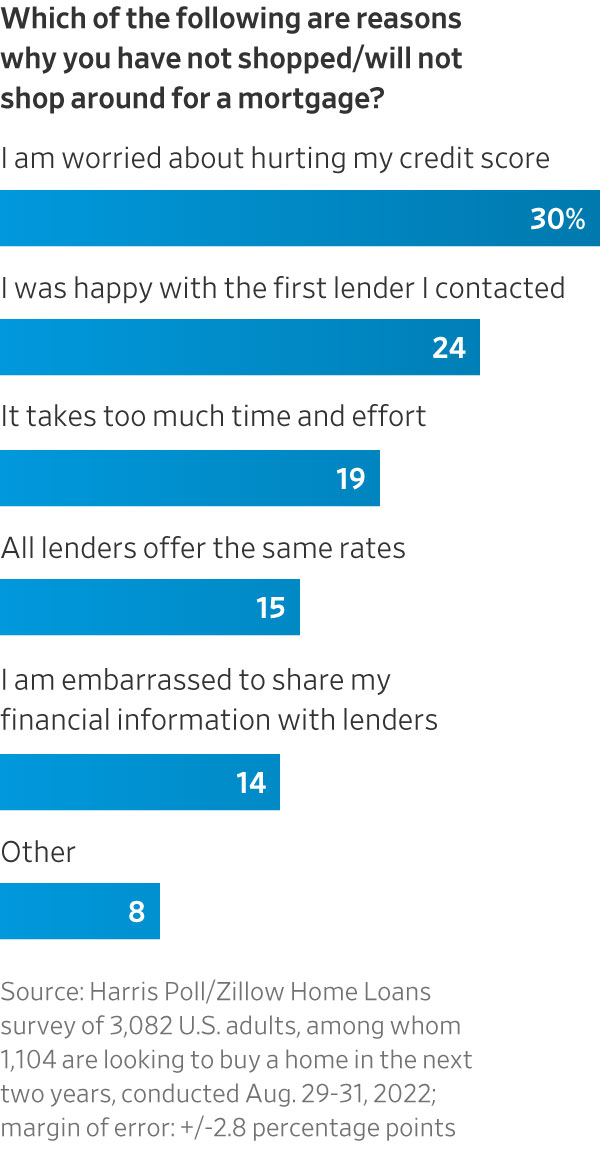

There are some guidelines. Don’t take a lenders’ first offer. Instead, compare offers from three to five lenders including a credit union, financial advisers say. Don’t let misconceptions or technical financial language hold you back either.

Doing this homework puts you ahead in seeking a loan. Most mortgage shoppers don’t bother to ask around for a lower rate, studies show.

It is also important to understand how mortgage inquiries affect your credit score. Lenders pull borrower’s credit reports, or make what’s called hard inquiries, before they decide if they’ll give you a mortgage. A hard inquiry usually dings your credit score by a few points, said Aniva Hinduja, general manager of home and mortgage at Credit Karma. All mortgage credit inquiries within a 45-day window count as one inquiry so, shop within this period to minimise how much your score will fall, said Bill Banfield, executive vice president of capital markets for Rocket Mortgage.

Once you compare terms such as the loan’s annual percentage rate and monthly mortgage payment, narrow down your list of possible lenders to two or three. Feel free to play one lender against another as you decide which loan is ultimately best for your financial situation.

Cellphone and internet

ROH SCORE: 5 (It is just a few phone calls, but also just a few hundred dollars a year in savings, most likely.)

Degree of difficulty: Beginner

The end of your wireless or internet bill contract means you’re free to change providers. It also means you’re ripe with fresh haggling power.

Companies may be more willing to dish out their best offerings to convince you to stick around.

Start by familiarising yourself with your plan. Salespeople often sell the priciest option, so there is a chance you’re already paying for a bunch of features you don’t need. You should also know competing service providers’ plan offerings, even if you want to stick with your current provider.

Now for the hard part: Picking up the phone. Don’t waste your time chatting with the general customer-service line. Ask to speak to the retention department (where trained specialists are better prepared to get you a sweeter deal) and mention that you’re thinking of switching providers.

“It’s the threat of canceling the service that gets us the most amount of money,” says Brian Keaney, chief operating officer at Billshark, a company that helps customers negotiate monthly bills.

Pat yourself on the back for making it this far, because it should get easier from here—you shouldn’t have to say much more. Industry executives suggest you say that you want to pay as little as possible, ask what they can do for you and listen. If they give you an offer, politely ask if there is more they can do.

Heads up: Wireless carriers won’t change the price of your plan. But! They could upgrade you to a better one—potentially one that isn’t advertised—or shave off pesky add-ons you don’t want. Even if you have a bare-bones plan, they could still give you loyalty credits to bring the cost down for a while.

If you do get one of those credits, check your bill and make sure it gets added. It can take two to three billing cycles to show up on your statement, Keaney said. Find out if your new plan or credit runs for a limited amount of time, like a year or two. If so, mark your calendar so you know to renegotiate the deal before the price increases again.

Some executives recommend mentioning life events such as a birth or job loss to unlock certain discounts if true, but only toward the end of the call after you’ve gained other offerings. Otherwise, the representative may be inclined to only give discounts that help in the short-term.

If you feel like you’re not getting anywhere with the representative you’re speaking to, politely let them know that you’ll call back later. (You can scream into the void after you hang up.) Every representative is different and you could get matched with someone who is more willing to help you out next time. Be patient, pick up the phone and repeat the previous steps.

Medical bills

ROH Score: 8 (It is a massive headache to negotiate payments when you’re dealing with a health crisis, but lower cost of treatments can save you thousands.)

Degree of difficulty: Pro

In 2010, Amanda Grossman was speechless when a receptionist requested a higher-than-expected $75 dental copay. She didn’t yell or scream. The shock and confused look on her face must have said it all. Seconds later, the receptionist said $50 would be acceptable.

“I thought, ‘Oh My Gosh. There’s wiggle room,’” says Grossman, 40, a certified financial education instructor.

Now emboldened, Grossman regularly questions medical charges, requests discounts and cheaper prescriptions. To her surprise and relief, she discovered that doctors who don’t accept her health insurance are sometimes willing to lower costs.

For example, her son sees a specialist who doesn’t accept the family’s health insurance. Grossman asked if the specialist would lower the per-visit cost, which the specialist did—to $150 from $200. Then, Grossman submitted a claim to her insurance company, which covered $97 for each $150 visit.

It also helps, she says, to ask for itemised bills to spot potential overcharges or errors. She recalls going to the hospital on a pregnancy-related visit seven years ago and seeing a $200 copay charge on her itemised bill for the emergency room, even though she never went to the emergency room. The charge was dropped after she called.

Nearly half of adults who received a medical or dental bill that they thought contained an error successfully resolved the disputed bill with their medical care provider or insurer, according to a 2022 healthcare debt survey from the Kaiser Family Foundation, a nonprofit organisation that focuses on health care issues.

With a few questions, prescription costs can be reduced or avoided as well.

Grossman’s husband, Paul Peacock, was prescribed a $400 medication from his dermatologist. She suggested he call his doctor, say $400 was too much for them, and ask if there was a cheaper alternative. He did and there was. His new prescription costs $168.

Grossman isn’t afraid to ask for price breaks in other parts of their lives as well. When the couple needed the HVAC replaced, the contractor handed them a bill for $7,600.

“Is there anything else you can do for us?” she asked. He gave one glance to his partner, she recalls, and responded “How about if we lop off $400?”

“Yes, let’s do that,” she responded.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.