Rediscovered John Lennon Guitar Heads to Auction, Expected to Set Records

Lost for decades, an acoustic guitar John Lennon used at the height of the Beatles’ fame is going up for auction after being found in the attic of a home in the British countryside.

The 1965 Framus Hootenanny is arguably one of the most historically important guitars in the history of the Beatles, and was used on some of the group’s classic songs and played by Lennon in the movie Help! , released the same year.

The 12-string acoustic guitar will headline Julien’s Auctions Music Icons event on May 29 and 30 at the Hard Rock Cafe in New York, the auction house announced Tuesday morning in London.

Darren Julien, the firm’s co-founder and executive director, expects the Framus to exceed its presale estimate of between US$600,000 and US$800,000 and says it could set a new record for the highest-selling Beatles guitar, a record his auction house set nearly a decade ago.

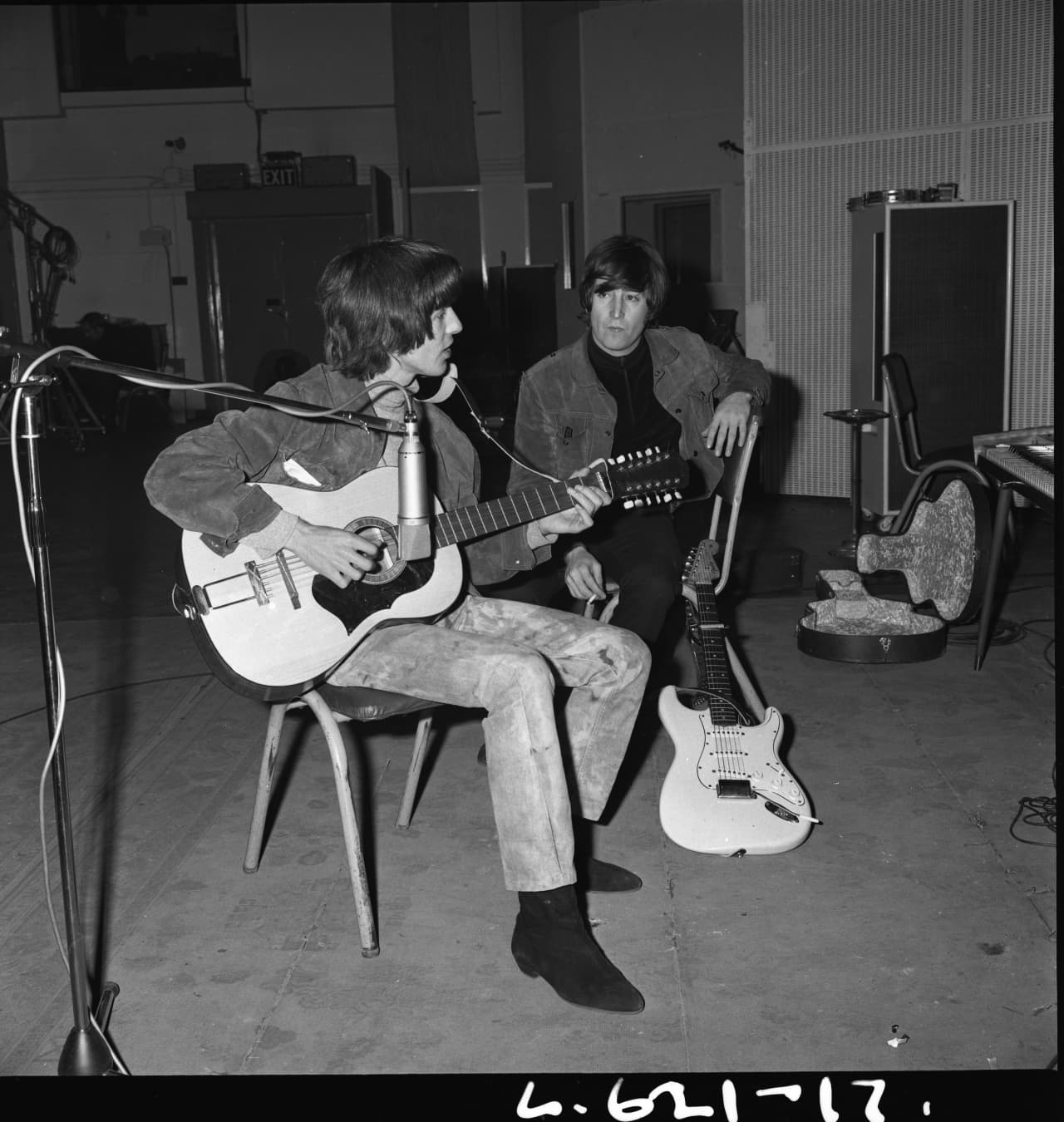

Rupert Hitchcox/Julien’s auctions

“Julien’s sold a John Lennon [Gibson J-160E] guitar in 2015 for US$2.4 million, and because this, historically speaking, is a more significant guitar, our expectation is that this guitar—played by John Lennon and George Harrison on the Help! album and other recordings—will be in the top five most expensive guitars ever sold at auction,” Julien says. “It’s likely the last chance for someone to buy and personally own an iconic John Lennon/George Harrison guitar.”

