Toy Shoppers Come Down With a Case of the Holiday Blahs

Sales of toys and games slump as Americans show signs of pulling back

Shoppers couldn’t get enough toys and games during the pandemic. Now, they are finding other ways to spend their time, and that is spelling trouble for toy makers and sellers.

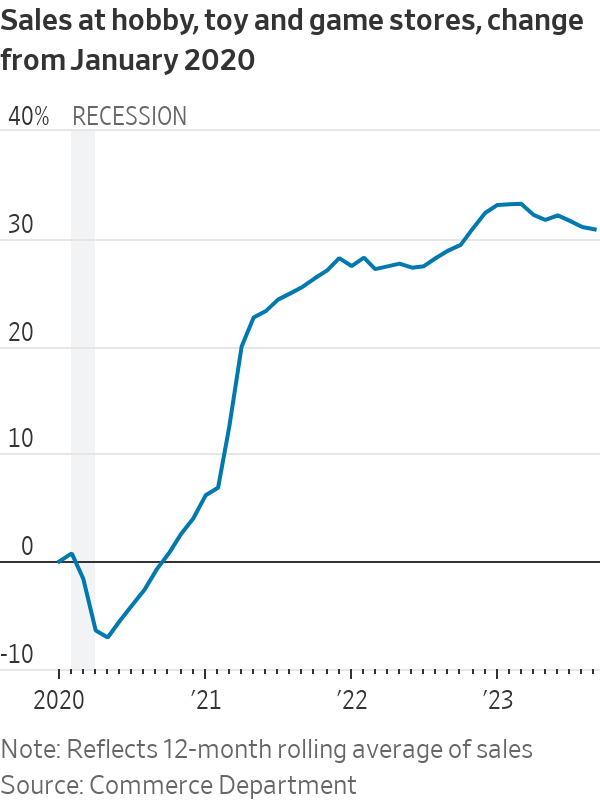

Sales of toys have slumped so far this year, down 8% through September compared with the same period last year, according to market-research firm Circana, and appeared poised to be lacklustre this holiday season. Imports of toys and games have fallen sharply this year and sales at toy stores, department stores and other gift sellers declined in October, leading a broader pullback.

A retrenchment on the most fun-to-give gifts sends a signal that Americans are starting to ease their spending more broadly as pandemic savings dwindle, the labor market softens and shoppers worry about global events and still-elevated inflation. Easing consumer spending would cool overall growth, because it accounts for more than two-thirds of economic activity.

This holiday season is off to a slow start for Wildlings Toy Boutique in Phoenix, which sells classic toys dollhouses and wooden cars and accessories. The store has been trying to drum up customer interest with experiences, including Santa visits and family photo shoots in front of a Christmas-tree backdrop outside the store.

“I think people are reluctant to spend as much and to spend as early,” said owner Jennifer Mawcinitt, who expects people to come in looking for deals on Black Friday.

Larger retailers are seeing similar trends.

Customers are “showing ongoing discretion and making trade-offs to be able to afford the things they want, given the sustained high cost of the things they need,” Walmart Chief Financial Officer John David Rainey told analysts last week.

Experiences valued over things

Early in the pandemic, when many were unable to travel and dine out, Americans shifted their spending toward goods, including toys, games and electronics. That has reversed.

Spending on services has grown roughly double the pace of goods for most of this year as consumers caught up on experiences such as concerts and trips to Europe.

Fewer board games and puzzles are coming off toy store shelves because “people are going outside,” said Katherine Nguyen, owner of Building Blocks Toy Stores, which has three locations in Chicago.

Nguyen is seeing an exception: Shoppers can’t wait to get their hands on toys they can squeeze, such as the Bitzee digital pet and Squishable plush toys. “I don’t have a store big enough to sell” all the stuffed animals now in demand, Nguyen said. She added that those toys are popular in part because they are geared toward social and emotional self-care as children navigate post pandemic life.

Hannah Sweet, a retired care manager in Tiburon, Calif., said she is more cautious about spending this holiday season than in previous years, pointing to concerns about an economic downturn. Economists surveyed by The Wall Street Journal last month put the probability of a recession in the next year at essentially a coin flip.

