The Three Big Transitions Reshaping Finance

Three phenomena have exploded since COVID: digital assets, Robinhood, and SPACs.

Ever since Covid disrupted our lives, two themes have emerged. First, a feeling that we are living in an antechamber to a new and still-undefined era. And second, a pattern of hybrids, from homes converted into hybrid spaces of living/working/schooling, to expectations of a new office hybrid that will mix virtual and in-person meetings.

But what about the world of finance and securities markets? There, too, we can find patterns of transition and hybrids. Consider three phenomena that began before Covid but have exploded in growth since then: digital assets, Robinhood, and SPACs.

Start with the rise of cryptocurrencies, digital tokens and other such assets, which remain very much in a transitory stage (like the “Wild West,” SEC Chairman Gary Gensler recently observed). Even as the crypto asset class has grown to an estimated $1.6 trillion, basic questions remain unanswered. Are digital tokens securities or commodities? Are decentralized finance platforms really securities exchanges? Are data miners and other digital service providers really broker-dealers? Should the SEC permit Bitcoin ETFs? And who should regulate these products, services and entities—the SEC, the CFTC, or banking regulators?

Gensler has called on Congress to give the SEC “additional authorities to prevent transactions, products, and platforms from falling between regulatory cracks.” Specifically, he wants “additional plenary authority to write rules for and attach guardrails to crypto trading and lending.” And the U.S. House has passed a bill (H.R. 1602, the Eliminate Barriers to Innovation Act of 2021), which would require the SEC and CFTC to establish a working group on digital assets.

Some of what passes as crypto innovations pretty clearly seems to be old-fashioned investment products dressed up in digital garb. That would include any stablecoins that function like money market funds and those tokens that fall within the definition of a security. Nonetheless, there is no denying that crypto mixes digital technology with traditional forms of finance in a hybrid of innovation.

