The Stock Market’s Magnificent Seven Is Now the Fab Four

It is a bullish signal that the market is rallying without the likes of Apple and Tesla, some investors say

The Magnificent Seven trade is beginning to fizzle—and yet, the stock market is still heading higher.

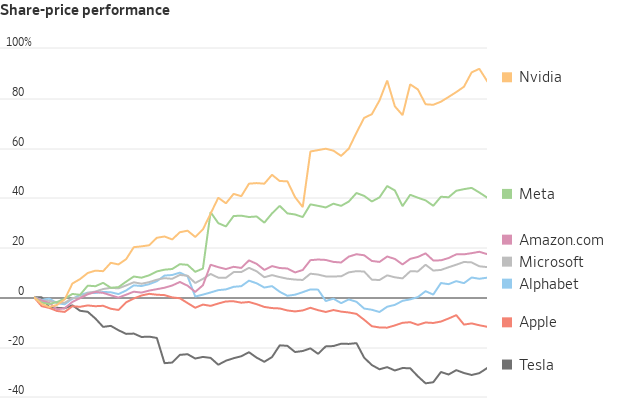

The S&P 500 climbed 10% in the first quarter, its best start to a year since 2019 , even though two of its biggest constituents suffered double-digit declines. Apple shares fell 11% in the first three months of the year, while Tesla dropped almost 30%. Alphabet shares sputtered for much of the period before making a run in the past three weeks and ending up 8%.

The other four big tech stocks in the group known as the Magnificent Seven— Nvidia , Meta Platforms , Microsoft , Amazon.com —continued their meteoric run and outpaced the broader market. Some market strategists have dubbed them the new Fab Four.

Some investors say it is a bullish signal that the market is still rallying without the likes of Apple and Tesla because it means other groups are taking part . All of the S&P 500’s sectors, except real estate, logged gains in the first quarter. Small caps, industrial and financial-services stocks are among those that jumped, fueling bets that the broader market might have more room to run.

Much of the enthusiasm is tied to hopes that the economy has escaped a deep recession and that the Federal Reserve will soon pivot to cutting interest rates , even if not at the pace some investors had previously hoped. A frenzy over the future of artificial intelligence has added to the zeal.

“If you’d have told me eight weeks ago that Apple and Tesla would be down as much as they are, oh and by the way, you’re punting when you’re going to do the rate cuts and you’re getting less rate cuts, I would have assumed the market would be down,” said Ryan Detrick , chief market strategist at Carson Group.

To be sure, some investors worry the divergence in the big tech stocks is a sign of exhaustion in the rally and question whether future gains will be harder to achieve from here. The S&P 500’s market value has swelled more than $9 trillion since late October, and the index has set 22 record closes in 2024.

In the coming days, investors trying to gauge the trajectory of the market and economy will parse the release of U.S. manufacturing data Monday and the monthly jobs report Friday.

Nvidia continues to be a stock-market star. The graphics-chip maker has indicated demand for the computing power that underlies AI remains astronomical . Its shares have jumped more than 80% to start the year, after more than tripling in 2023.

By some metrics, Nvidia has displaced Tesla as the most popular stock among individual investors . It is currently the biggest average holding in individual investors’ portfolios, at about 9%, VandaTrack data show.

Meta shares, meanwhile, have soared partly thanks to Meta’s investments in artificial intelligence that have made targeted ads smarter. The social-media company recently said it would pay its first shareholder dividend. Microsoft stole the crown of biggest U.S. company from Apple earlier this year, with a valuation that topped $3 trillion, and Amazon has sharply improved its profitability.

Despite their recent gains, some of the stocks look less pricey than they did last year. Nvidia is trading at 35 times its projected earnings over the next 12 months, below its peak of 62 in May of last year. Amazon’s multiple is 40, down from 2023’s high of 62. The S&P 500 is trading at 21 times future earnings, slightly up from last year’s highs of 19.

The Fab Four are responsible for nearly half of the S&P 500’s first-quarter advance, according to Howard Silverblatt , senior index analyst at S&P Dow Jones Indices.

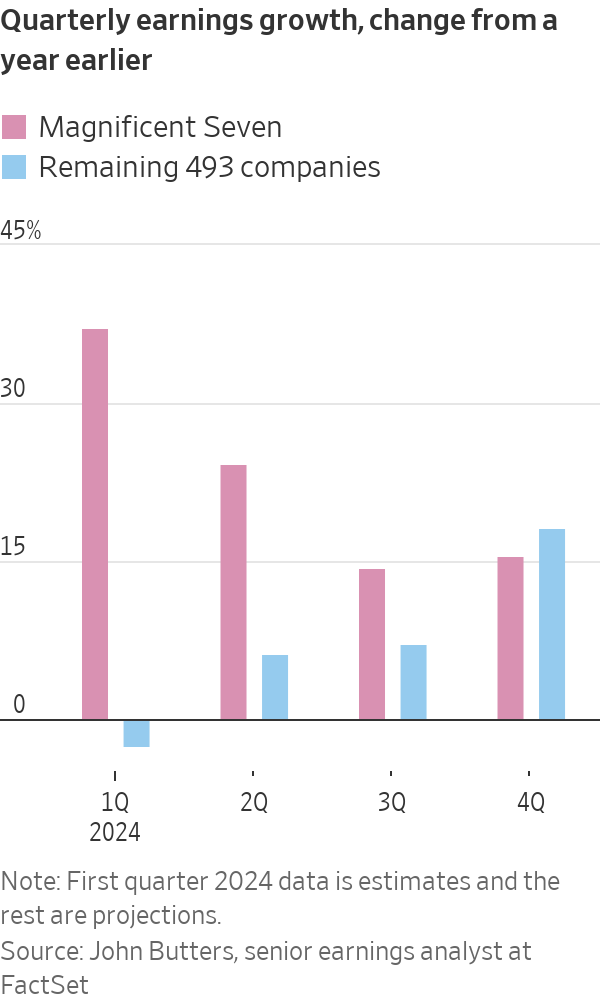

Joseph Ferrara , investment strategist at Gateway Investment Advisers, said he expects investors to rotate out of big tech stocks and funnel into other sectors as the year progresses. That is largely because the earnings of the other 493 companies in the index are expected to outperform those of the Magnificent Seven by the fourth quarter.

“The fact that the market is still holding these levels and trading up without that full force of the Magnificent Seven is actually a really positive thing,” he said.

Jonathan Golub , a strategist at UBS, said one reason Magnificent Seven’s earnings dominance could end is because it will be hard to top the explosive growth they posted at the end of last year. Those results looked like blockbuster beats when compared with 2022’s weaker numbers, he said in a recent research note.

Last year, any hint of weakness in the Magnificent Seven would have sent the broader market tumbling. In fact, for much of the year, those seven stocks were responsible for all of the S&P 500’s advance.

This year is a different story. Tesla is struggling on numerous fronts. The electric-vehicle maker is facing pressure from Chinese competitors, which have rapidly expanded their presence around the globe in recent years. It has also warned of notably slower growth in 2024, and its profit margins have taken a hit.

Apple’s woes have been mounting, too . The Justice Department recently sued the company, accusing it of monopolistic behaviour. European authorities are cracking down on its app store. Plus, it is facing another weak iPhone demand cycle, and investors are worried that Apple is behind in the current wave of excitement around AI.

Bespoke Investment Group data show Apple shares underperformed the S&P 500 over the 200 days through Tuesday by the widest margin since October 2013.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.