China’s Housing Market Woes Deepen Despite Stimulus

Home prices declined at a faster pace in May in major cities, while other data show a mixed picture for the world’s second-largest economy

China’s broken housing market isn’t responding to some of the country’s boldest stimulus measures to date—at least not yet.

The Chinese government has been stepping up support for housing and other industries in recent months as it tries to revitalise an economy that has continued to disappoint since the early days of the pandemic.

But fresh data for May showed that businesses and consumers remain cautious. Home prices continue to fall at an accelerating rate, and fixed-asset investment and industrial production, while growing, lost some momentum.

“China’s May economic data suggest that policymakers have a lot to do to sustain the fragile recovery,” Yao Wei, chief China economist at Société Générale, wrote in a client note on Monday.

The worst pain is in the property sector, which has been struggling to deal with oversupply and weak buyer sentiment since 2021, when a multiyear housing boom ended . The market still doesn’t appear to have found a floor, even after Beijing rolled out its most aggressive stimulus measures so far in mid-May in hopes of restoring confidence.

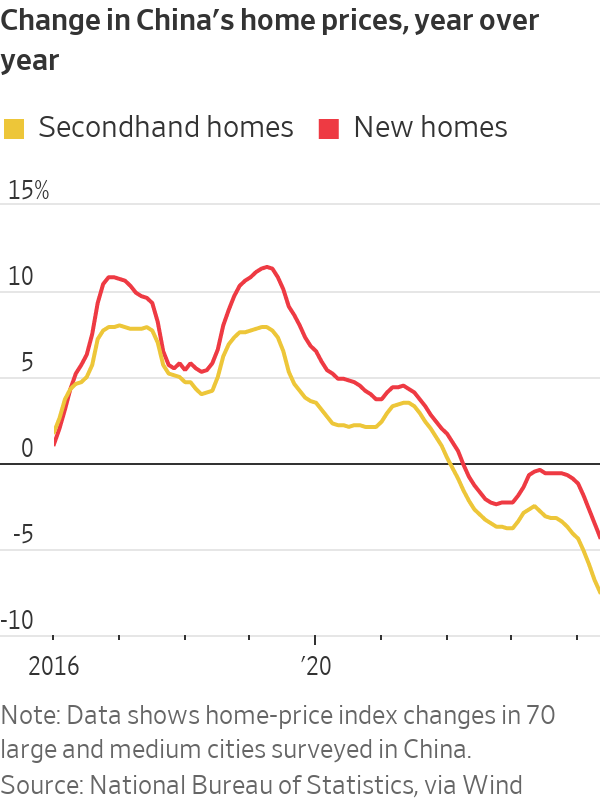

In major cities, new-home prices fell 4.3% in May compared with a year earlier, worse than a 3.5% decline in April, according to data released Monday by China’s National Bureau of Statistics. Prices in China’s secondhand home market tumbled 7.5%, compared with a 6.8% drop in April.

Home sales by value tumbled 30.5% in the first five months of this year compared with the same months last year.

“This data was certainly on the disappointing side and may ring some alarm bells, as May’s policy support package has not yet translated to a slower decline of housing prices, let alone a stabilisation,” said Lynn Song, chief China economist at ING.

Economists had also been hoping to see a wider recovery this month after Beijing started rolling out a planned issuance of 1 trillion yuan, the equivalent of $138 billion, in ultra-long sovereign bonds in May. The funds are designed to help pay for infrastructure and property projects backed by the authorities. Investors gobbled up the first batch of these bonds.

Monday’s bundle of economic data, however, underlined how the country still isn’t firing on all cylinders.

Retail sales, a key metric of consumer spending, rose 3.7% in May from a year earlier, compared with 2.3% in April, according to the National Bureau of Statistics. While the trend is heading in the right direction, it is still a relatively subdued level of growth, and below what most economists believe is needed to kick-start a major revival in consumer spending.

The expansion in industrial production—5.6% in May compared with a year earlier—was down from April’s 6.7% increase. Fixed-asset investment growth, of which 40% came from property and infrastructure sectors, also decelerated, to 3.5% year-over-year growth in May from 3.6% in April.

Key to the sluggish economic activity data in May—and China’s outlook going forward—is the crisis in the property market, which has proven hard for policymakers to address.

The property rescue package in May included letting local governments buy up unsold homes, removing minimum interest rates on mortgages, and reducing payments for potential home buyers. It also included as its centrepiece a $41 billion so-called re-lending program launched by the People’s Bank of China, which would provide funding to Chinese banks to support home purchases by state-owned firms.