“I am prioritising gifts to children and grandchildren,” said Sweet, 81 years old. Still, she recently took a trip to Germany and next year plans to go on a river cruise in Europe with family. “It’s important to travel while I can,” Sweet said.

The National Retail Federation, a trade group, expects November and December holiday spending to rise 3% to 4% this year from last, or hold about flat when factoring in inflation. That would be slower than a 5.4% increase in 2022 and a 13% rise in 2021.

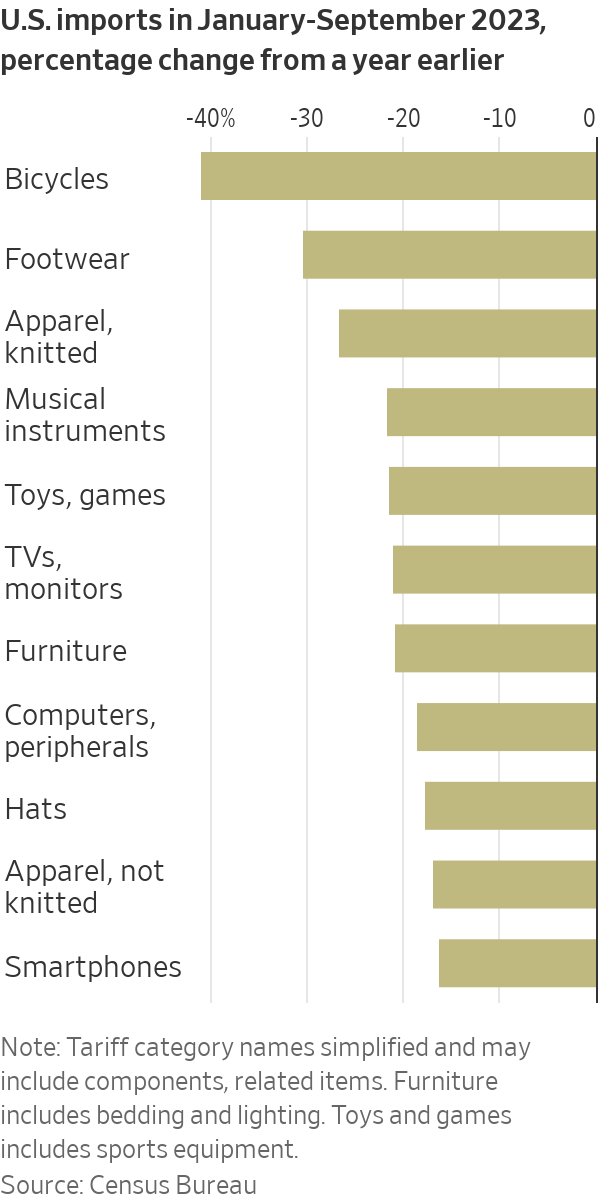

Expecting potentially weaker demand, retailers and other sellers ordered fewer toys and other popular gifts from overseas. U.S. imports of toys, games and sporting goods dropped 21.5% in the nine months through September, compared with the same period a year earlier, according to the Commerce Department. Bicycle imports fell more than 40%; smartphones declined 16%.

Toy companies struggled to clear out bloated inventories in 2022 after supply-chain snags left retailers with extra stock. Barbie maker Mattel warned that rising prices across the economy and high borrowing costs would likely continue to dent demand for toys this holiday season. Chief Executive Ynon Kreiz said last month that overall industry sales would fall by a mid-single-digit percentage for the full year.

Hasbro, the maker of Monopoly, Play-Doh and Transformers action figures, reported a 10% drop in revenue in the third quarter and cut its full-year guidance because of weak demand.

“We have a cautious outlook on the holiday,” Hasbro Chief Executive Chris Cocks said on a call with analysts. “And I think anyone who says they know how the holiday is going to go, they must have a crystal ball because this has been a tough one to predict.”