While equating its discovery to that of a “lost Rembrandt or Picasso,” Julien believes this is the greatest find of a Beatles guitar since Paul McCartney ’s lost 1961 Höfner bass, which was returned to him in February after it had been stolen in 1972.

The rediscovered Framus was famously seen in the 1965 film Help! , and was used in recording sessions for classics such as “You’ve Got To Hide Your Love Away,” “It’s Only Love” and “I’ve Just Seen A Face.” It was also played by George Harrison on the rhythm track for “Norwegian Wood” on the 1966 album Rubber Soul .

According to the auction house, by the late-1960s the guitar was in the possession of Gordon Waller of the British pop duo Peter & Gordon, who later gave it to their road managers. The instrument was recently discovered in an attic in rural Britain where it sat forgotten and unplayed for more than 50 years. After finding the guitar in the midst of a move, the homeowners contacted Julien’s.

Along with co-founder Martin Nolan, Julien traveled to the U.K. and immediately recognised that it was the storied Help! guitar. While on the premises, they also discovered the original guitar case in the trash and rescued it. It’s an Australian-made Maton case that can be seen in photos taken of The Beatles in 1965 The sale of the guitar is accompanied by the case and a copy of the book The Beatles: Photographs From The Set of Help by Emilo Lari.

In addition to Lennon’s acoustic Gibson J-160E—which fetched three times its presale estimate—Julien’s has broken multiple Beatles records, including Ringo Starr’s Ludwig drum kit (which sold for US$2.2 million), the drumhead played on the Ed Sullivan Show (US$2.2 million), and a personal copy of the White Album , (US$790,000), all of which sold in 2015.

Julien’s also holds the record for the world’s most expensive guitar ever sold at auction: Kurt Cobain’s MTV Unplugged 1959 Martin D-18E acoustic electric guitar, which sold in 2020 for US$6 million.

More than 1,000 pieces of music memorabilia will also be part of the auction, including items used by the likes of AC/DC, Nirvana, Guns N’ Roses, Judas Priest, Heart, Queen, and Tupac Shakur.

Sartorial highlights include custom dresses worn by Tina Turner (Versace) and Amy Winehouse (Fendi), both of which are expected to sell for between US$4,000 and $6,000, and Michael Jackson’s stage-worn “Billie Jean” jacket from 1984’s Victory Tour (presale estimate: US$80,000 to $100,000).

Bidders will have the chance to buy items benefitting a pair of U.K. charities. Several collectibles from The Who and other British musicians will be sold to benefit the Teenage Cancer Trust, and an assortment of memorabilia—ranging from a Stella McCartney dress worn by Helen Mirren and an Armani jacket stage-worn by Phil Collins to artwork created and signed by Pierce Brosnan—will be offered to help fund the King’s Trust.

Rounding out the two-day auction is Randy Bachman’s collection of more than 200 museum-quality guitars. Known for his role in The Guess Who and Bachman-Turner Overdrive, the Canadian rock star used the instruments on hits such as “These Eyes,” “Takin’ Care of Business,” “You Ain’t Seen Nothin’ Yet,” and “American Woman.”

The public can view the Help! guitar and other auction highlights at Hard Rock Cafes in London (April 23-29) and New York City (May 22-28).

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

Copyright 2020, Dow Jones & Company, Inc. All Rights Reserved Worldwide. LEARN MORE

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

A 30-metre masterpiece unveiled in Monaco brings Lamborghini’s supercar drama to the high seas, powered by 7,600 horsepower and unmistakable Italian design.

A divide has opened in the tech job market between those with artificial-intelligence skills and everyone else.

There has rarely, if ever, been so much tech talent available in the job market. Yet many tech companies say good help is hard to find.

What gives?

U.S. colleges more than doubled the number of computer-science degrees awarded from 2013 to 2022, according to federal data. Then came round after round of layoffs at Google, Meta, Amazon, and others.

The Bureau of Labor Statistics predicts businesses will employ 6% fewer computer programmers in 2034 than they did last year.