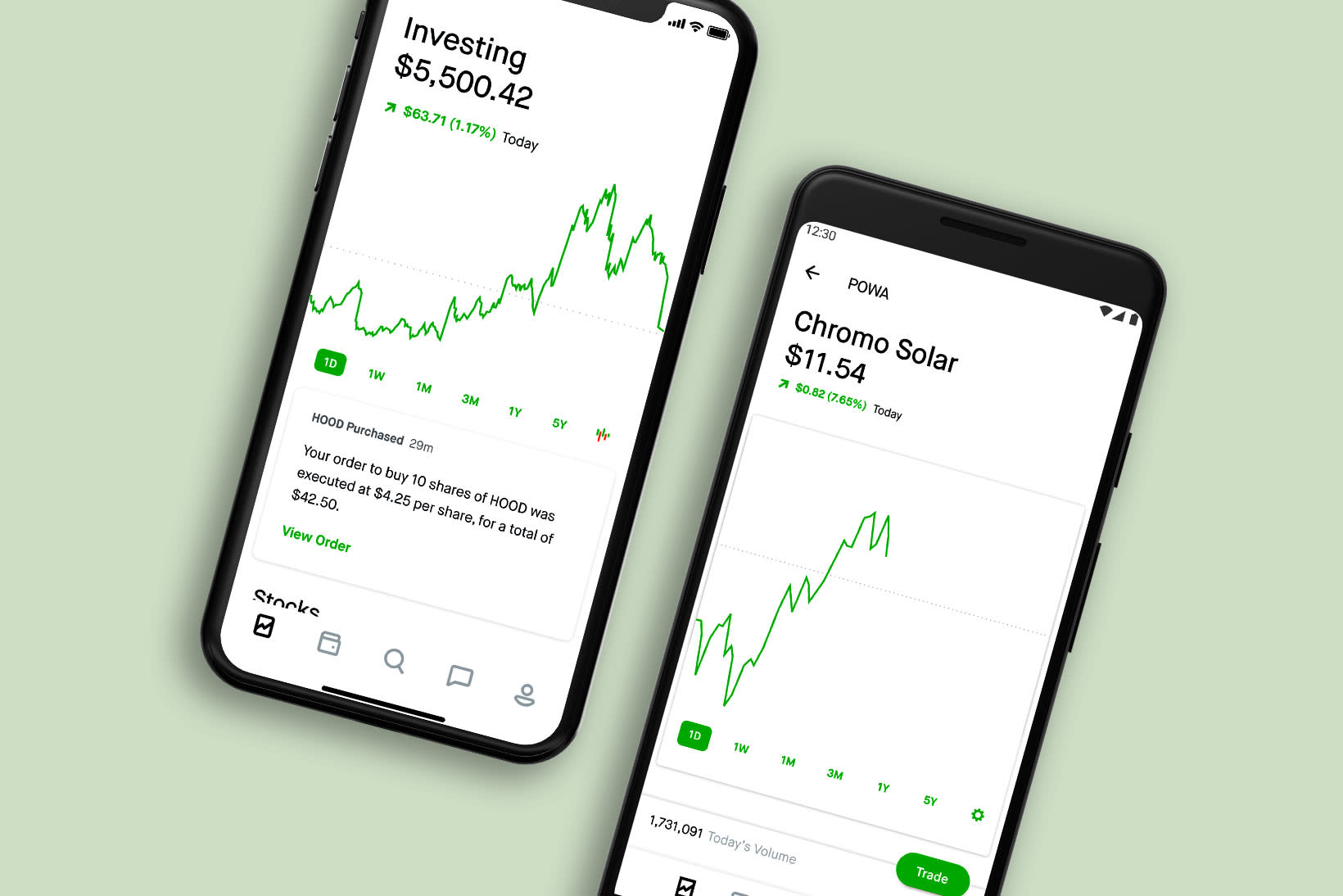

Second, consider Robinhood, which has exploded into view along with Redditor-fueled moonshot trades in meme stocks. Its proclaimed mission “to democratise finance for all” may invite skepticism, but the company can make a strong claim to having attracted a surge of first-time retail investors, representing a younger and more ethnically diverse customer base. Powering that success is Robinhood’s sleek mobile app—and its arsenal of gamification tools to entice and engage customers. But do the nudges and gamification tools cross the line into the realm of investment advice?

“Once individuals become customers, Robinhood relentlessly bombards them with a number of strategies designed to encourage and incentivize continuous and repeated engagement with this application,” the Massachusetts state securities regulator alleges in a lawsuit against Robinhood. The complaint points to several such techniques, from celebrating customer trades with confetti (a practice Robinhood has since abandoned) to plying customers with lists of most-traded and most-popular securities on its platform.

Should practices like these be subject to the fiduciary standard of an investment adviser? Or to the new Best Interest standard for broker-dealers? Robinhood has called the regulator elitist and says it isn’t making recommendations. Whatever the outcome of the lawsuit, these gamification techniques make Robinhood appear different in kind from the (boring?) practices of traditional broker-dealers that merely execute customers’ trades. The gamification of mobile trading apps may represent a hybrid between standard broker-dealer practices and full-fledged investment advice.

Third, consider SPACs, which have been around since 2003 but have exploded in popularity in the Covid era. In a hugely successful marketing campaign, SPACs have presented themselves as a kind of poor man’s private equity. If true, that would make SPACs a hybrid between private investment opportunities and public markets.

The deSPAC merger—the key event in the life of a SPAC—is also a hybrid. This is when the SPAC merges with a private operating company, allowing the target to become a public company without going through an IPO. Or is the merger itself really an IPO?

That’s precisely the question raised by John Coates, a Harvard Law professor who has become a top SEC official. In a provocative speech on April 8, Coates argued that the deSPAC merger is an initial public offering, because it is the first time the private operating company is introduced to the public. One speech, however, does not make SEC policy. And Coates’ theory remains untested in court. Nonetheless, it suggests how the deSPAC merger can be considered a hybrid between traditional forms of IPO and merger transactions.

At a House Financial Services subcommittee hearing on May 24, Michael San Nicolas, Guam’s delegate, asked how a SPAC differed from a closed-end equity (mutual) fund. The question may have seemed arcane at the time, but in retrospect it appears to have foreshadowed a series of blockbuster lawsuits against SPACs. Former SEC Commissioner Robert J. Jackson, Jr. and Yale Law Professor John Morley have joined in a lawsuit against Bill Ackman’s SPAC, Pershing Square Tontine Holdings Ltd. (ticker: PSTH), which raised $4 billion to become the single largest SPAC, and followed up with suits against two other SPACs, GO Acquisition Corp. and E.Merge Technology. The suits allege that the SPACs are really investment companies, like mutual funds and ETFs, because they invest in securities while searching for a merger partner.

“Under the [Investment Company Act of 1940], an Investment Company is an entity whose primary business is investing in securities,” the lawsuit against PSTH argues. “And investing in securities is basically the only thing that PSTH has ever done.”

Ackman says the suit against his SPAC is meritless, but warns, “Because the basic issues raised here apply to every SPAC, a successful claim would imply that every SPAC may also be an illegal investment company.” The suit suggests one more way that SPACs could be considered a hybrid—a cross between an investment company (like a mutual fund) and a publicly traded company.

One wonders how we will look back on these market developments a decade from now. Will SPACs, cryptoassets, and mobile trading apps be seen as hybrids that emerged in the antechamber we are living in now?

Reprinted by permission of Barron’s. Copyright 2021 Dow Jones & Company. Inc. All Rights Reserved Worldwide. Original date of publication: September 2, 2021.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.