Hasbro expects consumers to wait longer to make their purchases and to look for more deals. Some deals are already emerging. Toy prices fell nearly 4% in October from a year earlier, the Labor Department said.

Consumer concerns emerge

Shoppers are facing a number of headwinds that threaten to curtail holiday cheer this year.

Hiring slowed sharply in October and the unemployment rate has risen this year. Paying down credit-card bills is more difficult with interest rates at two-decade highs, and student-loan payments resumed for millions of borrowers. Consumer sentiment in November fell to the lowest level in six months, the University of Michigan said Wednesday.

Americans’ downer attitudes on the economy might not transfer to slashed spending. Many economists saw signs that elevated interest rates would cause consumers to ease up earlier this year. Instead, they spent lavishly, causing economic growth to accelerate.

“Overall, the consumer has been very resilient: that’s why we’re not in a recession,” said Sucharita Kodali, a retail analyst at Forrester.

Nguyen, the owner of Building Blocks, remains optimistic about this holiday season. “People don’t cut out their children,” she said. “Even if they have job insecurity, or worry about food costs,” they still buy gifts for their children, she added.

—Anthony DeBarros contributed to this article.

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.

Continued stagflation and cost of living pressures are causing couples to think twice about starting a family, new data has revealed, with long term impacts expected

Australia is in the midst of a ‘baby recession’ with preliminary estimates showing the number of births in 2023 fell by more than four percent to the lowest level since 2006, according to KPMG. The consultancy firm says this reflects the impact of cost-of-living pressures on the feasibility of younger Australians starting a family.

KPMG estimates that 289,100 babies were born in 2023. This compares to 300,684 babies in 2022 and 309,996 in 2021, according to the Australian Bureau of Statistics (ABS). KPMG urban economist Terry Rawnsley said weak economic growth often leads to a reduced number of births. In 2023, ABS data shows gross domestic product (GDP) fell to 1.5 percent. Despite the population growing by 2.5 percent in 2023, GDP on a per capita basis went into negative territory, down one percent over the 12 months.

“Birth rates provide insight into long-term population growth as well as the current confidence of Australian families,” said Mr Rawnsley. “We haven’t seen such a sharp drop in births in Australia since the period of economic stagflation in the 1970s, which coincided with the initial widespread adoption of the contraceptive pill.”

Mr Rawnsley said many Australian couples delayed starting a family while the pandemic played out in 2020. The number of births fell from 305,832 in 2019 to 294,369 in 2020. Then in 2021, strong employment and vast amounts of stimulus money, along with high household savings due to lockdowns, gave couples better financial means to have a baby. This led to a rebound in births.

However, the re-opening of the global economy in 2022 led to soaring inflation. By the start of 2023, the Australian consumer price index (CPI) had risen to its highest level since 1990 at 7.8 percent per annum. By that stage, the Reserve Bank had already commenced an aggressive rate-hiking strategy to fight inflation and had raised the cash rate every month between May and December 2022.

Five more rate hikes during 2023 put further pressure on couples with mortgages and put the brakes on family formation. “This combination of the pandemic and rapid economic changes explains the spike and subsequent sharp decline in birth rates we have observed over the past four years,” Mr Rawnsley said.

The impact of high costs of living on couples’ decision to have a baby is highlighted in births data for the capital cities. KPMG estimates there were 60,860 births in Sydney in 2023, down 8.6 percent from 2019. There were 56,270 births in Melbourne, down 7.3 percent. In Perth, there were 25,020 births, down 6 percent, while in Brisbane there were 30,250 births, down 4.3 percent. Canberra was the only capital city where there was no fall in the number of births in 2023 compared to 2019.

“CPI growth in Canberra has been slightly subdued compared to that in other major cities, and the economic outlook has remained strong,” Mr Rawnsley said. “This means families have not been hurting as much as those in other capital cities, and in turn, we’ve seen a stabilisation of births in the ACT.”

This stylish family home combines a classic palette and finishes with a flexible floorplan

Just 55 minutes from Sydney, make this your creative getaway located in the majestic Hawkesbury region.