The hope was that by stepping in as a buyer of last resort for millions of properties, the government would manage to mop up unsold housing inventory and persuade wary home buyers to re-enter the market. In turn, Chinese consumers, who have most of their wealth tied up in real estate, would feel more confident about spending again, thereby lifting the overall economy.

But the size of the re-lending program wasn’t big enough to convince home buyers, said Larry Hu , chief China economist at Macquarie Group. “Meanwhile, their income outlook also stays weak given the current economic condition,” he said.

For the property market to bottom out and reach a new equilibrium, mortgage rates, which stand at around 3-4% in China, need to be as low as rental yields, which are currently below 2% in major cities, said Zhaopeng Xing, a senior China strategist at ANZ. He said that a large mortgage rate cut will need to happen eventually.

The other key part of China’s push to revive growth revolves around the manufacturing sector, with leaders funnelling more investment into factories to boost output and reduce the country’s reliance on foreign suppliers of key technologies.

The result has been a surge in production. But with domestic consumption not strong enough to absorb all those goods, many factories have been forced to cut prices and seek out more overseas buyers.

Data released earlier this month showed that Chinese exports rose faster in May than the month before.

However, the export push is butting into resistance as governments around the world worry about the impact of cheap Chinese competition on domestic jobs and industries. The European Union last week said it would impose new import tariffs on Chinese electric vehicles, describing China’s auto industry as heavily subsidised by the government, to the point where other countries’ automakers can’t fairly compete.

The U.S. has also hit Chinese cars and some other products with hefty duties, while countries including Brazil, India and Turkey have opened antidumping investigations into Chinese steel, chemicals and other goods.

Beijing says such moves are protectionist and that its industries compete fairly with global rivals.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

A Sydney site with a questionable past is reborn as a luxe residential environment ideal for indulging in dining out

Long-term Sydney residents always had handful of not-so-glamourous nicknames for the building on the corner of Cleveland and Baptist Streets straddling Redfern and Surry Hills, but after a modern rebirth that’s all changed.

Once known as “Murder Mall” or “Methadone Mall”, the 1960s-built Surry Hills Shopping Centre was a magnet for colourful characters and questionable behaviour. Today, however, a $500 million facelift of the site — alongside a slow and steady gentrification of the two neighbouring suburbs — the prime corner property has been transformed into a luxury apartment complex Surry Hills Village by developer Toga Group.

The crowning feature of the 122-apartment project is the three-bedroom penthouse, fully completed and just released to market with a $7.5 million price guide.

Measuring 211sqm of internal space, with a 136sqm terrace complete with landscaping, the penthouse is the brand new brainchild of Surry Hills local Adam Haddow, director of architecture at award-winning firm SJB.

Victoria Judge, senior associate and co-interior design lead at SJB says Surry Hills Village sets a new residential benchmark for the southern end of Surry Hills.

“The residential offering is well-appointed, confident, luxe and bohemian. Smart enough to know what makes good living, and cool enough to hold its own amongst design-centric Surry Hills.”

Allan Vidor, managing director of Toga Group, adds that the penthouse is the quintessential jewel in the crown of Surry Hills Village.

“Bringing together a distinct design that draws on the beauty and vibrancy of Sydney; grand spaces and the finest finishes across a significant footprint, located only a stone’s throw away from the exciting cultural hub of Crown St and Surry Hills.”

Created to maximise views of the city skyline and parkland, the top floor apartment has a practical layout including a wide private lobby leading to the main living room, a sleek kitchen featuring Pietra Verde marble and a concealed butler’s pantry Sub-Zero Wolf appliances, full-height Aspen elm joinery panels hiding storage throughout, flamed Saville stone flooring, a powder room, and two car spaces with a personal EV.

All three bedrooms have large wardrobes and ensuites with bathrooms fittings such as freestanding baths, artisan penny tiles, emerald marble surfaces and brushed-nickel accents.

Additional features of the entertainer’s home include leather-bound joinery doors opening to a full wet bar with Sub-Zero wine fridge and Sub-Zero Wolf barbecue.

The Surry Hills Village precinct will open in stages until autumn next year and once complete, Wunderlich Lane will be home to a collection of 25 restaurants and bars plus wellness and boutique retail. The EVE Hotel Sydney will open later in 2024, offering guests an immersive experience in the precinct’s art, culture, and culinary offerings.

The Surry Hills Village penthouse on Baptist is now finished and ready to move into with marketing through Toga Group and inquiries to 1800 554 556.

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.