All of this should, in theory, mean there is an ample supply of eager, capable engineers ready for hire.

But in their feverish pursuit of artificial-intelligence supremacy, employers say there aren’t enough people with the most in-demand skills. The few perceived as AI savants can command multimillion-dollar pay packages. On a second tier of AI savvy, workers can rake in close to $1 million a year .

Landing a job is tough for most everyone else.

Frustrated job seekers contend businesses could expand the AI talent pipeline with a little imagination. The argument is companies should accept that relatively few people have AI-specific experience because the technology is so new. They ought to focus on identifying candidates with transferable skills and let those people learn on the job.

Often, though, companies seem to hold out for dream candidates with deep backgrounds in machine learning. Many AI-related roles go unfilled for weeks or months—or get taken off job boards only to be reposted soon after.

Playing a different game

It is difficult to define what makes an AI all-star, but I’m sorry to report that it’s probably not whatever you’re doing.

Maybe you’re learning how to work more efficiently with the aid of ChatGPT and its robotic brethren. Perhaps you’re taking one of those innumerable AI certificate courses.

You might as well be playing pickup basketball at your local YMCA in hopes of being signed by the Los Angeles Lakers. The AI minds that companies truly covet are almost as rare as professional athletes.

“We’re talking about hundreds of people in the world, at the most,” says Cristóbal Valenzuela, chief executive of Runway, which makes AI image and video tools.

He describes it like this: Picture an AI model as a machine with 1,000 dials. The goal is to train the machine to detect patterns and predict outcomes. To do this, you have to feed it reams of data and know which dials to adjust—and by how much.

The universe of people with the right touch is confined to those with uncanny intuition, genius-level smarts or the foresight (possibly luck) to go into AI many years ago, before it was all the rage.

As a venture-backed startup with about 120 employees, Runway doesn’t necessarily vie with Silicon Valley giants for the AI job market’s version of LeBron James. But when I spoke with Valenzuela recently, his company was advertising base salaries of up to $440,000 for an engineering manager and $490,000 for a director of machine learning.

A job listing like one of these might attract 2,000 applicants in a week, Valenzuela says, and there is a decent chance he won’t pick any of them. A lot of people who claim to be AI literate merely produce “workslop”—generic, low-quality material. He spends a lot of time reading academic journals and browsing GitHub portfolios, and recruiting people whose work impresses him.

In addition to an uncommon skill set, companies trying to win in the hypercompetitive AI arena are scouting for commitment bordering on fanaticism .

Daniel Park is seeking three new members for his nine-person startup. He says he will wait a year or longer if that’s what it takes to fill roles with advertised base salaries of up to $500,000.

He’s looking for “prodigies” willing to work seven days a week. Much of the team lives together in a six-bedroom house in San Francisco.

If this sounds like a lonely existence, Park’s team members may be able to solve their own problem. His company, Pickle, aims to develop personalised AI companions akin to Tony Stark’s Jarvis in “Iron Man.”

Overlooked

James Strawn wasn’t an AI early adopter, and the father of two teenagers doesn’t want to sacrifice his personal life for a job. He is beginning to wonder whether there is still a place for people like him in the tech sector.

He was laid off over the summer after 25 years at Adobe , where he was a senior software quality-assurance engineer. Strawn, 55, started as a contractor and recalls his hiring as a leap of faith by the company.

He had been an artist and graphic designer. The managers who interviewed him figured he could use that background to help make Illustrator and other Adobe software more user-friendly.

Looking for work now, he doesn’t see the same willingness by companies to take a chance on someone whose résumé isn’t a perfect match to the job description. He’s had one interview since his layoff.

“I always thought my years of experience at a high-profile company would at least be enough to get me interviews where I could explain how I could contribute,” says Strawn, who is taking foundational AI courses. “It’s just not like that.”

The trouble for people starting out in AI—whether recent grads or job switchers like Strawn—is that companies see them as a dime a dozen.

“There’s this AI arms race, and the fact of the matter is entry-level people aren’t going to help you win it,” says Matt Massucci, CEO of the tech recruiting firm Hirewell. “There’s this concept of the 10x engineer—the one engineer who can do the work of 10. That’s what companies are really leaning into and paying for.”

He adds that companies can automate some low-level engineering tasks, which frees up more money to throw at high-end talent.

It’s a dynamic that creates a few handsomely paid haves and a lot more have-nots.

A luxury lifestyle might cost more than it used to, but how does it compare with cities around the world?

When the Writers Festival was called off and the skies refused to clear, one weekend away turned into a rare lesson in slowing down, ice baths included.